Seasonality is when things change in data in a repeatable and predictable manner.

Like summer heat and winter cold, data too, has “seasons” which repeat itself predictably.

There’s seasonality in most datasets, especially in the financial and economic fields. Look at any economic statistic published by the government and you’ll often see the headline figure is “seasonally adjusted,” to remove the seasonal bias.

Before we move on with technical-speak, lets ensure that we understand seasonality in practical, common sense terms.

Some things are extremely seasonal and predictable.

Gasoline consumption is seasonal. People tend to travel and go out more in the summer so they buy more gasoline. Save for fluke events like a global pandemic, you can bet on this happening every year.

The above graph is an average demand/price for gasoline in the US on a monthly basis over 20 years of data. As you can see, there’s a predictable rise in the summer over the 20 year period, which repeats itself almost every year.

That is seasonality–a predictable and repeatable trend in data.

The same is true of retail sales. The holiday season is the biggest time of year for the retail industry and often this one quarter accounts for more than half of a store’s sales. This too, is highly predictable.

Notice the predictable spikes in retail sales during the holiday season every year from 2015 to 2019. This seasonal trend occurs in recessions and healthy economies.

In essence, seasonality is simply extracting human behavior patterns from data.

For that reason, it stands to reason that if the seasonal consumption trends of gasoline, home sales, and retail sales are all highly predictable, then perhaps people’s buying and selling of stocks has some predictability.

And that’s true. There are real socioeconomic factors that affect people’s buying and selling of stocks which occur at regular and predictable intervals which we’ll get into in this article.

But that statement needs a million asterisks and you’ll soon see why.

The Problem of Seasonality in the Stock Market

While, for instance, gasoline consumption is predictable, that doesn’t mean the future price of gasoline is predictable. So many factors outside of seasonality affect the price of gas that simply betting on seasonality might be profitable, it’ll be very noisy.

Furthermore, the true problem of betting on seasonality in any exchange-traded market comes with the very fact that we’re talking about.

When traders know about predictable seasonal patterns, they make trades based on them.

Let’s do a thought experiment.

Let’s say that gasoline was $1/gallon all year, except that during the summer season, the price goes up $2/gallon. This happens every single year in the same predictable pattern.

Smart traders would begin to take advantage of this by buying the day before summer starts. Their anticipatory buying would slightly push up the price the day before summer starts. So smarter traders would start buying two days before to front-run the price rising.

This would be an iterative process until there was no ability to front-run the summer effect and the price reflected this phenomenon all-year-round, adjusted for the time value of money obviously.

This is what people mean when they say “priced-in.”

It’s vital to keep in mind that any easily observable seasonality in markets will be to some degree, priced in. This doesn’t mean that you can’t profit from it, you just have to assess how priced in the effect is, and if the risk/reward stands up.

That all makes sense too. Any time there is a reasonably obvious way to beat the stock market (make better risk-adjusted returns than the broad market), many folks will jump on it until the edge is priced-in.

The stock market is a giant game of chess played by the smartest, richest people in the world, they take advantage of every easy edge there is.

The Summer Effect: “Sell in May and Go Away”

One of the oldest seasonal tendencies of the stock market is the tendency for weak seasonality in the summer.

Apparently one of the first observations of this effect was a result of traders realizing that London stockbrokers would take extended holidays in the summer, leading to reduced volumes.

Nowadays the same is true of Wall Street traders and portfolio managers spending more time and mental energy on their summer adventures in the Hamptons and New England.

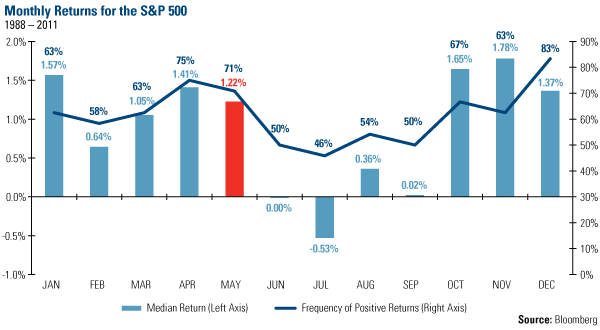

So how does the “sell in May” strategy stand up to scrutiny? The easiest way to measure this would be to look at average monthly returns in the S&P 500 for each month of the year:

As you can see there’s a very observable seasonal effect of summer weakness in the stock market.

