Many macro investors are betting on significant inflation in the US Dollar for the foreseeable future so we put together a list of some of the best hedges for a devaluing dollar.

At the risk of oversimplifying the prevailing opinions of this group, I think a basic simplification of the prevailing bearish dollar view are the following factors:

- Inflated Federal Reserve balance sheet

- Increased money supply

- Ballooning US government debt-to-GDP ratio

- Declining trust in the system

Precious Metals and Miners

Two of the biggest criticisms levied against gold, and other precious metals are that they don’t pay interest and that their status as a store of wealth is emotion-based, with no basis in rationality.

Sure, doesn’t pay interest. That’s certainly true.

However, one has to consider that due to long-term dollar inflation, an interest rate equal to or in excess of the inflation rate is required to break even in terms of purchasing power.

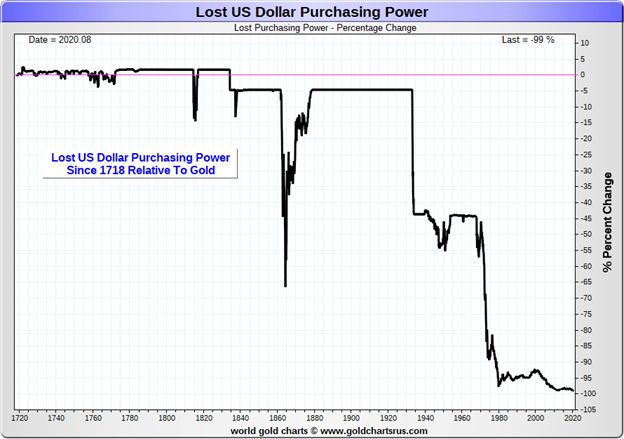

The fact is, that metals hold their purchasing power over time, while the dollar does not.

Source: goldchartsrus.com

The next argument that precious metals are an emotion-based store of wealth makes some sense.

After all, if our economy reached hyperinflation and went back to a barter system, who is to say that gold would be accepted anyway?

These types of hypotheticals are useful if you’re trying to shut down a total gold crank, who thinks that gold should replace all forms of currency, but they’re helpful for asset allocation.

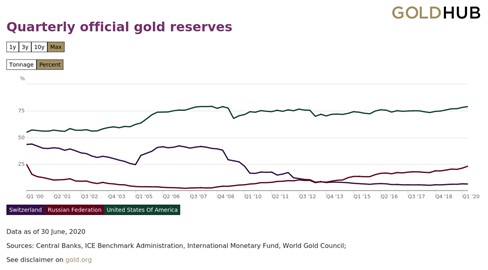

Consider the fact that the world’s largest central banks hold a large percentage of their reserves in gold as a hedge against exposure to fiat currencies.

Germany’s central bank had this to say about their gold reserves: “Gold is a type of emergency reserve which can also be used in crises when currencies come under pressure.”

Buying pure gold exposure through physical bullion, ETFs, or futures contracts are one way to gain liquid, quantifiable exposure to gold. They don’t carry the additional single-issue risks that holding a gold mining company would.

Metals Miners: The Benefits and Drawbacks

When gold prices increase significantly, gold miners are a leveraged bet on gold because of their fixed costs.

As a simplified example, if a gold miner’s production cost is $1,200 per ounce, should the gold price rise to $1,500, they’d make $300 per ounce. If gold’s spot price rose again to $1,800, that miner’s profits would double while gold only increased by 20%.

Like all leveraged investments, this works both ways.

As a result, mining stocks are viciously volatile and cyclical.

As an industry, it’s really nothing like investing in a stable consumer company that pays dividends and grows their earnings in line with GDP. Timing and solvency are exponentially more important for miners.

Should the gold price remain below their production cost for any sustained period, they can easily go bankrupt.

Metals miners in the microcap space are especially ripe for pump and dumps and hype.

Exploratory miners (which don’t currently operate as miners, but are looking for projects) frequently overhype their prospective projects to fool naive investors into buying stock.

International Stocks

Most of us are only familiar with US markets and exchanges.

