Momentum Day Trading Strategies : “Gap and Go!”

Click here for the hottest stocks gapping up/down today!

Some day trading strategies I use every single day. My focus each day is the same: find the big gappers, hunt for the catalyst, create a watchlist, and execute my trades according to the strategy.

This is the same thing everyday. Repetition is what makes us good at a strategy. Discipline is what keeps us profitable. Learning a Strategy for Day Trading the “Gaps” or “Gappers” is critical for success in the market!

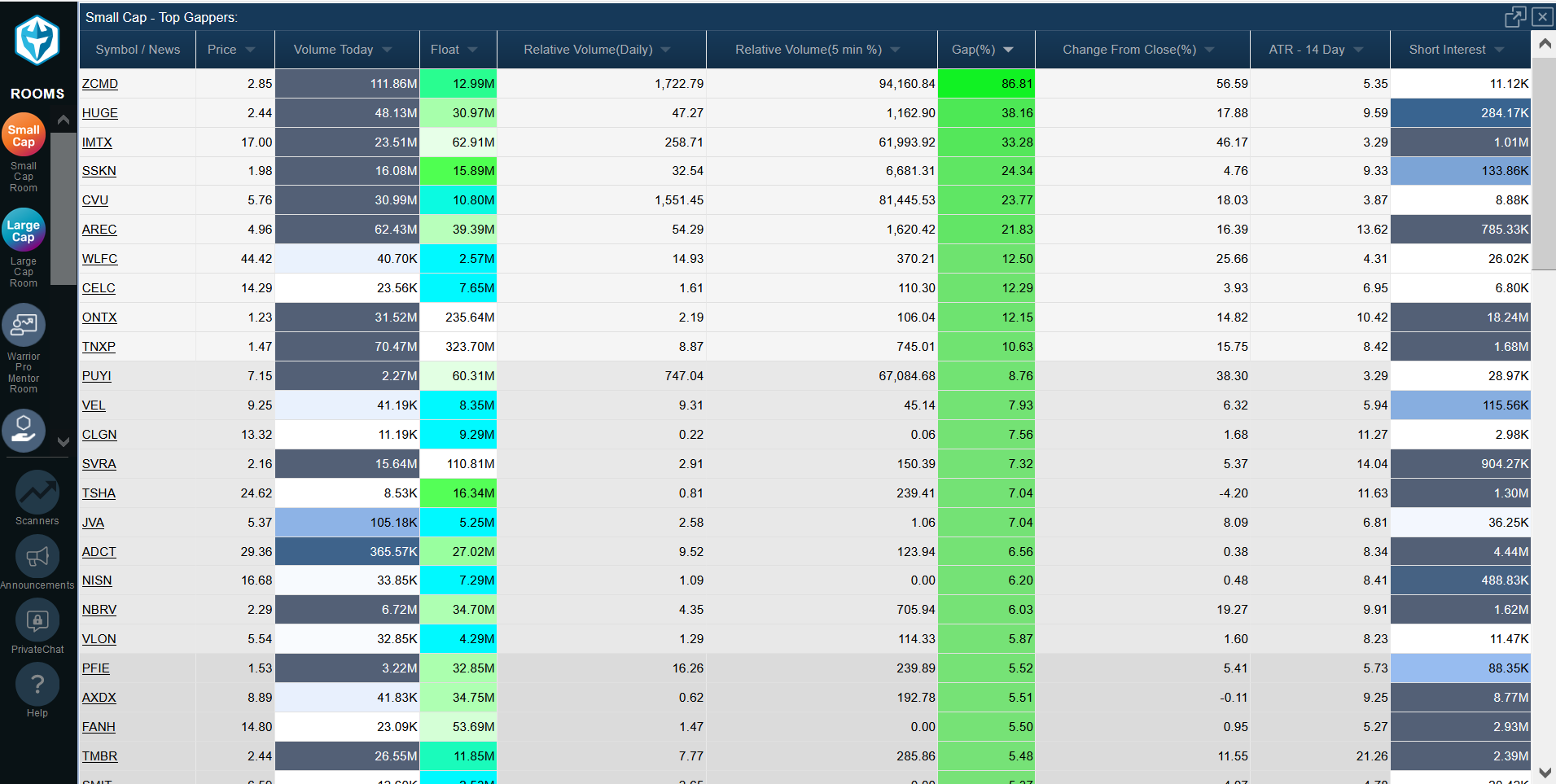

I trade a “Gap and Go” Stock Trading Strategy. It starts with looking at the gappers on the Day Trade Dash “Top Gappers” scanner.

