The public health crisis that began in December of 2019 has turned into a global economic crisis. Millions have lost their jobs and output and production has tumbled.

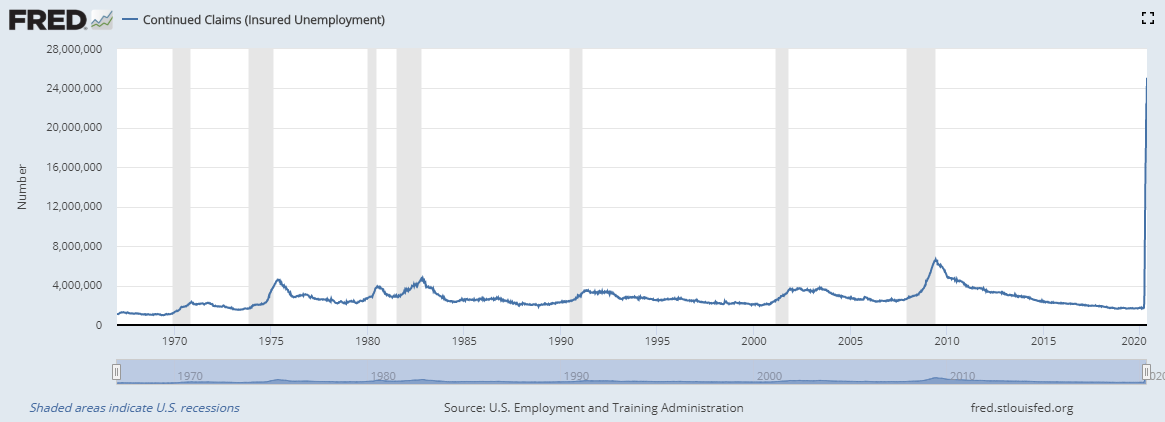

In the US alone, as of mid-May 2020, more than 25-million people are receiving some form of unemployment insurance. This is up from less than 2 million in February of 2020.

The unemployment rate, which is expected to rise further in May, surged to 14.7% in April the highest level since the Great Depression.

The individual elected President in November of 2020 will be responsible for handling the public health crisis as well as manage the economic recovery in the United States in the wake of a global pandemic.

The Congressional Budget Office (CBO) of the United States expects Q2 GDP to decline by approximately 12% year over year. Assuming the virus is contained, and the economy slowly begins to open, the CBO expects GDP to rebound by approximately 5% in the Q3.

The upbeat picture for the second half of 2020 assumes that the virus is contained and restrictive measures are lifted. However, the likelihood of a vaccine receiving approval in the near term has reduced the chances of a quick “V-shaped” recovery.

Growth is likely to slowly improve during 2021 forming a “U-shaped” recovery. The fear many economists have expressed is a slower recovery due to a second wave of the virus during the Autumn of 2020.

What Will Come Next?

The pace of the recovery of economic growth will fall on the shoulders of the person elected President of the United States. The economic agenda during a public health crisis will require a convincing plan. The person that provides the best plan will likely be 46th President of the United States.

During the unset of the Great Depression, Franklin Roosevelt clobbered Herbert Hoover, with the promise of “The New Deal”. Both candidates have guaranteed Americans a return to greatness.

Here is what they have promised as part of the economic agendas.

President Trumps Economic Agenda

Ahead of the onset of the global pandemic, President Trump was riding high, with one of the best economies in American history. His position is one of deregulation and low taxes, which is the standard playbook for a Republican President.

During the Great Recession (2008-2009), President Obama signed into law hundreds of regulations that were designed to protect the consumer. This included strict banking regulations.

During the 3-plus years that President Trump has been in office, he has significantly reduced:

- US corporate regulations

- Corporate taxes

- Individual taxes

The corporate tax cut helped buoy US equities as thousands of companies used their newfound capital to buy-back their stock.

During the pandemic, President Trump has signed for bills into law to help provide relief for struggling Americans. On March 6, the President signed the Coronavirus Preparedness and Response Supplemental Appropriations Act which allocated $8.3 billion to fund various efforts.

This was followed by The Families First Coronavirus Response Act was signed on March 18. Trump signed the $2 trillion CARES Act on March 27. The fourth package, which was signed on April 24 and tops-up programs created in the CARES Act with $484 billion.

Trump has not disclosed a plan to remake the US economy in the wake of the COVID crisis other than his budget for 2021 which was released in February. President Trump proposed a record $4.8 trillion budget for the 2021 fiscal year.

The focus was further cuts to safety-net plans, which included reductions Medicaid, federal housing assistance, and food stamp recipients, along with cuts federal disability insurance benefits and student loan programs.

The Biden Plan

Former Vice President Joe Biden, who is the presumptive Democratic nominee, has attacked President Donald Trump’s handling of the coronavirus stimulus efforts. He has also attacked the way the President handled the public health crisis.

Biden said that he would be giving more money to states and there would be a lot more oversight to determine who received relief.

Biden’s tag line is to “save America” and focus on the middle class. Money allocated to US states will make sure that first responders and health care workers continue to get paid. Without this allocation, the people that are risking their lives to make sure that people are safe will be laid off. The Biden plan will also provide health care coverage to those who have lost their coverage in the wake of the pandemic.

The plan will also extend unemployment benefits, and provide further direct cash relief. He also is calling for a cancellation of a minimum of $10,000 of student debt per person, and a Social Security boost.

The Biden recovery plan geared toward building a more robust middle class. He wants to lower the Medicare eligibility age to 60, from 65. He wants to raise taxes on everyone making above $400,000. According to Taxfoundation.org, the Biden plan would increase revenue by 3.8-trillion over the next decade.

Business Tax Changes would include:

- An increase in corporate taxes to 28% from 21%

- Create a minimum tax on corporations that have more than 100-million in profits

- A doubling of taxes on foreign subsidiaries

- An $8,000 child tax credit

- Establish a manufacturing community tax credit

Individual Tax Changes would include:

- Increase the tax rate back to 39.6% from 37% for those making more than $400,000

- Caps the tax benefit of itemized deductions to 28% percent of the value

- Long-term capital gains and qualified dividends would be taxed at the ordinary income tax rate of 39.6% on income above $1 million

Bottom Line

While Biden has outlined a plan that conforms to the standard Democratic playbook, Trump has yet to put forth an outline other than the 2021 budget. This budget will likely change given the enormous spending that is taking place to rescue American households.

To make up for the spending, either growth will need to exceed the historical norm, or taxes will need to increase. Raising taxes has been a relatively easy process for a President that is a Democrat, but it has historically been an issue for Republicans.