Benzinga Review

-

Value For Investors

-

Value For Active Traders

-

Fees

-

Customer Service

-

Mobile App

Summary

Benzinga Pro has proven to be a vital tool for active traders and is one we highly recommend for both beginner and experienced traders.

Pros

- Lots of great resources

- Many materials are free

- Excellent Pro platform

- Video and audio channels

- Information on esoteric assets, like cryptos and penny stocks

- Fast delivery of information

Cons

- News articles can be rather brief

- Pro subscription is pricey

- Stock profiles are short

- No in-depth pdf analyst reports

In the Information Age, knowledge is a vital component of any trading regimen. Before you place a trade, you have to know what’s happening in the global economy. You also need to know the particular asset you’re looking at and its competitors.

Acquiring this information at lightning speed is of paramount importance. Benzinga is one company that helps you accomplish all these tasks and more.

Let’s check it out.

Overview

Based in Detroit, Michigan, Benzinga offers a variety of digital tools for investors and day traders. The goal is to get as much financial data as possible into the hands of traders in easy-to-digest forms.

The company has a website at Benzinga.com that offers information on all aspects of investing. It has a large department that publishes real-time news articles on virtually anything that could affect asset prices.

The company also sends out newsletters in conjunction with a variety of other information agencies. And it hosts a pre-market podcast and video channel every weekday morning before the opening bell.

The crown jewel in Benzinga’s information services is Benzinga Pro. This is a digital platform that offers enormous amounts of real-time information on economic and market events.

Website

The Benzinga website provides data on:

- Cryptos

- ETF’s

- Markets

- Equities

- Binary options

- Penny stocks

- Cannabis companies

- Fintech

- Analyst upgrades and downgrades

- Futures trading

- General investor education

- And more

News articles have their own section, which can be accessed by clicking on “News” in the top menu. Articles are organized into topics. Examples include:

- IPO’s

- Buybacks

- Biotech/FDA

- M&A

- Guidance

- And others

A stock profile can be viewed by typing in a company name or ticker symbol in the search field. This is at the top of the page. Although some features are rather simple, such as charting, we did like the free analyst ratings.

In addition to trade recommendations from groups like Morgan Stanley and Citi, price targets are given.

Pre-Market Broadcasts

Before the market opens each morning, it’s possible to find market commentary in both audio and video formats. Available at premarket.benzinga.com, a live video feed runs from 8:00 am until 9:00 am, EST. This is a good way to look at a chart while listening to commentary on it.

For a different style, there is a live podcast right next to the video. The website has a list of previous podcasts that are available anytime.

The videos and podcasts discuss whatever the morning news is. During our investigation, we listened to commentary on a variety of issues. Examples include struggling airlines, the price of oil, an earnings release from Nike, and price action on Amarin Corporation.

Newsletters

Benzinga publishes several e-mail newsletters. These include a pre-market outlook, a mid-day update, and an after-market roundup. A brief 5-minute market update is also available.

One we really like is the analyst rating newsletter. This one is a summary of the day’s major rating changes from top analysts. You simply need to sign up with an e-mail address on the company’s website.

Benzinga Pro

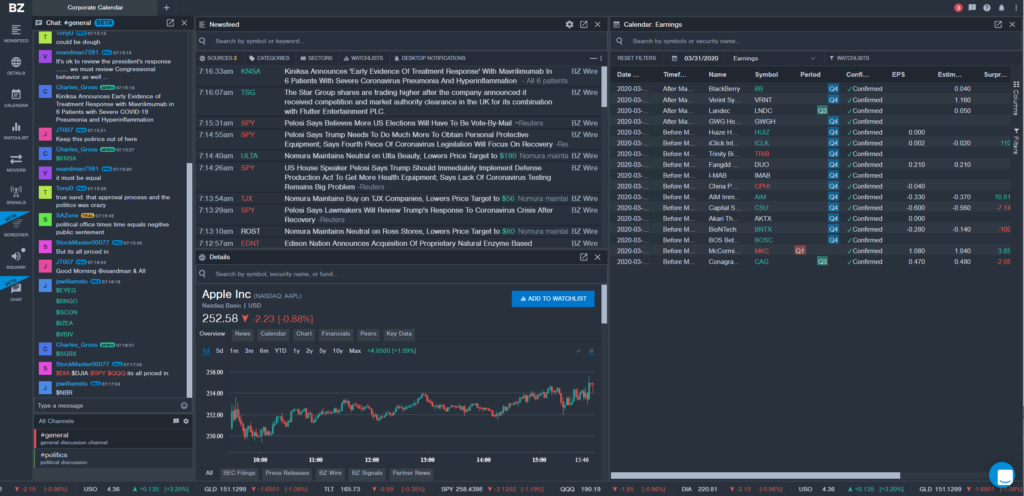

Benzinga Pro is a browser-based platform that delivers powerful research tools. Many of the features can be used for day-, swing-, and long-term trading. During our research, we found the software to be user-friendly.

