-

Value For Investors

-

Value For Active Traders

-

Commissions & Fees

-

Platform & Tools

-

Customer Service

-

Order Execution

Summary

Quick Review: Webull is a stock trading mobile app that offers a commission-free trading platform. They offer intuitive stock charts with plenty of technical indicators and tools for customizing your charts. They are SIPC insured and are regulated by the SEC and FINRA.

Pros

- Free commissions

- No account or software fees

- Best platform for a commission-free brokerage

- Offers margin without a subscription (unlike Robinhood with their Gold membership)

- Allows short selling

Cons

- Doesn’t offer options trading (but will soon)

- Requires membership for some advanced features

Webull Review

Webull is a stock brokerage firm offering zero commission stock trades on both mobile and desktop. They’re currently the biggest threat to Robinhood when it comes to acquiring millennial users with free services.

Webull started out as a research firm and have only recently branched out into the brokerage industry. This puts them way ahead Robinhood in the way of research and analytics, Robinhood’s weakest link.

In this Webull review we will cover in detail their services, platform and compare how they match up against their competitors.

Who Is Webull For?

Webull is best for the undercapitalized active trader. These are part-time traders with less than $100k to fund their account with. The zero commissions and advanced platform give new and intermediate traders a way to play small ball and learn how to trade actively.

Webull is also perfect for swing traders of all stripes. Swing traders don’t typically need flawless execution, as they’re looking to capture a large market move rather than a small intraday fluctuation.

Swing traders are also generally quite simplistic when it comes to their analysis. Rarely do they need more than a good charting platform and screener.

Who Is Webull NOT For?

Most full-time day traders are unable to switch to Webull from their current brokers. That’s because highly active traders need direct market access to best play out their trading edge. What they gain in commissions would be lost due to slower execution.

The ability to create sophisticated keyboard macros is also missing in Webull, a feature that day traders heavily rely upon.

Webull vs. Robinhood

Robinhood is Webull’s main competitor. Both companies are trying to be the Walmart brokers by offering the lowest price possible to those looking for bargains. Those bargain-seekers are by and large millennials, which is why both companies took a mobile-first approach, only developing desktop and web apps after establishing themselves in the industry.

Let’s go over some key differences between the brokers:

Pre-Market and After Hours Trading

All Webull members have the ability to trade during the pre-market or after hours trading periods, while Robinhood requires a paid subscription to Robinhood Gold.

Webull allows you to trade between the hours of 4am to 8pm EST.

Research Offerings

Webull has much stronger research and analytics offerings. Their web and desktop platforms feature the following:

- High quality charts (similar to TradingView) with technical indicators

- Stock screener with a surprising amount of features

- Top-down market analytics

- Stock and industry strength rankings

- Daily level of net cash inflows into indexes

- Active trader tools

Leverage

Webull makes the use of leverage available to all margin accounts. Robinhood, on the other hand, requires you to subscribe to Robinhood Gold, which costs $5 per month plus interest on any margin above $1,000 that is used.

Products Available to Trade

Both Webull and Robinhood have their advantages when it comes to product selection. Robinhood, for example, offers commission-free options and some cryptocurrencies. Webull, on the other hand, doesn’t offer options trading right now but, allows short selling, something Robinhood doesn’t allow on their platform.

Pure stock traders will much prefer Webull, as it gives them the ability to short stocks. Hybrid traders who like to use stocks and options are basically locked into Robinhood until Webull can offer the same.

