Learning how to make money in stocks is a great way to earn supplemental income or make it a full time job and be your own boss. Either way there is plenty of opportunity.

There are three main ways you can make money with stocks including:

- Investing long term

- Swing Trading

- Day Trading

Each way has its own requirements depending on the amount of time you have available, capital and personality.

Below we’ll go over the different ways you can make money and what tools you’ll need to get started.

How to Make Money in Stocks Long Term

You can read the name of our site–Warrior Trading. We specialize and much prefer short-term trading because of the greater potential it offers, but even traders have to manage long-term portfolios with their gains.

So what do we think of long-term investing?

Well… ask any talking head on CNBC about long-term investing, and they’ll launch into a soliloquy on why passive investing or buying stable mega-caps is the only solution for the small investor. Anyone who studies investing extensively knows that advice is pretty much BS.

Because in reality, it’s the complete opposite.

It’s the massive hedge funds and asset managers that are forced to buy mega-caps because they manage too much money to deal in the small, unscalable, inefficiently priced securities available to the individual investor.

One of the first books most read when they get interested in the markets is A Random Walk Down Wall Street. The book goes into several different styles of investing and informs the readers about the various ‘corners’ the market has to offer. This is all while telling you that it’s near-impossible to beat the market over a long time horizon. What this book gets wrong is assuming that your counterparty (the guy on the other side of your trade) is a rational market participant.

When you delve into the nanocap and microcap corner of the stock market, it’s mostly full of bagholders, stock promoters, and shell companies. These companies are worth anywhere from one to 100 million dollars–this means a big smart money hedge fund can’t take a meaningful position in the stock without owning almost the entire company. Forget about if they want to own less than 5% (so they don’t have to file extra documents with the SEC), even if the company doubled, it’d only mean they made a max of $5 million.

Bottom line, my opinion is that unless you have the potential to make many multiples of the S&P 500’s return on a relatively small amount of capital (<$1M), you may as well just invest passively with index funds. That extra few percentage points won’t be worth the hours spent sifting through opportunities (unless it’s a passion, of course).

But where do you find the opportunities worth your time? It’s easier said than done. There are lots of stones to unturn, though. If your tendencies skew towards value investing, look for the rare Graham-style net-net, spinoffs, and situations where price is depressed not because the assets are distressed, but because someone needs to sell, NOW! This is the advice Chris DeMuth Jr. of Rangeley Capital gives regularly.

You can learn a lot about these stock market “special situations” by reading You Can Be a Stock Market Genius by Joel Greenblatt.

Swing Trading

Swing trading is a general term, but it mostly refers to buying and selling the same security within a period of less than a month. The goal is to capitalize on the shorter-term ‘swings’ in price. These are situations where new breakout trends aren’t necessary to make trades. In fact, most swing trades are glorified support and resistance trades. Price dips and hits support, a swing trader buys and sells near resistance.

Swing trading has its pros and cons. Let’s touch on the pros first.

Less Competition

As a rule of thumb, the shorter the time frame, the more competition you’ll face. When trading mega-cap stocks like Apple or Bank of America, the counterparty on most of your trades will be a robot. There are millions of these trading robots, all trading based on complex criteria, creating more noise than exists on longer time frames.

As a swing trader, your speed/quality of execution isn’t essential. You can be off your target price by a few pennies, and it won’t affect the trade outcome because the profit targets and stop losses are much wider than in day trading.

Takes Less Time

An active trader can feasibly spend 1-2 hours per day on analysis and make decent returns, so long as their strategy is sound. That time would be spent developing a directional bias for the broad market, then running through all the charts on your screens to find the best opportunities to express that directional view.

Now let’s touch on some cons:

Less Capital at Work

Because of the uncontrollable overnight risk and larger price moves associated with swing trading, you’re forced to trim down your position sizing from day trade sizing. Day traders, on the other hand, have the nimbleness to size up on a high conviction trade quickly, then trim down as it goes against you (so long as the liquidity is there).

Missed Opportunities

Most swing traders perform their analysis during the same period each day. Most of the time, it’s an hour before the market close. This is time-efficient and enables you to spend your time on other projects. However, you’re going to miss out on some terrific opportunities which began setting up early in the day.

Tools of the Trade

Swing traders tend to keep their toolbox pretty basic. Most rely on a simple charging platform and a solid stock screener to filter through opportunities.

Charting

Most swing traders make trading decisions based on price charts. In today’s era, there are countless choices, many of them free, so we don’t have to spend much time discussing the pros and cons of different charting packages. The differences will only become clear as you become a more advanced trader.

Here are some free charting packages:

- com – easiest and most intuitive platform.

- ThinkOrSwim – free through your TD Ameritrade brokerage account. Immensely powerful when you learn how to utilize it.

- Yahoo Finance

- Most online brokerages offer a free trading/charting package to their clients.

The typical swing trader’s charts will look something like this:

They typically use one or two technical indicators (which are math calculations run on price) to give them some extra insight on how price trends are playing out.

Your needs as a swing trader may diverge, but you can see why the choice of which charting software to use isn’t high on most swing traders lists.

Stock Screener

A stock screener works like this: you feed it some criteria like “stocks hitting 52-week highs” or “stocks with price-to-earnings ratios less than 15,” and the screener spits out a list of stocks which match your criteria.

