You’ve probably seen headlines like “Rivian Files S-1 With SEC to Go Public,” and wondered what an S-1 filing is.

You see, if you want to sell a security like a stock or bond to the US public on an exchange like the NYSE, you have to register those securities with the SEC.

And the SEC requires very specific information about said security like how many shares you’re selling, what you’re going to do with the capital you raise, what your business does, data on your company’s industry, etc.

So essentially, an S-1 announces to the public “we’re going to do an IPO soon, here’s some relevant information you need to decide if buying our stock is right for you.”

What Info is in an S-1 Filing?

There’s a laundry list of information that the SEC requires filers to include in their S-1s, but companies frequently willingly provide more information if it looks favorable enough to increase investor attention.

Here’s some basic information you’ll find in nearly every S-1:

- Financial statements for the previous year

- How much capital will be raised

- How the capital will be spent

- An overview of the business

- How they stand in the industry compared to their competitors

- Future projections about growth

- Basic risks inherent to investing in the IPO

When it comes to financial information, companies typically provide their financial statements like income statement, balance sheet, and cash flow statement for the previous year.

This gives us an idea of where they were a year ago compared to the publicly traded comparable companies in their industry.

For example, Lyft went public after Uber, so we had the opportunity to compare crucial rideshare metrics between the two companies to choose which one had a better future.

Companies will typically work very hard on their S-1 filings, filled with pretty graphs showcasing their impressive growth in key areas. A platform company like Facebook might use graphics to emphasize how strong their growth in Daily Active Users has been.

Who Files an S-1?

Private companies who intend to go public on a stock exchange file an S-1 filing with the SEC. Every stock on a national exchange like the New York Stock Exchange or the Nasdaq had to file one at a point.

However, sometimes you don’t get to see the S-1 immediately. The 2012 JOBS Act allowed “emerging growth companies” to file their S-1 confidentially with the SEC, only revealing it to the public three weeks before the IPO roadshow, where bankers find institutional investors interested in participating in the IPO.

Where Can I Find S-1 Filings?

The SEC EDGAR website is the official source for S-1 filings. For example, we’ll demonstrate how to find Facebook’s S-1 filing from 2011, because of how exciting their IPO was for the markets. Aswath Damodaran called Facebook the “IPO of the decade.”

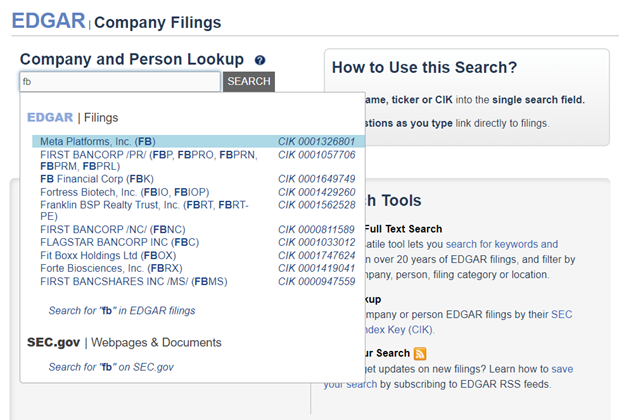

Navigate to EDGAR’s company filings page, found here. Now simply type the ticker symbol or company name. We’ll type “FB” to find Facebook (now known as Meta Platforms).

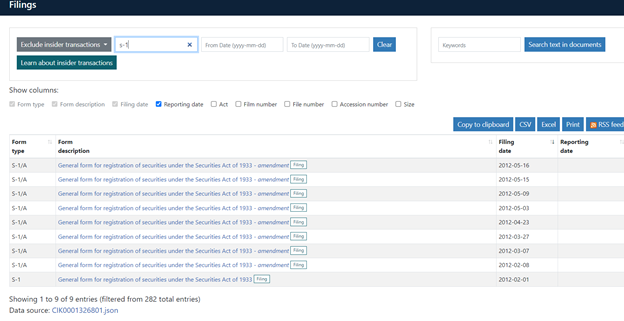

You’ll arrive on Facebook’s EDGAR page, which will look like the image below. Scroll down to the “Filings” section of the page and type “S-1” in the “search table” box. The results will fetch a list of S-1 filings made by Facebook.

Notice the long list of S-1/A filings, and only one S-1 filing. The S-1/A filings are amendments to the original filings. This happens frequently, companies will add or revise information in their original S-1 filing. You’re looking for the original S-1 filing, so click on the first one in the list.

If you notice, the S-1 filings on the SEC website aren’t formatted in the best way. There are no margins on the page and the lines of text are too wide, making it hard on the eyes to read for long periods.

For this reason, many companies provide a PDF version of the filing on their website. Let’s find that for Facebook.

First off, you want to search “Facebook investor relations” on Google. You’ll find the investor relations portion of Facebook’s corporate website.

Then look for “Financials” or “SEC filings.” On Facebook’s site, we found it under the “Financials” tab on the top menu. This is where Facebook uploads SEC filings like S-1s.

Now we just search for the appropriate filing. We want to change the drop-down menu to “All Filing Types” and the year to 2012, because that’s the year Facebook filed their S-1.

When Are S-1 Filings Made?

Most S-1s are filed a few months prior to the IPO. This gives the company time to gather investor attention, work with the stock exchange, their bankers, the media, etc.

For example, Rivian just started trading yesterday (November 10, 2021), and their initial S-1 was filed on October 1, 2021, just five weeks prior.

Bottom Line

A company’s initial S-1 filing often sets the tone for the first few weeks of trading for the company.

If investors seem quite excited about the S-1, you’ll likely see the company revise the IPO’s pricing up (which is the price that initial IPO investors pay per share), followed by an “IPO pop” on the first day of trading.

On the other hand, one of the best examples of a disastrous S-1 is when WeWork filed.

Their S-1, which is supposed to be a serious, sober document detailing financial information and potential risks, not only left out much of that crucial information, but said their company’s mission was to “elevate the world’s consciousness.”

The company got destroyed by investors and the press to the point of cancelling their IPO.

Lesson: S-1s matter!