-

Value For Traders

-

Platform & Tools

-

Reliability

-

Coolness Factor

-

Customer Service

-

Options Trading

-

Mobile Trading

Summary

TastyWorks is a fun broker to trade Options with and you have the ability to trade equities beyond the U.S. markets. They are reliable with a mobile and online chat along with competitive pricing and futures trading.

Pros

- Very good commission schedule

- Multiple software platforms

- Futures trading

- Business accounts and IRAs

- Free access to tastytrade, the company’s educational arm

Cons

- No Level II quotes

- Charting is elementary

- No currency trading (forex or crypto)

- Customer service is limited

- No direct-access routing

- Order ticket is rather basic

- No simulated trading

tastyworks is an inexpensive brokerage firm based in Chicago. It specializes in options and futures trading, although it does offer a few other assets.

Besides its software platforms, it has developed an educational service called tastytrade.

It also is a major investor in dough, another discount broker.

Services Offered

tastyworks offers trading in these investment vehicles:

- Stocks (including penny but not over-the-counter securities)

- ETFs and closed-end funds

- Futures (including micro and Smalls)

- Options (equity, index, and futures)

Pricing Schedule

tastyworks charges nothing for stock and ETF trades. Options on those products cost $1 per contract on the opening side and $0 on the closing.

There is a $10 maximum per leg, which of course will benefit high-volume traders. Futures range from $1.25 per contract to $0.25 per contract.

A few other charges worth noting:

- Option exercises and assignments cost $5

- tasty passes on exchange and regulatory fees

- There is a $60 fee to close an IRA

The one really nice policy is zero software fees. Speaking of software, here we go:

Trading Tools

tastyworks has three software platforms: a browser system, a desktop program, and a mobile app. They all have the same basic interface, but there are some important differences that we’re going to point out.

Browser Platform

First up is the web-based trading platform. It is launched after logging into the website, which has only basic account management functions. The trading platform launches into a new tab within the browsing window. One downside is that you have to log in again on the platform screen.

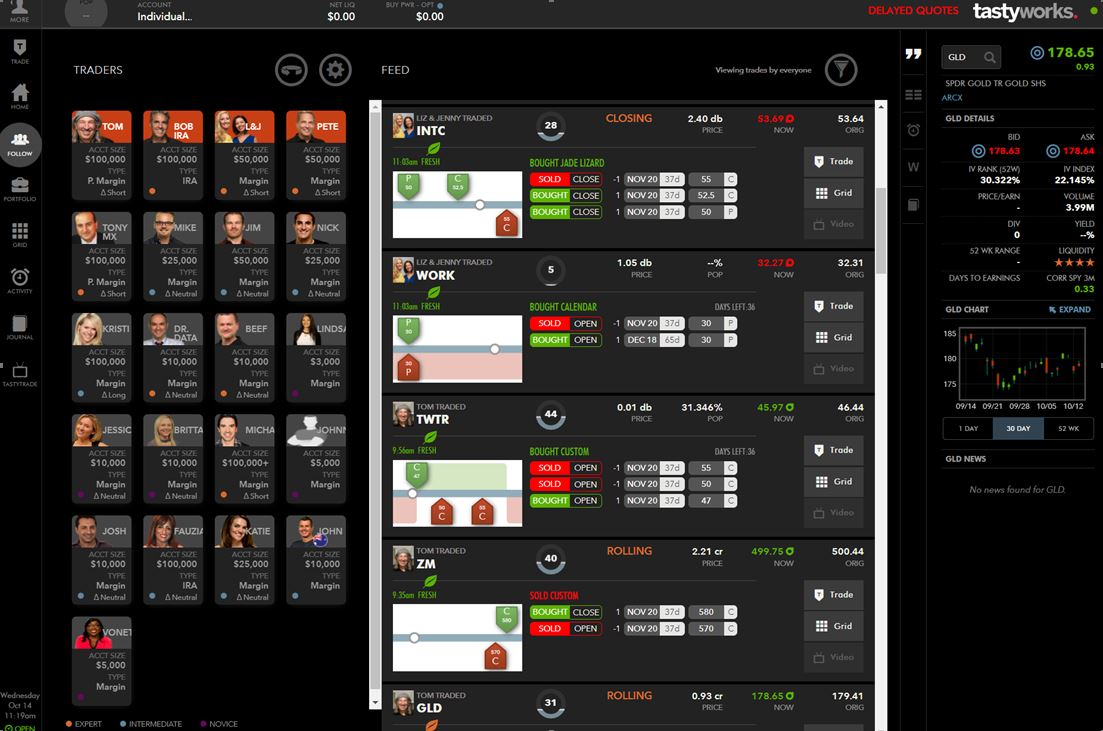

Once inside, you’ll find a vertical menu on the left-hand side. The Follow tab is a good place to start if you want to see what tastyworks employees are trading.

Yes, tastyworks actually posts its employees’ trades. On the day I did my research, the CEO of the company bought an iron condor on JPMorgan.

One of the really nice features on the Follow tab is the ability to copy a trade that’s posted. Clicking on the Trade button automatically pre-fills the trade ticket with the exact same trade. It’s also possible to add an underlying security from a trade to a watchlist.

In the left-hand menu there is also a Journal tab. This is a great tool to write notes about the trades you’re placing. And it’s possible to add tags to notes.

At the bottom of the vertical list is tastytrade. Here, you’ll find a live stream during market hours with comments on possible trades. You’ll also find on-demand videos on a host of topics, including:

- Volatility

- Options mechanics

- Covered calls

- Cash-secured puts

If you already know what you want to trade, just look to the top of the menu. The trade ticket is there. It has three modes: stock, curve, and table.