A sidebar is on the far left-hand side of the screen. Icons with descriptions show the platform’s major resources. From top to bottom, here they are:

Newsfeed

First up is a newsfeed. There are many news sources available. Benzinga Wire and Benzinga Signals are included by default. But there are many other outlets. These include Thomson Reuters, Newswire, AB Newswire, the SEC for filings, and Comtex Press Releases.

The platform displays not just the hour and minute of the news article, but also the second. This is important because if you select all available outlets, there will be a lot of articles streaming in.

It’s possible to limit articles by specifying only some economic sectors or industries.

Details

Next down the list is a details icon. This will give you plenty of information on a specific ETF, closed-end fund, or stock. News articles for the specific security are shown below a small graph. A large graph is available with technical indicators and 1-minute OHLC bars and candlesticks.

During our investigation, we found key data. These figures include:

- Payout ratio

- Dividend yield

- PEG ratio

- Earnings yield

- Book value

- EPS diluted

- And more

Calendar

An economic calendar presents companies that have earnings announcements, conference calls, stock splits, and other events. Oddly, a calendar format is not available. Instead, stocks are listed in column format on the event day or other time frame selected.

Benzinga’s software displays which fiscal quarter an event is for. Other data points include whether earnings are being released before the bell or after, and estimated revenue.

The calendar can be set up to display only stocks from a watchlist. This mode will show a history of earnings releases, with EPS estimates and actual figures.

Watchlist

Next in line is a watchlist. An infinite number of these can be created. It’s easy to shuffle from one to the next. Watchlists can be renamed and deleted.

Columns can be added and deleted. Choices include volume, 52-week events, symbol, and price change (% and $).

Alerts can be established for a watchlist, and it’s a breeze to download one as a spreadsheet. We found it easy to drag and drop columns to rearrange their order.

Movers

Here you can scan the markets for big price movers. Benzinga’s software can look for gainers, losers, or both at the same time. Results can be filtered by market cap and price, the regular session or extended hours, and sector.

On the day we did our research, the biggest gainer was AMZA, the InfraCap MLP ETF, up 911%.

Signals

If you want to find potential trades based on important events, you’ll need to use the signals tool. By checking a color-coded box, it’s possible to find stocks that have experienced intra-day or 52-week highs.

Other search criteria include stocks that have been halted or that have an opening gap. During our exploration, we found several stocks that had been halted due to excessive volatility.

Options events, price spikes, and block trades are other searchable variables.

Screener

No software platform designed for day and swing traders would be complete without a stock screener. Benzinga doesn’t disappoint here, delivering a scanner with several search variables. These include:

- Exchange

- Volume

- Sector

- Return on assets

- Forward P/E

- Country

- Industry

- Currency

- Average volume

- And much more

A convenient refresh button can update search results. And we really liked the ability to set the results to automatically refresh. Available intervals are 10 seconds and 1 minute.

Squawk

If you would rather listen to information rather than read it, Benzinga’s Squawk is for you. This is a live audio feed. It delivers market updates in real-time along with headline news.

The stream can be paused and muted. A green dot will appear when the connection is up and running. It lights up brighter when audio is streaming. The service is not always streaming, so sometimes there is no audio.

Chat

The final tool on Benzinga Pro we need to consider is the chat feature. Found at the bottom of the sidebar, there are two categories. These are general and politics. The former is for trading topics.

One feature we really liked was a pop-up window when we hovered over a ticker symbol in a message. The window shows a 1-day chart with an open price.

Pricing

Many of Benzinga’s resources are free. These include its website, news articles, pre-market video and audio streams, newsletters, and analysts’ ratings adjustments.

The Pro platform does come with a monthly subscription charge. There are two basic plans: basic and essential.

The basic package costs $99 per month. It doesn’t offer all the features we looked at in this survey. It does come with the following resource:

- Movers tool

- Watchlists and alerts

- A few newsfeed resources

- Details

The essential package is a little steeper at $147. It does come with the complete sidebar plus Nasdaq real-time quotes and sentiment indicators.

Institutions that would like to use multiple copies of the software should call Benzinga to discuss pricing. The company’s number is (877) 440-9464.

Customer Support

Although the prices for the first two options do look somewhat expensive, Benzinga does offer customer support for its platform. There is an online chat feature available at pro.benzinga.com. Alternatively, the company can be reached at [email protected] or over the phone at the number mentioned above.

Word of Caution

I would never recommend anyone trade blindly off the squawk box radio alerts. Sometimes we’ll hear breaking news that sounds great, but the stock drops. Other times we hear breaking news that ends up being incorrect.

The advantage of getting news early is that we have the first chance at getting into the trade, the problem is that we may not know which direction it’s going to move yet. So I often wait for the first pullback and then take a position. I learned the hard way that jumping into breaking news without fully understanding the headline can result in very quick losses!

Bottom Line

Benzinga is an excellent resource for trading data. Its myriad free resources themselves are quite useful, and the Pro platform offers even more in one well-designed package.