US stocks are climbing a wall of worry, yet again. Even amidst the most consequential global crisis in decades in the Russia-Ukraine war, stocks are still rising, even to the point of being at pre-invasion levels after this week’s price action.

At the technical level, you couldn’t tell that the entire global economy is being shaken up amid high inflation, rising interest rates, massive supply constraints, and most of all, a huge war between a United States adversary in Russia and ally in Ukraine.

Two key things to point out about the technical picture here:

- How aggressively stocks rallied off the lows

- Volatility compression near recent highs

The aggressive price action and breaking of the ~4360 level broke the short-term downtrend pattern that formed on the daily chart. Momentum precedes price, and the S&P bounced off highs with momentum not seen in months. The probabilities, on the technical level, are in favor of upside continuation. Obviously things are dynamic right now and there’s huge headline risk that can throw the technical picture out the window, however.

The market is pausing around the most recent high and significant level of ~4590. This indicates price acceptance, as sellers have failed to step in and push the price down further, which is a pattern that precedes many breakouts.

What’s most interesting is contrasting the price action against sentiment. Commentators love to say that the market is ‘climbing a wall of worry’ in times like these, and that doesn’t even do it justice. The prevailing sentiment from my point of view is near peak bearishness.

Chart of the Week

This week we’re highlighting the Canadian stock market, the TSX:

It’s within spitting distance of all-time highs during a global crisis and domestic social instability. This is likely a result of Canada’s very strong natural resources, of which they’re likely to be supplying to the United States at elevated prices.

Last Week’s News

- China continues to buy Russian oil

- The US House introduced a bill to decriminalize marijuana, and cannabis stocks went crazy

- JPMorgan CEO Jamie Dimon reportedly private urged Biden to encourage more natural gas drilling

- Putin to make ‘unfriendly’ countries pay for natural gas in Rubles or gold

- EU to pursue anti-competitive legislation against big tech platform providers like Meta, Amazon, Google, etc.

- China cutting taxes in a continued effort to create a more business-friendly environment

- Warren Buffett’s Berkshire Hathaway buys insurance company Alleghany ($Y) for $11.5B

- Nickel squeezed again at the LME

- Russia made a sovereign bond payment that investors were worried about

Weed Stocks Roar on US House Bill

The US House will vote next week on a bill to federally decriminalize marijuana in the US. This comes amid a flurry of M&A activity that was already creating activity in the sector and the stocks went crazy.

Let’s take a look at Tilray (TLRY), the biggest benefactor, up 60% on the week:

Russia Making Unfriendly Countries Pay for Natural Gas in Rubles or Gold

As soon as Putin said this, the price of European natural gas shot up on the news but has since forfeited most of the gains:

This is clearly a move not only to put pressure on Europe, but to stabilize the significantly damaged Ruble. The Ruble strengthened a bit this week against the US Dollar and pad their gold reserves, as Russia is largely cut off from the US dollar.

Earnings

Earnings season is still not quite upon us, as only seven S&P 500 components reported last week, with five of them beating EPS expectations. So far, the sporadic bunch of companies we’ve gotten during off peak earnings season have been mostly surprises.

Monday, March 28 2022:

- Jeffries Financial Group (JEF)

- Science Applications (SAIC)

- XPeng (XPEV)

Tuesday, March 29 2022:

- Micron Technology (MU)

- PVH (PVH)

- Chewy (CHWY)

- Lululemon (LULU)

- Academy Sports and Outdoors (ASO)

- McCormick (MKC)

- Elbit Systems (ESLT)

- Concentrix (CNXC)

- Conn’s (CONN)

- Sportsman’s Warehouse (SPWH)

- Lovesac (LOVE)

- Sundial Growers (SNDL)

Wednesday, March 30 2022:

- Paychex (PAYXX)

- AerCap (AER)

- Five Below (FIVE)

- BioNTech (BNTX)

- UiPath (PATH)

Thursday, March 31 2022:

- Walgreens (WBA)

- New Age Beverage (NBEV)

Economic Data

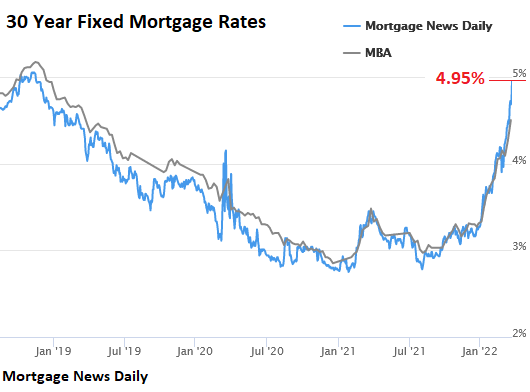

Last week we got some interesting housing data which came in lighter than expected, as home sales hit 722,000 in February versus an expected 820,000. There might be some hope that home prices will cool down a bit, as the market has been treacherous for prospective homebuyers, even to the point that a Federal Reserve governor is having trouble buying a house.

Surely, part of this reduction in sales is a result of inventory shortages, but also mortgage rates, which have been steadily on the rise.

Next week we get some interesting economic data points. By far the most consequential of them is the ISM manufacturing report, which gives us the Purchasing Managers Index number, a crucially important leading indicator on the health of the US economy.

Tuesday, March 29:

- Consumer confidence

Wednesday, March 30:

- ADP employment report

Thursday, March 31:

- Initial and continuing jobless claims

- PCE price index

Friday, April 1:

- Nonfarm payrolls

- Unemployment rate

- ISM manufacturing index