Fear of Missing Out – Behind The Trades | Ep. #25

[smart_track_player url=”https://media.warriortrading.com/2017/03/BBT-test.mp3″ download=”false” ]

Transcribed Audio of Fear of Missing Out

What’s up guys? All right, so we’re going to do our Friday recap and this is also going to be episode two of Behind the Trades. Today, we’re going to be talking about the fear of missing out. This is something that was really impacting me this week. I was really dealing with this on several days, both the fear of missing out on particular trades and then the frustration of having missed some really good opportunities. I’m going to start by giving you a recap of the week and we’ll start I suppose with the recap of today, the last day of the week.

I’m finishing today with $4,858.97, which means I’m now breaking over $40,000 in my small account. This is the account that I started on January first, just about a month ago, with $583. That’s pretty crazy, I’m up over $75,000 this year and 40,000 of that is in my small account. Let’s dive in here and talk about the agenda for today, episode two. We’re going to go over the weekly stats. We’re going to talk about the best trade of the week. We’re going to talk about the worst trade of the week. You’re going to find out that just like last week, my best trade and my worst trade were on the same stock. Last week was FFHL, this week is RGSE.

Then we’re going to talk about today’s topic which is the fear of missing out and some of the psychological battles that we all have as traders. Then we’re going to have a segment called ask the warrior. Where you can ask me questions that you have. You can talk about the trades you took this week, what went right, what went wrong, et cetera.

Free Day Trading Chat Room

Now, I’m excited to announce that on Monday we had our free chat day. We had over 2,370 traders joining the chat room. Between the main chat room and our free chat room. It was the biggest free chat day that we’ve ever had and it was fantastic. You can see this is a login map of where traders were logging in.

Logging in from all around the world. Hawaii, Alaska, South America, Africa. Lots of traders in Europe, lots of traders on the East Coast, lots of traders in China, Asian countries and of course some traders in Australian, New Zealand as well. Now, on Monday, this coming Monday, we’re going to host a follow up free chat Monday for anyone that missed the free chat day on Monday of this week. Mark your calendars, you’ll be able to log in to the room by 9 AM on Monday morning.

Weekly Day Trading Statistics

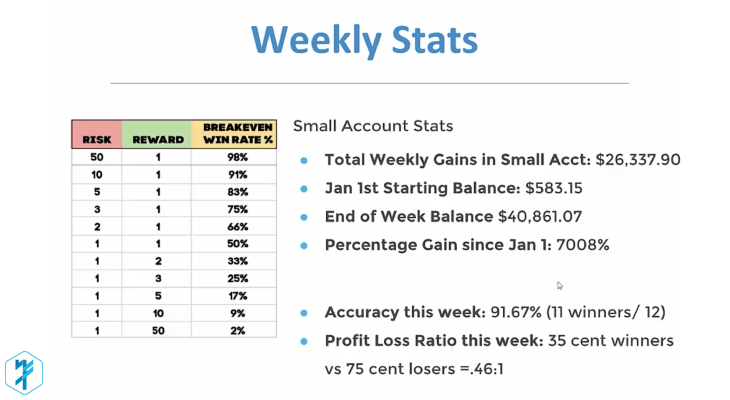

Now, let’s talk about the weekly stats. The total weekly gains in my small account, $26,000. Crazy, just crazy, $26,337.90. Really blew it out of the water. Last week, my total weekly gains were right around 5,500.

I really took a big leap forward. Last week I ended the week with $14,587 in my account. This week I’m ending with $40,861 in my account. That’s means I’m up 7008% this year for 2017, versus my starting balance. Which is in obviously pretty ridiculous. I had to be really aggressive to get there. I’ll talk about the trades I had this week. This was a wild weak. This was the craziest week I’ve ever had as a trader. I made 16,000 on Monday, I lost 13,000 on Tuesday and made 6,000 on Wednesday, 22,000 on Thursday. Today I was up 11,000 and then I lost 7,000 and now I made a little back and I’m up 4,800. Some real extremes, some real whip sauce. It’s the result of being really aggressive.

I’ve wanted to grow this account as quickly as I could. I’ve had to take more risks than I might ordinarily take. That’s resulted in these whip sauce. Accuracy this week, 91.67%, 12 trades and 11 winners. Now, unfortunately the one loss I have was over $5,000 and it was a 75 cent loss on 7,500 shares. My profit loss ratio this week is .46 to one, which is a negative profit loss ratio. It’s not one-to-one which means based on that profit loss ratio, when you risk, let’s say risk $2 to make a dollar. You need to be right 66% of the time just to break even. With these types of statistics, I really need to have very high accuracy. I had that this week but ultimately I need to learn from the lesson and that loss this week and not allow that to happen again. That’s the the big picture breakdown.

I did this week trade in both my small account and my big account. As a result, my total profits on the week are $37,000. Which is the best week that I’ve ever had. Last week was a fantastic week as well. We’re just seeing some really awesome opportunities in the market. That’s all it is, we’re just seeing really great opportunities and I’m in a position where I’m able to capitalize on them and be aggressive. Now, part of the reason I made so much money yesterday was because of the fact that I had taken a big loss earlier in the week and I was getting aggressive. I was compensating for that loss by being more aggressive and take more risk. That can be really dangerous.

