Day trading, the practice of buying and selling financial instruments such as stocks and ETFs within the same day, when mastered can be an excellent way to make money. There are, in fact, thousands of people out there that are making a successful living through day trading.

But this style of trading can be extremely risky and thus requires a high degree of objectivity and self-discipline, and most of all, a lot of practice in a simulator to get good at it.

In this article, you will learn what a trading simulator is, its benefits, and how to maximize your time in a simulator.

Practice in a Simulator Before Using Real Money

Practicing strategies and learning to control risk over and over are two of the most crucial aspects of achieving success in the day trading world. If you want to get into trading but don’t feel like an expert, it is vitally important to practice in a simulator before you begin to use real money.

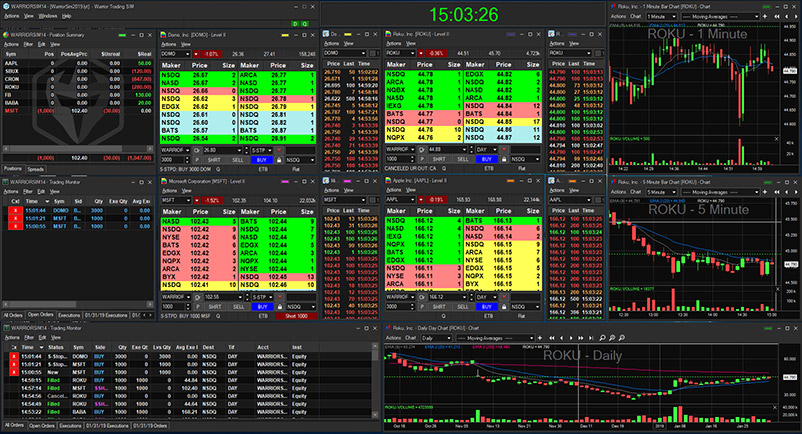

Day traders use online trading platforms that allow them to execute trades, do research, and track charts. These platforms also provide traders with most of the information and tools they need throughout the trading day.

Therefore, it is important to research plenty of online trading platforms and choose one that you feel will work best for you, including allowing you to practice day trading in a simulator.

What is a Trading Simulator?

A trading simulator is an online program that mimics the stock market and gives traders a demo brokerage account with an initial lump of virtual money to play around with. You can use a simulator for free with most online brokers but most of the time they have delayed data by 15 minutes.

Simulators allow users to trade risk-free with the demo account without putting any real money at risk. With a simulator, you be able to build a portfolio, trade stocks in near real-time, and gain or lose the simulated funds over time for practice purposes.

In short, maximizing your time in a trading simulator will earn you several benefits that include:

- Actual practice in a real money-trading environment

- The ability to familiarize yourself with the technical aspects of the trading platform

- Access to market news, charts, trading signals and more

- The ability to test various trading strategies without financial concerns

Remember that being a trader is like being a sports athlete. Just like all professional athletes practice before the games, you need to keep learning the skills and practicing if you want to succeed in trading.

How To Maximize Your Time In A Simulator

Whether you are using a simulator to learn how to trade stocks, ETFs, futures, options or currencies, you don’t need to worry about profit or loss at the beginning. Instead, you should focus on the following things:

- How to place trades, how to exit positions, how to change orders

One of the best ways you can maximize your time in a simulator is by learning how to place trades and do it right. You will also get to know other crucial things that are essential when placing a trade. This includes the ticker symbol of the stock you wish to trade and the number of shares to trade in an order.

A simulator also provides an amazing opportunity to learn how to change orders and exit positions at a right time to improve your trading results.

- How to read charts

If you are going to actively trade stocks or other instruments, you also need to know how to read stock charts. A stock chart is simply a set of information on shares of a particular company.

Charts generally display crucial financial details about the company, including current trading price, trading volume, price changes, historical highs and lows, and dividends. Most stock charts are pretty basic and many modern traders rely on them to identify setups.

- How to read level 2 and time and sales

Level 2 can be a very important tool to have, particularly if you are a day trader. Although charts can be astoundingly helpful for making strategic decisions, level 2 screens aid traders in making real-time decisions.

Another important tool that you need to familiarize yourself with in utilize in a simulator is the Time and Sales window. This tool shows how many shares are being executed by other traders at what price and it can show you whether the traders are being aggressive or not.

By learning how to interpret the Time and Sales window, you may be able to identify incoming demand earlier than chart readers.

- How to manage losing and winning positions

Trading simulators can also be quite helpful to people who want to know how manage losing and winning positions. But for the most part, that dives into the much less talked about mental side of the equation around position management.

The trading strategy you use in your demo account is going to be a key determining factor in how you manage positions. However, it’s your internal dialogue and emotional state that will ultimately determine whether or not you manage positions as your strategy suggests.

- Practice Hotkeys

Last but not least, you need to use the simulator to practice hotkeys so that you can be able to use them effortlessly. In the era of high-frequency traders, hotkeys are very valuable as they allow you to get into trades quickly, and sometimes more importantly, get out of trades quickly at the most ideal point in time.

So, make sure that your simulator enables you to personalize your trading interface with the use of hotkeys to properly develop the trading techniques that will allow you to optimize your returns.

Once you have learned how to do all the above, your goal should be to become consistently profitable.

Brief Overview of Warrior Trading’s Day Trading Simulator

Our day trading simulator was built specifically for active traders including all the tools you’ll need to succeed.

It includes:

- Live data feeds

- Hotkeys

- Real-Time level 2 market depth

- Advanced Charting

- Rich graphics

- Your trading statistics and trade history

This is the perfect platform for new traders looking to maximize their time in a simulator. It has all the tools needed to practice like you’re in a real trading account.

Bottom Line

Practice and knowledge are the keys to success in day trading and other styles of trading like swing trading and position trading. That’s why stock market experts strongly recommend trading simulators for newbies.

Trading simulators are ideal for first-time traders who want to learn how to trade various financial instruments.

They are also great for experienced traders who want to hone their trading skills or test various strategies before moving into the real world of trading. Experts recommend you execute 50-75 demo trades on the trading platform you will be using before you start putting your hard-earned money at risk.