Webull Trading Platform

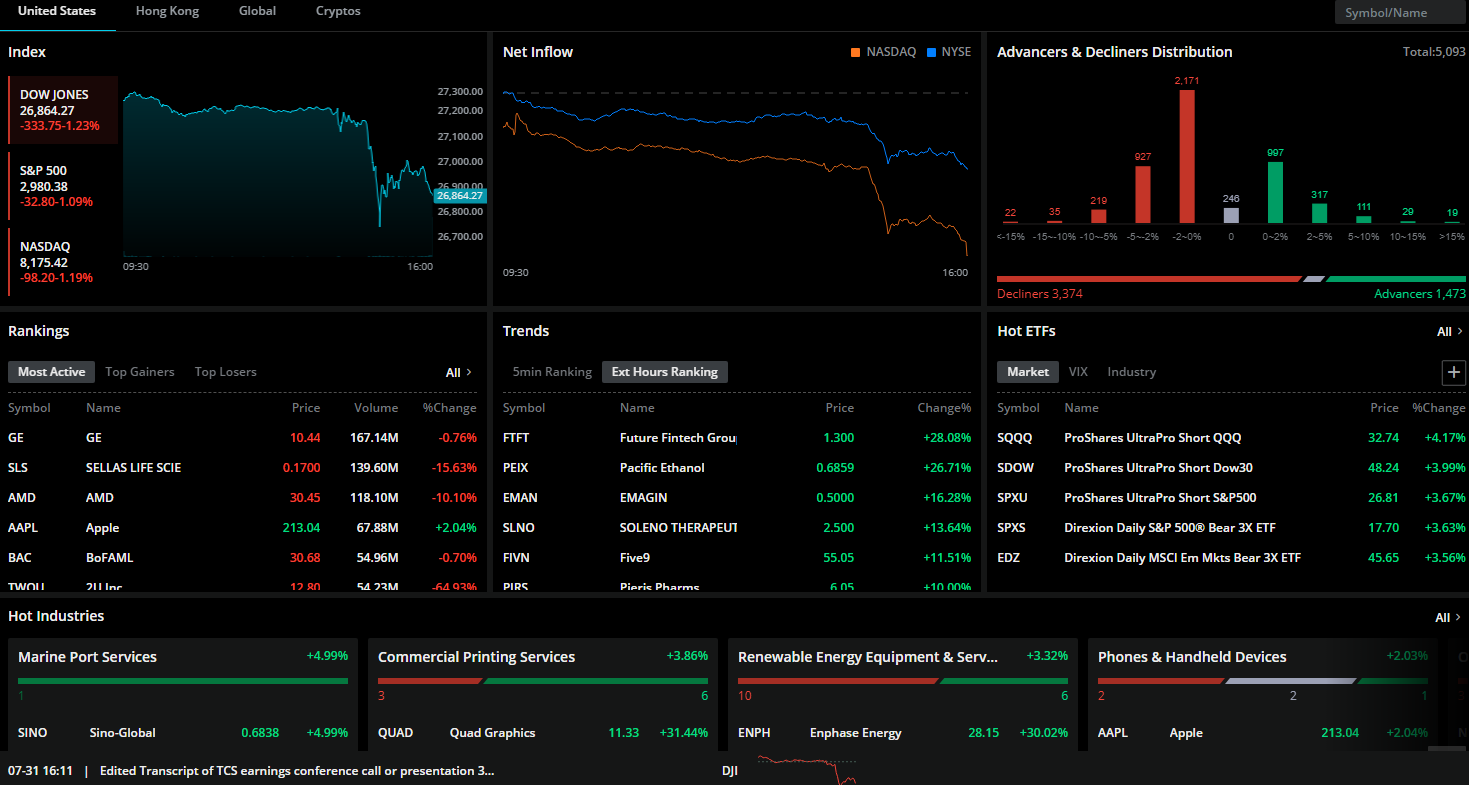

If you navigate to the Market tab in the desktop app, you’ll find a screen that looks like the following:

This interface gives you insight into the market macrostructure–what’s moving the market. Indicators like the net cash inflow to stock indexes, leading and lagging sectors, and emerging stock trends.

The effective use of market macrostructure can make the difference between a winning and losing trader. That’s because understanding where the money is flowing in the market on a daily basis enables you develop a directional bias for the day.

For example, if you identify lots of cash flowing into the US indices, and that advancing stocks significantly outnumber declining stocks, you can go choose to long-only for that day. It allows you to further put the odds in your favor by not trying to fight market direction.

Stan Weinstein, author of The Secrets to Profits in Bull and Bear Markets, heavily emphasized the use of macro indicators like the Advance Decline in his book.

Technical Analysis

In this section of the Webull review we will go over their charting tools and indicators and how they compare to other stock trading mobile apps.

The Good

For a platform that offers free commissions, Webull has decent technical tools that will satisfy the majority of traders. Their charts are high quality and remind me of TradingView: slick, fast, and easily manipulated.

There’s also several types of charts to choose from, like candlesticks, Heiken Ashi, bar charts, and line charts. It’s refreshing to see intraday Heiken Ashi charts given for free without a membership, as many platforms, like TradingView, charge for the feature.