Best Day Trade of the Week

We’re going to talk about that in a moment when we talk about the fear if missing out. Let’s first talk about the best trade of the week, the highlight of the week, RGSE $7,546. This was the one that really just got me going. This was Monday morning, I made 7,500 in this account. I made, I think it was 8,500 in my other account. Which gave me $16,000 in total profit. This was a huge day. Now, the entry was really pretty simple. I got in this at 450. It was 6,200 shares and it was based on a break of the half-dollar. Now, why did I get into RGSE? I got into RGSE because it was a former runner. It was a stock that has a history of making big moves. Last year, we had a day where it went from $2 to $8.

Knowing that it’s the type of stock that can make really big moves, I was especially aggressive on it. As soon as I saw it, I was like, “I need to jump in this and I’m going to ride this momentum as long as I can.” I got in at 450 and it spiked up to just under $6 per share. Which is a really, obviously a really good move. Now, I sold a partial at 550. Then we dipped down just for a second. You can see here on the chart, we have the screen candle, we dipped down and then we popped back up. As we broke this level here over 5.50, $6 or 5.50, 5.60, that’s my added back. Added back 4,000 share and we got that spike. Now, that spike was not sustained. It squeezed up and then it rolled over, but it was enough for me to be able to book a profit on it. That was the best trade.

This was a stock that was in play the day before. Now, when you look at the daily chart here, this was the day before, the stogie candle. When I was looking at this day here, this was Monday. I was like, “Okay, this is the first day that its going to make a new high.” That’s a pretty big deal. It’s a reversal on the daily chart. The last time we had a reverse on the daily chart is when we went from $2 to $8 per share. That was I think in the fall. I was like, “Okay, history might repeat itself.” It’s a former runner, the first day to make a new high, we’ve got potential. When I saw it here out of the gate squeeze from 3.78 up to four and of course it hits the high day scanners, 4.35, I was like, “Yup, this is it, I got to jump in.”

I see the symbol and right away I recognize it. That’s my process. When I see a stock hitting the high day scanner, the scanners are color-coded. Yellow is massive volume and low flow. These are typically stocks that if they have a lot of volume and there’s a good reason for it, they can make huge moves. I’ll show you some other examples about later on. As soon as I saw this I was like, “Okay, RGSE, I’m familiar with the stock, it’s a former runner, history of making a big move. I’m going to jump in. I’m going to get aggressive on it.” I jumped in 4.50, 6,200 shares. We have the momentum up $7,546. Now, last time RGSE made this kind of big move, it did something interesting.

Worst Day Trade of the Week

It had a big move and then day two was the day it exploded. That’s what I was thinking might happen on day two. Day two is right here where it ended up being red the entire day. My worst trade of the week was also RGSE. I’m going to move my iPhone here just for one second. My worst trade of thge week, RGSE. Same stock that I had, such a great win on, on Monday. I jumped back in on Tuesday and I really got destroyed on it. It was a horrible trade between my small account and my big account I lost $13,000. This was obviously something that we talked about quite a bit in the chat room. What went wrong here? Well, I got in this basically I was chasing the proper entry.

The proper entry on this was at $6. You can see right here, $6, the first five-minute candle to make a new high right in this area. That was the proper entry with a stop at 5.90. Now, I prepared my order to get in at $ 6. I press the buy button to buy 6,000 shares, that goes 6,000 and range 7,500. I only filled 200 shares of the order. 200 shares is extremely frustrating. Because it immediately popped up to 6.50. I knew if I had that full order of 7,500 shares I’d be up three grand. Unfortunately, I only had 200 shares so I was only up 100 bucks. I thought, “Okay, the last time the stock made that follow-through move, it ran from $2 to $8. Today is the same pattern on the daily chart. I think that that’s what’s going to happen.

I said, “You know what, forget it, that’s fine. I’ll just buy this at 6.50.” I buy 7,500 shares at 6.50 for the half-dollar break. Similar to what I did the day before, buying at the half-dollar. Well, in this case, we didn’t get follow-through. It immediately dropped down to 6.30 and then it dropped down to $6 and then I stopped out at 5.75. I lost 25% of my account in just one trade. That right there exemplifies the risk when you trade with large size and we use margin. You can have these really big draw-downs that really screw up your account. That’s basically what happened. I had this really big draw-down and it was very frustrating. That whole day I was moping around because losing $13,000 in a single day, having just had the best day in such a long time making 16,000 on Monday.

Then the to lose 13,000. I felt like, I just was so upset with myself. I’d gone from my account going from 14,000 up to 22,000. Now we were going to drop back down to like 16,000. It just felt like, obviously a big step back. It was fairly demoralizing. Now, on this trade on RGSE, I know that I made a mistake. The mistake was that I chased the proper entry. It was extended at 6.50 and I got in there it rolled over. This is a stock that was already fairly extended because of the previous move, the day before. Yes, it was on the gap scanner, it had some volume. My entry is 6.50, it was 50 cents too high. With my entry at 6, stopping out at 5.75 made sense. When you’re in a 6.50, 5.75, is now that much further away.

