-

Value For Investors

-

Value For Active Traders

-

Commissions & Fees

-

Platforms & Tools

-

Customer Service

Summary

eOption has a great offerings but also some shortcomings. High-volume option traders on a budget may find a good value and non-US citizens with at least $25,000 may find something they like, too.

But for other traders, eOption’s resources and pricing schedule won’t be spectacular.

Pros

- Good commissions for option trades of at least 4 contracts

- Several asset classes are available

- Numerous day trading tools

- Zero commissions on stock and ETF trades

- Multiple trading platforms

- Global emphasis

- Auto trading service

Cons

- Option trades with just one contract are expensive

- Assignments and exercises have fees

- $25,000 is required to get the best software and tools

- Customer support is inadequate

- Oddly, there’s a lack of option tools

- Trading platform has display problems on Chrome

Brief Overview

If you’re an active trader of option contracts, I highly recommend you take a look at eOption.

This little known broker provides several trading tools with decent prices. Even better, you’ll get more than just options.

Services Offered

Despite the name, eOption offers trading in more than just options. Clients get to trade these assets:

- Stocks (including some foreign stocks)

- ETFs

- Closed-end funds

- Mutual funds

- Bonds

Although the broker is based in the United States, it does provide accounts for non-US residents. Here are a few nationalities that can open an eOption account:

- Australia

- China

- Luxembourg

- Singapore

- Mexico

- United Kingdom

The major drawback is that international accounts must be opened with at least $25,000. US-based accounts have no minimum.

Besides taxable brokerage accounts, eOption also offers IRAs (for US-based customers). Even better, the broker permits options trading inside of IRAs (excluding some advanced strategies).

Pricing Schedule

Option trades cost 10¢ per contract with a $1.99 base charge. So the absolute minimum per trade will be $2.09. Assignments and exercises are $9 each.

In spite of the broker’s name, eOption actually has better pricing on stock and ETF trades. They are $0 for any share amount. But foreign stocks carry a $39 commission.

Here are some other noteworthy points in the firm’s pricing schedule:

- Bonds: $5 per bond with a $39 minimum

- Mutual funds: $5 per trade (periodic investments also carry the commission)

- IRA annual fee: $15

- IRA closeout fee: $50

- Inactivity fee: $50 per year (avoided with 2 trades in the year or $10,000 in assets)

- Professional data fees: $125 per month

Leverage and Shorting

eOption’s initial margin requirement on equity trades is 50%. Stocks below $3 have a 100% requirement. The broker’s maintenance requirement is 30% for stocks at $5 and above.

eOption does not permit the opening of short positions on stocks priced at $2.99 or less. Other stocks have a 50% initial margin requirement. Maintenance on short positions is 30% (or $5, whichever is greater).

Leveraged ETFs have higher requirements.

Day Trading

eOption provides several resources day traders need, including margin accounts. Currently, margin rates vary from 4.75% to 7.75%, depending on the amount borrowed.

Because eOption is headquartered in the United States, it does enforce FINRA’s pattern-day trading rule. Thus, if you plan to day trade, you’ll need $25,000 in assets. There are several legal ways around this regulation.

For example, you could:

- Use a cash account

- Complete 3 or fewer day trades in a rolling 5-day period

- Swing trade

Short-term traders at eOption get several nice digital tools. They include:

- Direct-access routing

- Level II data (for a fee)

- Short locating

Software

While bond trades at eOption must be phoned in, there are several methods to trade stocks, options, and funds. Starting with the most user-friendly, they are:

