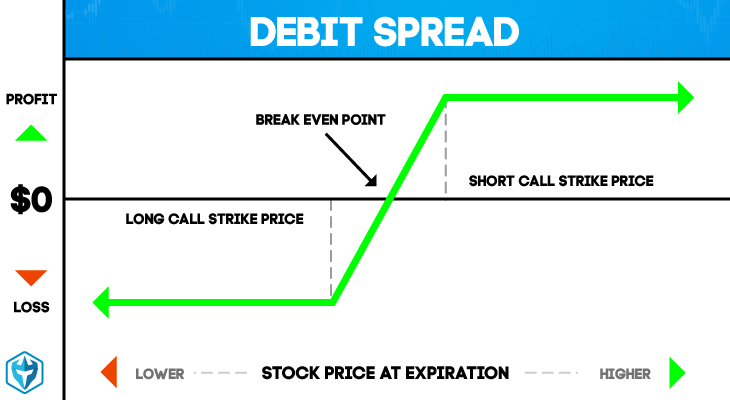

Options are a way for investors to get involved with the markets even if they do not have that many funds to get started. Many investors are hesitant to get involved with options because they seem too complicated. However, with just a little education on these it becomes a lot more clear. There are benefits […]