-

Value for Investors

-

Platform and Tools

-

Reliability

-

Customer Service

-

Fees

Summary

Stash Invest is a great place for beginner investors or people who don’t have time to do their own market research to start! The app works by easily stowing away your money into your interests and watching it grow over time. Stash Invest is very user friendly and offers as low as $1 monthly fees.

Pros

- Whole-dollar investing

- Two software platforms

- IRA’s and custodial accounts

- Library of educational materials

- Cash management features

Cons

- No day-trading resources

- Software is underdeveloped

- Level II quotes are missing

- Charting is terrible

- Small selection of tradable instruments

- No ability to route orders

- Trade ticket is very simple

Brief Overview

If you would rather trade whole dollars instead of whole shares, Stash is one place to consider.

But its fractional-share trading service comes at a high price as many other services are missing. Here’s the lowdown on this innovative broker.

Services Offered

Stash is a new brokerage firm on the scene trying to provide a modern way to invest and trade. But it surprisingly doesn’t offer any robo management services. It provides only self-directed accounts and some unique banking features (discussed up ahead).

Trading is limited to just stocks and ETFs. There are no other products, so you won’t be able to trade options, futures, or cryptocurrencies here. Moreover, Stash amazingly doesn’t offer access to all stocks and ETFs listed on the major exchanges.

During my research, I counted:

- 3,274 stocks at Stash (out of more than 6,000 total trading on the leading exchanges)

- 91 exchange-traded funds (out of more than 2,000)

Obviously, you’re going to miss some opportunities with a Stash account. But Stash’s selection does include some penny stocks that trade on the big exchanges. And I found one ADR trading over-the-counter (Koninklijke Ahold Delhaize with ticker symbol ADRNY).

Pricing Schedule

Although Stash doesn’t offer very much, it does nevertheless charge a monthly fee. There are three subscription plans:

- Beginner: This is the entry-level plan and costs $1 per month. It comes with $1,000 of life insurance, a unique feature.

- Growth: This one has everything in the beginner plan plus personalized retirement advice and an IRA if you want one. The cost is $3 per month.

- Plus: For $9 per month, Stash offers custodial accounts and more stock rewards for using its debit card. There is also an extra $9,000 of life insurance.

Trading Tools

This is where Stash is going to falter. It simply doesn’t put much emphasis on trading tools. It does provide two platforms, a website and a mobile app, and they are very user-friendly.

Mobile App

Stash’s mobile app is designed for phones (not tablets) and works on Apple and Android devices. It does have a very intuitive interface. During my testing of it, I had no problem learning the software very quickly.

At the bottom of the phone screen is a row of icons. This of course is the main menu. The two most frequently used icons are on the left-hand side. They are the Home and Invest icons.

The Home icon is the platform’s dashboard. Here, you’ll find tiles for all sorts of functions, including account balance, information on renters insurance, and educational articles. You can also view balance history and growth potential.

