What is Tax Loss Harvesting?

Tax loss harvesting is when an investor sells a position at a loss to help offset capital gains tax liabilities at the end of the year.

To understand what tax loss harvesting is, let’s create a hypothetical portfolio.

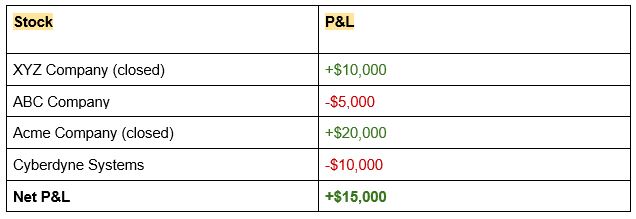

It’s December 15, and the following is your portfolio:

Here’s the situation, you’ve made good money on two stocks and closed those trades, bringing your realized profits to $30,000 for the year.

However, you still have two open losing trades in ABC and Cyberdyne. You might think that those losses would bring your taxable investment income to $15,000, but that’s not the case because those trades are still open, making them unrealized losses, and hence, ineligible as write offs.

So if you’re worried about paying taxes on all $30,000 of your profits, you might consider closing out your ABC and Cyberdyne trades (making them realized losses) in order to reduce your taxable investment income.

The practice of strategically closing out losing trades for more favorable tax treatment is known as tax-loss harvesting.

This is certainly a clever strategy applied by nearly all investors, but there’s a lingering question: what if you still want to own ABC and Cyberdyne? Clearly you do, or else you wouldn’t still have those trades open.

You might see a potential “loophole” here, where you close out your losing trades on the last day of the year, then re-open said trades on the first of the year. Well, the IRS has already thought of this. It’s called a Wash Sale, engaging in Wash Sales makes those trades become ineligible for write offs.

Wash Sales

In the previous section, we established that the IRS has measures in place to ensure that traders don’t over exploit the tax system by realizing gains on the last day of the year, and then opening up an identical trade on the first of the year.

Think about it this way, if you close a trade and then open the same trade a day later strictly for the purpose of claiming an artificial tax loss, that’s pretty unfair.

There’s a specific Wash Sale Rule in the IRS tax code, however, which states that you must wait 30 days before replacing an asset that you sold for a loss in order for it not to classify as a wash sale.

For example, let’s say you sold some Apple stock for a loss on December 15, you would need to wait 30 days (roughly until January 16 or so) before you can buy back Apple stock and still be able to write off the losses from your December sale.

The IRS goes a step further too, stating that you cannot replace a sold asset with a “substantially identical” asset to avoid the Wash Sale Rule. An example of this might be if you sold shares of FOXA (Fox Company Class A Shares) on December 15 and purchased shares of FOX (Fox Company Class B Shares) the next day.

While there isn’t specific guidance on cases like these, those two securities are almost identical.

While this isn’t tax advice and the tax code isn’t abundantly clear, many traders use a strategy of selling a stock for a loss and immediately replacing it with a similar, but by no means identical, stock. An example of this would be selling a stock like Mastercard for a loss, and immediately replacing it with Visa.

Of course, with matters such as these, you need to consult a tax attorney to figure out what you can do, as we’re not experts on the nitty-gritty of the tax code by any means and are unqualified to give you specific, personalized advice.

Tax Loss Harvesting Trading Strategy

Tax-loss harvesting is a known, repeatable phenomenon in financial markets.

The regulatory code makes this advantageous, and hence, there’s an element of predictability to the actions of traders and investors around the end of the year. Anytime there’s repeatable, predictable behavior, there’s potential for a profitable trading strategy.

By this I mean, identifying the stocks which are the most likely candidates for tax-loss harvesting, and buying them at the end of the year when everyone is selling them. Then, sell them back to the harvesters a month later when they want to re-enter.

Identifying Tax-Loss Harvesting Targets

This part is relatively simple.

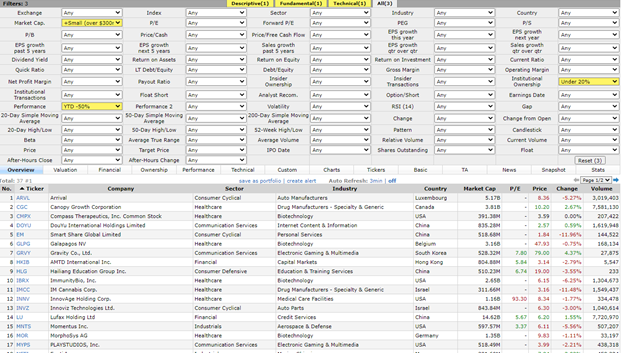

Identify stocks that have declined significantly throughout the year.

An extra tip I recently got in my inbox from The Macro Tourist is to favor stocks with low institutional ownership because “The more the stock is dominated by retail, the more likely the year-end tax loss selling will be indiscriminate.” To be honest, my assumption has always been the opposite, but when it comes to this stuff, I trust him.

You can create a simple screen for this on FinViz:

Then it’s as simple as finding favorable entry points in these stocks using technical analysis.

Because the majority of these stocks are in longer-term downtrend, you can’t think like a trend trader (which is difficult for me, personally), and instead adopt the mean reversion, “buy the dip” mentality. Easier said than done.

Look for trends that have begun weakening and showing significant hesitation to make new lows, waning momentum, and a developing support level.

Bottom Line

The end of the year is a great time for us to re-evaluate our portfolios. Sometimes we leave losing trades open longer than we should, and sometimes we need to reassess the reasons why we’re in a trade at all.

In general, it’s ill-advised to close a good trade idea that you still have conviction in just to harvest some tax losses for write-offs. Typically, tax-loss harvesting is best suited for those iffy trades that you are looking for a reason to close anyways.