Day 32 of the $100k Challenge +$6,367.66

Daily Recap

All right, guys. Time for a midday market recap on today, the thirty second day of the $100,000 Challenge. This week has been a little bit tricky for me. I had a red day yesterday and you know, it got me a little bit frustrated. I had a really good Monday and Tuesday then a red day Wednesday. Of course I was red on Thursday and Friday of last week and lost $9,000 on those two days, so that was still fresh in my mind this week as I was trying to rally and bounce back.

“I Have A Competition Inside Me”

Now something that I’ve talked about quite a bit is how I’ve been feeling really driven, and very eager to get to this kind of milestone of $100,000. I think it’s encouraged me at times to force trades, or to take really exceptionally big positions. Bigger trades than I would have taken at any time probably last year. Last year I really wasn’t thinking about this mindset of, “I needed to get to $100,000 or $200,000. I really wasn’t even thinking about it. It was just like, “Yeah, having a good week. That’s great.” You know, that was fine. On the one hand this goal that I’ve created for myself to take a $583 account and turn it into $100,000 is a huge motivator, and I am really competitive even with myself. I want to do better than I did last week. I want to do better than the last time I did a small account challenge.

I get really frustrated with myself when I’m not at the performance level that I think I should be at. Yesterday I was little bit frustrated, of course Thursday and Friday I was pretty frustrated. Whenever I have a set back I go into my hole, and I kind of think for a little bit. My man cave. Then I come out the gates swinging in a rage to attack the market. That’s what happened today. I came out of the gates swinging, looking for a big trade. I took I think a total of 5 trades today. Maybe even six. My accuracy was pretty poor.

Today’s Trading Stats

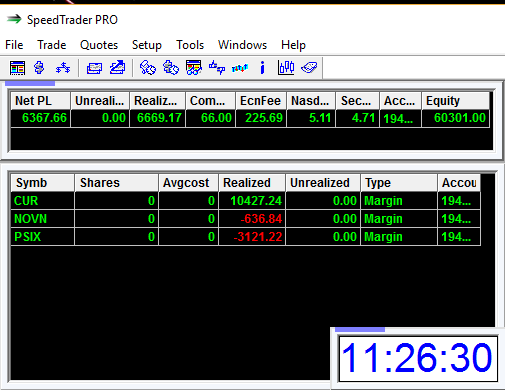

My first trade on $NOVN … And I’ll give you the breakdown of the stats. I’m finishing today up $6,367.66, which on the surface is a good day. A little below the surface is the fact that I was up $10,000 and then I gave back $3,000, or $3,500. That’s the part that’s not as pretty, and I’m ending the day on a red trade. Again, even though I had a great day I’m ending with a little bit of a slap in the face, so that keeps me … You know, every time that happens I get knocked down, I just come back wanting to get right back up and right back up to the top, or wherever I would have been if I hadn’t had that setback. I would have been around $70,000. Now in my mind is $70,000, I need to get over $70,000.

Today I started the day at $60,000, and I’m going to close around $66-$67,000. For those of you watching on Facebook, you can see the P&L right here. Obviously the big picture is that this is a great day. $6,300 is good, but it’s never fun to have a $3,100 loss. The $10,000 win is nice, but you can see I was red on 2 out of my 3 trades today. The stocks that I traded. Accuracy today, a little bit poor. Wasn’t really where I wanted to be, and the fact that I had a big win and a big loss is the result of being really aggressive on my position sizing. When I step up to the plate and they take 10,000 or 20,000 shares when I make 50 cents per share, that’s 10,000 bucks. That’s $5,000 to $10,000 dollars. I had 20,000 shares to $CUR after I added out of the halt. The 20,000 share position I made just over 50 cents. Which was obviously a great trade.