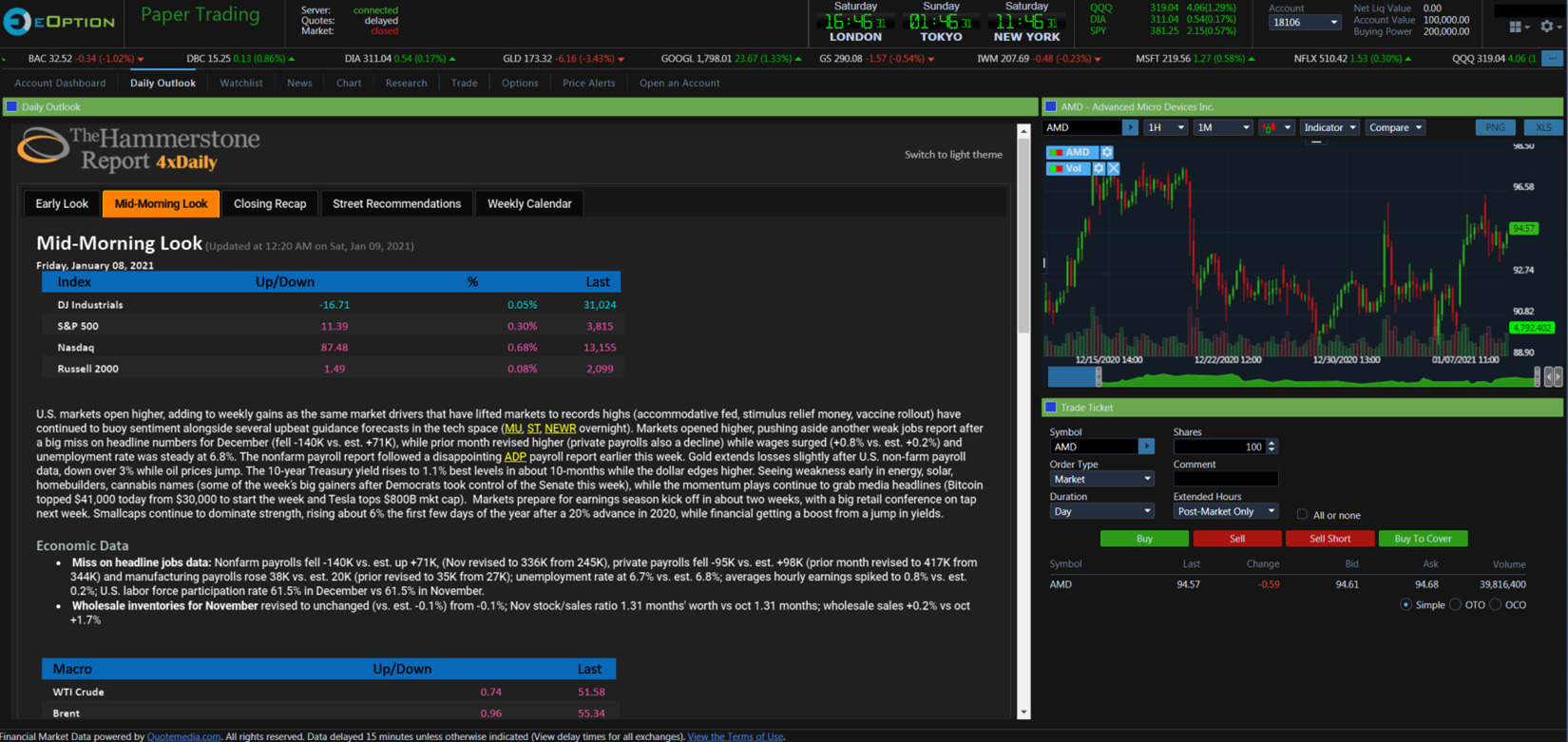

Browser Platform

eOption has a browser-based platform with several noteworthy trading tools. There is no account minimum or trading frequency to use the software. It has a demo mode if you want to practice it.

A horizontal menu appears at the top of the platform. It is just below a streaming ticker tape of stock prices.

The menu includes a watchlist, and several can be created. Specific option contracts can be added to a watchlist, a really nice feature.

To add a security to a chart, just click on its ticker symbol in the watchlist. To populate the software’s order form, just click on a bid or ask price.

A dashboard shows current positions, open orders, and balance information. This last column includes option and equity buying powers, house call, option maintenance margin, and other important data points.

