The single most significant event that is currently affecting investor sentiment is an event that we have little control over. But when will the Coronavirus stock market impact occur, if it does?

Depending on how much you pay attention to the news, the Coronavirus is a blip on your radar, or it is a genuine threat.

There is a perfect reason why many health experts around the globe are worried about this virus: humanity is due for another global pandemic.

That’s a fact.

If there is one constant in Nature, it is that cycles exist, and major events happen again and again.

Pandemic History

The last great pandemic was the 1918 Spanish Flu. Worldwide, it killed an estimated 50 to 100 million people with a mortality rate of 2.5% – 5%, and it was particularly harmful to people in their 20s to 40s. In the United States, it killed around 625,000 people or roughly 0.65% of the population.

In 2020, that number would be 2,145,000. Worldwide, the Spanish Flu killed 5.26% of the people from 1918 to 1920. In today’s figures, the number of deaths would be a staggering and almost incomprehensible 405,020,000 people – nearly half a billion people.

It doesn’t take a genius to imagine what kind of environment the world would be in if this were to occur.

Will something like this occur again?

That is uncertain.

In 1918, the world knew very little about how to tackle influenza. We see a lot more about influenza today. There have been a significant number of Flu scares that have occurred in the recent past that we don’t even remember how freaked out the world was.

Remember the 1997 bird flu? No one thinks about it.

Remember the 2009 swine flu? Some might remember that scare.

The 1997 bird flu and 2009 swine flu could have been worse. The 2009 swine flu infected a higher percentage of the world’s population than the 1918 Spanish flu – but the mortality rate was significantly lower.

Currently, many signs are pointing to the 2020 novel coronavirus resembling the 2009 swine flu in terms of global impact. But lets put things into perspective: the ‘normal’ Flu has killed more people than the Coronavirus has (so far).

In the US alone, the CDC estimates that 30,000 people have died from the Flu between October 1st, 2019, and February 1st, 2020.

Impact on Investors

The biggest threat that the 2020 novel coronavirus has on investors, currently, is news-based. We don’t yet know what kind of effect the Coronavirus will have on the world economy.

Yes, there are estimates that China’s GDP, Australia’s GDP, and other nation’s GDP will be affected. The effect that the Coronavirus is having in China is enough to spook any investor – and with good reason.

A significant portion of the world’s manufacturing occurs in China. With hundreds of millions of people quarantined and unable to produce products for multiple companies and industries, there will be an economic effect.

However, the gravity of that impact seems unquantifiable at this time.

The Chinese Economy

Markets tend to follow feedback loops.

Buying begets more buying, bullishness from the institutions begets bullishness from retail. We might see a negative feedback loop in play in regards to the Chinese stock market and economy.

Before the outbreak of Coronavirus, China’s GDP growth had slowed significantly to a 27-year low down to about 6%. While that’s much faster growth than we’re accustomed to in the West, it’s abnormally slow for China, possibly indicating that China’s days of exponential growth are behind them.

Right as the market is digesting China’s slowdown, Coronavirus began to spread.

The necessity of quarantines and travel restrictions is sure to make an additional dent in China’s GDP growth, likely to lead to wholesale US divestiture from the nation.

Even as the outcome of the virus is still uncertain, corporate giants like Starbucks, McDonald’s, and FedEx are all reducing operations in Wuhan and the surrounding areas.

Coronavirus and Market Impact

My personal (and imperfect) barometer to judge the likelihood of an event’s impact on the world is to judge how the stock market moves in reaction.

So as soon as I began to hear about this Coronavirus epidemic, the S&P 500 sold off a bit, but not enough to inspire worry in me. I believe in this indicator so strongly that it’s become a running joke among my family and me.

Let’s think about it this way, the wealthiest, most intelligent people in the world are putting billions on the line in the most competitive financial market in the world.

The institutions pushing around billions in S&P futures undoubtedly have much more information about the impact of Coronavirus than the rest of us.

That’s not to say that the market is always correct, but I put more trust in the analysis of folks putting billions on the line than that of pundits.

Before any analysis, let’s take a quick look at the S&P 500’s price action since the virus outbreak. We’ve actually seen higher prices since the publication of the outbreak and the first US-based cases:

How Has The Market Reacted to Past Outbreaks?

Soon after the outbreak hit the market with a quick sell-off, Charles Schwab published a graph observing the market’s reactions to past outbreaks like SARS and Ebola.

The takeaway from the chart is that the market tends to overreact to outbreaks in the short-term and shrug them off in the long-term.

Naturally, the past outbreaks didn’t become pandemics, something which we can’t know about Coronavirus yet.

What Are Market Wizards Saying?

In addition to judging the long-term impact of an event by watching the stock market’s reaction, I also prefer the analysis of those managing billions in client funds to that of journalists and financial analysts (no disrespect to the former, however).

There are political issues with putting too much stock in the opinions of hedge fund managers, in any case. They probably don’t want to sound the alarm too much, inspiring capital redemptions from clients.

Ray Dalio of Bridgewater

Dalio’s reaction to the outbreak was underwhelming. He considers the initial bearish market reaction to be an overreaction.

From Dalio’s perspective, Coronavirus looks to be a more servere version of the SARS outbreak, predicting limited long-term effects on global markets.