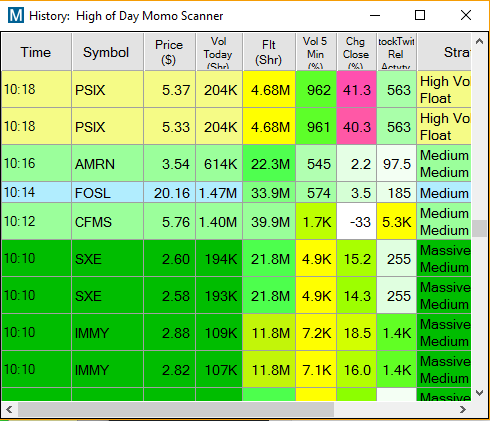

With $PSIX I took a starter of 2,700 shares and then I added 2,500, and added 2,500 again and got myself up over 7,000 shares. On that trade I was up about 30 cents on 7,000 shares. So I was up 2,100 bucks. And instead if taking profit I actually was adding, because I thought it was going to go higher. Then when it all of a sudden dropped down to break even, and then down 30 cents I just kind of … Again, the way I’ve done several times in the last week, I just kind of sat there because all of a sudden my position is so big that I know if I just mark it out I’m going to lose even more in slippage. Then the loss is going to get bigger. That’s exactly what happened.

I ended up holding some of $PSIX through a circuit breaker halt going down. Obviously in this one candle here where we went from $6.94 … Actually we were as high as $6.94. I guess that means I was up with 7,000 shares 60 cents. Seven times six. I was up $4,200 on that. Obviously only for a second, but my thought was that if we could break through a seven we’d be off to the next half dollar. $7.50, then maybe $8. Obviously that didn’t happen. It ended up coming back down. It happened very quickly.

You can see here on the one minute chart how fast you can go from being up to in this candle. I mean, literally in this one minute candle, I went from being up 50 cents to break even. I kind of was like, “Okay, I’ll hold through this for second.” In this candle we went all the way down to $5.94, and I was down 30 cents. Here we are coming back towards the highs.

Trading off the HOD Scanner Alerts by Trade-Ideas

In any case, a little bit of frustration there on that one. Both $PSIX and $CUR. These were both scanner alerts. These were stocks that hit the high day scanner. I saw them on the scanner. Punched in the symbol. I see it spiking up and I jumped in. On $PSIX it actually halted before I could get in. So I didn’t even get filled until after the halt. It resumes trading, so circuit breaker halt, because the stock moved more than 10% in the last, basically the last 2 minutes. It gets halted. Resumes, it gets halted at $5.41. It resumes at $5.65. Then I got in at $5.90, and it spikes up to $6.43, and it’s halted. Even right there I was up from my $5.90 average 50 cents, but only on like 2,700 shares. That’s when I decided to add 2,500 at $6.50, and another 2,500 at $6.80 for the break of $7.

So why would I add if a stock is going up, you might ask. I’ve got my good entry, maybe I should just hold that entry. Well, this is obviously an example where it didn’t work, but the reason … And I’ll show you $CUR, because that one did work. The reason I do that is because, let’s say I take 5,000 shares at … Well just, exactly how it happened. I take 2,700 shares at $5.90, and then it pops up to $6.50. Now I have two choices. One choice is to sell half. At that point I was up like $1,500. So I could have sold half and adjusted the stop to maybe to break even on the rest, or a profit stop.

Alternatively, because the stock is showing strength I could add to that position. That’s what I did. I added at $6.50, so now my average comes up to like $6.20. My average has come up, but now I have twice the share size, so instead of 2,700 shares now I’ve got 5,000 shares, and my stop is now … My stop should be at my entry point. That’s where I made a mistake here. My stop should be right at my entry point. Now I’m not actually risking a lot. If the stop now goes to 75 or 80 I’ll make twice as much in profit on basically no risk because my stop is break even. The problem that I’m having is keeping the stop at break even. That’s obviously the issue that I’m having. It’s come up several times where I’ve gotten into a trade, I’ve chased it higher where I keep adding as it goes up. The reason I do this is because, look, we’ve had trades where I add and it just squeezes straight to $7.50 or to $8. Even though my average isn’t as good I’ve got a bigger position, and I can ride this wave that much longer and make that much more money.