I chased it and that was the big mistake there. Now, just today, we saw the stock MYOS and it ran from $3 all the way up to five, a two point run. On this one I said, “Guys, I need to wait for a five-minute set up. I can’t chase it. I can’t. I need to get that clean five-minute set up.” You know what, we never got it. It never happened. It just went parabolic. Although even right now it started consolidating giving us a five-minute set up. The problem is this stock went from zero to up 80% in 30 minutes. When they gothat extreme that quickly, they don’t usually give you a nice clean gradual pullback. They go and then they come back down. Unfortunately on this one, I missed my opportunity.

The interesting thing here with MYOS is that I could’ve gotten away with chasing it. If I had chased the stock, I would’ve done okay. Sometimes you will get away with chasing and other times you’ll get stopped out and you’ll lose money like what happened on RGSE. How do you know when you should chase amd when you shouldn’t chase. For me, I obviously need to be a little bit more mindful about my share size when I decide that I’m going to chase a stock. If I’m making a conscientious decision that this is extended but I’m going to buy it anyways, I should be reducing my share size. That’s number one. Number two, stocks that are more likely to give us a big breakout on a one minute set up or that are worth chasing, our stocks to have a really strong daily chart.

MYOS has a very strong daily chart today, much stronger than RGSE so that’s in its favor. Number two, it’s just right now starting to squeeze. It hasn’t been moving all day long. It hasn’t been you know … It’s not well into the run. It’s the very beginning of the squeeze and traders are just starting to see it and just starting really to jump into the trade. We’re still very much, it’s still a very fresh momentum stock. Whereas RGSE on the second day was a bit more played out. I think traders had already had their fun with it. We’re either short bias or just no longer interested. Because we simply didn’t see the follow-through, but I was expecting. Now, the interesting thing this week and of course on my biggest day where I made $20,000, I traded four stocks that day.

Three out of the four ran 50 to 100%. The fourth one ran maybe 40% and then it rolled over completely. You never really know which of these stocks hitting the scanners are going to make that huge move. Which one is going to go from 2.80 to $5 and which one is going to go to 3.05 and then drop all the back down to 2.50. With that in mind, you always have to set your stops. You have to set tight stops and know your max loss in every trade. You don’t want to allow a single trade potentially to blow up your account. Although losing 25% was not boiling up my account, it certainly was a very big draw-down and I wasn’t happy about it, it was not something that I was planning on doing.

The Fear of Missing Out: Trading Psychology

The topic of today and this is very topical to my trades this week is, the fear of missing out. Obviously it’s been a really wild week for me. This week, with the huge wins, now the huge win on Monday wasn’t a result of fear of missing out. That was just, I got aggressive, I was in the right place at the right time, the strategy worked and paid off big time. Now, I’ve been trading with larger share size this year. I’m also been trading with larger share size because I’ve been trading in two accounts. In some of these positions I’ve almost been doubling my risk because I have 10,000 shares here and 10,000 there. When it works, it works well obviously. When it doesn’t work, you lose $13,000.

On Monday, everything connected and I was able to capitalize. My best day of the year was quickly followed by my worst day of the year losing 13,000. That type of loss can really start to trigger these emotions. The fear of missing out, it’s a phrase that really embodies both the fear and the greed. Which are the two emotions that drive the stock market. The fear of missing a big winner combined with the greed and the jealousy of knowing that others are hitting that trade and that you should be getting a piece of it too. That fear of missing out, it can really manifest in a number of different ways. This week it hit me really badly on RGSE. As you guys already know, as I’ve already mentioned.

At the same time that emotion carried me through the week and led to my biggest day. Has led to me making $37,000 this week. It’s to say that this emotion is not necessarily a bad thing. It’s just one that you have to be able to come to terms with and really understand and have a sense of awareness for. Now, fear and greed specifically, the fear of missing out, these are emotional responses to a trigger. That trigger can be any one of the following.

- Number one, you see a stock suddenly make a big move and you completely miss it. Maybe you weren’t trading that day. Maybe you weren’t even watching that stock. For whatever reason a stock has made a huge huge move and you missed it.

- Trigger number two, you’re watching a stock, you tried to get in but your order didn’t fill and what should have been a huge trade ended up being nothing at all.

- Number three, you see somebody up Facebook, Twitter or even in our chat room bragging about big profits and you feel like you missed that opportunity, you miss the trade. Now you’re on the wrong side or you’re breakeven or you’re at a loss.

- Or number four, you’re in the chat room, let’s say you’re in our chat room or any chat room and you hear me take a trade. Because you weren’t prepared for an entry you end up missing that opportunity completely and then you feel frustrated. You’ve got that fear of missing out, that you just missed out on something. These are a few of the triggers that I’ve experienced over the years as a trader.

