Last week was an intense week, inside of markets and out.

Russia invaded Ukraine and as of Friday, the conflict was still going at full-force. We’ve published an article on that already, so check that out for a more comprehensive breakdown. But here’s the bullet points as of early Friday:

- The US and EU levied sanctions on Russia targeting their financial system, specifically their banks and billionaire elites.

- The UK and other EU countries are pushing to boot Russia from SWIFT, the global payments system that our global banking system runs on. Germany is dragging their feet because they rely too much on buying energy from Russia.

- The White House said they see no increased threat of a nuclear attack from Russia

- The White House said they think Russia has grander ambitions than Ukraine

Markets moved pretty wildy and in some ways, unpredictably, in response on Thursday. Here’s what happened:

- US stocks were initially down, briefly breaking down below a key support level, only to reverse mid-day and rocket upwards, led by growth stocks of all things.

- The Russian stock market, tracked by the RSX ETF, was down 20% on Thursday, making it down over 30% for the week

- The Russian bond market is getting clobbered as well.

- Russia’s currency, the Ruble, is selling off hard relative to the US dollar.

- Crude oil touched above $100, only to retract most of those gains.

- Gold was briefly up modestly, only to reverse to decline 0.5% for the day.

Here’s a chart of the Russian stock market over the last few months:

And here’s the S&P 500, the S&P 500 tech sector (XLK), crude oil, and gold all in one chart:

Looking to the S&P 500 individually, it broke down below a key support level only to quickly reverse in a classic Wyckoff “Spring” price pattern, indicative of significant buyer support and accumulation and suggestive of a new trend leg in the near future.

It’s interesting that it occurs on the day that Russia’s invasion of Ukraine began. Perhaps the market is telling us something?

Other News From Last Week

We’ve all pretty much forgotten the rest of last week as a result of the escalation in what now seems to be a hot war between Russia and Ukraine. But some things happened anyway, although it was a pretty quiet week until the invasion:

- Q4 earnings season is wrapping up and 69% of companies beat revenue expectations and 77% have beat earnings expectations.

- Home Depot and Lowe’s both reported earnings last week, modestly beating expectations and seeing equally modest price rises.

- Citadel is pulling back most of their money from Melvin Capital, famous for being crushed on their GameStop short in January 2021.

What To Look Out For Next Week

Typically in these pieces we like to highlight some catalysts to look out for in the upcoming week. The Russia/Ukraine situation obviously tops the list, but the situation is so dynamic that it’s difficult to give catalysts to look forward to next week.

However, here are some key assets to watch that might be affected by the crisis:

- Natural gas: Russia is a primary supplier of natural gas to Europe, and that’s already showing as significant. Germany is hesitating to boot Russia from SWIFT as the rest of the EU wishes to do because of their reliance on Russian energy.

- Palladium: Precious metals are always moving during military conflict, but palladium is extra special because Russia is the biggest producer of the metal in the world. It’s primarily used to make catalytic converters for cars.

- Russian stocks: the price moves in Russian stocks have been violent, partly exacerbated by the fact that they’re affected by the deterioration of Russia’s currency, the ruble.

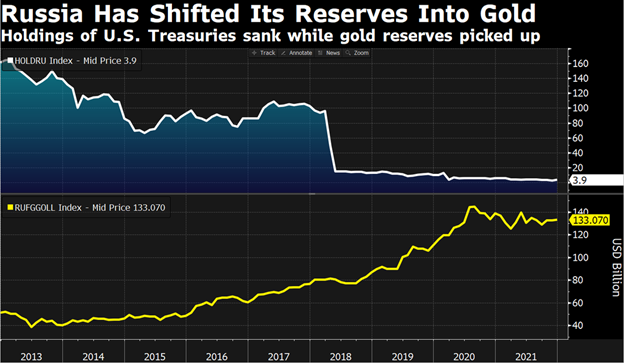

- Gold: it can’t seem to get up off the mat, barely registering a rally at its most opportune time, only to reverse and end the day negative. However, it’s notable that Russia has shifted their reserves into gold and sold a bulk of their US Treasuries.

Earnings Next Week

Earnings season is coming to a close, with over 450 of S&P 500 components having already reported. The notables for the upcoming week are Costco (COST), Target (TGT), and Berkshire Hathaway (BRK.B).

Monday, February 28, 2022:

Tuesday, March 1, 2022:

- Target (TGT)

- Kohl’s (KSS)

- Bank of Nova Scotia (BNS)

- Salesforce (CRM)

- Baidu (BIDU)

- AutoZone (AZO)

- Domino’s Pizza (DPZ)

- ContextLogic (WISH)

- AMC Entertainment (AMC)

Wednesday, March 2, 2022:

Thursday, March 3, 2022:

- Costco (COST)

- Kroger (KR)

- Best Buy (BBY)

- TD Bank (TD)

- Broadcam (AVGO)

- BJ’s (BJ)

- Canadian Natural Resources (CNQ)

Nothing of note for Friday.

Economic Data Next Week

On Tuesday we get the ISM manufacturing report, which will give us crucial data on how the supply chain is performing.

The ISM is pretty well accepted as a leading indicator for GDP, since it compiles monthly qualitative and quantitative surveys with manufacturing purchasing managers, who happen to be pretty predictive of GDP growth.

Tuesday:

- ISM Manufacturing Index

Wednesday:

- ADP Employment Report

Thursday:

- Initial and continuing unemployment claims

Friday:

- Nonfarm payrolls

- Unemployment rate

Bottom Line

With the first day of last week (Feb 21) being a market holiday, the market was relatively quiet until Russia invaded Ukraine.

Not only will there be more significant earnings and economic data, but there will invariably be very crucial events happening in Ukraine over the weekend which will determine where we open on Monday.