Gaps of more than 4% are good for Gap and Go trading. Gaps of less than 4% are usually going to be filled, but I don’t find them as interesting. Once I have found the stocks already moving, I search for a catalyst. The Day Trade Dash news features make this easy; I can click a ticker right from the scanners.

Only after confirming the catalyst, I will begin to look for an entry. My Gap and Go Strategy is very similar to my Momentum Day Trading Strategy. The difference is that the Gap and Go Strategy is specifically for trades between 9:30 – 10 AM ET.

I look for the quick and easy trades right as the market opens. Gap and Go is a quick stock trading strategy to give us a profit usually by 10 AM. In our Day Trade Courses, we teach the ins and outs of this strategy. (Click here to see the full syllabus of our Day Trading: Strategies & Scaling course, where the Gap and Go strategy is taught.)

Gap and Go! A Momentum Stock Trading Strategy

Gapper Checklist (Summary; Details for Trading Course Members Only)

1) Scan for all gappers more 4%

2) Hunt for Catalyst for the gap (earnings, news, PR, etc)

3) Mark out pre-market highs and high of any pre-market flags

4) Prepare order to buy the pre-market highs once the market opens

5) At 9:30 AM, as soon as the bell rings, I buy the high of the first 1-min candle (1-min opening range breakout) with a stop at the low of that candle or buy the Pre-Market highs.

Gap and Go Entry Setups (Summary, Details for Trading Course Members Only)

1) Break of Pre-market flags

2) Opening Range Breakouts

3) Red to Green Moves

Entry Setups 4. 5. and 6. are for Trading Course Members Only.

The importance of Float

I always look for low float stocks. These will have home run potential written all over them. A stock that has a 10mil share float and trades 1mil share pre-market has already traded 10% of the float.

There is an extremely good chance the entire float will be traded during the day once the market is open. These are the type of stocks that can run 50-100% in one day. Because of this, these stocks can also be extremely risky to trade; high momentum stocks, and my strategies in general, are not for everyone.

When we have the right catalyst, float, and retail trader interest, it’s the perfect storm for a big runner.

Review of Stock Trading Strategy “Gap and Go!” Scanner Results

Review of Stock Trading Strategy “Gap and Go!” Setups

$TCCO Gap and Go, squeeze over pre-market highs. Entry at 4.75, ride the momentum.