The trade we took on $DFFN … This is at the beginning of the year, but on this day the stock we got in at like $8 … I just grabbed 2,000 shares and it ended up opening at $15. Now imagine if that happened with a 20,000 share position. That would be a $100,000 winner. If it happened. You never know when you’re going to get in, and just be in the right place at the right time and have that type of resolution. Obviously it didn’t happen on $PSIX, but it wasn’t the worst set up. The real problem here is that I should have just hit the bail out button when I went down to break even. As soon as I went from being up a lot and I went red I should have just sold and not even thought about it. That’s something that I need to work on, because this is not the first time that this has happened. This week even. It’s something that I need to be mindful of.

When I get into a trade it’s fine if I want to add, but I’m increasing my average and I can’t get a winner turn into a loser. That’s really the rule of thumb: Don’t let a winner turn into a loser. That’s what I did on this one. It ended up being a 30 … You know, I basically lost $7,000 from the high of $6.94 all the way down to the low of $5.80.

The issue here is that I can be critical of myself, but the reality is this is was very quick … This was a period of 120 seconds. You don’t have a lot of time to think, and if you try to sit there for a moment and make a decision and think, the stock is still dropping and you’re losing more and more and more. Then you start to get to the situation where, “Well now I’m in the hole, maybe I should wait it out, I want to make a good decision. I don’t want to panic out of this trade.” It can just compound itself because you’re just sitting there like a deer in the headlights as a train getting closer and closer and closer.

Obviously I’m not happy with the way I managed risks on this trade. If I’d been able to stop at break even I’d be up $9,000 today. That would be nice. Instead I gave back some profit being overly aggressive, and this is kind of … I stepped up to the plate, big share size. I really thought it was going to work, and then I got stubborn. I didn’t give up when it came back down to break even. I just felt that it was going to work. Hind sight being 20/20 I should have just thrown in the towel as soon as it broke back below the half dollar, probably after moving up to 94. As soon as it came back down to $6.50 and broke $6.50, I should have just gotten out of the trade. A little frustrated with that. I see this getting some momentum again here. Clearly it’s very strong. The one minute pull back is the spot that some traders would take. The first one minute candle to make a new high right there. For me this is kind of a lunch hour. I’m down $3,100 on the name. I could recoup some of the loss, but I’d wait for a really clean setup, probably a clean five minute to reduce my risk. Because I don’t want to give back more profit from the day. That’s the trade on $PSIX.

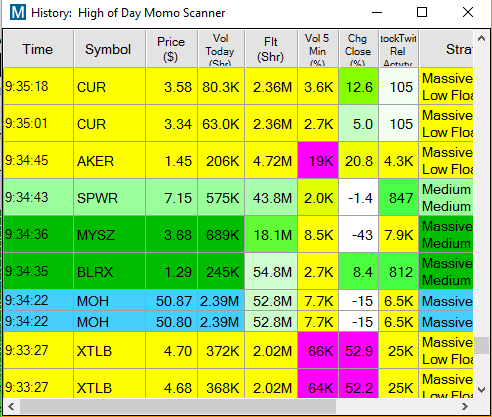

The trade on $CUR, and I’ll pull up $KBSF also. Now the trade on $CUR was in part motivated by the big miss I had yesterday on $NOVN. Yesterday we had the stock $NOVN that went from $5.50 to $8. This is a great example of a stock where if you had been adding … Let’s say you decided that you started with 5,000 shares at 550. You start with 5,000 shares at $5.50, and then you say, “Well, I’m going to double over $6.” Now you’ve got 10,000 shares at 575. It breaks up to $6.50 and you’re like, “You know what? I’ll add another 2,000 shares at $6.50.” So you’ve added 2,500 shares, now your average is getting close to $6 and you’ve got 12,000 shares. You say, “You know what? I’m going to do my final add over $7 and just try to ride this momentum.” Now you’ve got an average of 15,000 … You’ve got 15,000 shares with an average somewhere around $6.30. When this goes up to $7.30 you’re up to $15,000. When it goes to $7.50 you’re up 17, it peaks out at $8 and that turns into potentially 15 to $20,000 winner.