How you respond to those triggers. How do you respond to a trigger in general. The common reaction, when you feel like you have a fear of missing a trade, the common reaction is simply to do everything you can to alleviate that fear. How do you alleviate that kind of fear. You press the buy button. You get in. You no longer have the fear missing out once you press the buy button and once you’re in the trade. Or what might happen is, the next stock it shows even the slightest bit of potential you jump into it, barely without even thinking you just jump right in and try to capitalize on that opportunity. Here’s the problem, when you do that you really aren’t thinking about risk when you take that trade. When you start impulsively jumping into the next trade, you’re not thinking about risk. All you’re thinking about is profit, profit potential and it’s the greed.

Now, that’s kind of what happened to me. I know this, this is what happened to me on Tuesday when I buy RGSE at 6.50. I was in that same fearful state of having just missed a big trade. Feeling frustrated that I didn’t get filled. I said to myself, “This thing is going to straight to seven, maybe eight. You know what, why not just jump in. I don’t want to miss it.” I jumped in, 7,500 shares at 6.50. I was instantly down 25 cents on 7,500 shares and I was looking at a 1,500 loss. At that point, that’s when the fear kicked in. Instead of selling when I was down, selling when I was down 25 cents, I was feeling afraid. I was feeling afraid of taking my first big loss in the small account. I was afraid of what people might say about me. Think what the people in the chat room would think.

If I would be able to bounce back quickly. I really wanted to not make that loss real. To not make the loss real, the easiest thing to do was to keep holding it and not fear compound itself, I kept Holding. Instead of selling I held. The next thing I know I’m down 50 cents. Of course the fear intensified. Because now I know I’m really making a big mistake. The embarrassment id going to be even worse when I have to explain why I held the stock down 50 cents. At that point I realized that I needed to try to minimize the loss as much as I could. I decided, “Well, I need to get out of the stock. I am going to take a loss but I’m going to try to wait for the first candle to make a new high.” Unfortunately, we broke below six dollars, dropped immediately down to 5.75 and I said, “I got to sell this.”

I overcame my fear and I made the loss real. I said, “You know what, just take the loss, it’s not that bad you’ll bounce back from it.” I knew that I couldn’t allow the stock to blow up my account. I press the sell button and loss $5,500. Now, the stock ended up dropping two more points. From 5.50 down to 4.50 and under to 3.50. If I held it stubbornly, just held and held and held. I could’ve lost over $20,000 and I could’ve totally erased my entire account. Everything I’ve made from January 1 until then, I could’ve given back. Now, everything that I just talked about occurred in a period of about two minutes. I got in right out of the gates. As soon as the market opened, it popped in that one minute candle from $6 to 6.50.

I got in at 6.50 and then the next one minute candle it dropped down to 6.25 to $6, from 5.75 and then to 5.50 and then down to four. It dropped very, very quickly. You can see how, as an active trader, as a day-trader we have a very, really a very short period of time to make quick decisions. These decisions can be extremely important. Whether or not we make 10,000 or we lose 10,000. I’m glad that I was able to overcome that fear. That fear allowed me to hold the stock a little too long. The fear of missing out is what got me into the trade. The fear of missing out is also sort of, we call it the fear missing out but it’s really driven by greed. The fear of missing out what caused me to chase the trade.

Then the fear of making a loss real by pressing the sell button encouraged me to hold it a bit longer. The fear of loss. As Dave says in the chat room. After I had the fear of missing out, I had a fear of loss. I didn’t want to take the loss, I didn’t want to make the loss real and so I held way too long. Now, I always talk about break out or bail out. If you get into a trade and it doesn’t work immediately, bail out. I certainly had the opportunity to sell when I was down only 20 cents. With 7,500 shares, that would’ve been a pretty big loss and I was afraid of taking that loss. You could see how quickly all these thoughts had to run through my mind in a period of 120 seconds. I had to make a decision and that decision potentially could’ve ruined my account if I decided to keep holding it. Or minimize he loss.

I ended the morning down $7,500 or $5,500 in my small account, 75 in my big account, down 13,000 on the day. I felt embarrassed, I felt frustrated, I felt defeated. Obviously I’m doing this all in a very public way. I knew that, that would be something I would be challenged by during this small account challenge. That I’m not doing this to just challenge myself, I’m doing this to show you guys that it’s possible. That means when I have good days, I’ve got lots of people celebrating with me. When I have bad days, I have people saying that, “Why did you do this? Why did you do that?” Even on my good days I have people criticizing me as well. I have someone say yesterday that, if I took away the trade idea scanner, I’d be nothing. I was like, “Well, I guess the trade idea scanner is a pretty important tool.

I’d have to go back to basics. If you took a chainsaw away from a lumberjack, he’d kind of be nothing. He could use the old-fashioned method of using a saw, a bow saw or whatever it is.” There’s always going to be haters. Especially when you did something like this, it’s very public. In any case, I’ve seen many, many traders run into the struggle of revenge trading. On Tuesday after I took that big loss, I did not continue to trade. I said, “That’s it.” I just totally blew up my max loss. My max loss is supposed to only be $1,000 and I just blew wat past it. I’m done for the day. I’m not going to keep trading. There’s no way I’m going to recover this in one day. I just got to throw in the towel and that’s what I did.

