Lightspeed Review

-

Value For Investors

-

Value For Active Traders

-

Commission & Fees

-

Platform & Tools

-

Customer Service

-

Order Execution

-

Options Trading

Summary

Lightspeed Trading is one of the premier brokers when it comes to day trading. We really liked their platform and commission schedule but if you aren’t an active trader then this broker may not be for you.

Pros

- Very long list of software platforms.

- Helpful educational resources.

- SIPC insurance and FINRA regulation.

- Multiple commission schedules.

- Active traders get discounts on trades and software.

Cons

- Does not offer 6:1 leverage.

- PDT rule in force.

- No forex.

- No commission-free trading.

- Could be rather pricey for occasional traders.

Brief Overview

Lightspeed is a U.S.-based brokerage firm with low commissions and several trading platforms to choose from. The company also offers a lot of educational materials; so beginners should definitely sit up and take notice.

Insurance and Regulation

Lightspeed is headquartered in New York. It is a member of FINRA, the SEC, and SIPC. Every customer gets $500,000 worth of insurance from SIPC. Lightspeed also has a supplementary insurance policy through Lloyd’s of London for extra protection.

Services Offered

Lightspeed offers trading in futures, options, stocks, and ETF’s. This is a decent selection compared to other day traders. For example, TradeZero doesn’t offer futures contracts.

Besides individual and joint accounts, Lightspeed also offers the following account types:

- Trusts

- Hedge fund accounts

- Business accounts

- IRA’s

Day Trading at LightSpeed

Day traders will find lots to enjoy about Lightspeed—and probably one thing they don’t like. Because the broker-dealer is located in America, it must enforce the SEC’s pattern-day-trader rule. This requires an account balance of at least $25,000 to actively day trade. The rule does grant an exception for traders who place less than 4 trades in a 5 business-day period.

Despite this one disadvantage, there are several strengths, including:

- Direct-access routing

- Margin

- Short locate tools

- Level II quotes

Leverage

At Lightspeed, the standard amount of leverage day traders will receive is 4:1 with a $25,000 account balance. It is possible to qualify for 6:1 leverage. To get to this level, the broker requires a separate account.

It’s called the portfolio margin account, and it has a minimum balance of $175,000. The broker-dealer also requires a minimum level of day trading experience for this account.

Overnight positions have the same amount of leverage as day-trading positions.

Commissions and Fees

Lightspeed offers multiple commissions schedules. Futures are $1.29 per side, and options on futures are $1.79. Moving to other instruments, things get a little more complicated.

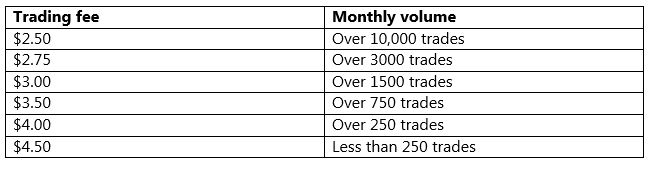

A per-trade plan is available for stocks and ETF’s with the following rates:

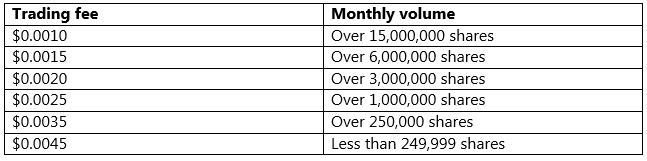

A per-share plan looks like this:

There is a $1 minimum commission on each trade on the per-share plan.

Options are priced on a per-contract basis with discounts for monthly volume.

Once again, there is a $1 minimum commission.

A final package offers commission-free trading on stocks and ETF’s. The securities must be traded on the mobile app, and the broker requires an account balance of $15,000.

Routing fees and rebates are assessed on orders that are directly routed.

Lightspeed waives market data fees for non-professional traders on Livevol X, the mobile app, and web platform. In other situations, data packages cost something for both professionals and amateurs. Charges range from $1 to $120 per month, depending on the data purchased.

Software Fees

Lightspeed has more trading platforms than any other brokerage firm we know of. There are programs designed for futures trading, others for options trading, and still others for stocks. Pricing and features do vary.

