The tides yet again shifted in the US stock market this past week.

Stocks rallied all week and now all the bulls are taking a victory lap while the bears swear up and down that it’s a bear market rally.

Here are the US indices returns for the week:

- S&P 500: +5.5%

- NASDAQ 100: +7.23%

- Dow Jones Industrial Average: +4.6%

- Russell 2000: 7.6%

The Technical View: Stocks

From a technical perspective, the downtrend pattern in the S&P 500 is officially broken and we’ve now entered range-bound territory.

After the recent price action, most would expect an immediate shift to an upward trend, or a trend reversal. But in reality, when a trend dies out as this one did (rather than die a climactic death), they tend to ‘rest’ and trade in a range for a bit before picking its next direction.

This is a fundamental principle of some of the most successful traders: that markets go through periods of range expansion and range contraction. Now that the market has reached some semblance of equilibrium, at least compared to recent history, don’t be surprised to wake up to a boring market for the next few weeks.

Because bears are the loudest and most confident in their proclamations, one of the prevailing narratives is that the current bullish price action in stock is a classic “bear market rally.” That could very well be true, but there’s a few reasons to not be sold just yet.

First off, we’re only about 15% off all-time-highs at the current price levels after about seven months of downward trends. That’s hardly a convincing bear market and could more accurately be called a long correction.

Furthermore, if you take a look under the market’s hood, things don’t look as bad as they’re made to seem. What rallies out of a downtrend is quite telling. Whereas during the “reflation” era of the stock market in 2021, tons of defensive and value stocks outperformed on market rallies.

During this rally, we’re seeing significant outperformance from pro-cyclicals like technology, consumer cyclicals, as well as small caps showing relative strength against mega-caps as can be seen in the Russell 2000 vs. the Dow.

And the ultimate gauge for risk-on appetite in equities, ARK Innovation ETF (ARKK), is showing steady relative strength to the S&P 500, which, to me, is a surefire sign that we’re not in a bear market.

The Technical View: Crude Oil

When it comes to crude oil, we’re once again approaching the crucial end of the multi-month range.

Back in June when crude tested the top end of this range and tried to break out, price rejection quickly occurred, sending the price back inside of the range and beginning a month-long downtrend which is still underway.

Crucially, crude oil is down trending into this significant bottom end of the range, significantly raising the odds that the level is broken.

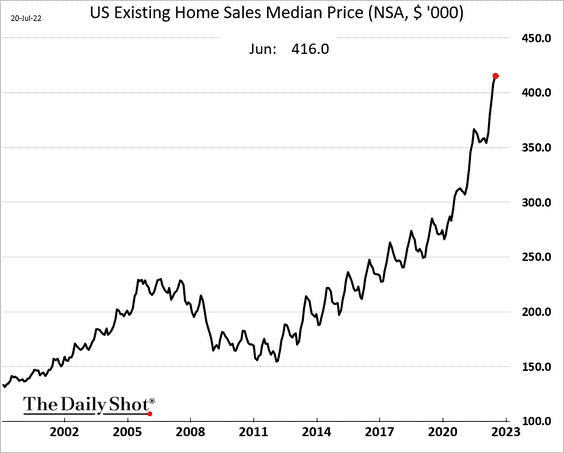

Chart of the Week: Home Prices

Look, the housing market isn’t as strong as it was six months ago. Mortgage rates are rapidly climbing, there’s price cuts across the board, and inventory is sitting on the market much longer especially in the previously strong markets like Austin, TX.

However, the median US home price just hit an all-time high. If we are to go into a recession in the next two quarters, expect much more pain in the housing market.

Federal Reserve Watch

This coming Wednesday we get a very consequential Fed meeting. One which traders are betting will be at least 75 basis points, if not 100 basis points.

With a few economic surprises in recent weeks like the hot job report, the hot inflation report, and the surprising Bank of America card spending data, which showed consumers aren’t spending like there’s a recession, there will be lots of pressure on the Fed to be even more hawkish than lately.

Powell is likely feeling immense pressure to make a statement. To beat the market into submission with hawkishness.

But on the other hand, it comes right as there seems to be light on the other end of the tunnel. It’s very likely that the next CPI print will be much lower than the June print, given the significant declines in commodity prices as of late. A meaningfully lower print can give Powell the support to relax on the rate hikes.