Now, when I did my video about being in Las Vegas on the racetrack, one of the things that I mentioned is the fact that, when you’re driving a race car, if you crash the car. If you’re going way too fast and you screw up and you crash that car, the car is damaged. It needs to go into the shop for repairs. During that time when it’s being repaired, you have the opportunity and really it is an opportunity to reflect on what went wrong. Traders don’t have that same opportunity really. Because as soon as you take a loss, you can jump right back in and keep training. I could’ve kept trading all the way to 4 PM. You know what, I’ve done that in the past.

That’s called revenge trading. When you’re trying to get back what you lost. I thought the desire to do that on Tuesday. I said, “I just got to walk away, I’m done for the day. I made 16,000 on Monday, lost 13,002 today. I’m still up 3000 on the week. Let’s just be happy wit that and take a break.” The thing is on Wednesday morning, as I was sitting down by my computer I couldn’t help but think, “I would like to make back everything I lost yesterday.” Sure, who would’ve. I’d like to make $13,000 today. I’d like to get my account up to $25,000 in my small account. I just felt so frustrated because I was really celebrating and really excited on Monday and then that was followed by being really bummed out on Tuesday.

On Wednesday I wanted to make it back. At the same time I knew that I couldn’t force trades. In the past, when I’ve had that desire to get back up on the horse and just really get back in the game. I have done some stupid things. Like just any time I see a stock spiking up, I buy 15,000 shares. I only need 30 cents, it’s 4,500 bucks. Do that three times then back. You can’t do that. Doing that is how you lose 30 cents four times in a row and you lose an extra $12,000 because you’re being emotional. You’ve thrown risk management out the window. You’re not focusing on good quality setups. You’re trading impulsively.

Now, what I decide to do on Wednesday is I said, “Okay Ross, look here’s the deal, obviously you want to try to make back the money. That’s an emotion that you feel right now, I understand that.” Of course this is me talking to myself. Of course I understand what I’m saying. I understand what you’re saying Ross. You’re dead on, you want to make your money back, we’re going to make it happen. Don’t forget only trade A quality setups. Don’t be aggressive on anything if it’s not A quality. If it’s not A quality, don’t trade. That was my mentality coming into Wednesday morning. Which was also the first of February. Now, for those that don’t know, I have a history of losing a lot of money at the beginning of the month. You can watch the video: Vegas With Ross by clicking on the image below.

That is also an emotional behavior because I want so badly not to have a losing month. That I’m desperately looking for a winning trade. When you’re looking desperately, you lower the quality standard of a trade that you’re willing to take. In the past I’ve had this history of losing a lot of money at the beginning of the month. I was very much aware of that when I was thinking about being aggressive on Wednesday, February 1 that this is the beginning of the month. This is really not looking good. What if you made $40,000 last month and here on the first day of the month you lose another 10 grand. You’re going to start the month in the hull. Don’t do that, just start slow and steady. My approach on Monday was the, if I saw a good setup I would be aggressive.

I took three trades, HMNY, PULM and ETRM. I made, let’s see, on Monday, around Wednesday I made back about 60, $6800. I was aggressive. I took big share size but I only did it on A quality setups. What I was able to do, was I was able to harness that emotion into a positive way. That’s where the sense of mindfulness, that presence of mind really paid off. I knew that taking two to 3,000 shares will not get me back to where I was before I have the loss. Then I would need to take six to 10,000 shares. Again, I knew that would lead to deeper draw-downs if I was wrong. That’s why I need to be so smart about what I was going to trade. I ended up having a little bit of a rebound.

I was like, “I made $4,500 in my small account, 2,200 in my big account, not bad.” $6,000 is a great day. Of course here is me saying, “It’s not bad, it’s not great. Still red versus yesterday.” Whatever, I guess it’s okay. I’m still moping. Then I come back on Thursday morning with the same kind of mentality that, “Okay, you’re back up to $20,000, you’re only 5,000 away from that first target of 25 grand, you can do it.” Just one trade, you’re going to get back on the horse. If you think about my P&L, let’s see, Monday was a big step forward. Tuesday was a draw-down, Monday was a little bit of a move back up. Do you see the bull flag forming? Then Thursday was the breakthrough, the high. As I squeezed backup through a high day. Now today it was a little bit of a continuation.

Missing the Biggest Momentum Stock of the Year

On Thursday and I also want to preface this by saying that, I have been struggling with the fear of missing out ever since I was away in November when DRYS ran to $100. On that day, I was checking my phone logs and meetings and I was getting more and more frustrated and upset. I was getting like just so aggravated that I was missing the biggest opportunity that I’ve ever seen in the market. I’ve never seen a stock go from $2 all the way up to 100. I had never seen that before. Of course I was out of the office that day and I wasn’t able to trade. I’ve been carrying that frustration, that baggage for a long time. Any time I see a stock starting to move up, whether it’s GLBS or it’s ETRM or IDXG or MYOS, HMNY, RGSE, I see it and I’m like, “I need to jump on this.

