-

Value For Investors

-

Value For Day Traders

-

Cost

-

Platform & Tools

-

Customer Service

Summary

TC2000 has proven to be a solid product for day traders and is worth checking out if you are in the market for a new broker/trading platform.

Pros

- Coupons are available for various activities

- Web-based trading for Mac and Chromebook

- Discounts for students

- Many useful tools on the desktop platform

- Very low margin rates

- Online short locate tool

- Direct Market Access

Cons

- Pricey commission schedule

- Additional fees for software and data

- Limited history in the brokerage industry

- Foreign residents cannot open an account

- Small list of tradable securities

- No direct-access routing

- Level II data is unavailable

If you need a broker that offers free simulated trading, TC2000 is worth taking a look at. In addition to paper trading on a desktop platform, the firm offers:

- Educational materials

- Several analysis tools

- In-person training events at several locations (except during coronavirus pandemics)

Brief Overview

TC2000 was founded in 2010 and is currently headquartered in Wilmington, North Carolina. On top of its brokerage services, the firm is also licensed as an investment advisor. The company has no disclosures on its BrokerCheck profile, which is a very good sign.

But does TC2000 deliver where it really counts? Let’s find out.

Services Offered

Several account types are available at TC2000. They include:

- Individual accounts

- Joint accounts

- UGMA/UTMA accounts

- Trusts

- Business accounts

- IRA’s

The broker-dealer requires a $2,500 deposit to open an account. With an opened and funded account, it’s possible to trade:

- Stocks

- Options

- ETF’s

- Closed-end funds

The equity category includes penny stocks and over-the-counter securities. Unfortunately, foreign exchanges are not supported.

Day Trading

If you plan to day trade at TC2000, you’ll need to keep an account equity (composed of both cash and securities) of at least $25,000. Somewhat surprisingly, TC2000 doesn’t offer Level II quotes or direct-access routing.

Leverage and Shorting

At TC2000, you’ll get 4:1 intraday margin on most securities. Leveraged ETF’s will have lower leverage, and some securities aren’t marginable at all. For overnight positions, the leverage drops to 2:1.

TC2000 uses Interactive Brokers as its clearing firm. Thus, you can use IB’s short locate tool to find stocks available for shorting. As expected, TC2000 will charge fees for this service. The rates vary by security and even by day.

Pricing Schedule

TC2000 is one of the few brokers left to still charge commissions, and they’re not cheap. Stocks and fund trades are $4.95. Options are $2.95 per trade with a 65¢ per-contract fee.

In exchange for this rather uncompetitive commission schedule, TC2000 offers excellent margin rates:

TC2000 charges a monthly fee for data and its desktop platform. The latter costs $9.99 per month for the most basic version. A Gold edition costs $29.99 per month and comes with the following features:

- EasyScan® screener for options and stocks

- Simple step-by-step wizard to create conditions

- Drawing tools

- Sortable watchlists

- Layouts across multiple monitors

- Alerts (up to 100)

- Graphs of sectors, earnings, % insider shares, and more

- Extended-hours mode

- Formula writing

A Platinum edition is a very steep $89.98 per month. It offers:

- Historical condition testing

- Historical scan results

- Automatic refresh intervals on scans & sorts

- Up to 1,000 alerts

- Market timing indicators built from scan plots

Every month that you place at least one trade, the broker will give you a $25 Platinum subscription coupon. Alternatively, you can maintain an account equity of $30,000 or more.

The brokerage firm offers reduced software rates if you pay annually or semi-annually.

Real-time data on U.S. stocks costs $14.99 per month. Options data is $9.99. Other data packages have other fees ranging from $1 to $50.

Customer Support

During our investigation of TC2000, we found a helpful chat feature on its website. We always received quick and accurate answers. The site also hosts a list of FAQ’s sorted by category. Many of these have screenshots of the broker’s software in step-by-step guides. These should be of great help to many traders.

TC2000’s customer service department is open during the weekday only. The firm has a toll-free number for technical support (1-800-776-4940) and another for brokerage services (1-800-508-9150). If you prefer e-mail, you can use [email protected] for technical help or [email protected] for assistance with your account.

If you need a quicker answer to a software question, you may find one on the broker’s YouTube channel. There are about 80 videos and over 6,000 subscribers.

Software

Windows users can trade on TC2000® Version 20. This is the company’s most robust software, although we will look at some other platforms shortly.

