The Roblox IPO is set to take place in March and with all the buzz around gaming, we can expect a lot of traders will have this name on their radar.

They will be going public on the New York Stock Exchange this month. It’s growing super fast, and with revenue of less than a billion dollars, it looks like it still has plenty of room to grow.

In this article, we’ll provide a quick overview of the Roblox IPO.

Roblox IPO: Quick Facts

- Ticker: RBLX

- Offering Date (date of first trading): on or about Wednesday, March 10, 2021

- Listing Method: Direct listing (more on this later)

- Exchange: New York Stock Exchange (NYSE)

- Offer Price: N/A–to be determined by supply and demand due to the direct listing method

- Shares offered: Up to ~199 million shares.

- Link to prospectus

What is Roblox?

Roblox is an interactive gaming community that allows users to create and play custom games using the Roblox platform. The company initially started as an educational physics engine that allowed students to simulate things.

Eventually, the company opened its platform to enable users to develop and share their own games using the platform.

Roblox has a vast online community, and if you look it up on YouTube, countless streamers get millions of views by streaming their play.

The game is so compelling among generation-Z gamers that there’s significant worry among parents that their children are addicted to the game. A quick Google search will yield several results from parents worried about their child’s addiction to playing Roblox.

This is a horrible thing, but it displays how strong of a product Roblox has created. The platform has tried to address this phenomenon by expanding parental control settings.

The game has its own in-game economy, driven by their currency, Robux.

Users can purchase or earn Roblux to upgrade their avatar. Users can also trade items with each other, which has created a large community of users trying to start with nothing and end up with many items.

This is similar to the strategy employed by Valve games like Counter-Strike and DOTA, which allow players to trade weapons and player skins back and forth.

Roblox’s Growth: Quick Facts

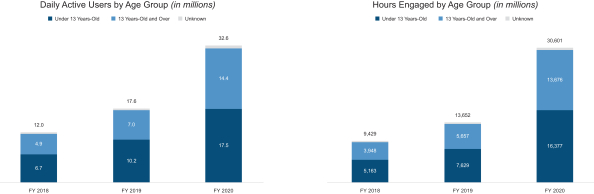

- 32 million daily active users (DAU) for 2020, up from 12 million in 2018, representing a 78% CAGR (compounded annual growth rate).

- 490,000 daily paying users in 2020, up from 125,000 in 2018, representing a 97% CAGR.

- $924 million in revenue for 2020, up from $325 million in 2018, representing a 68% CAGR.

- Net losses have ballooned as well, with $88 million in 2018, and $253 million in 2020, representing a CAGR of 69%.

Much of the company’s recent growth comes from outside of North America, for which growth has slowed over the last few quarters. See the graphs showing the user growth in North America, Asia Pacific, and the Rest of the World below.

Roblox is mostly viewed as a game for kids.

However, Roblox has made some progress in getting older users–over the age of 13–to join and spend on the platform. This is a positive outcome because older users have a better ability to spend on the platform. As you can see by the chart below, the company

The Drawbacks of Roblox’s Business Model

Revenue Sources

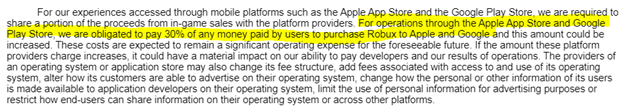

The majority of Roblox’s revenue comes through the Apple and Google app stores, of which Roblox has to pay a hefty 30% cut of those revenues to Apple and Google.

Most of Roblox’s Users are Young

Most of Roblox’s users are young children, which brings pros and cons. The pros are that young users are the biggest word-of-mouth advocates of their favorite products. They also would spend unlimited money on the platform if they could, only bound by what their parents allow them to buy.

The enthusiasm around Roblox among young children is significant. See this chart below, using data from the kids allowance app RoosterMoney, which shows the top items on kids’ wishlists. Roblox is number four.

Chart courtesy of Overlooked on Substack.

However, the two major cons are that social trends among the youth are fleeting. If there’s a new viral game next year, many of their users may abandon Roblox altogether.

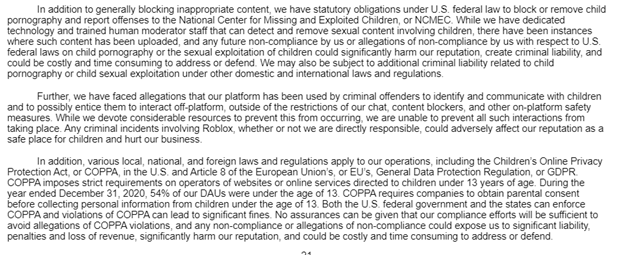

Further, any tech company targeting children opens itself up to massive regulatory and legal risks. Any misusing of that data is going to be viewed in a much harsher light. See the below risk disclosure from Roblox’s prospectus:

What is a Direct Listing? Why is Roblox Going Public Through a Direct Listing?

The traditional way to go public is through an IPO. Companies work with investment bankers who use their networks to gather investor interest and figure out how much people are willing to pay for the stock.

The bankers handle all regulatory, legal, and other details that management has no desire to do. Bankers pick an offering price and buy the company’s shares and sell them to their customers.

The problem with this process is twofold: first, the fees for traditional IPOs tend to be quite high. For a company of Roblox’s size, the fee would be around 4% of the deal value, according to Statista.

The second problem is the famous “first-day IPO pop.” Hot IPOs tend to go up a lot on their first day of trading.

While this sounds good, the insiders have sold many of their shares to the bankers at the offer price, only to see them go up 30%, 50%, or more than 100% on the first day of trading. Many call this the “one-day wealth transfer” from company insiders to public market investors.

As a result, more companies like Slack and Spotify have gone public through a direct listing. Here’s a graph from Harvard which shows the process of a direct listing:

Roblox is choosing to go public through a direct listing, allowing company insiders to watch trading play out in the public markets to get a feel for the true supply and demand for the shares.

In an IPO, they’d be selling at an offering price that isn’t determined by true market dynamics because not everyone can buy and sell the stock.

Roblox Dual-Share Class and Voting Rights

Roblox stock is split into two share classes: Class A and Class B. The two share classes are identical except for the number of voting rights each share gets.

- Class A shares get 1 vote per share

- Class B shares get 20 votes per share

Roblox is only offering Class A shares to the market, while the insiders will remain owners of the majority of the Class B voting shares. This means that activist investors can’t buy a large stake in the company and try to affect change and get seats on the board of directors.

These dual-share classes are very typical of the tech world. It’s become controversial for some public investors because they can’t affect change at the company if management is taking a route they disagree with.

Bottom Line

The Roblox IPO seems to be an exciting one with promising prospects.

While it’s growing like crazy, there are some really significant risks, making it a high-risk, high-reward play. This is definitely not a Berkshire Hathaway or Johnson & Johnson.

The market is hungry for tech IPOs and should the bull market continue until RBLX hits the market, a first-day pop in the stock wouldn’t be a huge surprise.