Dalio, of course, prefaced this with calling himself a ‘dumb shit’ compared to experts on virus outbreaks.

David Tepper of Appaloosa

Tepper, who manages around $13 billion under his Appaloosa Management fund, had a more lukewarm reaction to the spread of Coronavirus.

Tepper took a more sentiment-focused approach than Dalio, telling TheStreet that the outbreak “ruined the environment” for the continuing uptrend in stocks, saying that he loves “riding a horse that’s running.”

Outbreak Safe Havens

Bitcoin

Let’s assume the Coronavirus does hit the world population as the Spanish Flu did.

As an investor, where and what do you put your money in?

The same places you would always put your money when we fear economic troubles: precious metals.

However, there is a newer asset class that has acted as both a risk-on and risk-off asset over the past decade: cryptocurrencies (specifically, Bitcoin).

Hate it or love it, Bitcoin has seen some massive gains in 2020. Many of the most immense drives for Bitcoin have occurred after significant news releases. But Bitcoin isn’t the only risk-off asset that generates profits in a fear environment.

US Dollar

The world’s de facto reserve currency is the US Dollar.

Listen – there is a trend of sovereign currencies collapsing all around the globe.

Couple that with economies that could grind to a halt due to a crippling new influenza pandemic, people flee to safety. If you’re going to bet on a currency that will maintain its value, bet on the US Dollar.

The US Dollar, out of all the world’s currencies, is the safest currency. Look at the DXY (US Dollar Index) below:

The DXY – Dollar Index – is a ‘basket’ of currencies weighted against the US Dollar. Over half of the basket is made up of the Euro, followed by the Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc.

Basically, if the DXY is going up, then the US Dollar is outperforming almost every other currency around the globe.

What does that mean?

It means that people are buying the US Dollar. They’re dumping their currencies to flee into the Dollar. We see the same effect in equity markets.

Equities

Even though the aggregate stock market performance is heavily one-sided, there are some opportunities to find winners in a falling market.

Investors and traders have seen the S&P 500, and the NASDAQ suffered some big drives lower in 2020 – almost always related to the Coronavirus. But we need to think about things that will do well in a fear-driven market.

Think about the things people in China, Japan, Singapore, and now in Europe are using to combat the Coronavirus: masks.

Alpha Pro Tech (APT stock quote) is a big manufacturer of disposable masks. Look at APT’s chart below:

APT saw a massive gap from January 17th, 2020, to January 21st, 2020 (+20%). APT has experienced gains as high as +122% from the January 17th, 2020 date. It has traded lower, but it remains up over +46%.

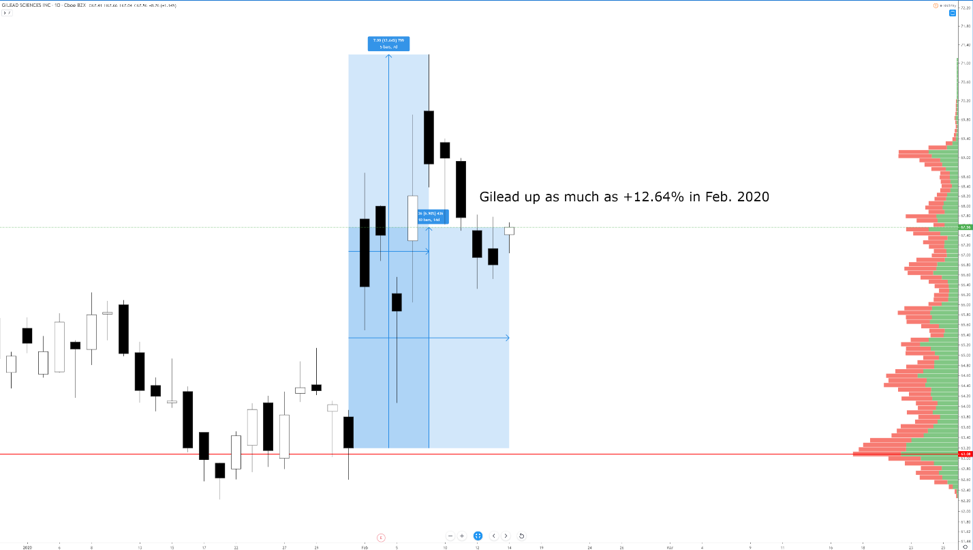

Gilead Sciences (GILD), one of the world’s largest biotech companies, has also benefited from fears of a coronavirus pandemic. GILD is currently up nearly +7% from the January 2020 close. GILD has made gains of 12.64% since the January 2020 close.

Fear is a powerful motivator in financial markets.

Fear moves markets in much quicker and violent ways than greed. Being able to identify the instruments that people will flee to for safety and growth is a critical advantage in combating fear.

Final Thoughts

Financial markets discount the certain and do their best to price-in uncertainty. There are pundits, doctors, journalists, and hedge fund managers alike that will make confident forecasts, but beware of overconfidence in uncertain times.

If you’re a technician, you know that only price pays. And right now, price is telling us not to overreact.

Until there’s a breakdown of critical levels in the indexes, I think it’s best to follow the advice of Dalio and Tepper–don’t leave money that you can’t afford to lose in the market, and try not to panic with the investing money you can afford to lose.