Housing starts for December 2020, reported in late January, hit a level not seen since 2006.

A confluence of several factors is driving this trend which we’ll explain in this article.

Translation: the housing market is booming once again. Is the boom here to stay, and how does this fare for the homebuilding industry?

Quick Rundown on Homebuilders

It’s in the name: home builders build and sell homes.

They buy plots of land in neighborhoods poised for growth and use construction crews to build houses on the land. Once the house is built, they typically use their own team of realtors to sell the house.

Some homebuilders build speculatively–meaning they build before they have a buyer, and list the home on the Multiple Listing Service hoping to get a good price.

On the other hand, many require a customer order and deposit before they start developing. Each model has their own benefits drawbacks, but the speculative builders are more likely to get caught out when the housing market cools down.

To build houses, you need land.

The two primary land acquisition strategies that homebuilders utilize are outright purchases of raw land from land owners, and buying call options on land–giving them the right (not the obligation) to buy that land in the future if they want to build on it.

The options strategy of course reduces leverage and increases return on invested capital (ROIC). Some firms, like NVR, will go a step further and buy options to acquire build-ready lots from local builders, instead of raw land.

The options strategy also allows companies to control much more land, because they’re only paying option premium for each lot until they decide that it’s time to develop.

Homebuilding is a difficult, low-margin business that is a victim of the cyclical nature of the housing market.

Further, because the large publicly-traded homebuilders operate in several regions, their competition are typically small operators who are experts in their local markets.

The advantage the big homebuilders have over their local competition is the ability to easily attain financing. Many builders choose to close the gap between their limited knowledge of any specific regional market by acquiring or partnering with the local experts.

They offer financing and leverage, and their local partners assist in development.

Because homebuilders acquire a great deal of property throughout a cycle, they’re often left “holding the bag” when the music stops. Their balance sheets will be bloated with land they can’t offload near their purchase prices because nobody else is building either.

This problem is compounded if the business is saddled with debt, as the leverage could wipe them out completely.

The profitability of homebuilding depends on both regional and macro factors. On a regional basis, population growth, local employment trends, and demographics play a key role in the demand for homes.

At a macro level, mortgage interest rates, national unemployment, and wage growth have direct impacts.

Migration trends driven by COVID-19 are creating a new housing boom. The usually quiet homebuilders index began significantly outperforming the S&P 500 after the breadth of the pandemic became clear.

See the below chart comparing the XHB homebuilding ETF to the S&P 500:

Recent Comments From Homebuilder Executives

Listening to recent quarterly conference calls from homebuilders confirms some of the trends laid out in this article.

Conference calls are great because executives can provide more color and talk more qualitatively, allowing us to realize things purely studying financial statements wouldn’t.

One of the largest homebuilders, Pulte Homes (PHM), had their Q4 conference call on January 29, 2021 and right off the bat, the CEO, Ryan Marshall, keys us in on some key developments going on in the industry:

“Thanks to the sustained efforts of our dedicated team, we successfully navigated through a year that started strong, slammed to a halt and then accelerated into the strongest demand environment this industry has experienced in more than a decade. As you read in this morning’s press release, PulteGroup completed an exceptional year by delivering outstanding fourth quarter results that included a 24% increase in orders, a 220 point increase in gross margin and a 31% increase in adjusted earnings per share. We also ended the quarter with $2.6 billion of cash and a net debt-to-capital ratio below 2%.

Here’s Lennar Homes’ (LEN) executive chairman Stuart Miller on LEN’s Q4 call:

“We started 2020 with great expectations in an expanding market, which came to an abrupt stop with the unexpected arrival of COVID and then left back into high gear to address the market with unusually strong demand that was desperate for a home, a refuge and a brand-new concept, the hub of everyone’s life”

Here’s KB Homes’ (KBH) CEO Jeff Metzger on KBH’s Q4 call:

“We began 2021 with momentum, with our backlog value up over 60% year-over-year and the potential to generate as much as $6 billion in housing revenues this year as we focus on building our scale. We are poised for profitable returns-focused growth, given the composition of our backlog, a strong lineup of community openings and our leaner, more efficient cost structure, all contributing to an expected double-digit operating margin this year.”

Here is Green Brick Partners’ (GRBK) CEO Jim Brickman on their Q3 call. They report Q4 earnings in early March:

“The inflection that started more than a year ago accelerated this quarter. We are seeing unprecedented demand for our homes as many people adapt to a post COVID lifestyle. People want to own their own spaces, have a home office and grill for their family and friends in their own backyard.”

You get the point.

The industry is at an inflection point and the stock prices reflect that.

Almost all of them are above their pre-pandemic levels, and the SPDR S&P Homebuilders ETF (XHB) is at all-time-highs, trading at almost triple it’s pandemic lows.

Do note, that XHB also holds home improvement retail stocks like Home Depot (HD) and building products stocks like Masco (MAS), so it’s not a pure homebuilders index.

Indicators To Track Homebuilders and Housing

Building Permits and Housing Starts

Most local governments require builders to attain building permits to start developing.

