-

Value For Investors

-

Value For Active Traders

-

Commissions & Fees

-

Platform & Tools

-

Customer Service

Summary

dough is a new low-cost brokerage firm. With funding from tastytrade, Inc., the new Chicago startup provides a fresh take on trading and investment education.

Pros

- Margin trading

- Some futures contracts

- Free DRIP service

- Videos on some topics

- Free stock promotion

Cons

- No desktop platform

- Limited selection of account types

- No Level II data

- Charting is very basic

- Only a few tradable asset classes

- Direct-access routing is not available

- Order ticket is missing many trade types

Brief Overview

dough is a new low-cost brokerage firm. With funding from tastytrade, Inc., the new Chicago startup provides a fresh take on trading and investment education.

But can its budget trading services match or exceed what is available elsewhere?

Let’s have a look.

Services Offered

dough provides trading in a small selection of investment vehicles. The list includes:

- Stocks

- ETFs

- Options

- Smalls futures

Unfortunately, you won’t find cryptocurrencies or traditional forex here. Regular futures contracts aren’t available, either. The broker only provides access to the new Smalls Exchange.

Penny stocks on the major U.S. exchanges can be traded, but the OTC marketplace is off limits.

Pricing Schedule

dough charges no commissions on stock, ETF, or option trades. However, it does have a $5 fee for option assignments or exercises. And it charges $50 for every voluntary corporate action. Hard copies of account documents have fees, too.

If you decide to try your luck with the new smalls futures, dough will charge you commissions. The cost is 25¢ per contract on both the opening and closing sides.

Regulatory and exchange fees for both futures and securities get passed onto the trader at dough.

Trading Tools

dough doesn’t place a lot of emphasis on its trading tools, but here they are:

Mobile App

dough’s mobile app is where all the action takes place. It functions on Apple and Android phones and is compatible with Touch ID. Two color themes are available: light and dark.

Once logged in, the best place to start is the dashboard. This can be found by tapping on the two horizontal lines in the upper-left corner and then selecting Home.

On the dashboard, you’ll see the platform’s watchlist. There’s an edit button at the top of the list, which makes adding and deleting entries quick and easy. It’s also possible to add a security by tapping on the Favorite button at the top of its profile.

When you get on a security’s profile, you’ll see a graph and a trade button. Up to 5 years of price history can be displayed. I was disappointed to discover that a graph cannot be rotated horizontally.

Even worse, there are no graphing tools of any kind. Obviously, you won’t be doing much charting at this broker.

The trade ticket is equally simple. There are only four order types:

- Market

- Limit

- Stop

- Stop limit

There are only two duration choices (day and GTC), and there are no other features to report on.

Scrolling below the chart will reveal several data points worth taking note of. Examples include:

- Volume

- Bid and ask numbers

- YTD Change

- Beta

- Market Cap

- OHLC numbers

- Previous close

- Ex-dividend date

Below this trade information is a set of horizontal bars that show ranges for the following issues:

- The day’s price action

- 52-week price range

- P/E ratio range

At the very bottom of an asset’s profile is a group of Related Investments. These typically are a stock’s major competitors. For example, on Ford’s profile I found Honda and Fiat Chrysler.

Computer Trading

dough does not provide any website or desktop trading, which of course is a huge disappointment. Its website does have a very short blog and a fairly brief Help Center.

Options Trading

dough requires a $250 account balance to trade option contracts. Once you get to this level, you’ll be able to access calls and puts on the broker’s mobile app. Just tap on the Options Chain tab located on an asset’s profile.

There are unfortunately no pre-installed option spreads in dough’s software. But it is possible to build your own multi-leg order if you wish. On the order ticket for one contract there is a Build Order button. Tap on this and you’ll get a second ticket with an Add Option link. Tap on this link to add additional contracts, up to four.

What I really liked about the order ticket is the ability to change any field. For example, it’s possible to change quantity or strike price. Just tap the field and adjust the value.

Besides lacking pre-installed strategies, dough’s software is also missing the following option tools:

- Greek values

- Options screener

- Profit-loss diagrams

- Probability widget

Day Trading

Without a browser platform or desktop program, dough obviously won’t be very high on the list of day traders. Nevertheless, its app does keep track of the total day trades an account has placed.

‘It’s also possible to enable a day-trade warning system. It will issue an alert if you’re about to place a day trade. This feature can be turned on or off.

Most other features day and swing traders may want, such as direct-access routing and Level II quotes, are unavailable.

Research and Educational Tools

dough’s app does have a good amount of learning materials. Stock profiles have lots of details. Examples include:

- Earnings history

- Net income

- Revenue

News articles are presented further down a stock’s profile. dough adds thumbnails to these articles, which is a nice touch. Reuters and Business Wire are two examples of providers.