The Trade tab in the menu is where the trade ticket normally sits. Multiple actions on the platform will also produce a pop-up ticket. In either form, there are sell short and buy-to-cover buttons.

Order types include:

- Trailing stop

- Trailing stop limit

- Market

- Limit

Charts on the platform come with several nice features, including:

- Intraday price action

- Multiple graph styles

- Comparisons

- 40 technical studies

Option chains of course will be found under the Options tab. Chains are only displayed for calls and puts, but there are several spreads on the trading ticket. To pull it up, just put a letter in the box next to a contract.

A red S means sell and a green B means buy. Then click on the Trade button at the bottom of the screen.

I counted no less than 30 integrated option strategies on the option order ticket. There are short and long plays and a couple of synthetics. Market and limit orders are available.

And what I really like about the ticket is the incorporation of advanced order types like:

- OCO (order cancels other)

- OTO (order triggers order)

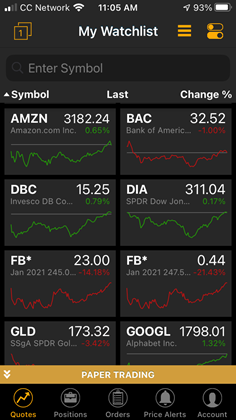

Mobile App

In addition to its browser platform, eOption has a free mobile app. During my testing of it, I found it easy to use. Charts can be displayed horizontally, although there are no tools.

The options order ticket does not offer any pre-installed spreads, a major weakness compared to the computer platform. Nevertheless, it is possible to create custom 4-leg orders.

One feature I really like about eOption’s app is its watchlist. It automatically syncs with the one on the computer platform. So if you add a stock or ETF to the computer watchlist, it will show up on the app.

The watchlist can be displayed as a list or as tiles with small graphs if you wish.

Other Software

eOption customers get to use OptionsPlay for free.

This is a discrete options trading platform that delivers several tools that the regular platform doesn’t have. These include an options screener, profit-loss diagrams, and a strategy builder.

The latter widget will recommend trades based on a ticker symbol and bullish or bearish sentiment.

eOption doesn’t offer direct-access routing, a short locate widget, or Level II quotes.

To get these vital day-trading tools, you’ll need to upgrade to a desktop program. eOption offers both Sterling Trader® Pro and DAS|Pro.

However, you must maintain an account equity of at least $25,000 to gain access to either platform.

Both of them come with hefty monthly fees.

Equity Research and Trading

Because of its name, many traders will choose eOption for derivative trading. But we shouldn’t forget that it offers trading in stocks and ETFs as well (with no commissions to boot).

Both the mobile app and browser-based platform provide a great deal of information on stocks. Under the Research tab, I found:

- Time & sales data

- List of corporate events

- Trade recommendations (20 for Tesla)

- Earnings history in bar chart format

- Key metrics in pie chart and bar chart formats

- Institutional trading activity

During my investigation, I couldn’t get these details to display on Chrome. But Firefox and the mobile app worked fine.

Comparison

The really strange thing about eOption is the lack of option tools.

Besides chains and the resources on OptionsPlay, we didn’t find any other resources. For example, we didn’t find Greeks, a probability lab, or a volatility skew widget.

By contrast, Interactive Brokers does offer these tools. Its commission on option trades varies from 15¢ to 65¢ per contract with a $1 minimum charge.

Webull and Robinhood have eliminated per-contract option fees and even fees on assignments and exercises. But Webull doesn’t offer any spreads. Robinhood does have a few spreads, but strangely they aren’t available on its browser platform.

Neither Robinhood nor Webull has advanced option tools.

Bottom Line

High-volume option traders on a budget may find a good value at eOption. And non-US citizens with at least $25,000 may find something they like, too.

But for other traders, eOption’s resources and pricing schedule won’t be spectacular.

As always, if you have any questions or comments regarding eOption, please leave us a message below!