If it’s not listed on the NYSE or NASDAQ (or sometimes the TSX), chances are we’ve never analyzed the company. It shouldn’t serve as a surprise that global markets look much different than the US, especially today.

Throughout this economic cycle, the S&P 500’s valuation has been at a steep premium to emerging markets, with that delta increasing each year.

So not only do international stocks offer relative value but because they’re not denominated in USD, you’re reducing exposure to the dollar. So you’re betting on valuations mean-reverting while hedging some of your USD exposure.

On the other hand, the US isn’t the only developed economy in the world.

Emerging markets are generally more sensitive to business cycles because their economies aren’t as robust. What if you wish to remain in stable equities while hedging dollar exposure?

Austria is a well-developed European economy with very cheap equities on a relative basis right now.

The iShares MSCI Austria ETF (EWO) is one way to easily buy a basket of Austrian stocks with a pretty low expense ratio of 0.49%, considering that buying each issue on a foreign stock exchange with US dollars would incur significant fees.

The ETF is currently trading at mid-2009 levels with a P/E ratio of 8 and a low dividend yield of 0.80%. On a P/E ratio basis, Austria is the cheapest European single-country ETF, according to ETFdb.

Domestic Stocks

Asset prices rise with inflation and even tend to outpace it as domestic investors need to put their wealth somewhere.

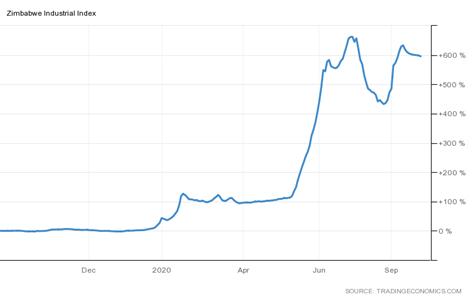

Consider Zimbabwe, a regularly cited case of hyperinflation. Around the time of the global financial crisis, Zimbabwe’s inflation rates were so high that the government began printing 100 billion dollar bills to keep up with inflation.

According to Cato, the peak monthly rate of inflation was 79.6 billion percent.

In 2019, the Reserve Bank of Zimbabwe said that foreign currencies like the US dollar and South African rand were no longer legal tender. They reinstated their domestic currency, renamed to the Zimbabwe dollar.

Fast forward to July 2020, and the Zimbabwe dollar’s annualized inflation rate was estimated at over 700%. Here’s what happened to the Zimbabwe stock market throughout:

Domestic investors were virtually forced into the stock market, pushing it to stratospheric nominal highs. While Zimbabwe’s situation doesn’t directly apply to the US, it helps to see the effects of inflation on such a dramatic scale.

If you expect US dollar inflation, it can make complete sense to keep your money in domestic stocks, even if they’re denominated in US dollars.

Quantitative easing pumps massive liquidity into capital markets, which leaks into the stock market. When inflation is high, and real interest rates are low, investors are forced into stocks.

Large-cap indices like the S&P 500 and NASDAQ 100 could be the real winners, as the US is still home to several high-growth companies, even in a world of slowing growth.

In his May 2020 investor letter, Paul Tudor Jones ranked the NASDAQ 100 as his third favorite inflation hedge, after gold and the yield curve.

Bottom Line

If you read investor letters from global macro investors, imminent US dollar inflation is one of the key repeating themes. This past Thursday, Crescat Capital, a large macro manager, released a memo called The Reckoning Is Upon Us.

They argued that the only choice the central banks have is to reduce further the value of their currencies, which, of course, is inflation. They cite gold mining stocks as their preferred trade for this theme.

From a sentiment point of view, it might be easy to shrug this off as a crowded trade and take the other direction.

However, I think this is one of those cases where even a bunch of multi-billion dollar funds making similar bets doesn’t even hold a candle to what’s going on because it affects the entire global economy.

I’m no macro expert, but I can definitely see the logical case for inflation, and I’ve outlined a few assets which might serve as reasonable hedges in the case of inflation.

For a deeper understanding of this, several podcasts and books can further your understanding of the matter, like the MacroVoices podcast.