I find almost every single trade setup on one of the stock scanners that I built with the team at Warrior Trading. I can’t speak highly enough about this tool, because without scanning software I would be lost as a trader.

A trader can have all the textbook knowledge of the markets but if they are unable to find setups in real-time they will never profit. Stock scanners are how we find those setups. Before stock scanners existed traders would trade off a master watch list which they would make by manually going through charts, which you can imagine took a long time.

This is not an effective method of day trading because typically there are only 5–10 stocks in play each day, out of the several thousand stocks available to trade. I consider a stock in play if it is surging up or down more than 4% with a strong catalyst.

Stock Scanners are a Requirement For Day Trading

Using stock scanners I can choose the specific type of stocks I want to see. I can make complex scanners to look for specific chart patterns or I can use simple scanners to look for broad matches such as stocks that just reported earnings in the last 24hrs.

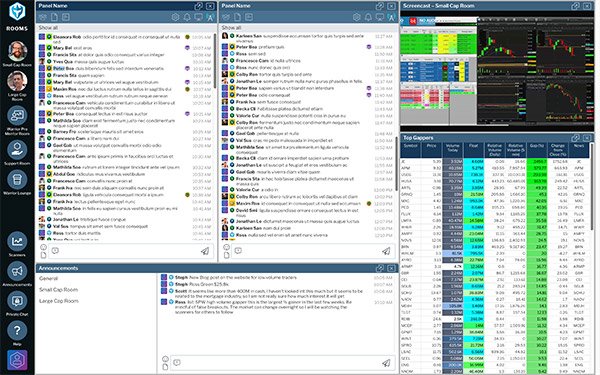

Day trading is a difficult career that we can make a little easier by using the best tools. That’s why I and my team built the Warrior Trading Stock Scanners with the same best practices and strategies which undergird our courses. Best of all, the scanners are available to add onto any Warrior Trading membership with access to our chat rooms, so our members don’t need to spend tons of time and money finding the right scanning software.

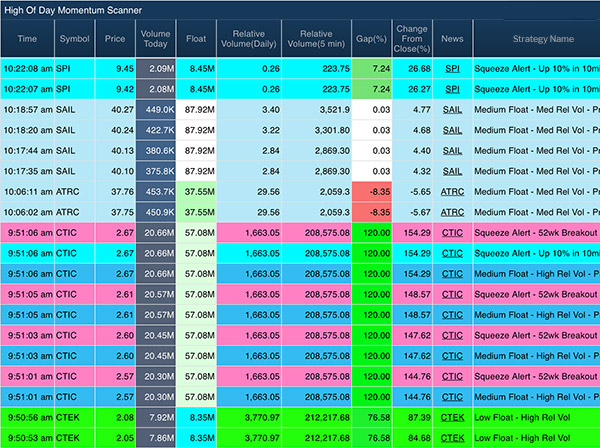

One of my favorite features is that our Stock Scanner includes notes on former runner stocks — allowing new traders to consider historical patterns. I can look back and see all the alerts from a day or week and review the results. Our High of Day or HOD Scanner has a strategy built within call “former runner” to give traders more context and information. This saves us a tremendous amount of time when watching scanners in real-time.

With these scanners, members are able to use the exact layouts I use to find trades. Although I have about 15 scanners I’m actively using everyday, they are clustered in two groups. I have scanners looking for reversal opportunities and I have scanners looking for momentum trades.

Those are the two strategies I trade and those are the setup ideas I need to find in real-time. All of the stock scanners I use have been highly customized to provide me with a watch list of the type of stocks I have the highest percentage of success trading.

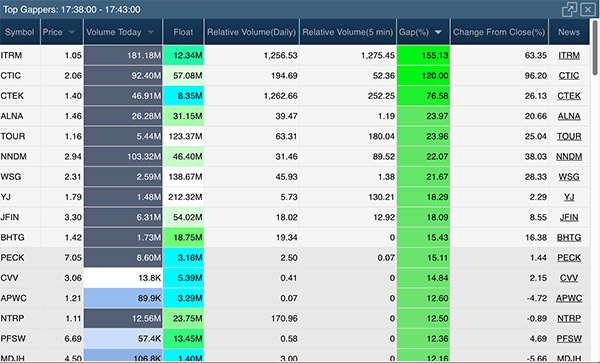

Premarket Gap Scanner

This is the scanner I look at first thing in the morning because it shows all the stocks that are gapping up in the premarket that fit my pricing and volume criteria.

This scanner is how I build my watch list in the morning and I can’t stress enough how much time it has saved me. Before building this scanner, I would have to manually go through stocks and it took forever.

Most of these stocks will have some kind of news which is exactly what I am looking for; a stock with a news catalyst that is active in the premarket. You can access our custom news service directly from the Scanners to learn more about a stock’s catalyst.

High of Day Momentum Scanner

The high of day momentum scanner is my go-to scanner when premarket activity is light and I don’t have much to watch. This scanner will pull up stocks that are hitting a new intra-day high on high relative volume.

This is great for momentum scalps, especially in the first 30 minutes of the market opening.

Final Thoughts

Day trading is one of the hardest careers to become successful at and that is why it is imperative you have the right tools.

Having real-time scanners like our Stock Scanners is essential to finding the right trading opportunities quickly. And with the instruction in our education courses, we will make sure you learn how to use and customize the scanners to match your trading strategy. Another tool in your day trading tools quiver!