What Is Quadruple Witching?

Quadruple witching is a market event where several derivatives contracts expire on the same day.

The simultaneous expiration of all of these hedging products creates tons of order flow and repositioning, resulting in significant volatility and market whipsaws.

It’s called quad witching because these four types of contracts expire on the same day:

- Equity Futures Contracts

- Options on Individual Equities

- Options Contracts on Equity Futures

- Options on Equity Indexes

Single-stock futures might also expire on this day, but those are largely irrelevant to the broad market because they’re thinly traded.

Investors are forced to roll their hedges, market makers’ inventories are going to change dramatically, short-term traders are closing their positions to avoid assignment, and arbitrageurs are taking advantage of the mayhem by betting on convergence.

Note: “roll or rollover” means closing your short-dated options or derivative position and replacing it with a contract with a later expiration date.

Quadruple Witching Dates

The dates of quad witching events are when the above four derivatives expire on the same day:

- The third Friday in March

- The third Friday in June

- The third Friday in September

- The third Friday in December

What Happens During Quad Witching?

Because many large options positions either expire, are closed, rolled, or exercised, this can lead to abnormal market volatility and generally unpredictable price action.

Historically, the volume and volatility have picked up in the last hour of the New York session, often referred to as “quad witching hour,” a reference to the idea in folklore that there’s a specific period of night where witches appear and black magic is most effective.

Typically, you’ll see the implied volatility of individual derivatives, as well as the VIX spike upon, or in anticipation of, the quad witching Friday.

When Is the Next Quad Witching Event?

Quad witching happens once each quarter. That is, on the third Friday of March, June, September, and December. The next quad witching event is on Friday, June 18th, 2021.

Activity Around Options Expiration

Let’s put yourself in the shoes of a trader that is forced to make a decision on a quad witching day.

You’re holding 1,000 shares of a relatively illiquid stock XYZ long, and you’ve written 10 calls against the position, creating a buy-write (which is identical in P&L to a short put). The calls expire on June 18th, the next quad witching event.

June 18th comes around, and your calls are going to expire worthless. You meant to roll them to the next expiration a few weeks back, but you forgot. So now it’s expiration day, and you don’t know what to do.

You decide that you want to roll the calls over to the next quarterly expiration, so you buy back your calls and write another 10 in the next expiration.

It seems simple, but your activity is just a microcosm of all the potential trading going on that day.

You and many others are in the same position, closing, rolling, exercising, or letting your derivatives expire on that day. Not only is this an unusually high level of volume for the derivatives markets, but the market makers play a role here.

Remember how we mentioned that XYZ is illiquid? Well, chances are, there was a market maker on the other side of your trade.

And that market maker is trading quantitatively, according to their options pricing model. So they have no interest in taking on your directional risk.

As a result, they have to delta-hedge the position by buying a proportional amount of stock. If the delta on your calls is 0.10, they have to buy 10 shares of stock per call to hedge the position.

This type of market maker hedging happens every single day and usually is no problem.

But when that hedging becomes a much larger than usual portion of the daily volume, we can see some pretty weird price action, leading to traders giving this day its ominous name of quadruple witching.

Let’s consider a more involved trade.

You’re holding a basket of long stocks against a short position in index futures. Perhaps your data shows that this basket of index components will slightly outperform the index as a whole until expiration.

By closing this position, you’re simultaneously exerting selling pressure on your basket of stocks while exerting buying pressure on the futures contract.

If lots of traders were similarly positioned, the buying pressure on the futures contract could lead to it trading at a premium to “fair value,” which is essentially the carry of the futures position: the value of the stocks plus/minus the dividends, and the financing cost of holding the futures position.

Expectation of Quadruple Witching Days

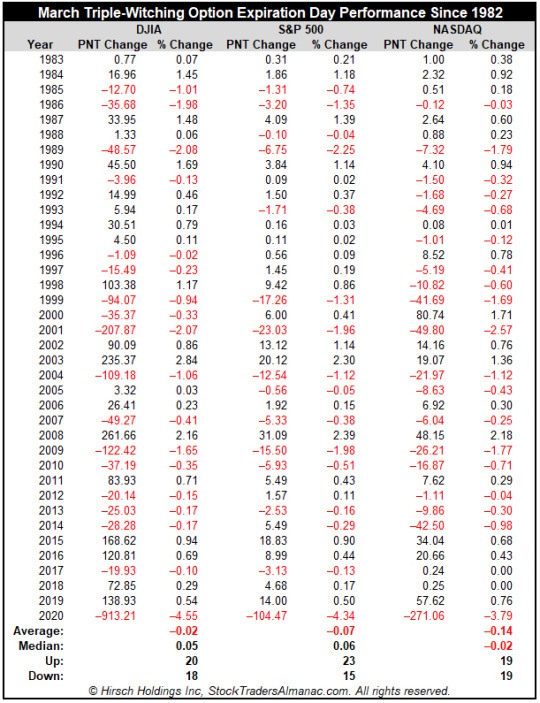

Jeff Hirsch, the author of Stock Trader’s Almanac, posted a table of the performance of March quadruple witching days since 1982 on his blog. Performance is mixed.

Volatility trader and blogger VIX And More also tested the performance of the VIX on the Monday following quadruple switching events and found no statistically significant patterns compared to the usual post-expiration Monday.

Bottom Line

If you’re an arbitrageur or derivatives trader, there’s no doubt that quadruple witching days and expiration Friday, in general, create great trading opportunities.

However, if you’re an ordinary directional trader, you’re going to have to do deeper research to find any specific patterns, as nothing pops out in the broad data we looked at in this post.

There’s nothing wrong with keeping it simple and (a) sticking to your regular trading plan, or (b) just sitting out for the four days a year that quadruple witching occurs.

We all have limited time to devote to research, and many times, it’s better to work on your core trading strategies than to chase potential edges outside of your core competency.