Marty Schwartz is the Pit Bull.

He’s one of the most successful publicly known independent traders in the last few decades. Being independent for the majority of his career, he became known through his outstanding performances in trading championships, and his interview with Jack Schwager in the first Market Wizards release.

After his brush with fame through the championship wins and his Schwager interview, Schwartz penned his own book Pit Bull, detailing his trading career up until that point. Rather than being a tail of fortunes and excess, his book showed the misery that a budding trader can go through during their development. Marty spent an entire decade broke due to his market losses, and this was while holding a high-paying Wall Street job.

According to his interview with Schwager, his average return in four-month trading championships was 210%, non annualized, and in the singular one-year contest he entered he achieved a return of 781%.

Most of Schwartz’ career was spent trading S&P futures, but in the early 2000s he began a decade-long voyage into trading oil futures. Recently, Schwartz has become a huge proponent of selling options premium. Having gone through so many market evolutions over his career, some might cast doubt on a veteran like Marty’s ability to still achieve superior returns in a world full of quants and HFTs, but Marty actually had the best month of his career in February 2015, according to his interview with MrTopStep.

The Raschke piece was very tactic-focused, looking at different indicators and market models she uses to make her trades. This spotlight will be more focused on the fundamentals of trading, the simple rules that if gone unnoticed, no amount of tactics can make up for.

Principles

Never Freeze When Under Attack

This lesson was impeded on Marty during his time spent in the Marines and it saved him from a possibly catastrophic loss on Black Monday. He came into the trading day long 40 S&P contracts, and had to take action quickly.

The S&P’s high on Black Monday was $269, and he liquidated at $267.50. In total, he lost $315,000 on the position, but he could have easily lost $5 million had he hesitated to take quick action. Marty has referred to this trade as one of the best in his career because of the potential losses he avoided.

Prepare The Night Before

Mary writes down vital levels, plots indicator values, and plans possible trade setups for the next day. He enters each market day fully prepared with a directional bias.

Stop Seeking Action

Trading is (usually) fun. Many of us found trading due to our interest in other action-packed, probability-based activities like poker. In poker, playing hands is fun. Nobody wants to sit at the table and fold for an hour, waiting to be dealt a premium hand. But that’s often necessary to play winning, positive expected value poker.

The same applies to trading. Sometimes there’s not a setup. Some days you’ll make no trades at all, idly watching the market, and you’ll get that urge to start hitting buttons on your keyboard.

One of the biggest turning points in Marty’s trading career was when he stopped seeking action, and instead just tried to make money.

Work, Work, Work

Trading coach Courtney Smith once told the story of when Marty got pneumonia:

“At one point, I watched Marty being carted out of the office on a stretcher with what turned out to be viral pneumonia! He was still trading as they wheeled him to the elevator! Now that is focus!”

Marty Schwartz Quotes

“If you’re ever very nervous about a position overnight, and especially over a weekend, and you’re able to get out at a much better price than you thought possible when the market trades, you’re usually better off staying with the position.”

“I always laugh at people who say “I’ve never met a rich technician” I love that! Its such an arrogant, nonsensical response. I used fundamentals for 9 years and got rich as a technician.”

Trading Tactics

There’s not a whole lot published on Marty’s trading tactics, and that’s probably by design. Trading coach Courtney Smith told MoneyShow that he learned nothing about the mechanics of trading during his time spent with Schwartz because of how uncommunicative he was about his entries and exits.

Some aspects of his strategy were touched upon in Pit Bull, but it was mostly focused on his rise to success. I’ll outline the few important tactics used by Marty in his trading below.

Red Light, Green Light Filter

Throughout Pit Bull, Marty repeatedly referred to the 10-day exponential moving average as his “red light or green light.” In other words, Marty won’t even entertain getting long a market trading below its 10-day exponential moving average.

There’s nothing inherently special about a 10-day EMA. The powerful thing about this filter is it will keep you out of so many losing trades. A mere moving average filter can dramatically change your trading results.

Perhaps you’re not a fan of moving averages, you can opt to use an oscillator or price action-based function. As long as you have a method by which to filter out the lower quality opportunities. It’s often the trades that you don’t take that make the biggest difference in your P&L.

Divergence and Convergence

Marty is big on filters. He likes certain parameters to be in place before he takes a trade. A key thing he pays attention to is convergence and divergence between markets.

While Marty isn’t often a stock trader, a key sign of strength in a stock was positive divergence with the broad market. He’d look for the S&P to penetrate it’s most recent low while the stock held above it’s low.

Back in the ‘80s, when interest rates and the S&P had a heavy negative correlation, it was a positive sign when both of the markets were moving inversely.

T-Theory

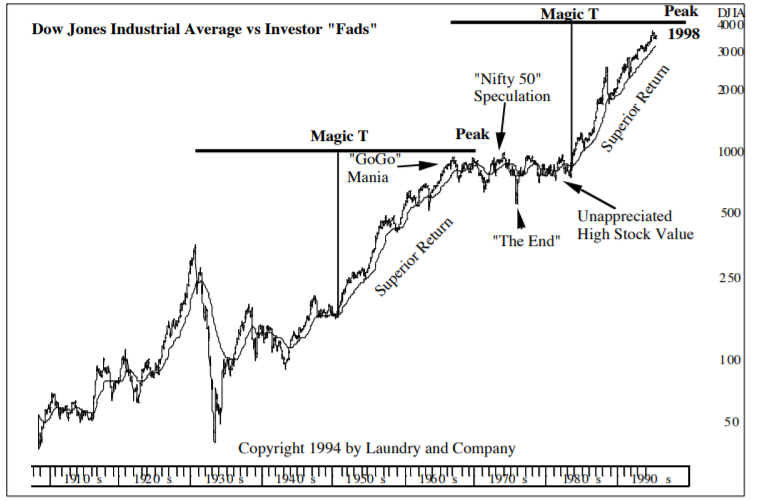

Marty bases much of his market framework on the works of Terry Laundry, a relatively obscure market researcher and trader. Laundry developed what is known as T-Theory, which theorizes that markets spend the same amount of time trending as consolidating.

The theory market action into two periods: rest periods and run periods. A strong run in either direction is necessitated by an equal rest period. Laundry called this idea “The Theory of Matched Trend Time.” A key emphasis made by Laundry is that periods of outsized market returns must be followed by periods of subnormal market returns.

Here’s a demonstration from Laundry’s newsletter of the idea in the DJIA:

Marty uses what he calls a “Magic T Oscillator” based on the principles of T-Theory to make trading decisions to this day.

Final Thoughts

Marty Schwartz just came out of what he calls his “Ray Kroc decade” in 2015. Kroc made most of his fortunes in his 60s, and believe it or not, Schwartz’ 60s was the highest earning decade of his career. He’s truly been knocking it out of the park since the 1980s.

One powerful thing I noticed about Marty is that he doesn’t know everything about markets. Many would expect one of the best traders of our time to be a trading encyclopedia, but while watching him be interviewed by MrTopStep, he readily admitted his ignorance about several things, the way the VIX is calculated and the differences between American and European options, for example.

It made me think about how much information we store, thinking it benefits us. Marty Schwartz seems to approach learning about the markets with the philosophy of: does it change my bottom line? And if it doesn’t he dismisses it. I think we can all benefit from adopting a bit of this mindset in an age of Google where we store so much useless information.