One of the key components of achieving consistent success as a day trader is having a well-designed trading edge that specifies how and what you will trade.

Whether you are new to trader or have been trading for a while, having a trading edge is important as it helps keep you on track to attain steady and profitable trading results.

In spite of this being the case, most traders don’t even have a clue what a trading edge is, let alone how to develop one.

Below, we will look at what a trading edge entails, the importance of developing one and the steps involved.

What is a Trading Edge?

A day trading edge is when a trader can identify something in the market that gives them an advantage or insight into how well a trade will do. Simply put, it is a general term used to describe the fact of positive expectancy.

This means the trader has a way to identify trading opportunities that will provide them with a positive outcome over the long-term. Traders who have an edge have developed a method to navigate the stock market in a way to come out ahead.

This makes you act like a casino in a way. You are looking for only the most favorable outcomes that puts the odds in your favor.

This is important to understand because not every trade, no matter how perfect the setup is, will work out as expected. But with a proven trading edge, you will have a positive expectancy over the long run.

Example of a Trading Edge

A good example of an edge is the casino.

If you play Roulette, the casino will have an edge. You can win many times, or win once. But, if you gamble for a long period of time, you are going to lose money because the casino receives $100 and pays out $95.

The casino has an edge that will show itself resulting in a guaranteed loss for the gambler in the long run.

Every gambler that plays there is at a disadvantaged but that doesn’t mean you can’t win there once in a while. You might have luck sometimes, but the casino will always make money because of its edge.

However, it is important to note that having an edge does not guarantee that you will have winning trades. It means your winning trades will offset your losses in order to make money consistently over the long-term.

Trading Example

What makes a trading edge successful?

First, you need to have a trade setup that makes more money than you risk OR has a high win rate.

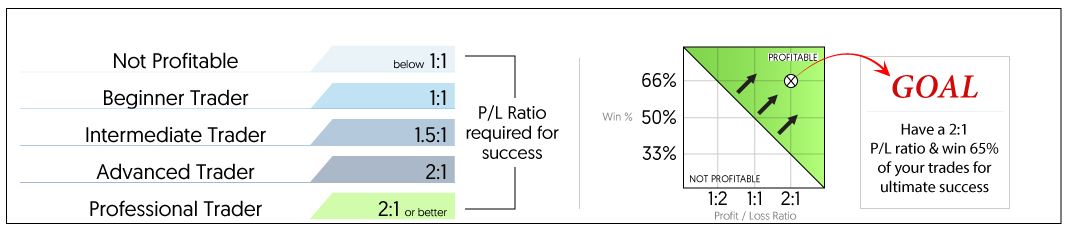

We trade edge’s that offer usually a 2:1 profit/loss ratio or more. So for every dollar we risk we are looking to make $2. That means one winning trade covers the losses of two losing trades to breakeven.

So we need to have a win rate higher than 33% to be profitable as you can see in the graph below from our profit trifecta page.

With a high win rate trading edge you would have a lower profit/loss ratio but since you would be hitting more winning trades than losses it would make up for it.

The problem with this type of edge is you’re more of a hyper-scalper that is in and out very quickly which can become quite expensive with commissions and exchange fees. For new traders this can be a very tough to accomplish and generally not recommended.

As shown in the graph above, a trading edge with a 1:2 profit/loss ratio requires a win rate of 66% or higher.

Importance of Having a Trading Edge

Although you can still do well while being at the mercy of the market forces most of the time, you have much less insight into what happens in the market.

An edge gives you more insight or advantage over other participants trading with the same stocks and forces you to be a disciplined trader.

Doing what everyone else is doing will yield similar results as everyone else. And we all know that the majority of traders fail. Your trading edge is the critical component of both your strategy and mindset that sets you apart from other traders.

Trading with an edge is something that every trader should always aspire to do.

Steps for Developing Your Trading Edge

Starting out, you need to learn how to trade and sharpen your skills. Learn how to place orders, how to manage risk, when to trade, how to pick stocks to trade, how to size your trades, rules for day traders, etc.

This can help increase your chances of reaching your trading goals and minimize losses. Knowing these things also helps you make to better-informed decisions and take strategic actions.

More importantly, it boosts productivity and reduces your trading anxiety.

- Learn different trading setups

To develop a trading edge, you also need to learn different trade setups. This is immensely useful and is an easy way to improve your trading performance irrespective of your strategies.

Some important trading setups to consider include: breakouts, reversals, flag patterns, range-bound, continuation, etc. We are big fans of bull flag breakouts which, when traded correctly, can provide excellent risk/reward results.

On these setups, you should know exactly your win percentage, risk vs reward, how much money you will risk, and every other little detail of the setup.

Next, you need to practice those setups on a demo/simulator using the skills you learned on how to trade to see if you can develop an edge with these patterns in simulation. A simulator allows you to trade the securities with real quotes in real time, but with paper money.

This gives the chance to experience market risks, and test your ability to endure and overcome them while losing nothing in the process. You should not put real money in the market before you have proved edge first on a simulator.

- Decide which setups make most sense to you and that have been consistently profitable

The best traders have one setup that they are intimately knowledgeable about. You need to focus on finding this setup that you can count on to bring you income.

You should consider what time frame you will trade on, what patterns you will look for, and what type of stock you will trade.

- Master your setup

Once you have decided which trading setup makes most sense to you, the next step should be to master it as this helps create focus and clarity in your mind by minimizing decisions and removing clutter.

You can do this by journaling trades, reviewing results and learning where to improve, as well as understanding what type of market works best for that setup.

However, mastering a setup takes time and you need to be constantly refining it. Sticking to a setup and not deviating is also one of the hardest things particularly for new traders.

Once you master your setup and have an extended period of consistent gains, you can begin to add more setups to your repertoire.

Bottom Line

To be a successful trader, it is important to understand that trading starts with having an edge in the markets. Having a trading edge will not make you a profitable trader, but it will make your life a lot easier and point you in the right direction towards success.

The basis of trading lies in understanding what it actually means to have an edge in the markets and how to identify it.

Things such as indicators also ought to be used to help you make trading decisions only after you have identified an edge.

Remember that your edge is your secret sauce. It’s how you standout from the rest and define yourself as a trader!