Avis (NASDAQ: CAR), the rental car company, is a meme stock now. This is the same company whose bonds yielded 22% just 18 months ago due to fears of it following competitor Hertz into bankruptcy.

And meme stocks have consequences.

Just as GameStop changed the landscape of short-term trading in January of this year, this insane price action from Avis basically broke one of the oldest stock market indexes in existence: the Dow Jones Transportation Average.

Well, actually, it was always broken, but we’re now noticing how broken it is in an age of parabolic meme stocks.

Who is Avis?

Avis Budget is a rental car company.

Rental car companies are very capital intensive and require massive fleets of vehicles. These vehicles are treated pretty poorly by their customers, meaning they require tons of regular maintenance. As such, the stock market doesn’t typically reward rental car companies with rich valuations.

When the COVID-19 pandemic hit in March 2020, rental car companies were some of the first victims.

The rental car company is driven by travel. People rent cars when they fly to a new town and need some wheels to get around. When almost all flights are grounded and people aren’t traveling because of a pandemic, people stop renting cars.

Because rental car companies have a ton of debt that they use to acquire their massive fleet of cars, cash flow dropping to zero puts them in almost instant bankruptcy due to their inability to pay their lenders.

As a result of the pandemic, rental car companies had trouble making their bond payments and Avis’ competitor Hertz was forced into bankruptcy early on in the pandemic.

Luckily, for Avis, they were in a better financial position and avoided bankruptcy, but not without lots of pain along the way.

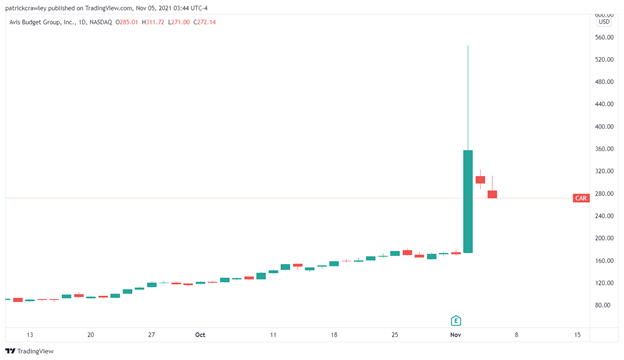

Avis recently became one of Reddit’s new favorite meme stocks, which created a massive short squeeze in response to a bullish earnings report from Avis. Here’s how the stock price reacted to the report:

What is the Dow Jones Transportation Average?

The Dow Jones Transportation Average is a stock market index (much like the S&P 500) full of companies in the transportation industry: airlines, trucking and logistics companies, and of course, rental car companies.

It has 20 stocks, and the weighting of the stocks is dictated by their stock price, rather than their market cap. This is important.

The DJTI has a very important place in history, because Charles Dow, the creator of the average, used the Transportation average and the Industrial Average to predict market movements in a top-down technical analysis methodology which was coined “Dow Theory” after his death.

Back in the time of the average’s creation, the Transportation Average was full of railroad companies, and the Industrial Average was full of producers like energy companies, commodity miners, and consumer good manufacturers.

The two indexes served two different parts of the economy: the industrials would make the products while the transports would ship them out.

Charles Dow used the two Dow Jones averages to forecast broad moves in the stock market based on their relationship.

If the Industrials broke out to a new high while the Transports couldn’t, Dow viewed that price move as a false breakout, because the move wasn’t confirmed by the Transports.

How Did Avis Break the Dow Jones Transportation Average?

Remember how we said that the Transportation Average was price-weighted? That essentially means that you take the prices of each of the 20 stocks in the index, add them up, then divide by 20.

In this way, a very high-priced stock like Adobe (trading over $600 right now) would have a disproportionate influence on the index compared to a stock like Bank of America (trading around $50 right now), even though Bank of America is a larger company by market cap.

So despite being only a $15B company, Avis’ current stock price of $272 has more influence on the change of the average’s price than the $183B market cap UPS, which trades for just $210.

The Dow indexes have been losing favor among traders for decades, who instead prefer the market cap-weighted S&P 500, which is arguably a much better representation of how the average stock is performing because of its market cap-weighting and larger breadth of components.

But instances like this might make traders and investors abandon these relics altogether, or perhaps it will get Dow Jones to change the calculation of the index.

Here’s how the Dow Jones Transportation Average moved in price in response the Avis’ earnings beat:

Bottom Line

Everyone thought GameStop was a fluke, even me.

But the Reddit crowd is proving that the game of the markets is truly changed forever. We know have CEOs of struggling companies making memes to garner investor interest from Redditors, rather than trying to win favor with the old guard of Wall Street.

Bloomberg’s Matt Levine recently said that “arguably it’s a breach of fiduciary duties not to be weird on Twitter all the time.” in reference to meme stocks.