$ATOS nice clean Gap and Go Setup

$ATOS nice clean Gap and Go Setup

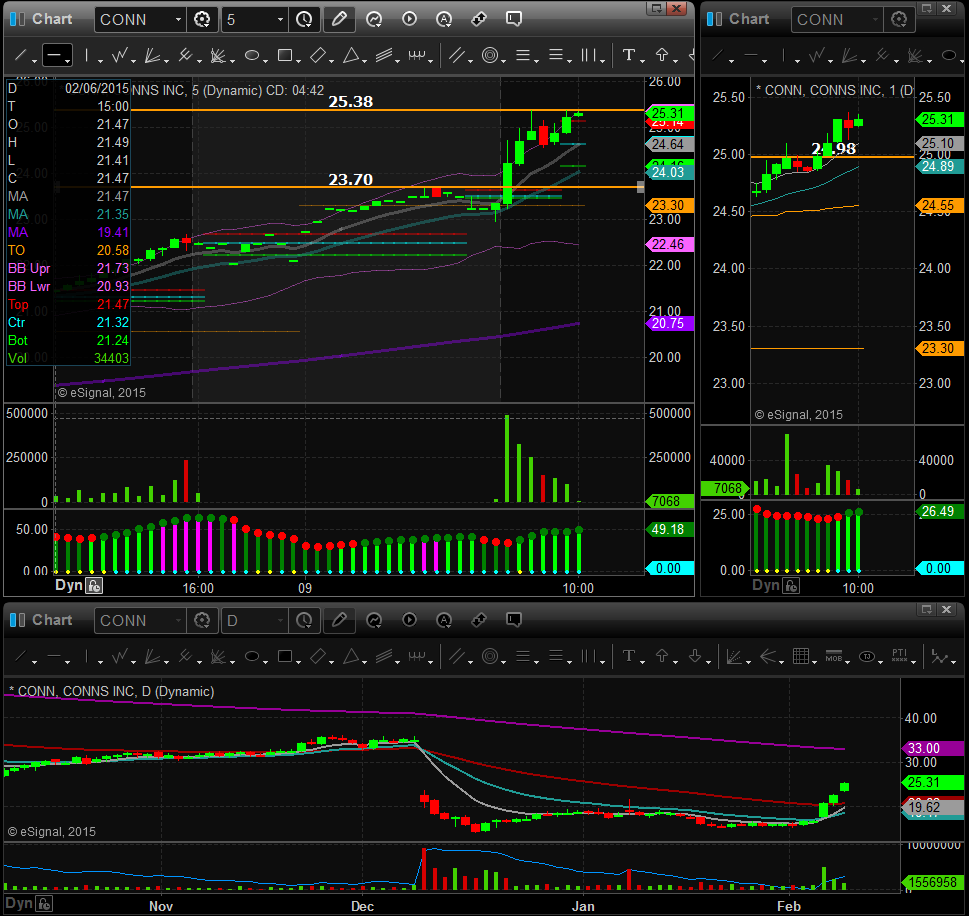

$CONN Gap and Go

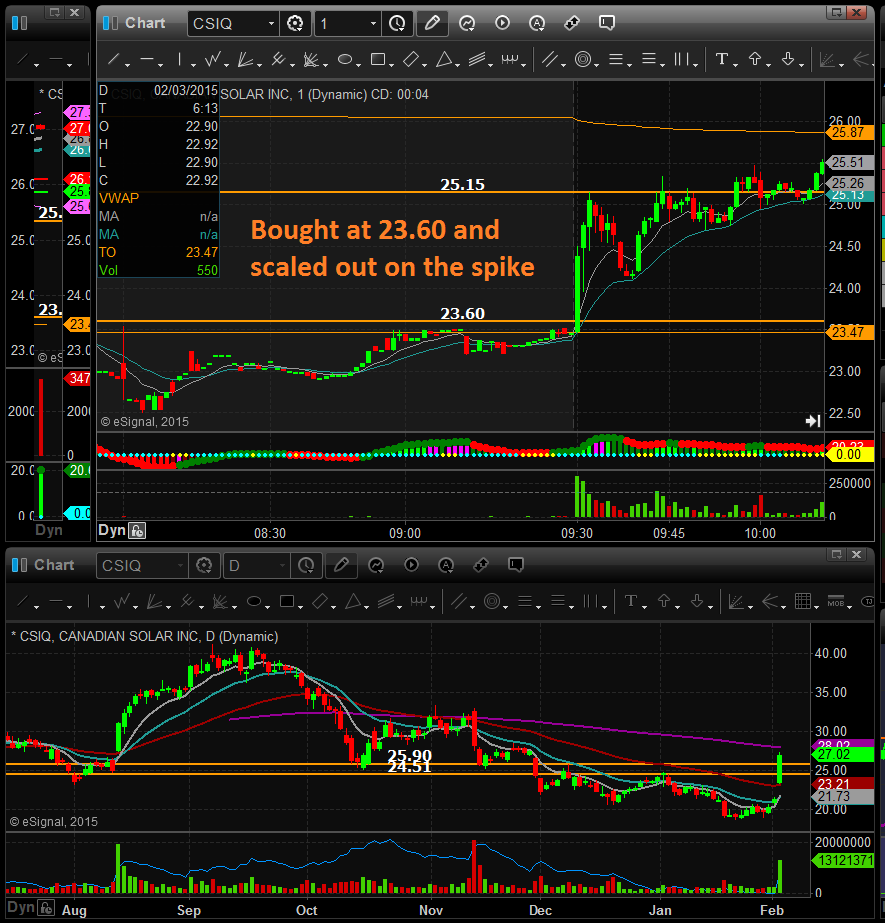

$CSIQ really nice gap with pre-market flag at 23.60, bought this at 23.60 and rode the wave up to 25.00, what a nice move.