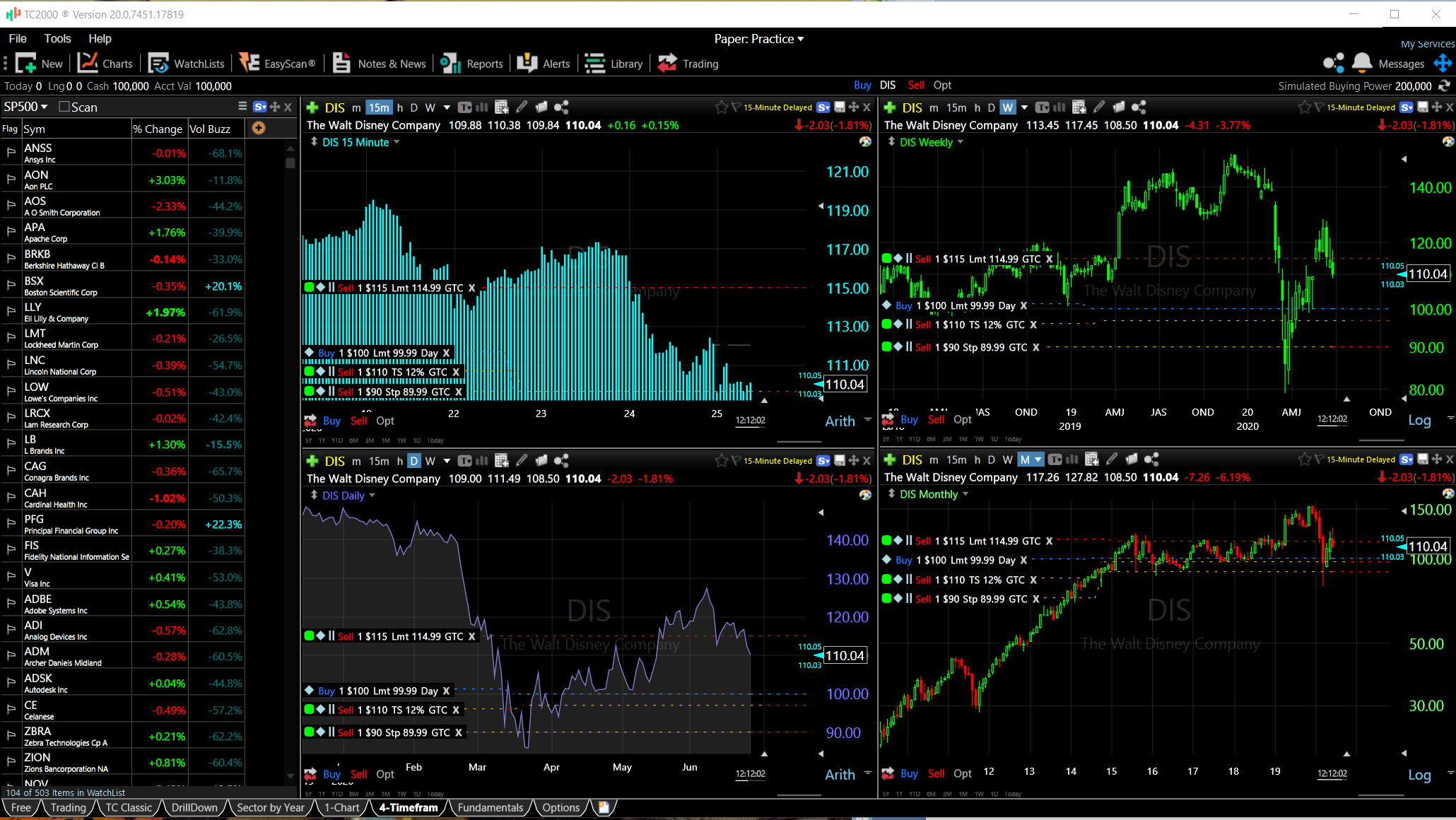

Desktop Software

Version 20 is the latest and greatest of TC2000, the broker’s flagship desktop trading system. By default, the software literally has hundreds of pre-installed watchlists. Many of them require a subscription to a Gold or Platinum package, however. Watchlist examples include:

- Forex

- Canadian ETF (these can’t be traded)

- Industry by sector

- Nasdaq bank index

- Airlines

- Oppenheimer International Revenue ETF

And of course, it’s possible to create your own custom watchlist.

