With Airbnb’s recent announcement of going public soon, we decided to shed some light on how to buy Airbnb stock when they go public or if you’re lucky enough to grab some before it starts trading publicly.

Latest Updates

- December 1 – Airbnb updates its filing with a projected share price of $44 to $50

- November 16 – Ticker symbol is announced $ABNB and trade on the Nasdaq

- Expected to IPO in early December 2020

- December 10 – Begins trading live

What is Airbnb

Established in 2008, Airbnb is a company whose mission is to give rise to a world that can provide people with a sense of belonging through healthy travel.

The firm distinctly leverages technology to empower numerous individuals across the globe financially.

Airbnb projects that its earnings – before taxes, depreciation, and interest – will be as much as $3.5 billion per year by 2020. The resulting growth would be a significant achievement for the apartment and home-sharing corporation that only a few years back seemed to have massive potential, but not along the lines of profit-making.

In 2007, the foundation for Airbnb was laid when Brian Chesky and Gebbia, his then-roommate offered airbeds for rent to three guests in their apartment on Rausch Street, located in San-Francisco.

Their action was as a result of a regional design conference that saw the entire booking of all the rooms in the neighboring hotels.

Through quick thinking and the determination to turn that idea into a company, Airbnb was born.

Achievements

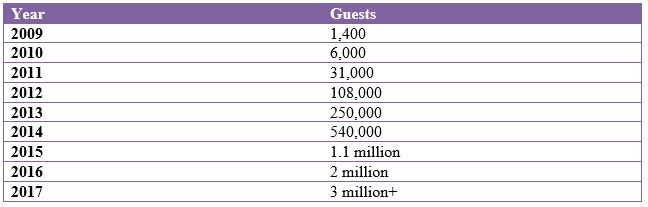

According to a tweet from Brain Chesky, the CEO and co-founder of Airbnb, during the New Year’s Eve, the following are the number of guests who stayed in Airbnb from 2009-2017 as highlighted by CNBC.

More notable accomplishments

2008– After the company was founded, approximately 50 people per day were visiting the site, and this resulted in around 10 to 20 bookings daily.

2009– Y Combinator gave a $20,000 seed funding to the firm.

2010– Airbnb became more popular and was launched globally and created an iPhone app in November.

2011– The venture acquired funding valuing the firm at $1 billion according to Chesky. Also, the co-founders established around the clock customer support, a compliance and logistics team, and local groups to handle matters distinctive to every city.

2012– As of this year, the number of freelance photographers recruited by the company to photograph 13,000 listings on six continents had grown by over 2,000. During summer, Airbnb engaged in redesigning to optimize the product for the purpose of engagement.

2013– The venture named its custom brand colors, whereby the founders called their unique shade of pink “Rausch” like their original residence. Moreover, among the firm’s 550,000 listings, there were around 6 million guest stays.

2014– By spring this year, the site had 10 million guests as well as 550,000 properties listed internationally, and a $10B valuation. That, in turn, made the enterprise worth high than legacy competitors such as Hyatt and Wyndham.

2015– The annual numbers rose from 40 million to nearly 80 million, which almost doubled and helped push the total figure to about 160 million since Airbnb was founded.

2016– Bloomberg previously stated that Airbnb turned its initial profit during this year.

2017– This was a remarkable year for México’s Airbnb community, including the launch of the company’s office and dialogue with authorities on matters such as tax collection. A collaboration agreement, or memorandums of understanding, was reached with Yucatán.

2018– Forbes noted that early this year, Airbnb had more than 4.5 million properties globally in 81,000 cities. More than 300 million guests check-ins took place in ten years. The company’s hosts earned in excess of $41 billion. In addition, users were able to filter their search through various property types.

2019- Airbnb indicated that it would IPO in 2020 and invest $25 million in reasonably-priced housing as well as small businesses. The firm also announced that hosts could benefit from skilled electrical contractors in a bid to meet the regulations.

How to buy Airbnb stock

Airbnb is a privately held company, thus purchasing stock in the company isn’t possible, yet.

As soon as Airbnb goes public, interested parties will use the following straightforward process to purchase of Airbnb shares:

- Register with an online broker account

- Select a favorite online broker option

- Input your SSN to activate the account (for Americans)

- Start trading.

Acquisition of Airbnb as a pre-IPO stock can occur through the following three ways:

- Purchase of Airbnb stock in the Initial Public Trading (IPO)

Determined investors can position themselves to invest in the Airbnb IPO. As opposed to the past, the marketplace and financial technology are revolving; thus, investors now have access to IPO investing. TradeStation, one of the top brokers for accessing IPOs in the modern era, has partnered with ClickIPO, an IPO investing app in offering its customers seamless access to IPOs and other offerings.

- Purchase of Airbnb stock after it starts trading

Often acquiring pre-IPO shares is deemed delicate and usually reserved for nimble investors and the wealthy (accredited), a possible way for the average person to own the stock is to wait for the IPO to complete. Spending substantial effort to own the stock before the IPO may not be worth it in the long run. Also, one may spend energy and time to acquire shares, only to receive a small allocation.

Even as stock soars, the upside gain may be limited. The best time to own the stock is waiting for the IPO and purchasing Airbnb stock via a discount online brokerage account. This account can be opened before the IPO, and a deposit made in preparation for Airbnb stock to go public.

- Purchase of Airbnb stock in Pre-IPO secondary marketplaces

Investors, early employees, and founders often find themselves in a dilemma. They own valuable share of companies that hardly trade publicly, and might have multi-million dollar net worth of stock that is not liquid. The good news is that two platforms; Sharespost and EquityZen now offer these individuals a way to liquidate their holding pre-IPO. For this reason, accredited investors can now join sites and purchase shares of this company as soon as they become available.

Bonus tip: One final possibility of purchasing Airbnb stock is through a directed share program. Companies often file their SEC S-1 filing to start the IPO process and include a directed share program for affiliates and executives who contributed to the growth of the company.

Bottom Line

Airbnb assists people in making a living through providing their property on a rental basis.

For everyday investors, acquiring pre-IPO Airbnb shares is hardly possible. However, determined persons can follow the pre-IPO marketplaces and pay close attention to any offerings.

One must be accredited to invest through this method; otherwise, the wait to purchase shares on the IPO date is inevitable. Of significant consideration is that due diligence is performed on the SEC S-1 filing when the Airbnb IPO is near. Investors should also refrain from buying Airbnb stock with money they cannot afford to lose.