-

Value For Investors

-

Value For Active Traders

-

Commissions & Fees

-

Platform & Tools

-

Order Execution

-

Customer Service

-

Options Trading

Summary

Zacks Trade offers some really solid products including an advanced trading platform and tools for active traders. If you are an active trader looking for a new broker, this is one you should check out.

Pros

- No software fees

- Multiple platforms

- Foreign stocks are available

- Up to 6:1 leverage

- Competitive margin rates

- Residents of many foreign countries can open a Zacks Trade account

- Accounts are available for hedge funds, professional traders, and institutions

Cons

- Data bundles can be expensive

- Commissions on foreign stocks aren’t cheap

- Minimum deposit required to open an account

- Some withdrawals have fees

- Limited selection of investment vehicles

- Software can be difficult to master

Summary

If you’ve been using Zacks Investment Research to find potential trades, it’s time to check out Zacks the broker. More commonly known as Zacks Trade, it’s the brokerage arm of the security research firm.

The brokerage house offers a lot of trading services that may be absent at your current broker. So it’s definitely worth having a look at.

Brief Overview

Headquartered in Chicago, Zacks Trade caters to investors all over the world. Residents of many foreign countries can open an account and trade U.S. and foreign securities. Canada and Japan are a few countries that aren’t eligible.

Everyone else, keep reading.

Services Offered

Zacks Trade clients can buy and sell:

- Equities

- Options

- ETFs

- Bonds

- Mutual funds

Missing in action are futures, currencies, precious metals, and cryptocurrencies. Zacks does offer foreign currency exchange, but not forex trading.

Besides accounts for professionals, institutions, and hedge funds, Zacks Trade also offers margin accounts.

Day Trading

Because Zacks Trade is headquartered in the United States, day traders will need to maintain account equity of at least $25,000. There are a couple ways around this PDT Rule, however.

Place fewer than 4 day trades in a 5-business-day period. Or keep the day trades to less than 6% of your account’s total trading activity during the same period.

In return for staying within the rules, Zacks Trade delivers:

- Direct access to market venues

- Short locate features

- Level 2 quotes

Leverage

Zacks Trade offers 2:1 overnight leverage in a regular brokerage account. This assumes it has at least $2,000 in assets. Initial maintenance margin is 4:1. Some stocks may have less leverage.

At Zacks Trade, the special memorandum account (SMA) must be positive at least 10 minutes before the market closes. Otherwise, positions are subject to liquidation.

For short positions, the broker has a 30% maintenance requirement. This assumes the stock price is above $16.67. The requirement goes up if the stock price goes down.

Zacks Trade also offers something called Portfolio Margin. You get 6:1 leverage if you can deposit at least $110,000 in your account. You have to maintain at least $100,000 in the account to keep the leverage on steroids.

Commissions, Fees, and Account Requirements

Zacks Trade requires a $2,500 deposit to open an account. There are no inactivity fees or low-balances charges, though. The broker is one of the few we know of to charge for withdrawals.

A wire is $10, a check is $4, and an ACH is $4. Zacks Trade customers do get 1 withdrawal per month for free.

The broker’s commission on options trades is 75¢ per contract with a surcharge of 25¢ for the first contract. There are no fees for assignments or exercises, a great policy.

Trades of stocks and funds priced above $1 are a penny per share with a $1 minimum commission. For stocks and funds below $1, the charge is 1% of trade value with a $1 minimum.

Although Zacks Trade’s equity commission may look a little pricey compared to $0 brokers, its margin schedule is very impressive.

When we get to foreign stocks, it’s a different picture altogether. Margin rates in other currencies are usually higher, and commissions are too:

Zacks Trade imposes no surcharges on broker-assisted trades, a rare policy in this industry.

Software, Data, and Research Fees

Zacks Trade charges nothing to use its software, which is borrowed from Interactive Brokers.

Data is a different story. NYSE ArcaBook Depth of Book (Level II) is $11 per month for non-professions and $65 for pros. Many other data packages have fees.

Here are a few examples:

Data from foreign exchanges have monthly fees as well. They range from $1 to over $100 (usually denominated in a foreign currency), depending on the package and exchange.

Besides data packages, Zacks offers research subscriptions. Many of these are free. We found news articles from Dow Jones, Morningstar, Seeking Alpha, and of course Zacks Investment Research.

Other services charge monthly fees, although some do offer a free trial. Recognia, Benzinga, MT Newswires, and Thomson Reuters are a few examples.

Software

Now we come to the software that Zacks Trade customers get to use. As already mentioned, Zacks uses the same trading tools that Interactive Brokers uses.

This suite consists of a desktop program, a browser platform, a website portal, and a mobile app.

Zacks Trade Pro

The first feature worth mentioning about this desktop program is that there’s a demo version available at login. This is a great way to learn the software if you don’t have a lot of experience with it.

Once inside, you’ll find many great features. The platform is divided into two interfaces: Mosaic and Classic. These two tabs are located in the lower-left corner.

Although the layout is slightly different in each setup, the tools are mostly the same. It’s not a 100% overlap, though.

It’s also possible to create a custom layout. Just click on the plus (+) sign next to the two layout tabs. You can easily add windows to your custom setup using the blue “New Window” button. It appears at the top of the screen.

The custom layout has the same look and feel as the Mosaic layout.

iBot is an Artificial Intelligence that makes an appearance on the Mosaic side. It’s designed to answer all sorts of investment-related questions.