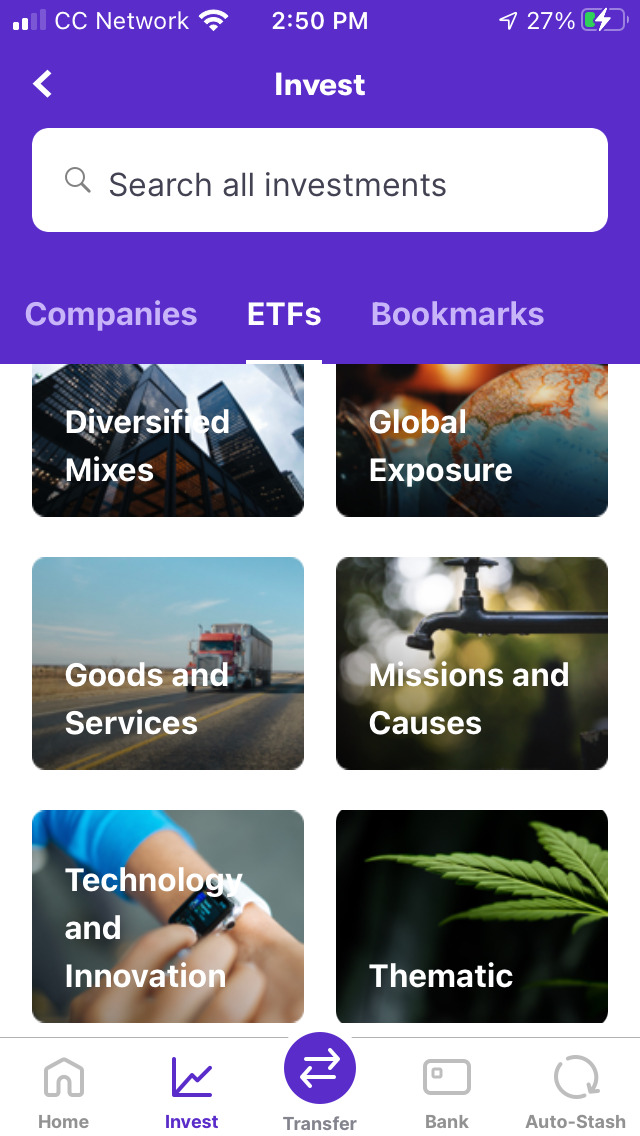

Moving from left to right, the next icon is Invest. This is where trading and research take place. To get started, just tap on Search companies & ETFs. Both stocks and funds have tiles that present broad categories. Examples I found include:

- Commodities

- Goods and services

- Finance

- Real estate

- Health care

This is the extent of the broker’s screener. It is not possible to search by deeper characteristics like P/E ratio or volume. It is possible to sort through ETFs by risk level, the lone exception.

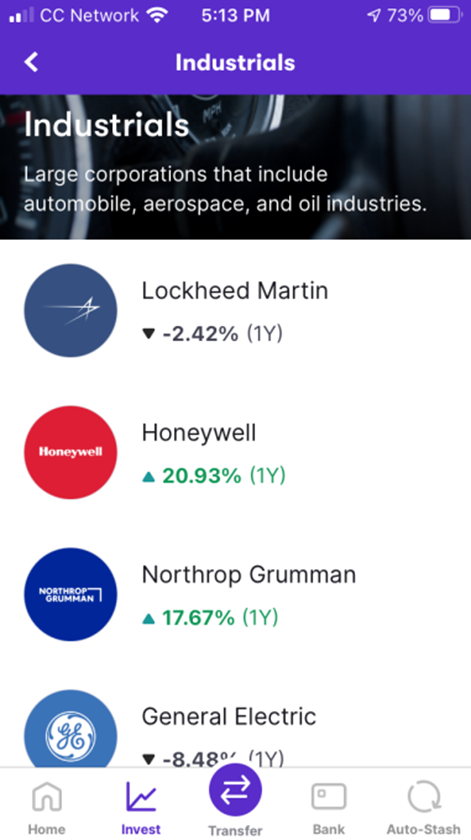

Tapping on a sector tile generates a list of securities. Stocks have company icons, which makes browsing through them quick and easy. Both stocks and funds show 1-year price performance, and that’s it.

You’ll find more information about a security by tapping on an entry and looking at the asset’s profile. Graphs are shown only in line format. Up to 10 years of price history can be displayed, although a graph cannot be rotated horizontally.

Somewhat oddly, the ticker symbol for a stock or fund is shown near the bottom of the profile.

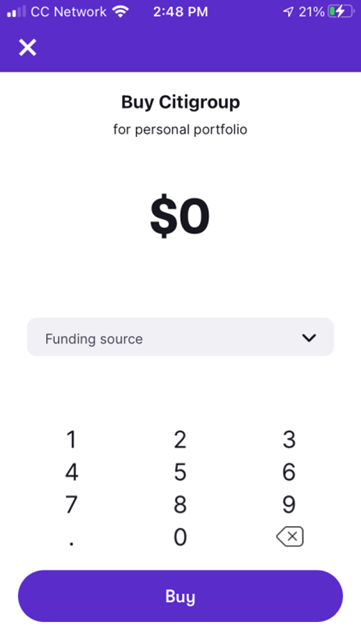

When you get ready to place an order, you will have to use a dollar amount. There is no trading by number of shares here. The broker’s order form is very simple with no way to customize anything.

Stash sends orders to the exchanges during four trading windows each market day.