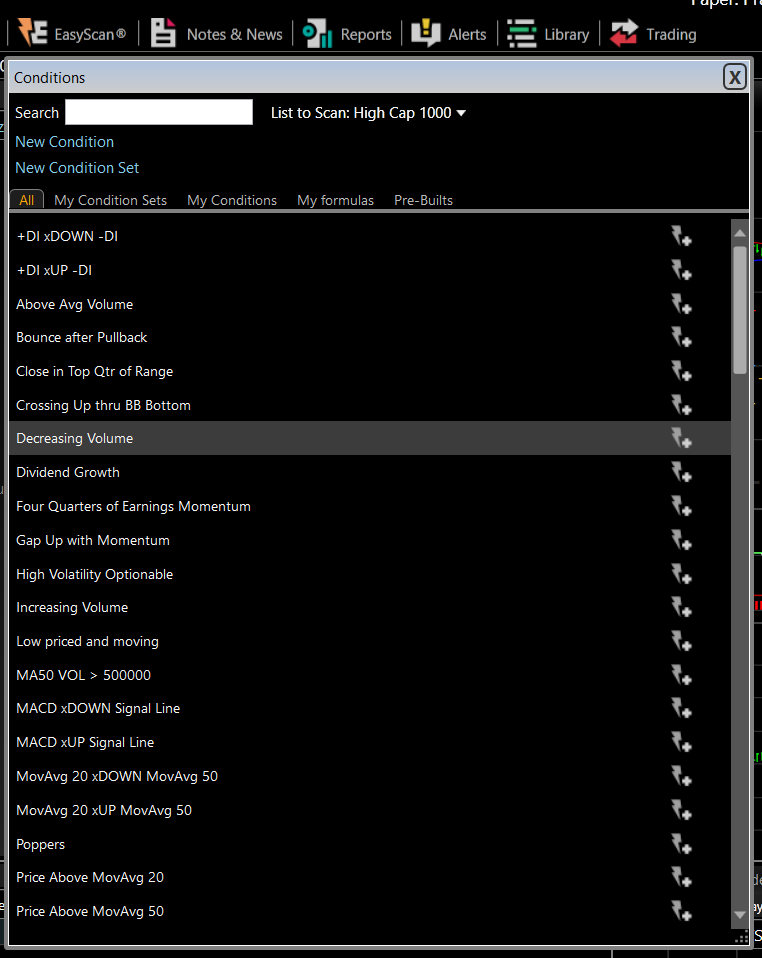

The platform’s EasyScan® tool is located in the top menu. It has a lot of pre-installed screens. They include:

- Increasing volume

- Price above moving average 20

- Dividend growth

- Bounce after pullback

It’s also possible to write your own formula for a custom-made scan.