The thing is if you started at the very beginning with 20,000 shares you right away are risking, let’s say 30 cents, $6,000. Where as when you started with 5,000 shares, 30 cents is only $1,500. 25% of the risk on your initial add, and then knowing that you can add as it goes up, you’re not actually really increasing your risk if you’re moving your stop up. That’s you you get yourself into this position where you’re holding 15 or 20,000 shares of a stock, and you’re like, “My stop is at break even.” If you could have the opportunity to hold at 25,000 shares of a stock with a break even stop, your risk is now zero. Your profit potential, if it works, let’s say it goes one point, you’re at $25,000. If it goes two points, that’s $50,000. This is a stock here that went from $5.50 up to $8. That’s 2 and a half points. That’s a lot of potential.

That’s what I thought when I started. When I saw $CUR hitting the scanner I saw it hitting the scans, and I was like, “Okay. This looks like $NOVN did yesterday. It’s kind of coming up out of consolidation, it’s got a lot of room to go. I’m going to jump on this and I’m not going to mess up.” That’s what I did. $CUR starts popping up. I got in at … Now my average was fairly high. I started adding at $3.50 and I got filled $3.68, $3.70, $3.78, and even as high as $4. I really didn’t get as good as a fill as I wanted. My average was just under $3.70. Because I took 5,000 shares and then doubled to 10,000 and then added another 5,000 it got halted. Halted at $4. We resume, and as we resume I take my final add, and we squeeze up to a high of $4.44. Now I thought potentially that this could go up to $5, because that was resistance on the daily chart at the 200 moving average. Although it didn’t get up as far as that for my average of $68.70, as it started to come back down I took my profit and I got about 50 cents of profit with 20,000 shares. So there you go. There’s $10,000. This is not a trade that even worked out that well, but it was still a good winner.

Unfortunately $NOVN yesterday, it was just a great trade and I missed it, and that’s the luck of the draw. Sometimes you miss these. Sometimes they just completely run without you. They hit the scanners. The hundreds of thousands of people using these scanners see the stock hitting it, they jump in. It moves up, and if you went to go walk the dog or fell out of your chair for a second and then got back up you might have missed the opportunity. It just happens that quickly. $NOVN, great example yesterday. $CUR, not even the best example. Not even the best trade, but I positioned myself aggressively. $PSIX I wasn’t able to position myself as aggressively because I didn’t get in before the first halt. It was halted here at $5.41. If I was able to get in with 10,000 shares or 15,000 before this first halt then I could have done a lot better. I was adding before this first halt, getting in at $5.90, so not the best average there. Then, let’s see we’ve got someone is mentioning $KDSF is getting some momentum. Look at that, from $8 to $9.70. That obviously right there is a good amount of volatility. A point and a half. The volume is pretty light on it.

If we go back to $PSIX … This one just moved from $5.50 to $7.50. These are the opportunities that you have to be looking for in the market. When a stock starts to move, when a stock starts to hit the scanners, when it starts to get a little bit of momentum … We’re in a market right now where those moves become exaggerated, and although some of them become real targets for short sellers, they pop up and they come way back down. Others get really good continuation like $PSIX, and they make that secondary move. Figuring out which one is going to make the secondary move and which one is just going to pop up and fade is something that obviously if I knew I would just hold through the pull back, or I would just be accumulating through the whole pull back. You just don’t always know.

It’s kind of like you have this collective trading mentality where you’ve got hundreds of thousands of day traders out there, and they go from one stock to the next. For whatever reason this one is pretty attractive right now. $CUR had a headline this morning which made me think it was going to be pretty good. $NOVN … I don’t even think there was news on that yesterday, but it was fantastic.

It’s hard to understand the rhyme or the reason. That’s where traders who focus on fundamentals can get themselves so frustrated because it just doesn’t always make sense. That’s why we focus on technicals. We just do what the chart tells us. If the chart is showing volume. If we’ve got a scanner alert, we’ve got volume, we know it’s a stock that has potential.

Whether it’s $NOVN, it’s $HMNY, $GLBS, $CUR, or $PSIX. These are stocks that all have potential for various reasons. They meet the criteria of being in play. When we see those stocks hitting our scans we look for an opportunity to get in and manage risk.