Tracking these can serve as a leading indicator of the housing market. After receiving government approval to start a project, developers get to work.

At this point, a housing start is recorded, which, according to the National Association of Home Builders is when “excavation begins for the footings or foundation of a building primarily as a housekeeping residential structure.”

Trends show up in building permits before they show up in housing starts.

If you notice a significant divergence between the two for at least three consecutive months, you might be noticing a shift in the housing market.

US housing starts just hit their highest level since September 2006, which was during the last housing boom.

That’s the level of pent-up demand being released by lower rates, pandemic migration, aging millennials, etc.

Of course, the comparison to the housing boom feels ominous, so we have to be careful as the housing market is definitely frothy right now.

But a look at the long-term chart of housing starts tell us that we’re still not even close to the peak of the housing boom, however.

Housing Market Data

You can obtain pretty granular data on how both national and local housing markets are shifting from Zillow for free.

Some data points of note are:

- For sale inventory

- Newly pending listings

- Share of listing with a price cut

- Average sales price

You can view some of the data directly from their website using Tableau data visualization tools, while others require you to download CSV data and chart it yourself.

Let’s look at an example of a hot area: Austin, Texas. Elon Musk and Joe Rogan, some of the biggest celebrities right now, just moved there last year.

Tailwinds for Homebuilders

Low Mortgage Rates

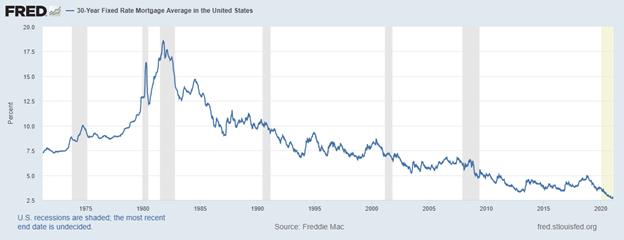

Mortgage interest rates are the lowest they’ve ever been in the United States. According to the St. Louis Federal Reserve, the average 30-year fixed rate mortgage is at 2.7%. Mortgage rates have a direct effect on home affordability.

Here’s an excerpt from a DoughRoller article demonstrating how significant the impact of mortgage rates is on affordability:

Scenario #1: 3.5 percent interest

Paying 3.5 percent interest, you could afford a mortgage of about $187,434. With your down payment, that brings your upper limit home price to $197,434.

Scenario #2: 5.5 percent interest

Paying 5.5 percent interest, which seems like such a small increase, you could afford a mortgage of $148,235, for a home worth $158,235.

Scenario #3: 7.5 percent interest

Add two more percentage points in interest, and your mortgage limit drops to $120,373, or a home worth around $130,373.

So between 3.5 percent interest and 7.5 percent interest, which is really a huge leap in the world of mortgages, where things are calculated to 1/100 of a percent, you’ve lost over $67,000 of buying power.

While low interest rates can’t go on forever, Fed Chairman Jerome Powell reinstated the Fed’s intention to keep them low for the foreseeable future this week.

Millennials Are Finally Buying Homes

The millennial generation got a tough break. The price of student tuition rose, forcing many to take out student loans to pay for their education.

Right around the time when many were exiting college and entering the workforce, the global financial crisis hit.

Beyond short-term macroeconomic cycles, real wage growth has been declining precipitously since the 1970s, decreasing the buying power of millennials as a generation.

They’re also getting married and having children later and at lower rates. So it’s unsurprising to learn that millennials are buying less homes than previous generations were at the same age.

All of these are bearish long-term for homebuilders, but the tide is shifting. Perhaps, rather than forego purchasing homes altogether, millennials are simply doing so later, due to the macroeconomic factors detailed above.

This chart from Green Brick Partners’ (GRBK) recent investor presentation shows the momentum of millennial home buying:

Recent data from Ellie Mae supports this view, and that much of it is driven by younger millennials. To further compound this, housing inventory is plummeting, which pushes the prices of homes up.

New Migration Trends

Millenials are leaving expensive cities in record numbers in favor of suburbs, exurbs, and rural communities. It makes sense.

If they have the opportunity to work from home, they don’t have to pay the sky-high rents of the major job markets, and instead can find cheap housing outside of their city.

A report from HireAHelper found that these migration trends are concentrated in specific areas. Specifically, Idaho, Florida, and Vermont were some of the top destinations for pandemic-driven movers.

One of the key findings of the was the biggest regional winners and losers:

This data suggests that the homebuilders best positioned in the new growth markets created by this migration will benefit most from this demand rush.

Bottom Line

While this thesis is compelling, homebuilding stocks have never been the most attractive because of their cyclicality.

They’re extremely sensitive to changes in interest rates and the overall business cycle.

Also, many homebuilding stocks have run up to reflect this, making them potentially overbought in the short-term.

From a long-term investment perspective, the thesis is questionable.

But it’s created several tradeable trends from those within homebuilders, to building products, to regional companies poised to benefit from an expanded total addressable market.