As the name implies, the first can be used for trading stocks and ETFs. The second can be used to trade stocks, ETFs, options, or futures using a graphical interface. And the third mode replaces the graph with numbers in a table.

The real disappointment with the order form is the lack of advanced trade types. These are the orders that are available:

- Limit

- Market

- Stop

- Stop limit

There is no direct-access routing, and no Level II data.

The platform’s charting tool can be found in the right-hand side of the platform. Clicking on the Expand link next to a very small chart produces a medium-sized chart in the middle. There are five drawing tools and zero technical studies.

Desktop Software

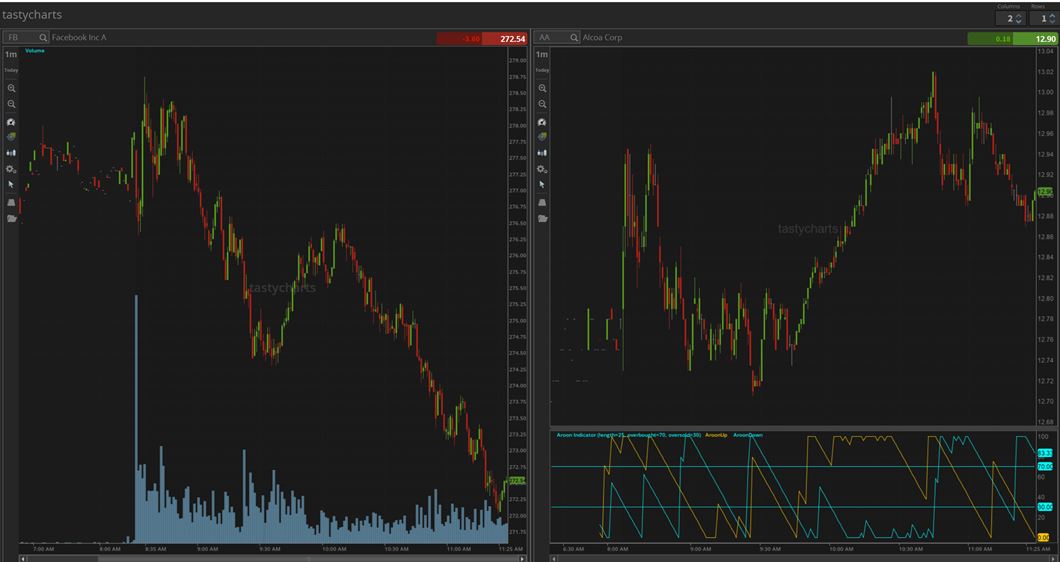

If you want better charting (and if you’re day trading, you should), you’ll find it on tasty’s desktop software.

To launch it, you’ll first need to download and install the software. Once launched, you can log in and start trading and charting.

The desktop system does a much better job of providing decent graphing tools. Finding the charting widget is a little difficult. The chart icon is located in a vertical column of tabs next to the watchlist on the left-hand side.

Click on the graph icon and then click on a ticker symbol in the watchlist. You’ll then have the software’s charting tools, which will be displayed in the middle of the screen.

Some of the really nice features I found useful include:

- Over 100 technical studies

- Several drawing tools

- Four graph styles

- Price history from 20 years to intraday with 1-minute candlesticks

Unfortunately, there is no right-click trading. But if you click on a bid or ask price above the graph, an order ticket will automatically appear. Somewhat disappointingly, it has some of the same limitations that the browser ticket has, namely a limited number of order types.

A recent software update has added bracket orders (click on the gray Bracket button). This addition brings the total to five.

The desktop program also has more duration choices. They include:

- Day

- Extended hours

- GTC

- Good-till-a-date

If you don’t currently own an asset, the sell button will be shown as a short button.

The software upgrade has also added tastycharts, a discrete window that permits full-screen charting. It also allows multiple charts to be displayed within one window. The downside is that tastycharts has no trade button, and there’s no right-click trading, either. The icon for tastycharts is in the same location as the regular graphing icon.

For market research, the desktop platform once again offers videos courtesy of tastytrade. I was hoping to find at least a stock screener, but found no screener at all.

Mobile App

If you’re away from your computer during trading hours, tastyworks has an answer for you. Its mobile app is compatible with Apple and Android phones and tablets. It has the same night-time interface with zero customization.

The mobile app is a little weaker than the other platforms. For instance, graphs are shown on a trade ticket in a very small window. In this mode, a graph cannot be rotated horizontally, further restricting the use of graphs. And just forget about any charting tools.

There is one other charting option: go to a watchlist and tap on an asset. You’ll get a profile where a graph is a little larger and can be shown in horizontal mode. But there are no tools of any kind.

Although charting is pretty much off limits on the mobile platform, I did like these features:

- Trade ticket with the same option strategies as the other two platforms

- Live stream from tastytrade

- Trades from tasty insiders with the ability to replicate their trades

- Color-coded watchlist in tile format—green for assets that are up and red for those that are down

Comparison

Compared to some other $0 brokers out there today, tasty’s software outperforms some of its rivals but underperforms others. For example, Vanguard has no desktop software at all. But TD Ameritrade does, and it is light years ahead of tasty.

For example, TD Ameritrade’s order ticket offers many more order types plus direct-access routing. Charting is also much better, Level II quotes are available, and futures can be traded on the platform.

Unlike TD Ameritrade, E*Trade also has a browser platform in addition to its desktop system. E*Trade’s browser software has a very advanced order ticket that tasty’s is missing. For example, it has

no less than 13 order types and 8 duration choices. And charting is much better than anything else you’ll find on tasty’s web-based system.

Bottom Line

tastyworks has some decent tools that can be used for day trading, but only in limited fashion compared to what else is out there.