Behind the Trades: The Metrics of Profitable Trader | Ep. 8

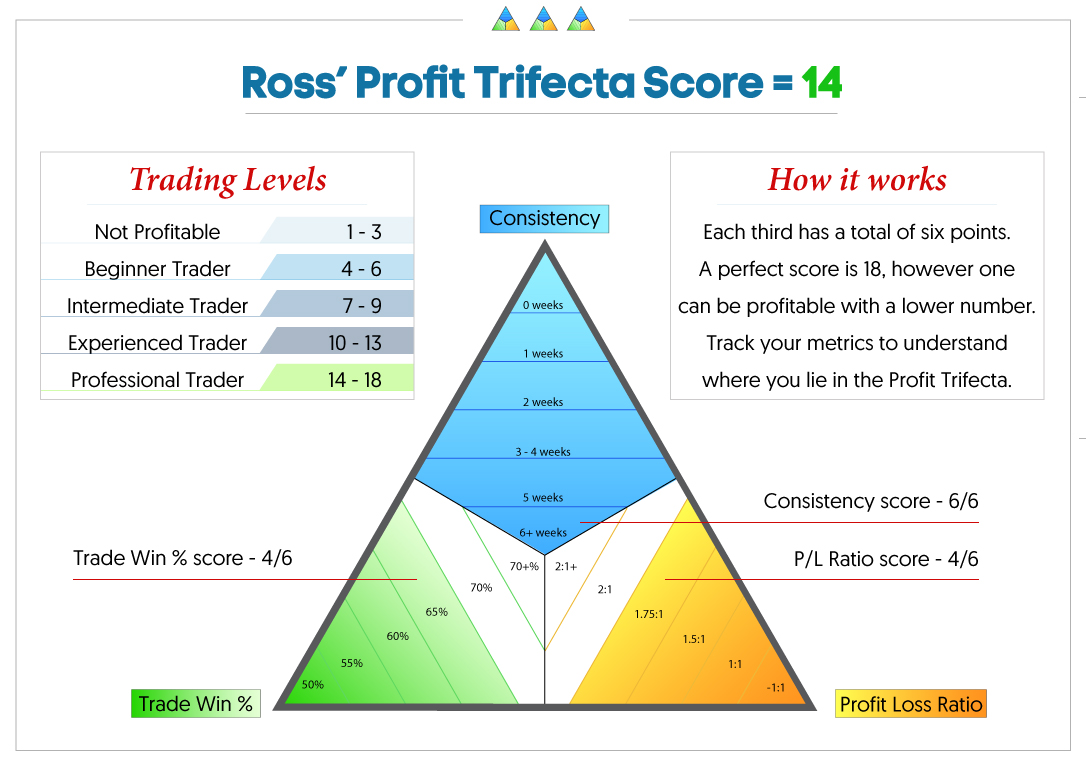

The Warrior Trading Profit Trifecta

Click/tap images to enlarge or Click/tap here to see the Full Profit Trifecta

Student Questions for Ross This Week:

1. When a stock hits the High of Day Scanner, what’s the first thing that you look at?

The first thing that I look at is what’s the strategy that triggers the alert? I have 8 unique strategies that are part of the scanner. I know right away that some of these scans are better than others. My favorite is the yellow scan because I think those are the best, this scan is called Massive Volume & Low Float. So if I like the scanner alert and I like the time of day, I’ll then pull up and evaluate the chart on a technical level. I will check the daily chart for resistance or if we have potential.

2. Which moving averages do you use?

I use the same moving average on almost all my chart time frames. But I have narrowed it down to what I think are respected the most.

Exponential Moving Averages breakdown:

9 EMA Gray (5 minute and daily charts)

20 EMA Blue (all time frames)

50 EMA Red (daily chart only)

200 EMA Purple (5 minute and daily chart)

3. Which would you rather drive, a Lamborghini Huracan or a Mclaren 675?

Fantastic question. The answer is without a doubt, the Lamborghini. That’s because I prefer the naturally aspirated engine. I don’t really like the twin turbo of the McClaren. I drove both of them in Las Vegas and I really prefer the Lamborghini.

See you on the next episode of Behind The Trades!

Ross