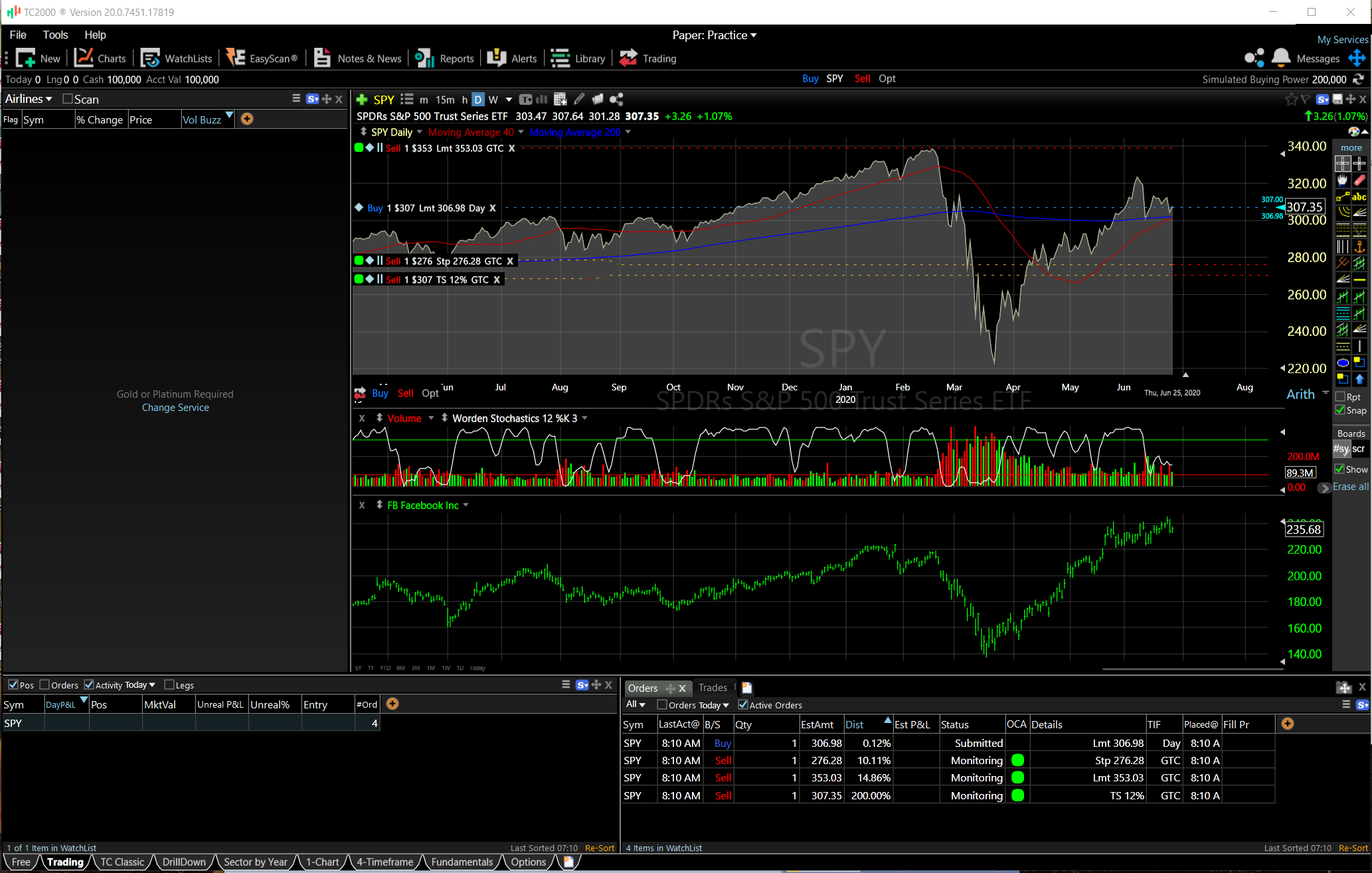

By default, the software uses limit orders at plus or minus a penny. These defaults can of course be changed. Besides limit orders, there are:

- Trailing stop

- Trailing stop limit

- Primary peg

- Stop limit bid

- And more

The software’s order ticket automatically populates both buy and sell orders for a single trade. This of course makes bracket trading a breeze.