I cannot be the guy that misses another big move.” I’ve been jumping on these with more size. I’ve also realizes that because my metrics are good, because I have a good profit loss ratio and I have good accuracy, the only difference between me making 20,000 in a month and making 40,000 is share size. If I increase my share size, I’ll make more money and that’s why I made 40,000 last month and I’m up $37,000 this week. $37,000 on the month of February so far and it’s February third. Now, let’s bring back to or come back to Thursday morning. Thursday morning, I recognized that on Wednesday I had kind of mismanaged my trade on PULM. Because it ended up actually going parabolic, it made a really big move.

I’ve noticed that the market right now is extremely strong. We’re seeing some really good opportunities. HMNY, PULM, let’s see, what was the other one, ETRM. On Tuesday morning, or Thursday morning the first trade I took was PULM. I jumped in 7,500 shares, made 10 cents. 750 bucks, 800 bucks. I was like, “All right, that’s good.” Again, a lot of people would be totally happy with that and I’m like, “That’s fine, I’m 20% away from the goal, $5,000.” I look for the next trade. I see BNTC hitting the high day scanner. I look at that and I said, “That stock is a former runner with a history of making big moves.” I looked at it, I jump in, I get in 6,000 shares at 2.55. It pops up to $3, I’m up $2,700. I ended up making about, I think 4,000, around $4,500 on that stock that day. The first pullback and then the second pullback.

BNTC popped up and it surged. If I back out of this just for a second, I’ll just back out this webinar or this slide that I’m running here for you guys just to show you the BNTC chart. Because it was really a beautiful chart. This is the type of thing that we love to see as traders. The move from $2 up to 3$, pullback from three up to four, 4.33 second pullback. These circled areas, these are the safe opportunities to get in these types of names. I’ll show you guys who are watching on screen share, on Facebook live. Super, super clean and I realize, okay clearly there is some strength in the market today. We had BNTC and then we had of course PULM, some good trades on that.

This was today, go back to yesterday, PULM from $4 to seven. We had NAKD which parabolic from a low yesterday of a $1.20 up to a high today of over 4.50. Totally parabolic and by scalping these opportunities, getting in, booking the profit. The first one minute pullback and the first five minute pullback yesterday. Yesterday Thursday I was able to have the biggest day I’ve ever had, $22,000 in total profits. I came into the day feeling a little bit emotional. I was being a little bit aggressive. Now, this was again because I just had this big loss. The interesting thing is that, I would not have made $22,000 yesterday. I guarantee you I wouldn’t have made that much money if I haven’t lost 13,000 on Tuesday.

Losing that money on Tuesday is really what triggered that kind of emotional response to get more aggressive. The good news is that I have the educated intuition. Which is the result of years of trading to channel that emotion, to harness that emotion to help me be a better trader. Other traders will say that, “You should …” No one should really say this but, “You should bottle up your emotions. You got to be like a machine.” I try to be that way sometimes. Just be a machine, don’t let this get rattled, don’t get frustrated, don’t get emotional. Nest thing I know I’m wallowing all afternoon. I lost $13,000. I was watching this movie, it was like, I think Louis the 14th on Netflix.

They show this woman whose in labor, no she’s got poisoned. She’s laying down the bed, she’s dying. I’m like, “She’s having a better day than me.” I feel like I’m in the same boat as her. We are both just, “Ah, this is the worst. This is no fun.” This is the struggle with trading. As much as you try to not allow it to get to you, you just can’t help it. On Tuesday of course, when you have these extremes in the P&L I was just feeling really bummed out. Of course you know, yesterday I was like, “Wow, that was …” Yesterday I was almost like, “That’s crazy. I never thought I’d have a day where I’d make $22,000.” I was just like, I don’t think I was like celebrating. I was just, “That was nuts and what a fantastic day.” Now here we are on Friday. I had said that I would not trade on Friday.

I was like, “I’m not going to trade on Friday.” I’m going to wire out all my money from SureTrader and go put it into my SpeedTrader account. I’ll start Monday on a clean slate. I called SpeedTrader this morning, they said my account won’t be ready Monday. They’ve got to do some more paperwork. I was like, “Well, in that case, I might as well trade in SureTrader today.” Then I was starting to feel like maybe I jinx myself. I put on my lucky sweatshirt and I was like, “We’re going to do this. We’re going to trade this.”I took two trade and I made 4,800 bucks. Now I’m up over $40,000 in the small account. Today, in big account I made $8,000 on DFFM.

I took 15,000 shares I made 50 cents. I was like, “That was good. I’m going to buy the first pullback.” I bought the first pullback with 16,000 shares and I was up $4,000 on it it turned around, it dropped and ended up losing 8,000. I lost everything I made. In my big account I’m actually down $86. This is again, me finishing the week with … It’s like, it’s almost like I win the race and after I cross the line I fall off my bike and like scrape my knees. Because it makes it impossible to enjoy the victory. This happened yesterday too. I made $22,000, but my last trade of the day I lost 750. I have this sort of, I don’t know what it is but I keep doing it. The good news is that in the sense I think keeps me kind of grounded.