With this broker, you don’t actually send an order to the marketplace when you submit your order. That’s a major disadvantage. You have no control over the time or price of your trade.

After you’ve done your trading, you can find your statements, tax documents, and trade confirmations on the app. Just tap on your initials in the upper-left portion of the phone while on the Home screen.

Website

Moving on to the website, I found a very similar platform with the same elementary tools. Charting has no tools of any kind, and line once again is the only graph format. As on the mobile app, the order ticket has no share amount.

You must specify a whole-dollar amount, and Stash is responsible for sending your orders to the exchanges.

One advantage that the website has over the mobile app is news articles. On the mobile app, an asset’s profile doesn’t display news articles. But the website does. When you click on a link, it generates a new tab within the browsing window.

Sources include CNBC, Business Insider, and 24/7 Wall Street.

Another advantage the website has over its mobile cousin is the portfolio builder tool. This widget appears only on the website. It recommends a portfolio of ETFs based on a short questionnaire.

The website and mobile app use the same watchlist. To add a security, just click or tap on the bookmark icon that appears on an asset’s profile.

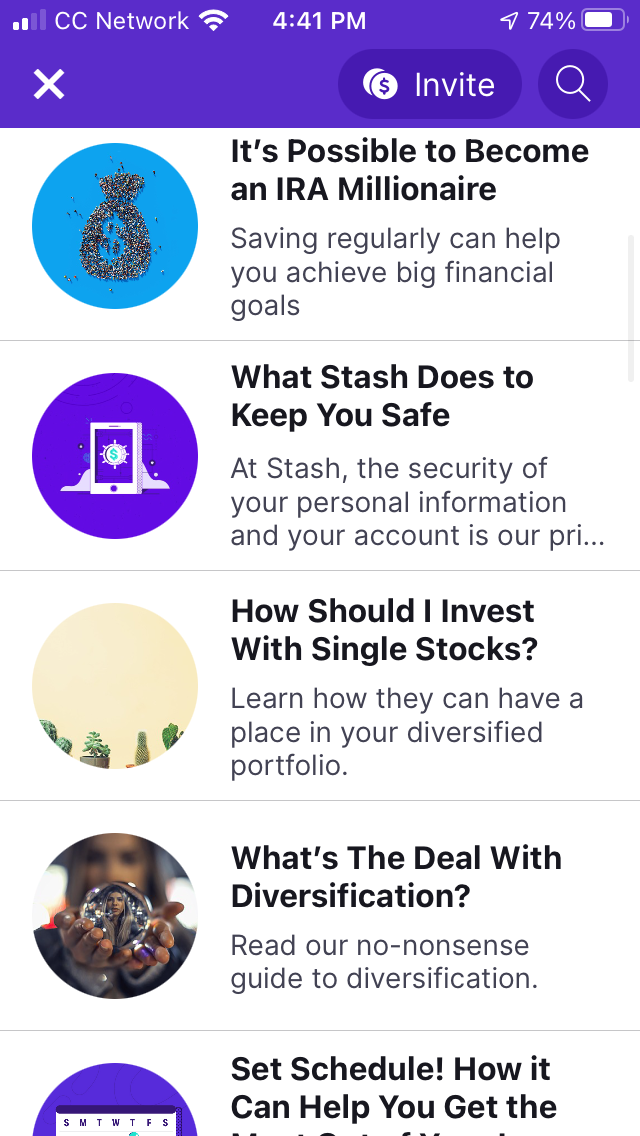

Stash Learn

If you need some guidance with your finances, you can browse through all the articles at Stash Learn. They cover mostly personal finance topics rather than trading. Examples include:

- How to Manage Credit Card Spending

- Find Out About the Most Important Changes to Your 2020 Taxes

- Tips for Negotiating Lower Rent During the Pandemic

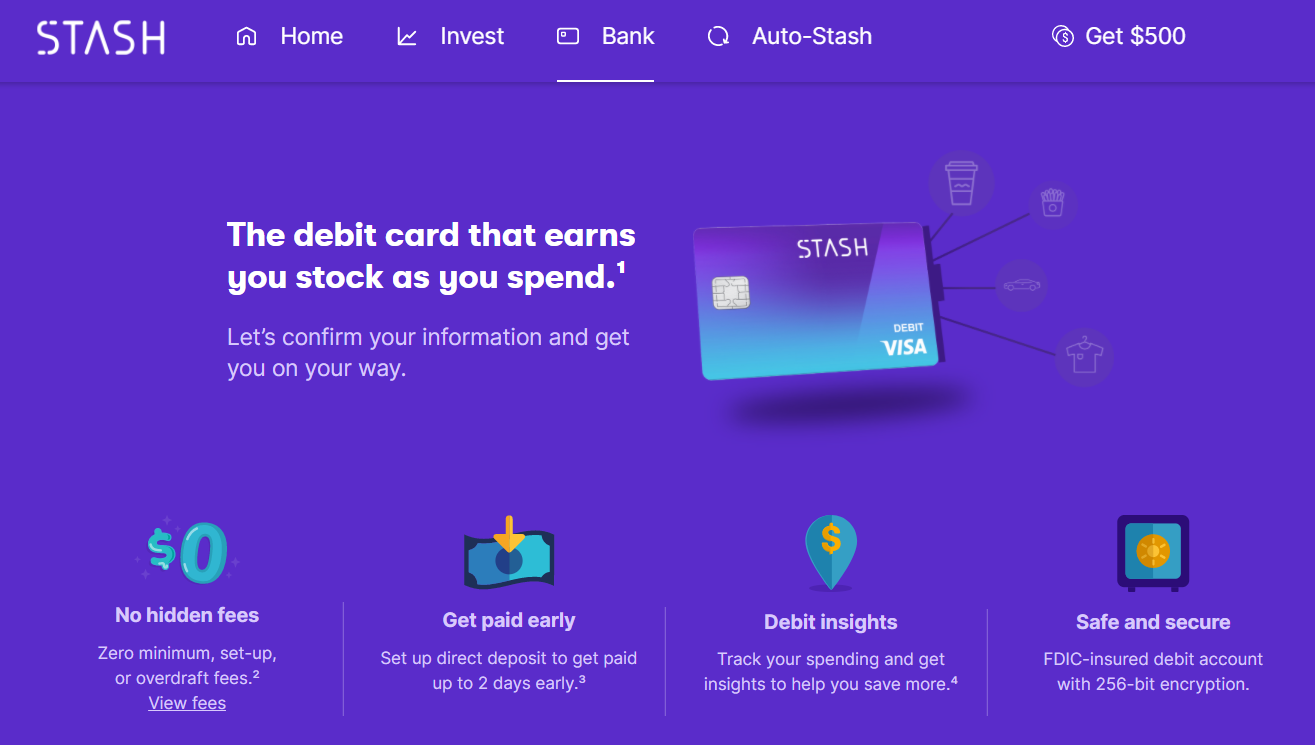

Banking Tools and Stock Back

All three subscription plans come with a Visa debit card linked to a bank account. Green Dot Bank provides FDIC insurance, and Stash provides stock back for purchase made with the card.

The way it works is pretty simple. When you use the Stash debit card at a retailer, you earn fractional shares of its stock. This of course assumes that the stock is available at Stash. And as we have already seen, that’s not always the case. Amazon and Walmart are two examples of stocks that Stash customers can trade.

If a stock isn’t available at Stash, you’ll earn fractional shares of an ETF instead.

Other Services

Besides its debit card and associated stock-back program, Stash also offers these services (at no additional cost):

- Round-ups: You can also round-up your purchase and the change will be transferred to your Stash investment account

- Dividend Reinvestment Plan (DRIP)

- Smart-Stash: The broker’s software analyzes your spending patterns and transfers money to your Stash account when you can afford it

- Set Schedule: Automatic transfers from a linked bank account

Customer Support

If you have any questions, Stash has a good FAQ page on its website. There is a robo chat tool on the same page (just click on the purple Ask your question button). During my testing of this service, I didn’t find it very effective.

If you give up on the automated service, a human Stash representative can be reached over the phone (1-800-205-5164). This live service is up and running during the weekday only.

Bottom Line

Stash has a few services that may benefit some traders. But the bulk of what’s available is geared towards novices who don’t actually know how to trade. And the broker’s monthly fee just isn’t competitive anymore.

If you’re looking for a place to day trade using an advanced software platform, you’ll need to move on.