Updated February 25, 2025 – Written by Ross Cameron

There are a ton of brokers for traders to choose from so we put together a detailed list of the best online stock brokers.

Finding the right brokerage firm for your trading demands just got a little simpler, thanks to our research. We poured through a long list of brokers and compared them in the most important areas.

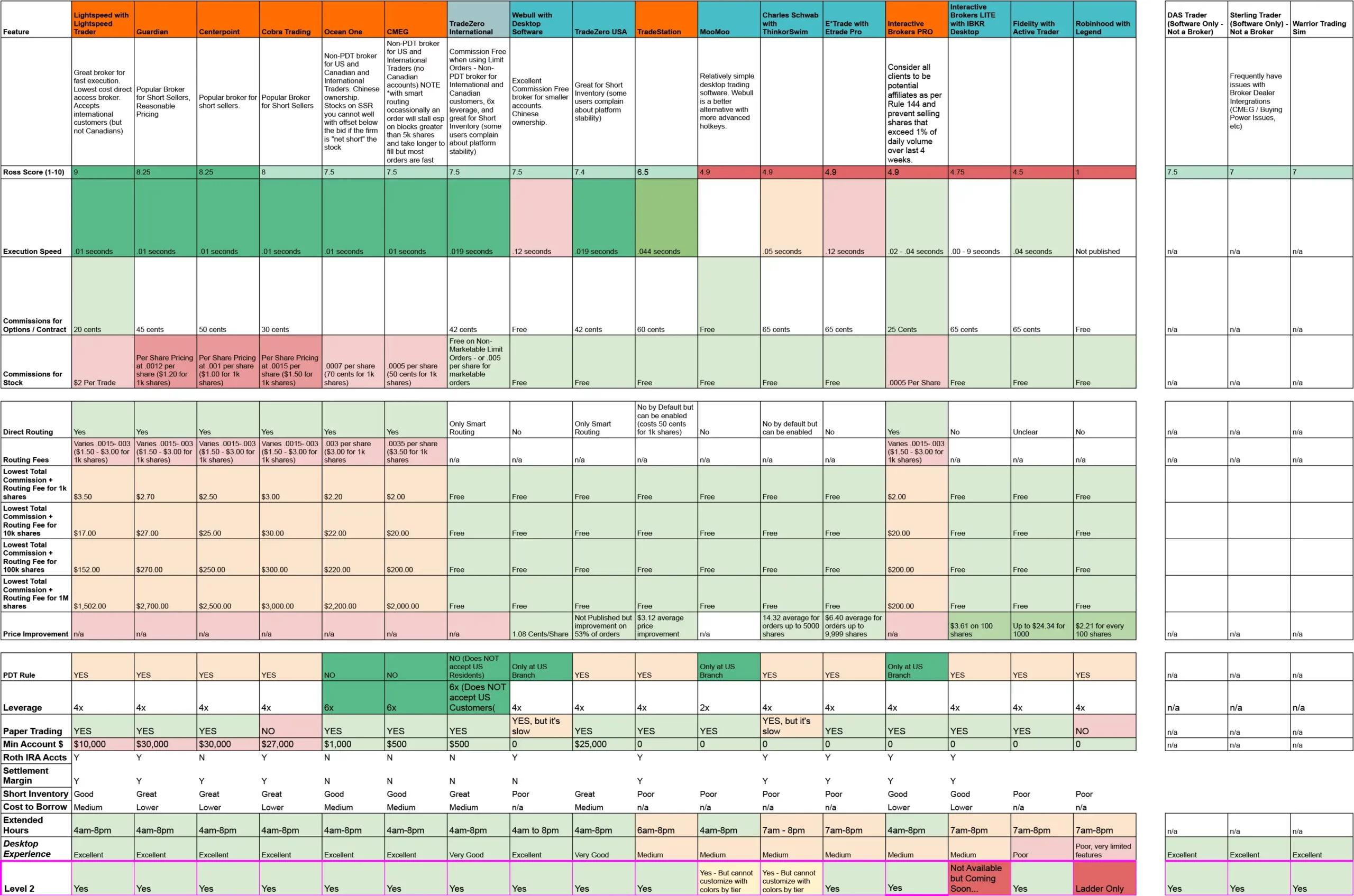

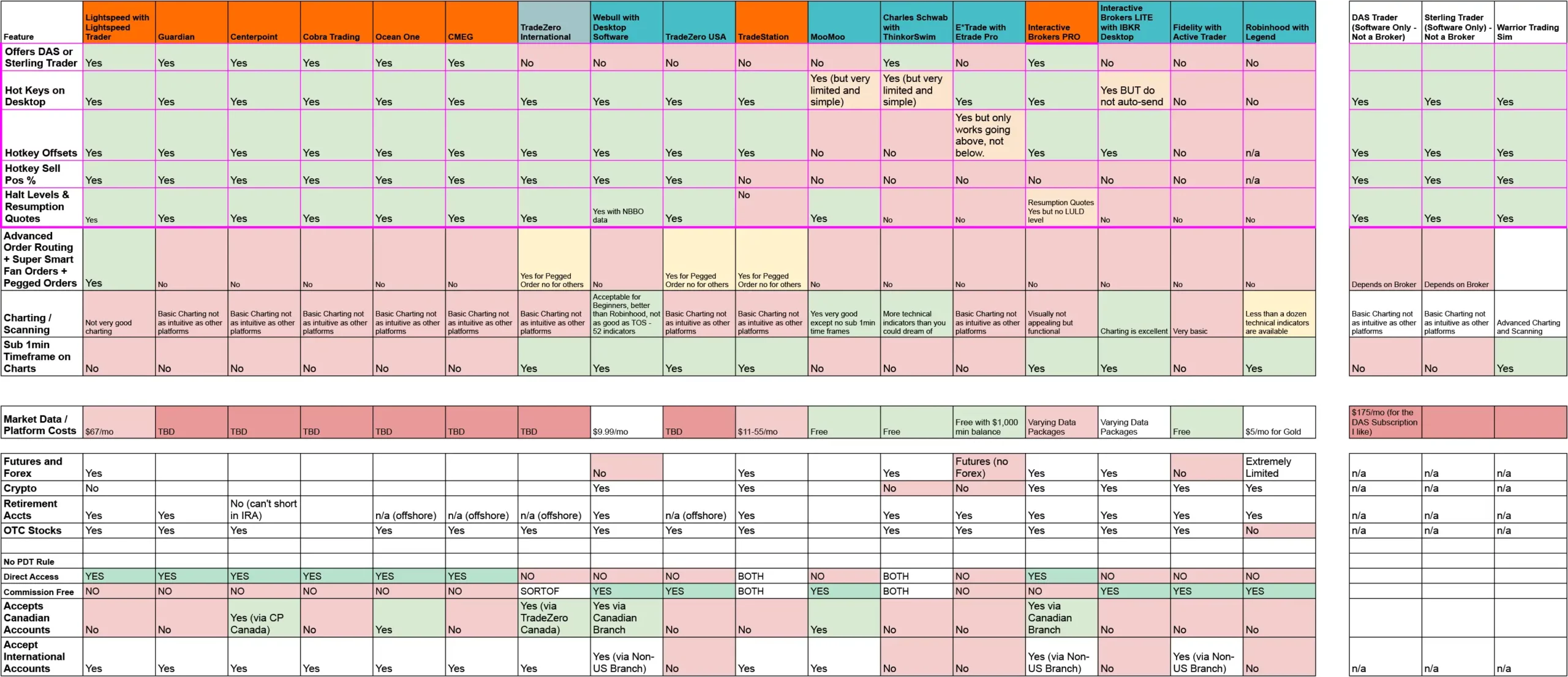

Comparison of the Best Brokers for Active Traders

Video Comparison of the Best Brokers for Active Traders

Best for Active Traders: LightSpeed Trading with a Ross Score of 9 out of 10

Lightspeed Trading

Lightspeed is my top choice and it’s a broker I’ve been using for more than a decade. Despite being a long-term customer at Lightspeed, I have no affiliate relationship with them. I don’t get paid a penny if you sign up to use them. I recommend them because I genuinely think they are the best broker for my strategy and the way I trade today. Here’s why. Lightspeed has always catered to active traders. From the design of the platform, the functionality they offer, to the speed of execution. It’s always been about being a super fast, super lightweight platform, for serious traders.

The Lightspeed Trader platform offers advanced and customizable hotkeys, customizable Level 2 Market Depth Windows, and complete market data subscriptions. Warrior Pro members have access to my customized layouts so you can install them directly on your machine.

Prior to commission-free trading (which began in 2019), they were competing on a bit of a more even playing field with brokers like E*TRADE, Interactive Brokers, and Charles Schwab. They offered discounted commission but expected traders to be trading higher volume and everyday. This was a profitable business model. However, when commission-free trading began at most retail brokers, Lightspeed was presented with a challenge. How to stay in demand while continuing to charge commissions. You might ask, why not just get rid of commissions entirely? That requires a deeper look at how retail brokers profit from commission-free trading.