I think I did a pretty good job today on $NOVN. I managed risk on that even. I did trade that one today. I was going for continuation. On this one I took, I think it was right around 5,000 shares right out of the gates. I was thinking a long over $6.70. Because of this consolidation all of yesterday we were holding the $6.30 level curling up, so I was like, “Okay, I’ll get in this, ride the momentum.” I get in at $6.70. I’m up 50 cents per share as it spikes up to a high of $7.22. I was like, “This looks great! I’ll probably add over $7.50 and then look for the move to $8, and I’ll end up having 10, 15,000 shares with a $7.20 average, maybe a $7 average. This is potentially an 8, $10,000 winner.” Obviously it ended up rolling over, didn’t follow through. Stopped out, but I only lost $636. On that one I was really good.

On $PSIX I think I … I don’t know. I think I just … I was surprised at how fast it dropped. I really thought it was going to go more, and I was wrong. I need to be more willing to accept defeat faster, and not hold on to these so long because I get myself into a pickle.

Bad News for Tomorrow

Now this week … And this is the worst news of the day for many of you. I’m not going to be here tomorrow. I’m not going to trading tomorrow. I’m taking the day off. I’m taking a long weekend because we don’t have any trading on Monday. So I’m going to be out, obviously Monday and then also Friday, so a four day weekend. Today is also the last day of my trading week. I’m finishing the week with $21,000 in total profits. Here’s the thing. On my winners I made $40,000, and on my losers I lost $20,000 this week. $40,000 in winning trades and $20,000 in losing trades this week. That tells you kind of where I’m at with my trading. I’m stepping up to the plate with pretty big share size and when it works, it works. When it doesn’t it’s bad.

This week I had a $4,500 loss. I had a $3,100 loss, a $2,600 loss, a $2,400 loss. Three $1,500 losses, and then several that were smaller than that. On the bright side I had two $10,000 winners, or winners that were very close to $10,000. I had a $5,000 winner earlier in the week. $2,500 winner and three $1,500 winners. The winners outweigh the losses. Ultimately that’s what any successful trader looks for. I’m not going to beat myself up for losing $20,000 this week. I mean I’m at a net profit, and you always look at what your net gain is.

Weekly Statistics

My statics … The interesting thing is that my average, my percentage of success has gone down. During my share trader challenge, when I was trading for the first 24 days of this $100,000 challenge, I was trading with share traders. So from $583 up to $41,000. During those 24 days I traded with 87% accuracy. I was being very selective about what I was willing to trade. Within those 24 days I only had one red day. On that red day I lost $5,000, but really my accuracy … I had 54 winning trades and only 8 losers. That’s something that was really fantastic.

Now this week I actually only traded with 56% accuracy. My accuracy has dropped down a little bit, and it’s absolutely a result of trades like $PSIX today that earlier in the year, when I didn’t have as much of a cushion, I wouldn’t have been as aggressive about adding. I would have just taken the profit. I would have just been like, “Forget it, take the $2,000 and be done with it.” This is to say that even if you lined up two versions of me side by side to trade the markets, those two versions of me would trade the market differently depending on their mentality. Where they’re at in the month, where they’re at in the year. How they feel on that day. Whether that orange dog over there is driving them crazy. There’s going to be variables. Whether you’re one of our students that’s trying to trade similar stocks as me, or there are three of me lined up. There’s always going to be a lot of variables.

We all have different risk tolerances. You can see how mine have changed during the last … Really during the last few weeks that we’ve been in February. Even in the last two weeks. Last week I made $5,000. I was up $15,000 and I gave back $9,000 on Thursday and Friday. The week before that I made $26,000. I mean it was like I killed it. $26,000 and then $5,000 last week and this week I’m up $20,000, so on the month I’m up $58,000. On the year in total profits, I’m up $100,399. That’s in 6 weeks of trading.

On my “small account challenge” I’m up $66,655. Obviously at the very beginning of the year there’s an extra $35,000 that’s because for the first month when I had that really small account I was also trading in my regular account and holding positions longer. I was applying two different types of strategies to the market, and that ended up working.