An interesting feature not offered by most charting packages is their capital flow analytics. It lets you get a grasp on how big money is positioned in the short term.

The cherry on top that makes this free platform so great is the ability to compare securities easily, which is useful for CANSLIM traders who pay attention to relative strength.

The Bad

The main drawback is that Webull’s library of technical indicators is severely lacking, offering only ten of the most popular indicators, with several notables like ADX and RSI missing.

Here are the technical indicators currently included in Webull’s desktop platform:

- Simple Moving Average

- Exponential Moving Average

- Bollinger Bands

- Keltner Channels

- Ichimoku Cloud

- SAR

- VWAP

- Volume

- MACD

- KDJ

Fundamental Analysis Tools

You’re definitely not going to be able to write a research report on a stock with only the fundamental analytics provided by Webull. With the service being targeted at traders, the platform offers rudimentary analytics like trends in financial statements: cash from operations over four years, for example.

If you’re a savvy fundamental analyst looking to invest for the long-term, you’re probably going to want additional tools.

Stock Screener

Webull’s stock screener isn’t the most comprehensive but its still pretty impressive. It has a few filters and limited customization possibilities. However, it’s important not to judge the platform in a vacuum. With Webull’s free commissions, their main competitor is Robinhood, who doesn’t offer any stock screening capabilities.

On the bright side, the screener has some pretty sophisticated preset technical filters that screen for specific technical setups. Things like MACD golden crosses, bullish engulfing patterns, and three white soldiers patterns.

