The difference between catching a perfect trade and watching it slip by can often come down to a split-second decision. That is why it is absolutely essential that your trading screen is designed to optimize your trading performance.

While everyone’s optimal chart layout will be different, there are a few key guidelines that are universally applicable when it comes to optimizing your own chart layout.

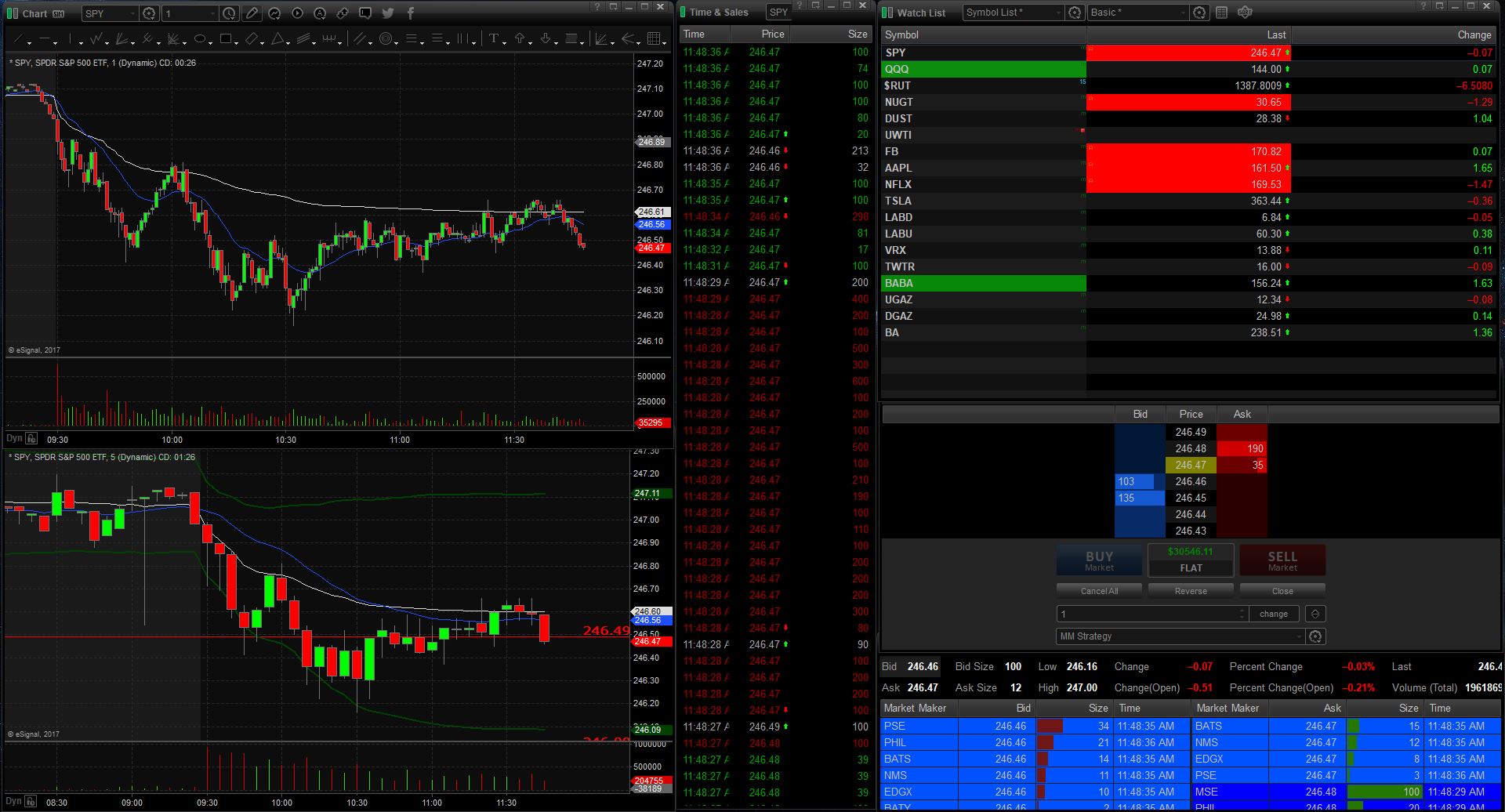

Separate Your Time Frames

When organizing your charts, you want to have your different time frame charts in different areas of your chart layout.

Top traders keep their trade execution area front and center, so that they have all the information that they need to make trading decisions right in front of them.

This means that your longer time frame charts should be off to the side so they are not distracting or confusing you when you need to focus strictly on information related to trade execution.

You can then glance over at your longer term chart area whenever you need to get a bigger picture for which stocks are looking like they may produce a good trading opportunity.

Keep Your Trading Screen Simple

One mistake that is particularly common with newer traders is to get too excited and involved with using every statistic and technical indicator that is available for your charts.

This provides the trader with the illusion of sophistication, when all they are really doing is confusing and distracting themselves.

Your trading strategy should rely on a few key indicators at each stage of identifying possible trades and executing them. If an indicator is not essential for a chart, then remove it.

Each chart should only have the exact amount of information that it requires, no more and no less.

Keep Related Information Together

Once you have your established trade execution area in the front and center of your chart layout, ensure that you have all the necessary supporting information there with it.

In particular you want to keep your time and sales and Level 2 information in a location where you can observe it and your short time frame charts like the 1, 2 and 5 minute.

Optimal trade execution requires processing a lot of different sources of information all at once, so top traders make it easy to track all of the essential trade execution information without having to turn their head or look away.

Having an optimized trade execution layout will ensure that you have everything that you need available to make the best possible trades.

It’s All About Trade Execution

Optimizing your trading screen for trading performance is all about creating the perfect trading execution area, and then building up the supporting charts and other information around that.

Spend some time with a paper account just testing your execution area until you are confident that it is the best that it can be.

Not only will this provide you with the best possible set-up for optimizing your trade execution, but it will also give you the confidence that you need to make those split second decisions that often mean the difference between success and failure.