Here’s a list of the most popular programs:

Lightspeed Trading Platforms

The most commonly-used program at Lightspeed is the company’s namesake platform.

Lightspeed Trader

Launched from the desktop, this software program offers many features day traders need. Two buttons, one blue and one green, appear just below the top menu. Clicking on the blue button generates a layout designed for stock trading. The green button is for options trading.

In the very top menu, there are several tabs. The most used selection will be the “New” tab. Here, many great tools are found:

- Notifications can be set up for volume, most recent trade price, and bid and ask numbers.

- Time & sales data for both options and stocks. These numbers can be viewed in streaming mode for any entered ticker symbol.

- Level II data for both options and stocks. The trade ticket isn’t in this window, although OHLC numbers are.

- Short locate feature. Every ticker symbol entered in the Level II window will show one of three icons.

- A green ‘E’ means the security is easy to borrow and can be shorted immediately.

- A gray ‘L’ indicates the stock needs to be located using a locate tool on the platform. Alternatively, users can call or e-mail the broker.

- A red ‘T’ means the asset can’t be borrowed at all.

- Multiple charts. It’s possible to add multiple charts with different timeframes to the LS window. To use a different ticker, simply right-click on the chart and select “unlink” and enter a different symbol.

- During our trial of the software, we could easily move windows around the workspace. We could also add more windows and delete default ones.

- Risers and Fallers. This window displays the day’s biggest movers. Data points include % change, dollar amount change, volume, and last trade price.

Charts on Lightspeed Trader can show almost 20 years of price data. There are candlesticks and OHLC bars. Drawing tools are available, and include the following:

- Ellipses

- Dashed lines

- Rectangles

- Vertical date range lines

- Fibonacci retracements

The software has (just) 20 technical indicators. Examples include:

- MACD

- Linear Regression Slope

- Relative Strength Index

- Pivot Lines

- Bollinger Bands

A drop-down menu is generated with a right click of the mouse. There are selections for technical studies, customization options, and drawing tools. However, here is no trade button in the menu, which is something we would hope to see.

Eze EMS Pro

For futures trading (and stocks and options) Lightspeed offers Eze EMS. The platform is available in both Pro and Express formats. The latter has fewer features but costs $200 less per month.

The Pro edition comes with:

- Time & sales data

- Alarms and alerts

- Multiple Level II windows

The software’s order ticket is integrated with the Level II window. There are just two trade choices—buy and sell—without discrete buttons for sell short or buy to cover.

During our inspection, we counted 37 order types. They include tracking limit, passive liquidity, and market not held. Time-in-force choices include some exotic choices like core, current session, and now.

An options chain window shows calls and puts. But there are no multi-leg strategies. Expiration dates have color-coded buttons, a nice feature.

Charting on Eze EMS has some useful features, including 44 technical studies. There is also a handy crosshair tool and pivot lines. A graph can be printed and copied.

Other Platforms

Sterling Trader Pro is available at Lightspeed, although there are no software fee rebates for active traders. Sterling provides basket order entry and hot keys. While it is possible to trade options, there are no derivative scanners.

Livevol X is a free platform that offers a lot of nice features. These include an options scanner, multi-account access, and a basket order-entry system. Missing on Livevol X is extended-hours capability.

There are still other software programs available to Lightspeed clients. These include Wex, a program designed for options trading; and efutures, which trades what it sounds like.

Learning Materials

The Lightspeed website has a great deal of learning materials. These are found under the “Resources” tab on the broker-dealer’s website. A blog is devoted to the active trading of various financial instruments. On the day we did our research, we found resources on arbitrage strategies and trading copper futures.

There is a glossary with lots of terms day traders need to know. And options strategies have explanations with profit-loss diagrams.

The Lightspeed site hosts a section of videos on trading basics, such as margin requirements and stock halts. Another great resource is a long list of YouTube videos on how to use Lightspeed Trader. The broker’s clients can also sign up for free live webinars.

Bottom Line

Lightspeed does a great job of providing many services that day traders will love. The cost of this is the U.S. government’s pattern-day-trader rule, which requires deeper pockets than some traders have.

If you don’t have $25,000 to set aside and feel you can forego SIPC protection, an offshore account may be a better choice.