$MTSL beautiful Gapper with pre-market high of 1.94. Bought the breakout and sold on the spike up through 2.30 for an 11% move in less than 1minute. Picture perfect!

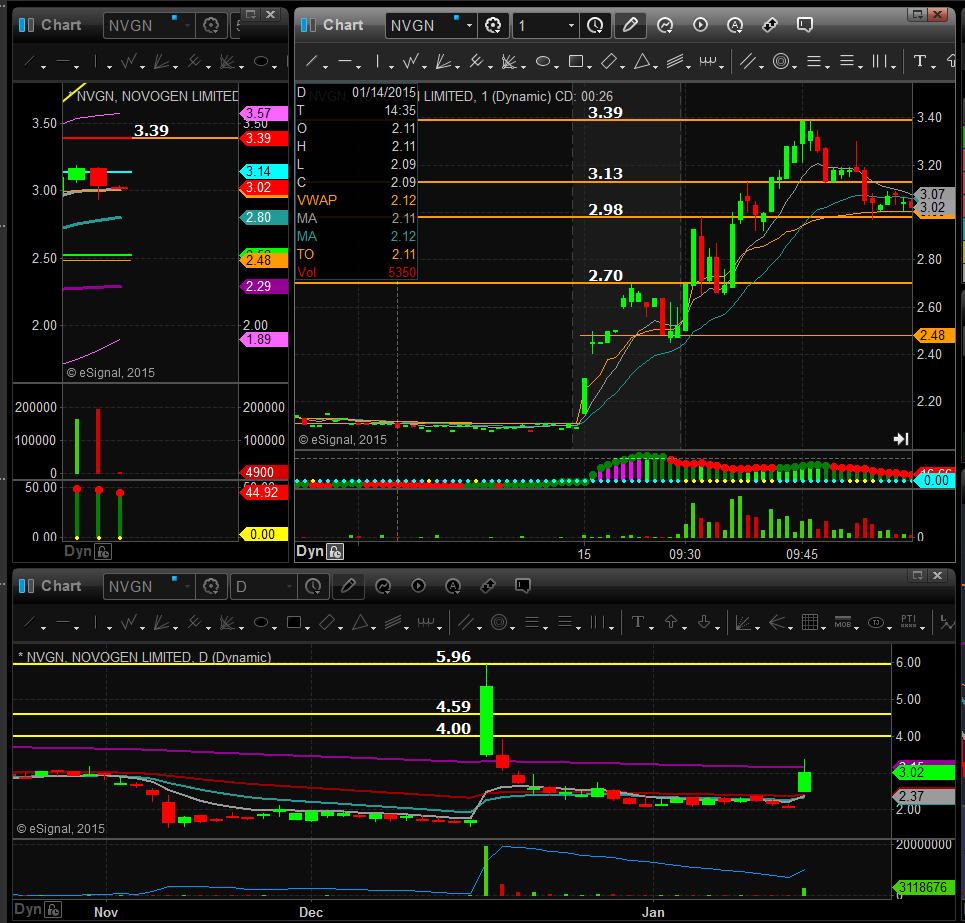

$NVGN nice gap pre-market with a low float stock, bought the pre-market flag at 2.70, then bought the first pull back at 3.00, skipped the 2nd pull back at 3.13 but that would have been a nice one too!

$BCLI – big gap up in anticipation of news on Monday. Pre-market high of 7.55, bought at soon as it broke and got filled at 7.60, sold on the spike to 8.48. Beautiful opening range breakout.

$NDRM got long at 8.48 as soon as the market opened. This surged up to 11.00 in the first 45min of the market being open. I continued trading this as the day went on, applying our Opening Range Breakout, Flat Top Breakout, Bull Flag Breakout, and Top Reversal Strategies.

$GILD was watching over pre-market highs of 96.16, market opened and it surged up to 97.31, perfect Gap and Go setup

$LIVE premarket high of 4.10, but flagging under 4.00. Long was 4.00 as soon as the bell rings, popped up to 4.15, sold 1/2, pulled back, when it came back up I doubled up and it surged to 4.25.