We’ve been in a market where stocks are strong, and I’m going to continue to ride this momentum as long as I can. I can’t wait to get to the $100,000 mark. I think that, I mean I could be two weeks away. I could do it … I don’t think there should be any reason that I won’t be there at the end of March. You know, we’ll see. Maybe things will slow down and I’ll have to kind of adjust a little bit. The reason that I’ve been making as much as I’ve been making is because I’ve been willing to risk a lot. I have confidence in my strategy. I have confidence in the stocks that we’re trading. I have confidence in these trade idea scanners that I’m using. Confidence in the tools I have, and I’ve been stepping up to the plate. The wins have been good, but the losses have also been fairly painful.

If I look … Jeez, I don’t even know if I want to look, but since I just said it now I need to know. I’d like to see how much in total I’ve lost in this year, because I know I’ve had some pretty big losses. Let’s see, that’s column X. I want to see my total winning trades. There’s my total losers. In total so far this year I have made $191,000 in winning trades, and I’ve taken $90,000 in losses in 2017. Those are some big numbers, but the end result is that I’m up $110,000 before commissions and $100k after commissions, so green is good. I think there is some room for me to improve as a trader.

I think that if I saw these metrics on a student’s account I would say that you need to tighten up the losses a little bit. Some of these losses are too big. In the last six weeks you’ve … I’m saying this to myself. If I was looking at this as a student I would say you’ve taken $90,000 in losses. I’m not saying you haven’t had a good month, you have, but you’ve got to find a way to tighten those up.

For me, what I need to do is get better at stopping out break even, when I get into a trade that works and is green and then comes back down. I also need to try to be a little more careful about chasing. I definitely chased $QBAK earlier this week the same way I chased $RGSE last month, and both times doing that really costs me.

Broker Statements

Anyways, that’s where we’re at here at the end of the month, the end of February. I will post my February broker statement. I’ve already posted my January broker statement for my share trader portion of the challenge. These are real trades. It’s a real strategy, I will one hundred percent back it up with my statement for anyone that wants to see them. This is not something that I don’t think almost anyone could do, if you get the proper training. If you learn the strategy. If you start with small size 100 shares at a time, 200, 300, 400, and just slowly scale up as your confidence grows, then you can do really well.

I’ll be excited to hear how our student John does this week. Not this week, but this month. I know that he’s doing a really fantastic job trading side by side with me. Same strategy, and he’ll probably be approaching at least $40,000 this month. You know, there may be a month where he does better. I know that there were days this week where he was green and I was red because I pushed it a little too hard and I got spanked. That’s what happens when you get a little too aggressive, and I think he’s not quite as aggressive as me and that, for him, sometimes really does pay off. In any case, I’m sure John will … He said he was going to do a blog post about his month, so he’ll do that. John and Roberto both trade in the same strategies as me, of course so many of you are as well.

Really the goal is just, as a momentum trader to search the market. We’re hunters of volatility. We’re searching for volatility, and volume and opportunity. We see it almost every single day whether it’s a bull market or a bear market. I statistically do better when the market is red. Today we have a red market. Yesterday we had a green market and I lost money. It doesn’t appear to be a coincidence since that was the statistic that I maintained for all of 2016 and I’m continuing through 2017. These are things that if you don’t know you are typically red on green market days when the market is up a lot, then you’re not going to be able to adjust your strategy. You have to be aware of these metrics, so I track all of my metrics. I’ve got them in trader view. My metrics for the month of January are posted. You guys can look at them, and I’ll just keep posting them on a monthly basis. Shortly after the end of the month once I get my statements and stuff like that.

All right guys, so I think that’s it for today. I hope you guys all have a great weekend. I’m sorry I won’t be here tomorrow. You can bet that I will be missing the market. At 9:30 I will be feeling a bit lost about what to do, but it is what it is. I’ll be back first thing on Tuesday morning. I hope everybody has a great long weekend, and yeah, I will see you here bright and early. We’re not going to do a free chat next week. We’re going to postpone it. We’ve got so many new faces in the community. I think we’ll just take a week off from that, so we’ll just enjoy next week. It will be a short week. Maybe I’ll make a YouTube video this weekend skiing with Ross, so you guys can look out for that. It will be coming soon. All right, I’ll see you guys soon. Have a great weekend.