Iron Butterfly Options Strategy

The Iron Butterfly options strategy, also known as the Ironfly, falls into a category of options strategies known as Option Income Strategies.

Option income strategies focus on time decay and collecting premiums over the decay. Specifically, the Iron Butterfly is a type of income strategy known as a credit spread. Credit spreads are calls or puts sold against another call or put, with the result being a net credit.

Credit spreads provide many varied ways to generate income. While strategies like the Iron Butterfly are not as exciting as other options strategies, the allure is that they’re not exciting.

Risk-averse traders and investors may consider the Iron Butterfly as a less risky but profitable method for generating income.

The key attraction to this strategy is the capped risk and potential for a high return.

The Iron Butterfly is an advanced options strategy – and a popular income strategy.

It involves four separate options – two calls and two puts – and all four options have the same expiration date. The entire purpose of this strategy is for income.

It’s low risk and low reward. The best way to describe this setup is a combination of a Bull Put Spread and a Bear Call Spread. The biggest thing to take away from this strategy is this:

You don’t want the underlying asset to be trending up or down.

Let me say that again.

You do not want the asset to be trending up or down.

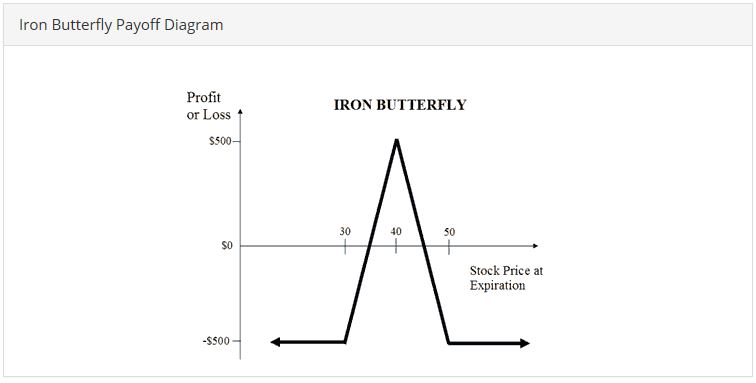

Why? This strategy makes its maximum profit when the underlying asset closes inside the two middle strike prices. The middle strike levels should be treated as a sort of support and resistance, but levels of support and resistance that you don’t want to get close to.

For those of you coming from the stock market, forex market for futures market, you can probably figure you what kind of market you need for this strategy: boring. A flat market with a tight range is the exact kind of environment you want.

Iron Butterfly Setup

- Buy one Out of the Money Put with a strike price below the current price. This protects against any downside movement.

- Sell one At the Money Put with a strike price below the current price, but closer to the current price than the out of the money put above.

- Sell one At the Money Call with a strike price above the current price.

- Buy one Out of the Money Call with a strike price above the current price, but below the Out of the Money call that was sold. This protects against any upside movement.

For stock traders and futures traders, the best way to describe the bought Out of money Put and the bought Out of the Money Call is to think of them as stop losses for both sides of the market.

The money made on this trade is from the net credit.

Ideally, you want the options to expire with zero gain – to expire worthless. The money you make is on the combined net credit.

This strategy is designed for stocks that just sit flat and are expected to sit flat until expiration.

When should you use an Iron Butterfly?

First, you should know what you are doing. This options strategy is a straddle and strangle that involves limited profit and limited risks.

However, depending on your broker and the frequency of your trading, the costs can be high: four separate options, the round turn costs, and separate strike prices. The primary purpose of this strategy is to limit risk while generating small gains – it is an income-generating strategy.

It is also essential to make sure that the underlying stock is appropriate for this strategy. Filtering stocks that have high average daily volumes (500k or greater) is ideal. Low liquidity is a big bad no-no for this strategy.

The open interest should be between 200 and 500, ideally at least 500.

Pros and Cons of the Iron Butterfly

Pros

- Limited Risk

- High probability of success

- Can provide consistent income

Cons

- Complicated position to manage for new option traders

- Limited reward

Utilizing this strategy also requires a better than average understanding of the price action and behavior of the underlying asset.

Not only do you need to be intimately familiar with the underlying asset, but you need to understand some of the basics of technical analysis and how to measure the length of time a stock will spend trading in a range after it has been in a trend.

Learning some of those concepts will significantly enhance your options trading and put you in a much more advantaged position relative to other traders.

This strategy is not without its risks. There can be some considerable costs involved with taking four options out at once. Both the risk and gain are capped with this trade, so if you have substantial costs in the execution of the trade, keep that in mind.

This strategy may also not be the best for those who have longer time horizons. The effect of time decay is a double-edged sword in any strategy, but it is especially crucial with the Iron Butterfly setup.

One of the distinct advantages is that we can profit from a tightly traded range-bound stock with little (and capped) risk. Another advantage is the potential profit for a stock that remains in a tightly traded range can be high – especially when compared to the capped risk. Some of the cons involve time decay.

Unfortunately, the highest profit potential occurs near the expiration of the option. There are some dangers to this type of trade when considering the bid/ask spread. Because this Iron Butterfly relies on a ranging stock, the bid/ask spread can undoubtedly throw things off.

Bottom Line

While the Iron Butterfly is not the most exciting options strategies – it is less risky. The capped risk and limited gains over the life of the option are appealing to traders who do not enjoy significant uncertainty – or who are finding themselves whipsawed out of sideways trading markets.

For traders who enjoy trend trading and find themselves ‘on edge’ because their favorite traded stock is ranging, the Iron Butterfly provides an opportunity to make money those consolidation periods.