Payment For Order Flow

Payment-for-order-flow is a business agreement between retail trading brokers and institutional trading firms. The way the agreement works, the institutional trading firm pays the retail broker to funnel their order flow (Customer Orders) through the institution. The big institution uses incredibly sophisticated algorithms and orders matching systems to fill orders internally without sending them out to the Nasdaq or NYSE markets. In other words, the institution is able to make a profit and bypasses the exchanges. They share some of that profit with the retail broker, which allows the retail broker to offer zero commission. In fact, zero commissions invite more trading by retail traders, which in turn produces more profits.

Here are the downsides to the payment-for-order-flow business model. The first is that it introduces latency because instead of buying directly from another market participant who wants to sell, your order goes through a complex order matching system that has to decide what price you should get the stock filled at. This means all brokers engaging in payment-for-order-flow will take longer to execute an order versus a broker that sends orders directly to the open market. The second downside is that you have institutional traders essentially siphoning trading volume away from the market and scalping profits that might have otherwise gone directly to the traders themselves. The third issue is that payment-for-order-flow segregates the market. A 50,000 share buyer at a retail trading firm may not be able to be matched with a 50,000 share seller at a direct market firm because the institution stands in the middle. This means both traders could suffer from a worse execution on their order versus all orders going into a single auction.

While we can’t control the fact that payment-for-order-flow continues to exists, we can choose whether or not to use a broker that engages in that business model. By trading at Lightspeed, I’m using a broker that allows me to send orders directly to the market. This means I have faster execution speeds. In a fast moving market where milliseconds matter, I value speed. I would be willing to wager that the commission I pay to Lightspeed is less then the additional profit I make as a result of faster order speed.

Best Brokers for Commission-Free Trading

Webull with a Ross Score of 7.5

I recently funded a Webull account to test it out for myself and give it a comprehensive review. Webull has created a really fantastic trading platform. The area where they shine is that the Webull desktop software offers nearly everything I look for in a trading platform. They have excellent Hotkeys with Offsets, the ability to sell by % of Position, and they are easy to script and get up and running. The charts are great and they offer sub 1-min time frames. The Level 2 is somewhat customizable (although not as much as Lightspeed), and displays both Halt Levels and Halt Resumption Quotes if you subscribe to NBBO Market Data for $9.99 per month.

Charles Schwab with a Ross Score of 7.5 (If you use DAS Trader instead of ThinkorSwim)

Charles Schwab is probably the most popular broker-dealer in the United States. In fact, they are the broker that wanted to buy TD Ameritrade, and in 2019, they were the first big broker to announce commission-free trading. This forced TDAmertirade to offer commission-free trading as well, and I suspect it hurt their bottom line to the point that they accepted a buyout offer from Schwab shortly thereafter. Now that TD Ameritrade has merged into Charles Schwab, they are, without a doubt, one of the largest brokers in the world.

Following the merger, the ThinkorSwim platform, which has been around since 1999, became the primary trading platform at Charles Schwab. ThinkorSwim is a platform I’ve used over the course of my career. Most recently, I did a small account challenge using the platform. I was able to grow my account to over $25,000 in less than 16 days (my results are not typical). However, during the challenge I did uncover some challenges with the platform. The biggest issue is that it’s slow. There’s no other way to put it. Compared to Lightspeed, it just feels very slow. The biggest value proposition is that it’s free. I think it’s a decent platform for beginner traders who are on a budget, and I think it’s also a good platform for serious traders who trade with such daily shares traded that commissions would eat into their profits. But for traders like myself who are quick and only take a few highly selective trades each day, we can’t afford to miss opportunities due to the platform running too slow. So although I continue to use Lightspeed, I will say that ThinkorSwim is popular among traders here at Warrior Trading, and several of our +$1million Student Success Stories here at Warrior Trading earned their badges on the ThinkorSwim platform.

ThinkorSwim is packed full of sophisticated features, including robust charting, advanced order entries, direct access routing, and plenty more customizable features.

My biggest issue with ThinkorSwim is that the platform does not offer advanced or customizable hotkeys, ability to sell based on a percentage of your position, halt levels, resumption quotes, and the level two is difficult to read. Additionally the platform is not very fast to execute trades. The best solution to using Charles Schwab is to integrate it with the DAS Trader software so you can bypass ThinkorSwim entirely.

There is a bit of a learning curve, but there are plenty of tutorials on the internet to help you get started.

Best Brokers for International Traders

Currently, the most popular international broker-dealers for non-US residents are TradeZero, Webull, and Interactive Brokers, and in that order.

