Options trading is already complex enough but when you start looking at margin trading with options you are adding a whole new dynamic to it. However, once you have a solid understanding on how options work with margin then you will be in a position to execute strategies that have a statistical advantage like credit spreads and selling calls and puts.

Options are expiring assets so if you are able to put on strategies that take advantage of this, like the pros and big institutions do, then you will be stacking the deck in your favor.

What is Margin Trading?

Margin trading with stocks is much different than margin trading with options, but lets have a quick look at what margin is and how it works.

Trading on margin is when you borrow money from your broker to place a trade. It’s kind of like a loan and if you hold the position overnight then you will usually have to pay interest on that loan amount, but every broker is different so make sure to check with them before leveraging a trade.

Margin accounts require a minimum initial investment of $2,000 and you will have to be preapproved for it before they will open an account for you. This is a quick process and most brokers will have it done in a day.

There are a couple of terms that you need to know about with margin accounts. The first one is initial margin. This is what you will have to deposit when you make a purchase and is usually around 50% for stocks but this also depends on the broker. This means if you have $10,000 in your account you will have $20,000 in buying power for stocks.

The next term you will want to familiarize yourself with is maintenance margin. This is a big one because it is the minimum account balance you must maintain before you are issued a margin call.

A margin call is when a broker requires you to deposit more funds into your account or sell other securities to pay down part or all your loan. If you do not do this when the margin call is issued, the broker will do it themselves.

Margin Trading With Options

Trading options on margin is much more complicated than with stocks and each broker can have different margin requirements depending on the strategy you are implementing.

For demonstrative purposes we will use TradeStation as our example and will go over their margin requirements for the listed strategies below.

Selling Naked Calls & Puts

Selling naked calls or puts is the riskiest options trading you can do and is why it requires the highest options level approval. When you sell a naked call you basically have unlimited risk because in theory the stock can go up infinitely. Below are Tradestation’s margin requirements for selling Calls and Puts:

As you can see in the table above, there are three different ways to calculate margin requirements for selling each a naked Call and Put (I told you it’s complicated!). So lets break this down into an example.

Say you wanted to sell a naked call on $AAPL, which has a current market value of $175.00 per share, and we were selling that at-the-money strike that has a premium of $3.00. This is how each calculation would break down:

1.) 100% Option Premium + 20% Underlying Market Value – OTM Value

$300 + $3,500 – $0 (since stock is trading at the money) = $3,800

2.) 100% Option Premium + 10% Underlying Market Value

$300 + $1,750 = $2,050

3.) 100% Option Premium + $100/contract

$300 + $100 (one contract) = $400

So of those three values above, the first one is the greatest at $3,800 and is what you would expect as your initial margin requirement. You can do the same for the Put side and you would take the greatest number from those three calculations to get your margin requirement.

Credit Spreads

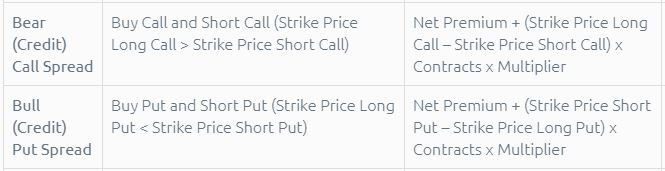

Credit spreads are a great way to bring in money while limiting your risk. Check out the table below for margin requirements whether you are opening a bear or bull credit spread.

So, fortunately, there is only one calculation needed to find your margin requirement with credit spreads. Lets say you wanted to open a bear credit spread on $AAPL. This involves Calls so we will use the top calculation to find our margin requirement.

In this example we are going to sell the 180 and buy the 185 strikes for the March monthly’s. To sell the 180’s we would bring in a credit of $1.14 and buying the 185’s we would have a debit of $0.44. Here is how the math works out:

Net Premium + (long strike – short strike) x number of contracts x multiplier

$70 + 5 x 1 x 100 = $570

So with this spread you are looking at $570 in margin requirements. These are much easier to calculate than naked calls or puts. Keep in mind that brokers software will automatically calculate this for you so you won’t have to do all the math but it is a good idea to have an understanding of how it works before jumping into it.

Final Thoughts

Selling options is a great way to trade options with an edge but if you don’t know how margin works with them then you could be putting yourself at serious financial risk. In order to utilize these strategies you will need a margin account and be approved for the required option level.

Let us know if you have any questions in the comments below!