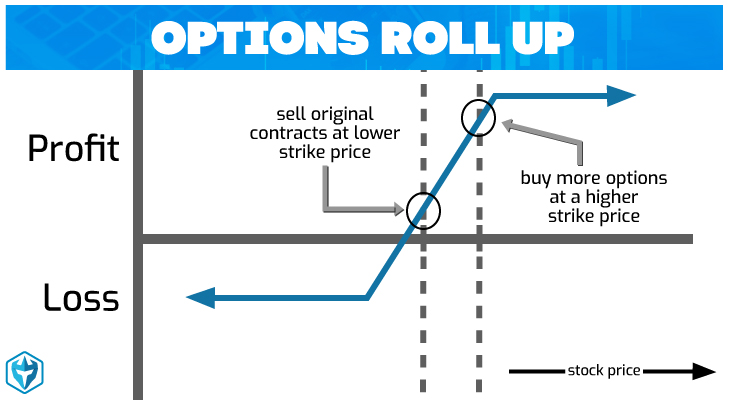

An options roll up is the act of closing a position in an option contract while simultaneously opening a new position in the same option with a higher strike price.

The opposite of an options roll up is an options roll down, where the existing position is closed at the same time that a new position in the same option is opened at a lower strike price.

Options Roll Ups in Options Trading

Most options roll ups are performed as a result of the time value of options contracts.

Suppose that a day trader owns a call option for shares of company A with a $45 strike price and a 1 month expiry.

After 1 week the share price for company A hits $50 per share. Not only does the call option have an intrinsic value of $5, but it also has a time value for the remaining 3 weeks.

The day trader remains bullish on the shares of company A, so he closes his position at the $45 strike price while also opening a new position at a $50 strike price. This is the options roll up strategy.

Instead of using the existing position to trade on their continuing bullishness, the day trader alters their position in call options for the shares of company A to maximize the potential profit from a continued increase the in the price of the underlying shares.

Options Roll Ups, Roll Downs, Bears and Bulls

The underlying principle of an options roll up can be applied in a variety of ways for a variety of reasons.

The options roll up described in the previous section is known as a bullish roll up, as the day trader is opening a new bullish position with a higher strike price.

A bearish roll down, by contrast, would mean that the day trader is buying call options at a lower strike price after closing a position with higher strike price call options.

A bullish roll down would mean that the day trader is buying put options at a lower strike price after closing a position with higher strike price put options.

Options Roll Ups and Trading

Day traders will often find themselves using roll ups and roll downs to adjust to changes in the price of the underlying security.

A roll up in call options often allows a bullish day trader to close out an existing call position on favorable terms while entering a new call position on terms that are even more favorable to a continued price increase in the underlying security in comparison to the initial position.

While both positions would increase in value as a result of an increase in the price of the underlying security, the new position will increase more. Therefore, it often makes sense to roll up and roll down options trading positions to capitalize in shifts in option prices.

Final Thoughts

Options roll ups and their counterparts are the product of the nature of option pricing, where even small changes in the price of the underlying security can produce new and more profitable positions.

Therefore, day traders use options roll ups to ensure that their position in the options for a security is set to maximize potential profits from forecasted price changes in the underlying security.