TradeZero with a Ross Score of 7.5

TradeZero is located in the Bahamas, offers 6x leverage, and does not enforce the PDT Rule on International Customers (They Do NOT Accept US Residents through TradeZero International). TradeZero has decent customer service, and offers commission-free trading as long as you execute non-marketable limit orders. They do charge a commission on Market Orders. So as long as you’re comfortable using Limit Orders, you can trade commission-free with them. Personally, I use marketable limit orders on all my buy orders, but for my sell orders, I try to use non-marketable limit orders. That means with TradeZero I’d pay a commission on at least half of my trades, if not a bit more. TradeZero offers a decent platform with advanced hotkeys and customizable Level 2 Market Data. The only complaint I’ve heard over the years is that sometimes the platform can have issues. It’s not as stable as Lightspeed Trading, Interactive Brokers, or Webull. However, the executions are fast when the platform is working well (which is the majority of the time).

Webull with a Ross Score of 7.5

Webull has international branches for non-US residents. Webull in Canada, Mexico, Japan, Australia, and about a dozen other countries service foreign customers who still want to trade in the US Markets. They charge commissions on their international customers, and the rates vary depending on the jurisdiction where you open an account. The branch you open an account with is based on your residential address, so unfortunately, you can’t shop around for which branch is the cheapest. The Webull platform is decent. They offer customizable hotkeys for day trading, complete Level 2 Market Data, and the platform is stable. The only downside is the execution speed is a bit slower, and they have order thresholds that will prevent big money traders from taking large sizes. For that reason, the broker isn’t suitable for me, but it can work for beginner traders.

Interactive Brokers with a Ross Score of 4.9

Interactive Brokers is one of the largest brokers in the world. They have branches in dozens of countries to support international traders in both Forex and equities markets. However, Interactive Brokers has a flaw that makes it very difficult for the broker to use on stocks experiencing a sudden spike in trading volume. My strategy involves finding stocks with breaking news that are making a sudden, surprise move. Typically these are lower priced stocks that trade on relatively low average daily volume, then suddenly have a great news headline and the stock goes up 250%. It’s not uncommon for these stocks to have average daily volume of just 50,000 shares, then suddenly trade 50 million shares in 1 day when the news comes out. There is a rule that affiliates of a company cannot trade more than 1% of the average daily volume without filing disclosures. Interactive Brokers assumes everyone is an affiliate and thus will stop you from trading a stock if your order is for more than 1% of the average daily volume. This is a problem when the average daily volume is 50,000 shares. Even though today it may have 50 million shares of volume, the figure they use for average daily volume does not update in real-time. In reality, 99.99% of day traders are not affiliates associated with the companies they trade. But Interactive Broker goes on the side of caution and blocks trading until you affirmatively confirm with their compliance team that you’re not an associate/affiliate. So while this is a broker that might work for traders focusing on Forex, or trading large caps everyday, it’s not a great platform for small caps.

Best Non-PDT Brokers for US Traders: Ocean One Securities and Capital Markets Elite Group

Ocean One Securities with a Ross Score of 7.75

Ocean One Securities is a relatively new broker-dealer located in the Bahamas. They are a competitor of the more established broker-dealer Capital Markets Elite Group (CMEG). They pride themselves in offering excellent availability of shares to borrow for short sellers, and have thus quickly become a popular new broker. Like CMEG, they offer DAS Trader as their front-end trading platform (screenshot below). The platform is basic, but it’s extremely fast. I personally don’t use it for charting since the charting technology is outdated, but I do find the order execution to be extremely fast. I have timed execution on Ocean One and found that it matched speeds at Lightspeed Trading and was slightly faster than CMEG.

These two brokers are competitors in the non-PDT broker space. Both are located in the Caribbean and both allow 6x leverage with accounts as little as $1,000. The biggest challenge with these two brokers is that because they allow trading on leverage and with such small account sizes, they frequently restrict the use of leverage to prevent traders from getting a margin call. However, these restrictions can make trading fast-moving and highly volatile stocks difficult, if not impossible.

Capital Markets Elite Group (CMEG) with a Ross Score of 7.5

During my recent Small Account Challenges, I used an offshore broker called CMEG (Capital Market Elite Group). Since this broker is not located in the United States, they are not required to enforce the $25,000 Pattern Day Trader Rule. You may not have heard of this broker before and there is a reason for that. There is a rule that states they are not allowed to solicit US Customers. This means CMEG does not advertise to US residents. They advertise internationally but not in the United States. However, many US residents learn about them through word of month since they are one of the few international brokers that do not enforce the PDT rule and also will accept US residents who apply. Their platform is similar to Lightspeed Trading. Unlike commission-free brokers, they do charge commissions on all trades and they also charge platform fees. In total, CMEG is a more expensive broker than trading using Webull or ThinkorSwim with Charles Schwab.

CMEG and Ocean One both offer DAS Trader as their primary trading platforms. Below is a screen shot of my CMEG account where I use the DAS Trader software.