How a Disciplined Trading Chat Room Can Save You Big

Hey all, John L10 here!

I spent some time trying to figure out the right theme for this article, which will cover my trading during the month of July 2017 and although I was debating the direction in the last 2-weeks of the month, the title hit me like a brick on the very last day. I will have to credit Roberto, one of the Jr. moderators who just came back to the chat room from vacation.

Trading in a community

Although the last couple months in small caps have been slow, we continue to produce profits. There’s a few reasons for this, but the main one is the Warrior Trading community.

Right as we were approaching 11am ET, my hard cut off time for when I completely shut down my trading computer and move onto my other income producing projects, I was focusing on a particular stock. I had a bit of tunnel vision where I started to obsess on what I wanted the stock to do, instead of what the stock is actually doing.

Roberto casually mentioned that the setup doesn’t really look good and I just sat back and said yep, then quickly began to shut down my platform. Maybe without that realization from Roberto, I would have kept trading it, wasting commissions and taking unnecessary risk to my already positive day.

It was already past 10:30 ET, which is a time where I like to voluntarily shut down anyway, and now I was running into 11am, the point where I shut down no matter what, and I am trying to force a trade into a direction that it isn’t going.

Understanding reality

Roberto, who typed that helpful comment inside the Warrior Trading community chatroom allowed me to protect profits and stop trading on the last day of the month, because the setup I was looking for was not actually there. It happens every day to many people.

I call out several stocks that people should be paying attention to, but also many stocks that there is literally no reason to look at. We tell people to don’t trade unless it’s the best setup possible, we tell people to downsize risk as they progress throughout the day.

We tell people who are new to sit back and relax. Just watch, paper trade and don’t be in a rush to lose your money. This time, somebody told me the setup wasn’t good and I am very grateful for it. That’s what the trading community at Warrior Trading is about.

Avoid tunnel vision

Even those who have been trading for 3, 5, 8 years or more professionally get into this tunnel vision where they want to be right and start focusing on an imaginary reality. The market does not care if you are right and you shouldn’t either.

Every trader no matter their education or years in the market will make these mistakes from time to time, but I don’t think I would have caught this so fast if I were trading by myself under the influence of tunnel vision.

I often seen traders who think trading communities are for just followers, so they trade alone. Do you know what ends up happening? They realize the biggest losses out of everyone. These people spiral out of control with no insight or help from anyone. I have found that by being part of the Warrior Trading community, it helps keep more profits in my pockets, it’s just that simple.

July P&L for 2017

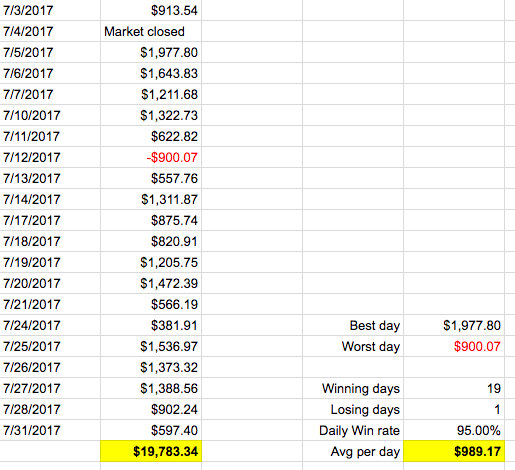

With that out of the way, we can go straight into the performance of the month. The methodology has not changed, trade defensively, protect capital and take base hits. It has worked out. With trading a couple hours per day, July brought in $19.7k USD. This is almost $1,000 per trading day.

I kept losses small, to where if I did have a loss during a trading session I could overcome it with profit on the next trade. I have a mantra that my losses should not be larger than my average profit per day. Sure, there always a big loss that just end up happening, but generally, staying true to the rule, keeps the probability that my profitability percentage stays very high.

By obeying my own rules, I get to reap the rewards of being able to apply these capital gains towards my entire monthly income. Trading for income is just one additional income stream that you should be managing like a business. I often say that I am not trying to be a hero in stock trading. Implying that, I just want to make my profit with as little risk as possible.

A small but growing percentage of my P&L came from mid-to-large cap stocks in July. While small caps weather the dead of summer, I have been following closely what Mike, Warrior Trading’s resident expert moderator is paying attention to.

He trades strictly high priced stocks and is probably the most disciplined trader I have seen doing that kind of strategy, so it has been very easy not losing a ton of my small cap profits to large caps. In fact, I didn’t lose any but I gained more by implementing a new strategy.

It’s takes time though, I am a long-time scalp trader, and to interchange strategies at the flip of a switch requires intense mindfulness. It’s good practice for me, and I get to keep learning which is what traders should continue to do.

I spent years focusing on one strategy and becoming very good at it, and I knew that when I was a new trader, I should not try to trade many different kinds of setups as I risk screwing up my P&L and accuracy. I have advocated that traders should stick to one strategy and I still believe that is the case for most traders.

If you’re a brand-new trader and are thinking about trading whatever pops up, understand that is an additional risk without the right education. You can find that education at Warrior Trading, but without that education, it takes a long time to learn all the pitfalls that the market throws at your face, let alone all the different rules for the different kinds of stocks that are available to trade.

My suggestion for new traders is to focus and learn one strategy until you achieve long standing profitability, and only then try to diversify your setups a bit more. This is the first time that I have considered doing that.

Anyway, thanks for reading and see you in chat and stay profitable!