It reminds me at the very end of a good day that you can just quickly give back money as you make money. This week in total I have lost, it’s really pretty crazy but I’ve had over $20,000 in losses this week. Despite being up 37,000 I’ve had 20,000 in losses. That means this would be a $57,000 week if I didn’t have any losses. Again, that’s not reality and I wouldn’t have had the aggression. If I hadn’t gotten knocked down, exactly, I wouldn’t be so hungry to bounce back. I wouldn’t have been probably contentious to do 2,000 a day, 3,000 a day. Maybe 4,000 on a good day. I wouldn’t have pushed it so hard and pushing is what propelled me up to this level. Here’s the thing, when you guys feel that sense of fear, the fear that you’re missing out on the trade.

You see that trigger. You need to train yourself to have the presence of mind. To be mindful enough to realize that you’re experiencing that emotion. Now, the first step is tracking that you’re having this emotion. I’m feeling, and you could say that out loud, seems silly but I do it a lot, “I’m feeling angry.” I get a flat tire, I’m feeling angry right now. It’s like, I say the emotion, but because I say it I now having the presence of mind that I’m angry. There are times in my personal life where I’m having just not a good day. I’m like, “I’m feeling agitated. This person around me is maybe getting on my nerves more than I should let it. Let’s just keep this perspective. I’m a little agitated, I’m not going to take it out on them.”

Interestingly trading has made me more mindful of how I can act when I feel emotional. Whether it’s happy, sad, frustrated or whatever. The fear missing out is an emotional response but it’s not a bad one. It’s only a bad one if you allow it to overtake your rational mind and common sense. For me, I was able to use the fear missing out this week and I was able use fear in a sense to drive me. I was able to use it almost as the carrot in front of the rabbit to really encourage me to push harder, to dig deeper and then produce the best month or the best week that I’ve ever had.

This may end up being one of the best month I’ve ever had depending on how the rest of the month goes. If you can improve your sense of awareness and harness FOMO, the fear of missing out, you can improve your trading. This no longer has to be a bad word. That’s the big thing that I want you to take away from this. Over my years of trading, it took me a long time to make these kind of realizations. I hope that you guys are able to learn from what I’m saying and not have to learn by experiencing this. I’m one of those people, this is something I was saying to a student yesterday. I was on the phone, he was saying that, “I like to do things on my own.”

I said, “Well, you know what, so do I.” That’s what most day-traders are like. We want to do things on our own. This is the inherent conflict with trying to provide education for day-traders. I’m trying to provide education to a group of people who desperately want to be independent. I wanted to be independent. I didn’t want a regular job. I didn’t want to keep doing that. I wanted to be on my own. That seem personality trait is why I didn’t seek out education when I started trading. I was like, “No, I’m going to do this on my own. I can figure it out. I want to be independent.” Here’s the thing, I’ve gone through all of this. I went through all these struggles.

I can help you avoid some of the trial and error that I had to go through. Even if you’re in our chat room, you’re part of the community. Maybe you’re not in the classes yet. You haven’t joined them. Just by being part of this community, you are surrounded by traders who are going through some of these same experiences. The fear of missing out, emotional trading. Someone who says, “Well, I bought MYOS at the higher day two weeks ago I’m still holding it.” Some of us has to learn by experience. We have to fall off the bike a couple of times before we really get it. My hope is the by us talking about these things, it will at least help you process these kind of experiences in your journey to becoming a trader.

Because these are things that we all struggle with and we will all struggle with at one time or another. This is the thing, I used to think that you have to not trade from a place of fear at all. You have to just totally put that aside. What I realized was the that’s almost impossible. It’s very, very difficult to not be emotional, to not have emotions. You look at any trader, traders on a hedge fund, a trading desk. They’re not going to say that they don’t have emotions, that they don’t get angry, that they don’t get frustrated. It’s not about not having emotions. It’s not about not being afraid. It’s about facing that fear and it’s real fear. Facing that fear with the bravery to not give into it.

Or to be even better, be able to channel it and harness that so you’re harnessing that emotion to help you be a better trader and maybe even a better person. This obviously has been a fantastic week. I’m hoping that the month of February, that these first three days are a sign of a fantastic week to come and a month to come. We’ll see. I really don’t know. The market has been exceptionally strong. We’ve got several stocks almost every single day going up over 100%. MYOS is up 99% right now on 11 million shares of volume. There are lots of opportunities every single day. My job is to find those opportunities, to point out what I consider to be some of the best entries and to trade my strategy.