Depending on how simple your strategy is, there are probably free screeners out there that can fulfill your needs. Here’s a list of quality free stock screeners:

- com

- com stock screener

- Yahoo Finance stock screener

- ThinkOrSwim’s Stock Hacker

- StreetSmart Edge Screener (free to Charles Schwab clients)

Day Trading

Day trading refers to buying and selling a security within the same day. Day trading and investing are two different beasts. Most day traders use technical analysis to make trading decisions, while investors use fundamental analysis to choose their investments.

Technical analysis involves using market data like how price has changed over time and the number of shares traded over time. Technical analysts identify trends in this data to find profitable trading decisions.

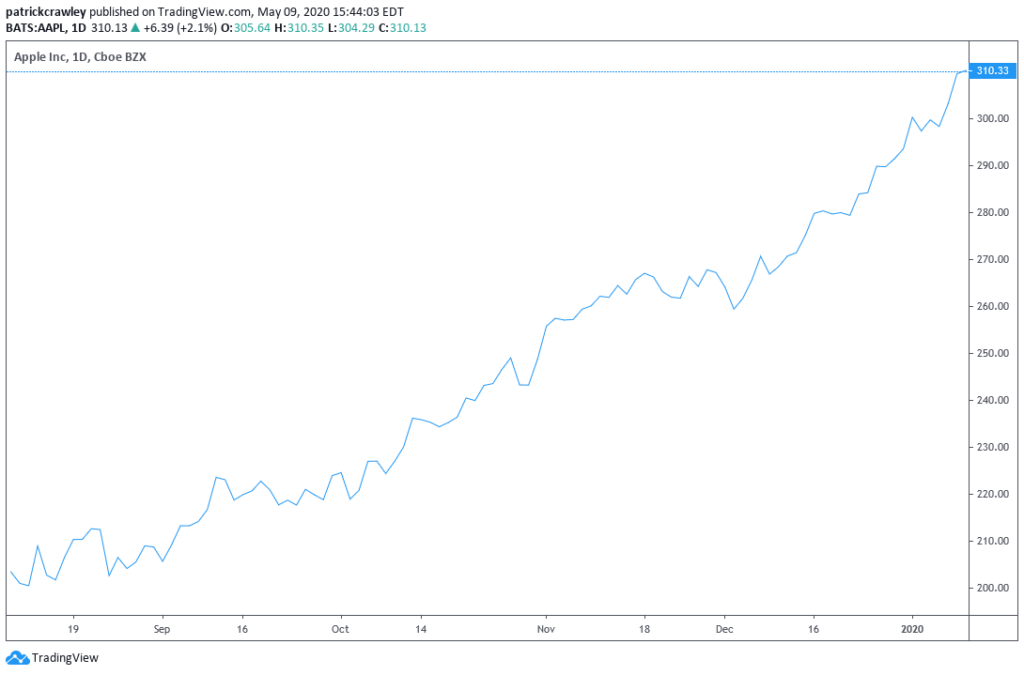

At the risk of oversimplifying, here’s a basic example. See the chart below, if someone asked you which direction this stock is headed in the next month, what would you say?

It’s not a trick question. Most of you responded ‘up’, which is generally the correct answer. This is a simplified version of what technical analysts do for a living.

They analyze the price charts of stocks and other financial assets and try to determine not only where the stock is going, but how far it will go, how much the price will bounce up and down on its journey and the probability that their analysis is correct.

In the exercise above, we chose the direction the Apple stock is likely to go in a month. Day traders take this a step further. They use charts that plot the minute-to-minute price changes and perform quick technical analysis to take advantage of these fast changes in price.

They’re looking to buy (or sell short) a stock, then sell it for a slightly higher price 5, 20, 60 minutes later. The gains on each trade tend to be pretty small, but day traders make this up by making several trades per day. I’ve met traders who make over a hundred trades per day, turning over close to a million shares of stock daily.

Tools of the Trade

Day traders require better tools than swing traders. They need speed, accuracy, reliability, and customization.

Platform

Rather than filling out an order ticker like you do when you invest in a stock, day traders use keyboard macros or “hotkeys” to buy or sell a block of stock with the press of their keyboard. Most trading platforms don’t support this feature, and as such, most day traders purchase subscriptions to software tailored to their needs like DAS Trader, Sterling Trader, or REDI.

Above is an example of DAS Trader Pro, a popular paid day trading platform, which tends to cost around $100 per month. You might expect it to look sleek and clean for the high price tag, but the software isn’t designed for UX or style, it’s designed to run with low latency on a range of computers.

Stock Scanners

The key distinguishing factor between a stock scanner and a stock screener is that a scanner continually scans the market for your criteria, updating in real-time. In contrast, a stock screener only updates when you refresh the screener. Additionally, many screeners don’t fully support intraday screening, leading to missed opportunities.

Think of a stock scanner being like Twitter. Imagine how annoying Twitter would be to use if the Tweets didn’t update live, and you had to refresh your page to see every new Tweet?

Bottom Line

Making money in stocks is a great way to add additional income to your personal balance sheet whether you’re investing long-term or day trading.

The key is to take it slow, learn the ropes and gain some confidence. Learning how not to lose money is just as important as learning how to make money.

Let us know if you have any questions in the comments below!