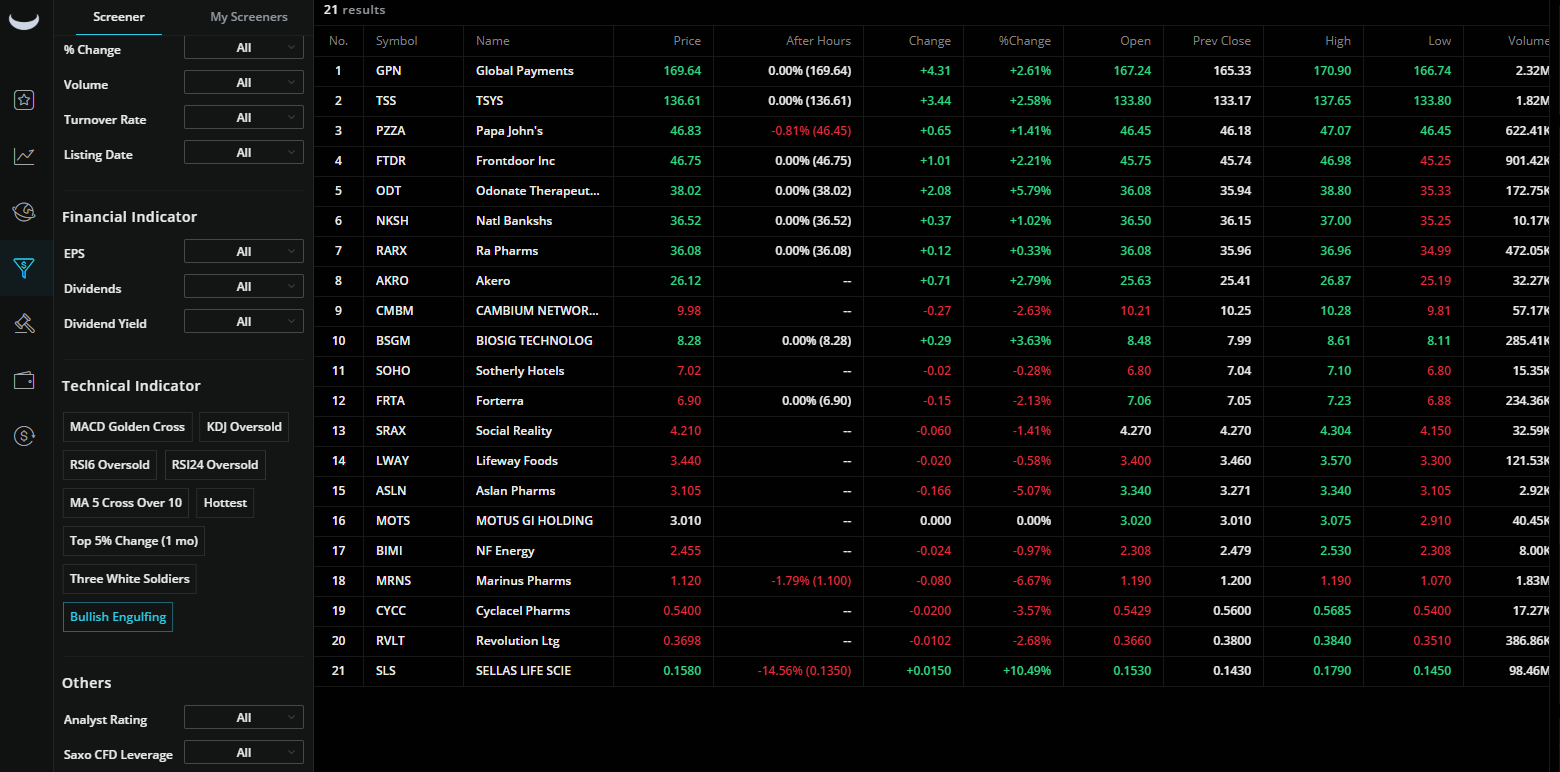

Below is a screen for bullish engulfing setups:

Paper Trading

Webull offers an advanced paper trading platform, through which they hold daily and weekly competitions with monetary prizes. It further proves their dedication to the budding trader.

Webull Commissions and Fees

Webull doesn’t charge any commissions for trades, and only requires you to pay SEC and FINRA fees, which you would pay with any other brokerage, including Robinhood.

These fees are pretty inconsequential, with SEC fees being $23.10 per million dollars of trading volume, while FINRA fees are $0.000119 per share.

Software Fees

Webull’s platform is completely free, but they charge for premium data. They currently offer several different data packages:

- Toronto Stock Exchange Level 1: $24.99/month

- Nasdaq Basic: $2.99/month

- National Best Bid and Offer: $9.99/month

- Taiwan Stock Exchange Level 1: $2.99/month

- Hong Kong Stock Exchange Level 2: $59.99/month

- London Stock Exchange Level 1: $16.99/month

- Deutsche Borse Level 1: $9.99/month

Traders who utilize time & sales (“the tape”) in their trading will need to subscribe to a premium data feed, as it’s not included for free within the platform. This is in contrast to a platform like TD Ameritrade’s thinkorswim, which provides free time & sales data.

Discounts are offered if you buy an annual subscription instead of monthly.

Can You Trust Webull?

Webull has SIPC insurance, which provides coverage of up to $500,000 for each account. This insurance protects clients from the loss of cash and securities held at a brokerage firm. The company is also registered with FINRA, and has a clean BrokerCheck record.

These two protections are standard in the brokerage industry, and protect the vast majority of clients from any loss due to the firm itself.

A Word of Caution

When speaking about “free” services, the quote “If you’re not paying for the product, you are the product” often comes up, and it’s especially true in the case of free stock trading apps.

Webull likely makes a large portion of their revenue through a practice called payment for order flow. In other words, large market making firms will pay firms like Webull and Robinhood to interact with their clients’ order flow before the rest of the market.

Many would ask in this situation: how are Webull and Robinhood able to offer free commissions when the big brokers like E*TRADE and TDAmeritrade are also able to sell their order flow?

A recent analysis done by Logan Kane found that Robinhood makes more than ten times per dollar of order flow they sell than E*TRADE.

Pros

- Free commissions

- No account or software fees

- Best platform for a commission-free brokerage

- Offers margin without a subscription (unlike Robinhood with their Gold membership)

- Allows short selling

Cons

- Doesn’t offer options trading (but will soon)

- Requires membership for some advanced features

Webull Review – Final Thoughts

Webull is still finding their footing within the industry but have made a big impact so far. They’ve identified their niche: younger, frugal traders dissatisfied by Robinhood’s lacking features. They’ve built a platform that blows away Robinhood’s current offering which is why we tend to lean in their favor.

The choice between Webull and Robinhood ultimately comes down to your trading product preferences. Those who trade lots of options are forced to stay with Robinhood, and Webull is a no-brainer for those who only trade stocks.

Hope you enjoyed our thorough Webull review. If you have any questions or comments, let us know below!

From time to time we refer third-party products or services to you. We may receive compensation from those third parties whose products or services we refer, however, our reviews and recommendations are independent of any compensation we may receive. There is no obligation for you to interact or transact with these third parties.