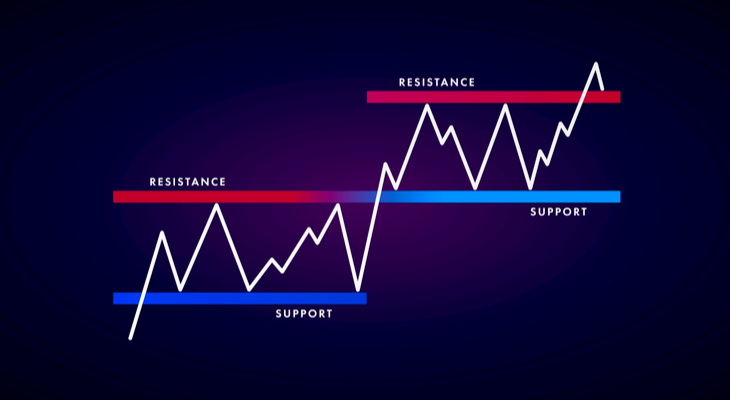

The shooting star pattern is a reversal candlestick pattern. At its core, the shooting star is a failed breakout or “fake out” pattern. Trading this strategy aims to take advantage of the fact that most breakouts fail, and helps you identify some clues of a breakout with a high probability of failure. Throughout this […]