Currently the market is pricing in a 73% likelihood of a 75bp hike, and a 27% likelihood of a 100bp hike:

Last Week’s News

- Snap (SNAP) reported ugly earnings and the stock dropped 27%. The company also suspended their guidance. They did, however, outperform new user expectations and initiate a $500M buyback program.

- As usual, the rally in cannabis stocks was a “sell the news” event, as they declined on news of legislation being introduced to the US Senate.

- Russia and Ukraine plan to sign a deal to start exporting grains and fertilizer out of the Black Sea again

- The judge chosen in the Twitter vs. Musk case is Kathaleen McCormick, which is notable because she forced a reluctant buyer to close a merger deal, a rare occurrence in Delaware court.

- Judge in Twitter/Musk case grants Twitter’s request for an expedited trial

- Amazon (AMZN) is using Rivian (RIVN) vans to deliver packages in select metro areas.

- Russia restarts Nord Stream pipeline, gas flows to Europe again after a 10-day shutdown

- Tech hiring pause continues this week with new pauses at Microsoft and Google

- Netflix (NFLX) beats earnings and the stock has rallied nearly 30% from recent lows.

- Bank of America card spending data shows consumers are still aggressively spending especially on travel.

Upcoming Earnings Next Week

The stock market was helped last week by a few giants like Netflix (NFLX) and Tesla (TSLA) reporting positive earnings, which is being viewed as an indicator for the rest of the market.

So far, 70% of companies have beat EPS expectations, which is down from 76% last quarter, however given the baked-in bearish expectations, the market seems pretty happy with the earnings results so far.

Next week is the week of the FANGs. We get Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), and Microsoft all in one week. In addition, we get dozens and dozens of large-caps and mega-caps, with a huge portion of the Dow 30 reporting.

Next week’s reports will likely determine the direction of the market for the next few months.

Here are the most significant earnings reports coming this week. Because there is so much reporting, we’re just giving you the most notable and potentially volatile reports. Checkout an earnings calendar for a more exhaustive list:

Monday, July 25:

- Newmont (NEM)

- Koninklijke Philips (PHG)

- RPM International (RPM)

- SquareSpace (SQSP)

- NXP Semiconductors (NXPI)

- Cadence Design Systems (CDNS)

- Packaging Corp of America (PKG)

- Whirlpool (WHR)

Tuesday, July 26:

- Coca-Cola (KO)

- McDonald’s (MCD)

- Microsoft (MSFT)

- Alphabet (GOOG)

- Visa (V)

- Texas Instruments (TXN)

- Chipotle (CMG)

- Enphase Energy (ENPH)

- Moody’s Corp (MCO)

- United Parcel Service (UPS)

- Raytheon Technologies (RTX)

- 3M (MMM)

- General Electric (GE)

- UBS Group (UBS)

- MSCI (MSCI)

- NVR (NVR)

Wednesday, July 27:

- Meta Platforms (META)

- Qualcomm (QCOM)

- Ford Motor (F)

- Etsy (ETSY)

- T-Mobile (TMUS)

- Bristol Myers Squibb (BMY)

- Boeing (BA)

- ADP (ADP)

- CME Group (CME)

- Sherwin Williams (SHW)

- Shopify (SHOP)

- Kraft Heinz (KHC)

- Hess Corp (HES)

- Spotify (SPOT)

Thursday, July 28:

- Apple (AAPL)

- Amazon (AMZN)

- Intel (INTC)

- Mastercard (MA)

- Pfizer (PFE)

- Merck (MRK)

- Comcast (CMCSA)

- Honeywell (HON)

- Anheuser-Busch (BUD)

- Altria (MO)

- Keurig Dr Pepper (KDP)

- Hershey (HSY)

- Southwest Airlines (LUV)

Friday, July 29:

- Exxon Mobil (XOM)

- Procter & Gamble (PG)

- Chevron (CVX)

- AbbVie (ABBV)

- AstraZeneca (AZN)

- CBOE Global Markets (CBOE)

Upcoming Economic Data Next Week

Tuesday, July 26:

- S&P Case Shiller National Home Price Index (YoY)

- Consumer confidence index

- New Home Sales

Wednesday, July 27:

- Federal Reserve meeting

- Pending home sales

Thursday, July 28:

- GDP, first release

- Initial and continuing claims

- PCE inflation report

- Consumer spending

- Chicago PMI

- University of Michigan Consumer Sentiment Index