A very simple way to implement this strategy would be to hold stocks from October to April, and sell them in May. This approach has some problems as spending roughly half of the year out of the market could mean that you miss the strongest rallies.

After all, summer weakness is not a rule, it’s simply a statistical tendency. Any given summer in the stock market could be extremely strong, like summer 2020 in tech stocks for example:

Furthermore, the S&P 500 has, on average, positive returns even during the summer (just weaker than the rest of the year), so you’re missing out on gains by being out of the market.

The Santa Claus Rally

The Santa Claus Rally is like an annual Christmas gift to the stock market. It refers to the seasonal outperformance of the stock market during the holiday season.

There’s no settled timeframe to define the Santa Claus Rally.

Some start the holiday season the week before Thanksgiving and end the day after New Year’s Day, while others use a much smaller timeframe of the trading days following Christmas Day, ending the day after New Year’s Day.

There’s no clear-cut reason to explain this seasonal effect, although some theories pertain to end-of-year tax-related trading, or increased investing activity due to holiday bonuses/gifts. Our job isn’t to find why, but to exploit these tendencies for profit.

This effect is quite similar to “sell in May and go away,” except it focuses solely on the winter months which are the primary source of outperformance.

Here’s a chart showing S&P 500 seasonal strength during the holiday season from 2000 to 2020:

The Market Holiday Effect

There’s a strange stock market tendency that leads to outperformance in the days leading to and following market holidays. These don’t have to be major holidays, either, this effect holds true for any day the market is closed, like Memorial Day or President’s Day.

Note that a ‘market holiday’ in this context means the stock market is closed for that day.

The trade involves buying the S&P 500 or Dow Jones Industrial Average three trading days prior to a given holiday and holding it three trading days following the holiday.

Tax Loss Harvesting/Selling Seasonality

One of the more explainable seasonal tendencies in the stock market relates directly to human behavior.

There are real incentives in place to drive this predictable and repeatable piece of human behavior, making this strategy more robust than most in the eyes of many seasonality traders.

It’s called tax loss harvesting. It’s the tendency for investors to sell their losing investments before the end of the calendar year to realize capital deductible capital losses, while simultaneously replacing them with similar investments.

For example, let’s say you were betting on oil stocks and owned shares of ExxonMobil (XOM). At the end of the year, you had a $10,000 loss on your Exxon shares.

You’d love to write-off those losses against your taxable income but you’re still bullish on oil stocks. Some investors in this situation might sell Exxon to realize and thus “harvest” the deductible losses, and then replace your Exxon shares with a very similar asset, like say, Chevron (CVX).

Note that investors cannot simply realize the $10,000 Exxon loss and then just re-buy Exxon shares, that would be considered a “wash sale” and your losses wouldn’t be eligible for deduction. This is why investors will often replace their shares of, say, Exxon, with something similar but not identical like Chevron.

So essentially the seasonal tendency here is that weak stocks tend to get weaker in the last few weeks of the trading year, and bounce back when the new calendar year starts as investors buy back their old positions.

Now that you understand why this structural incentive to sell weak stocks at the end of the year exists, let’s look at some simple ways to exploit it.

One such strategy is to focus on really beaten down small caps, as these tend to represent some people’s biggest portfolio losers. An additional headwind to put in your favor is to focus on stocks with less institutional ownership, as retail investors and traders tend to tax-loss sell more indiscriminately.

So the basic concept here is to find small-cap stocks with low institutional ownership that were really beaten down on the year.

Bottom Line

While seasonal trading is mainstream and a well-accepted form of alpha in the commodities world, it’s still a red-headed step child in the stock market world.

The seasonality of commodities is obvious to everyone; grains have their harvest season, gasoline consumption has well-established consumption trends, and so on. It’s not so clear in the stock market.

But it’s quite clear that seasonality does exist in the stock market, it’s just harder to find and even harder to explain.

The catch here is that when a trading advantage is more esoteric and less widely accepted, it also tends to be more profitable.