During our testing, it was able to answer some, but not all, of our questions.

Features on Zacks Trade Pro that day traders especially will like include:

- Time & sales window. This can be added using the blue “New Window” menu. NBBO figures are shown along with last price and size. The software also offers a convenient search feature for time & sales data.

- These can be established based on number of shortable shares, volume, price, % change, and other variables.

- Shorting and margin tools. The trade ticket displays whether an entered ticker symbol is shortable or not. The “advanced” menu on the ticket has a “check margin” feature. It shows initial and maintenance requirements for the security under investigation.

- Level II quotes. Under the New Window menu, select “Market Depth.” Level II quotes will appear in a new window.

Charting on the desktop platform offers a professional-level experience. Highlights include:

- Full-screen charting

- Over 100 technical indicators

- Drawing tools

- Buy, sell, and alert buttons

- Two chart styles (candles and OHLC bars)

A drop-down menu can be generated by right-clicking on a chart. Options include show/hide volume, time & sales data, zoom in, zoom out, add a drawing tool, and many more.

A chart’s interval can be set anywhere from 5 seconds to monthly. The time frame goes back only 5 years.

It’s possible to add multiple graphs to a single charting window by creating multiple tabs. The charts can be used for multiple ticker symbols with their own time-frames, drawing tools, and technical studies.

So if you need to watch multiple assets simultaneously during a market day, this is a great feature.

Client Portal

If the desktop program delivers more than you need, Zacks Trade offers a client portal. This is a browser-based trading system with fewer tools than Pro. But it’s more user-friendly.

The portal’s dashboard is divided into tiles. Themes include recent transactions, top news, positions, a watchlist, market indexes, and more. Each tile can be expanded full-screen.

A menu icon in the top left presents many of the platform’s tools. Examples include a watchlist, an economic calendar, and security screeners.

If you already know the ticker you’re interested in, just enter it in the search field at the top. Doing so will produce a profile with lots of information, including option chains and trade recommendations from industry analysts.

Although research tools are actually better on the client portal, charting is horrendous.

The platform’s trade ticket offers a lot of great features. They include:

- Whole-dollar investing

- Market-on-close and limit-on-close orders

- At-the-opening orders

- Extended-hours trading

Zacks Trader

Next up is the company’s browser platform. We were hoping to find better charting than the client portal delivered, but we were only slightly successful. A chart on Zacks Trader cannot be displayed full-screen, and there are no tools of any kind.

There are some good security screeners on Zacks Trader, though. They are able to scan many exchanges throughout the world based on lots of criteria.

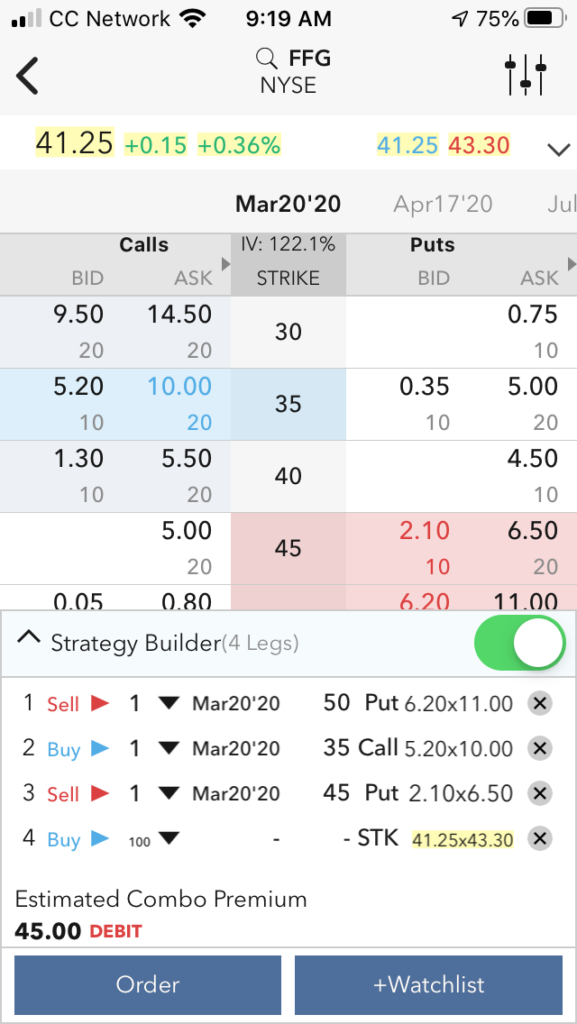

In addition to direct-access routing, the software offers option chains. Spread trading is possible.

Handy Trader

Last, but definitely not least, is Handy Trader. This is a powerful mobile app with lots of great features. These include:

- Options trading with up to 4 legs

- Horizontal charting with tools

- Watchlists and alerts

- Security scanners for U.S. and foreign assets

There are two order forms on the mobile app: a regular vertical ticket and a horizontal wheel-order system. The former offers:

- Algorithmic order types

- Extended-hours trading

- Bracket orders

- A hidden chart that can be swiped over the ticket…and many more advanced features

The wheel system attempts to simplify the order-entry process. It does this by listing prices on the left-hand side, and shares and dollar amounts on the right-hand side.

It’s easy to tap on the order specifications and select buy or sell.

Bottom Line

Although it does have the PDT rule, Zacks Trade has a lot of great resources for day traders. Its software is on a very high level, and we really like the broker’s global services. Futures, crypto, and forex traders will have to look elsewhere, though.