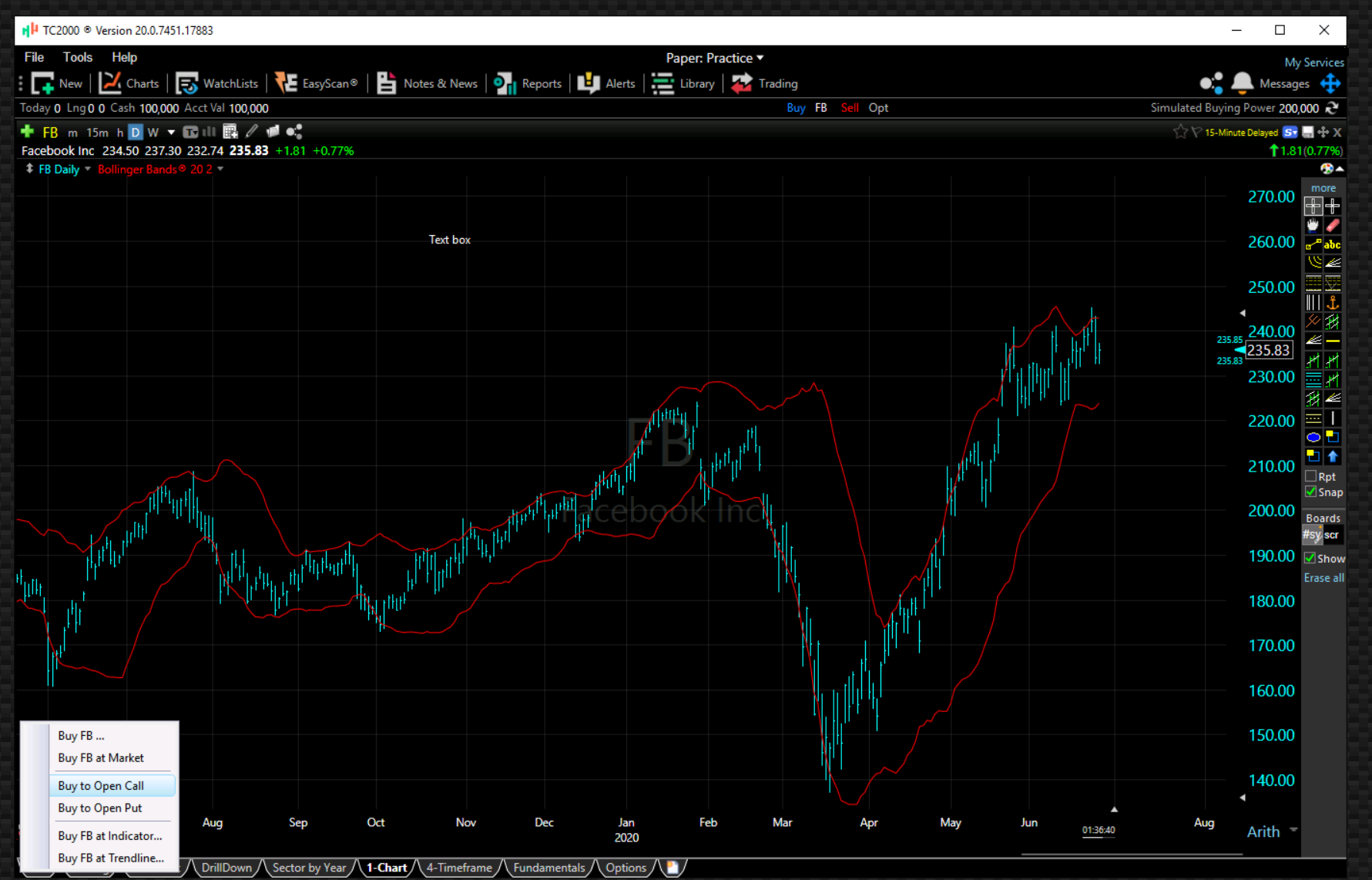

Charting on the desktop system offers multiple graph styles, drawing tools, and a great deal of customization. Trade buttons sit in the bottom-left corner of a graph. Click on either buy or sell, and a pop-up window will appear.

This will have choices for stock or options trades. Making either selection produces a small pop-up trade ticket with everything you need. The chart will also display profit and loss points.

TC2000’s charting software displays buy and sell limit and stop points, which we really like. A small ‘x’ is shown at each price point. Clicking on one will cancel an order straight from the graph.

At the bottom of the platform is a row of tabs. Each one represents a default layout that offers a specific trading purpose, such as options or sector analysis.

Browser Platform

Customers who can’t use the desktop program for any reason can use a browser platform instead. It comes with the same layout and interface as its desktop cousin. A workspace window sits inside the browser and can be dragged around and resized. Compatible browsers include:

- Chrome

- Edge

- Firefox

- Safari

- Internet Explorer

- Opera

Mac and Chromebook

TC2000 has developed its trading platform so that it can be used on Macs and Chromebooks. To use the platform on a Mac, you must first install Parallels Client. On Chromebook, you need to enter apps.tc2000.com as the server address inside the application server.

Mobile

The broker also has a mobile app. It functions on Apple and Android devices (including tablets). Strangely, it has no trading capability. The platform offers these features:

- Multiple watchlists

- Horizontal charting with more than 70 technical studies

Interactive Brokers’ Software

Because TC2000 uses Interactive Brokers as its clearing firm, TC2000 customers can opt to use IB’s software. This lineup includes a much better mobile app, a browser platform, and a desktop system.

IB’s browser platform has direct-access routing, which is missing at TC2000 on any platform. But it has far fewer features than TC2000’s browser-based system. IB’s desktop program has many advanced features and definitely rivals Version 20.

Bottom Line

TC2000 customers get a lot of software options, but they have to pay steep commissions and data fees. The broker’s pricing schedule is no longer competitive in an era where most brokers have eliminated commissions altogether.

But traders who use margin may find a good value here.