That’s what I’ve been doing and that’s what I’ll continue to do. I’m thinking that this is going to be a pretty strong month. I know that there’s hot streaks and when we have those hot streaks, that’s when you have to be aggressive. You have to capitalize. This is a week where I’m making $37,000. If I have a week later in the month where I breakeven, it doesn’t matter. Because this week is going to tide me over. Just to step back a little bit, last year I didn’t start off nearly as well as I’ve started this year. I started with about 11,000 in January and then only 5,000 in February and 7,000 in March. During February and March and to April last year I was doing my small account challenges at SureTrader. Although at the time I was proud that I took $1,000 and turned it into $8,600.

I now look at that as being totally pathetic (joking). Look at me now, 500 to 40,000 in 23 trading days. I’ve really one up myself and I don’t think I’m even going to dare to do this challenge again next year. Because I don’t know that it would be even possible that I could top this return. What I am going to do is keep trading. I’m now 40% of the way to $100,000. $100,000 I guess is my next target now. 50,000 is going to be a nice milestones. Put a milestone of 50,000, another one 75,000 and last the last one at 100 grand. That was my goal for all of 2017. To turn $583 into $100,000. I’m 40% of the way there on February third. Things are looking good, I’m not going to put the carriage ahead of the horse.

Take it slow, be aggressive when the trading is good. Step back, ease of the throttle when it starts to slow down and make sure that I’m trading in a smart way. I know that I got a little aggressive this week. I want to try to taper that back a little bit. I think now that I’ve gotten such a big cushion on this account. Some big swings on the way up. Now that I’ve really built myself up, I can just get into the grind. If I can grind on $4,000 a day, I mean that is a million in one year. I don’t expect to be able to make that amount of money consistently. I know that there’s going to be lots of slow days. That is the potential. If you can really figure out the strategy, then all you have to do is size up. I know there’s traders out there.

I see them on Twitter and stuff like that, that are taking 30, 40, 50,000 shares on a regular basis and having $30,000 days on a regular basis. It can be done. It’s just whether or not you’re in an emotional place to handle that amount of risk. I’m not really there yet. Even my first trade yesterday I wasn’t really risking much more than maybe $1,000. We’ll see where I’m at in six months. Just keep working along and just keep making progress. I will keep trying to be a better trader. Now we’re going to do just a few short minutes of asking questions. This has been longer than expected behind the trade episode. I’m glad that we really got into this topic because it’s something that I have so many traders ask me about on really almost a daily basis.

Any questions that you guys have from the week or from some of the trades that I’ve taken here today. Let me back out the slides and let’s see. I will jump into screen share. MYOS obviously you know I missed this doing this recap. It’s very rare the I would take a trade at lunch time. I don’t know that I would’ve taken it today. You can see the first five minute candle make a new high, it was over 4.50. that candle popped to 4.70 and then dropped down to 4.37. If you got into a trade with let’s say 5,000 shares at 450 and it pops up to 4.70, you’re up 20 cents, that 1,000 bucks. To go from being $1000 to down 750, because you had to hold until it dropped back down and then goes up again.

You’re a little choppy. It’s not something that I would be super excited about. Andy, I’m a momentum trader. I’m a day trader and the strategy that I trade is primarily a momentum day trading strategy. That means I’m looking for stocks that are moving. The way I find the stocks is by using these high day scanners. Then searching the stocks that are on the scans to see if they have news, if there’s a reason they’re running. Interestingly, a lot of stocks make really big moves with no news whatsoever. News is not always required is the stock does have high relative volume and is starting to get some really good action. The starting balance for my SpeedTrader account will be exactly what’s in SureTrader.

I’m going to take that money and I’m going to move it into my SpeedTrader account. I think I’ll be starting on Monday with, what was it, $40,861, plus or minus. Commissions and ECN fees sometimes changes out a little bit. Right around there as well started on Monday. It depends on what SpeedTrader says. If I can fund my account on Monday, then I won’t trade in the small small account on Monday. That will be the day that I wire the money out. I will wire out and then wire into SpeedTrader and hopefully be able to trade at SpeedTrader on Tuesday. Sarah, the commission structure at SpeedTrader is much lower, it’s much better. That’s obviously preferable once you’re above the $25,000 minimum.

Until you’re above that level, you got to trade at SureTrader. Which is why I started the challenge ar SureTrader. With $583 that you don’t have a lot of options of where you could trade. I started at SureTrader, built up to 25 K. Which was my first mark and then I said, “Once I hit 25 K, I would move to SpeedTrader.” Now, I didn’t realize that I would blow through 25 K all the way up to 36,000. Then there would be some delay in opening my account. Right now I just continue to trade there and added an extra $4,800 today. My commissions today are 250 bucks. Those commissions are pretty big piece of the profit. It’s something that I would always have to deal with if I stayed with SureTrader.

The minimum balance, I’m not sure if it’s 25,000 or 30,000. Definitely the minimum balance to day trade is 25,000. We started right around 12:00 noon and it’s just about 1:00 PM. I’m going to ask if you guys have any other questions, leave comments in Facebook, on YouTube. This is going to go on Facebook, YouTube and on podcast. It sounds like it’s time for me to take the dog for a walk and go get some fresh air. I’m going to take off and I will see you guys all first thing on Monday morning.