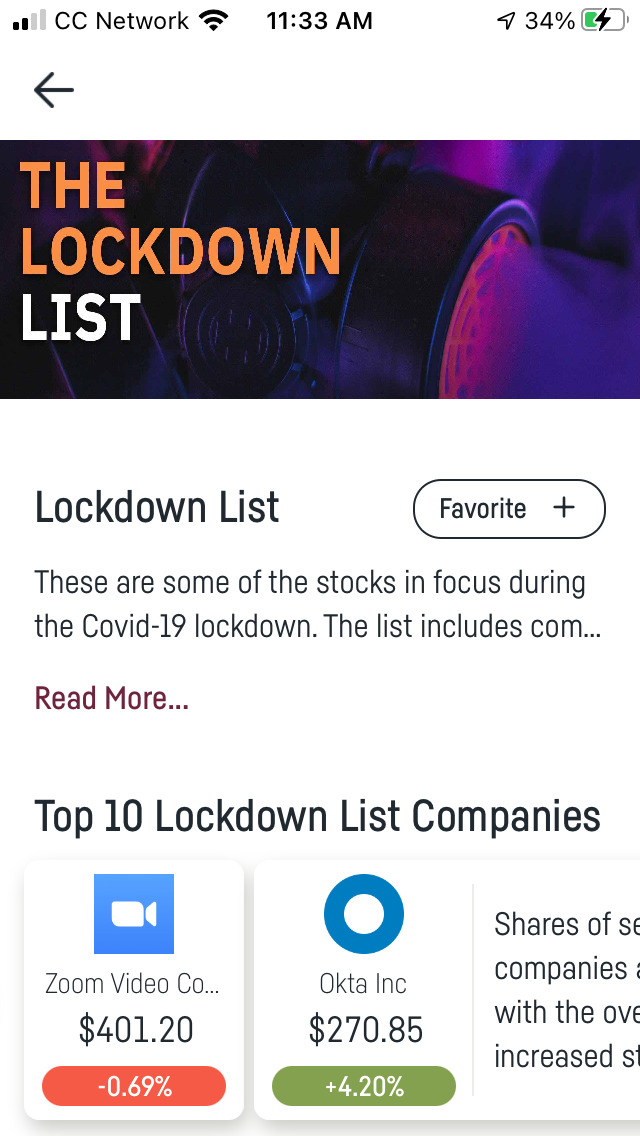

dough doesn’t have a traditional stock screener, which of course is a major drawback. But it does group stocks into categories. Examples include:

- New Releases (you’ll find Uber and Peloton in here, for example)

- Interested in Cars

- Interested in Video Games

- Sectors

To locate the research section of the app, just tap on the magnifying glass icon located in the upper-right portion of the screen.

dough Premium

Although several trading services are missing at dough, the broker-dealer does offer margin and shorting privileges. They are available through a program called Premium.

The largest buying power at dough is 2:1 leverage. Currently, margin rates vary from 8.00% to 5.00%, depending on the amount borrowed. The second tier starts above $25,000. The lowest rate begins at $1 million.

A $2,000 account balance is required for a subscription to the premium service. There is no monthly fee for it other than dough’s margin rate.

Customer Support

If you need some help while using the dough app, there is a support section. You’ll find it in the menu with two horizontal lines in the top-left. Just tap on Support.

dough has representatives available from 7:30 am until 5:00 pm, CST, during the week. There are no weekend or evening hours, although there is an email function outside of regular hours.

There is also a list of FAQs available through the Support channel. During my research, I wasn’t able to get the list to display. Other parts of the app were working.

dough’s website does have a robo chat function (located on the Help Center). During my testing of it, I received correct and incorrect answers to a variety of questions.

Comparison

dough’s great advantage is its $0 commission schedule.

But many other firms today have the same pricing for stock and ETF trades. These brokers include E*Trade, Schwab, and TradeStation.

Plus, these firms have desktop programs with advanced trading features like direct-access routing.

And if you want to trade smalls futures contracts, you can do that at tastyworks on a desktop platform. tastyworks has the same commission schedule that dough has.

dough’s margin rates don’t compete with Interactive Brokers, who charges a flat 2.59% right now with no trading fees.

With dough’s modern emphasis on trading, it’s somewhat surprising that it doesn’t offer cryptocurrencies. TradeStation, SoFi Invest, Webull, and Robinhood do.

Bottom Line

dough has rolled out a user-friendly mobile app, but it hasn’t done much else. Day traders will have a difficult time here due to the absence of almost all software tools they need.