Did you know that a vast majority of members belonging to the Forbes 400 list of wealthiest people in the world have increased their wealth by investing stocks?

According to history, trading or investing in stocks is one of the best ways to build wealth over an extended period.

What you should know is that a lack of understanding the basics about stock investing and trading could result in the loss of capital.

Since stock trading is a tricky business, you need to learn the basics first and how to find the right stocks before you risk your hard earned money in.

What Are Stocks?

You may have encountered the use of the following words referring to stock – security and equity. Well, stock is referred to as equity because as an investor, you get to purchase a share of a company.

It is also referred to as a security since as an investor; you will be securing a part of the company. This means that you will become a part owner of the organization based on the amount of shares you have.

Types of Stocks

Stocks are the foundation of an investment portfolio. Over the years, they have outperformed different investment options. To become a well informed investor, you need to know the different types of stock.

Common Stock

This type of stock entitles the investor to share in the company’s profits through capital appreciation or dividends. It is important to know that common stockholders have preemptive rights. This gives them the power to maintain the same proportion of ownership.

In addition, they have voting rights where the number of votes is directly related to the shares owned. Returns from common stock do fluctuate with changes in market condition.

Preferred Stock

Preferred stockholders have a larger claim on the company’s equity but since the stock is considered to be less volatile, there is less probability for profit. The stockholders are entitled to receive dividends which are fixed and regular.

The dividends are provided over a certain period unlike those provided to common stockholders (variable dividends).

One advantage of preferred stockholders over common stockholders is that in case the company goes bankrupt, preferred stockholders will be paid first.

What is an Investment Portfolio?

When investing, financial advisers will advise you not once but several times to diversify your portfolio. The reason for doing so is to lower any risk(s) that could result in the total loss of your capital.

To avoid this, you need an investment portfolio. This refers to a collection of all your investments that includes stocks and bonds.

You can do this by investing in a lot of different stocks or you can look at investing in ETFs that cover certain sectors or industries.

You can also look at investing in mutual funds but make sure you do your research because there are a lot to choose from and many have different types of fees that are different from stocks.

Choose Your Trading Style

There a ton of different ways to invest in stocks but the two main categories that most investors fall under are either technical traders or fundamental investors.

Technical traders will look at charts for patterns that have a high probability of a certain outcome. This is known as technical analysis.

This type of trader will use technical analysis to invest in stocks while also using strict money management rules to protect their capital.

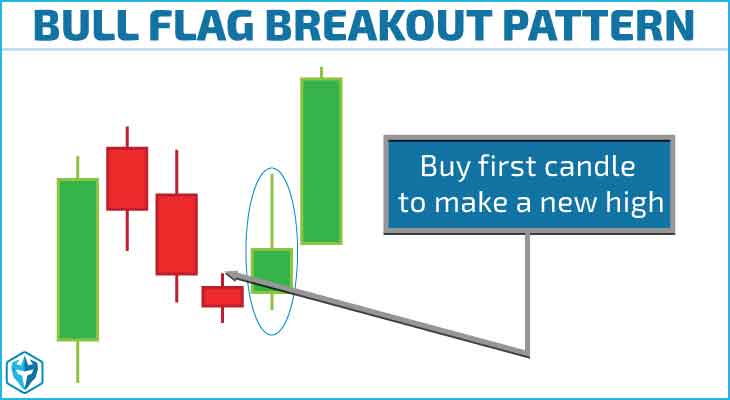

For instance, a popular chart pattern is the bull flag pattern like the one above. It happens after a stock makes a strong run up and then makes a slight pullback on lighter volume before bouncing back and continuing the move up.

Fundamental investors will use fundamental analysis to make investing decisions by finding undervalued companies. They will look at the companies balance sheet and income statement to find out how a company is performing financially versus their competitors.

A popular fundamental investor is Warren Buffet, who has literally made billions investing this way.

Ways To Invest In Stocks

When it comes to investing in stock, you have two options. You can either choose to become an independent investor (be your own boss) or work with robo advisors.

As an independent investor, you will be in charge of everything – setting up stock screeners, choosing stock symbols to invest in and coming up with trading strategies among others. In this case, you will work with a brokerage in order to access market data.

Robo advisors refer to digital platforms or financial advisors who provide automated investment management services with moderate human intervention. They provide digital financial advice thanks to the use of algorithms.

Select the Right Type of Investment

There are three main types of investments you should know.

Stocks – also referred to as individual stocks, investing in it/them allows you to own part of a company. There are two types namely common and preferred stock which have been elaborated previously. When you choose to invest in individual stocks, you have the option of creating your investment portfolio and watch it grow.

Exchange Traded Funds (ETFs) – also referred to as stock mutual funds, this investment type enables you to own different parts of varied stocks.

This is usually achieved through a single transaction. With ETFs, you have the option of building your diversified portfolio similar to mutual funds but with the trade-ability of stocks.

Mutual Funds – A mutual fund an investment vehicle whereby funds are pooled together with the goal of investing in specific sectors or industries. By investing a lot of different stocks at the same time you are limiting your risk and reducing volatility in your portfolio through diversification.

Research on Capital Requirements

You might think that trading stocks requires you to have big money, right? What you ought to know is that today, investing in stock is not a capital intensive venture.

Thanks to upcoming mobile trading solutions like Acorns, Robinhood and Stash Invest; you can start with $5 only and continue building your investment portfolio.

Choose Your Broker

Selecting your first broker requires lots of careful contemplation. Why? The right broker can help you find the right securities and diversify your investment portfolio without costing an arm and a leg, while the wrong broker will limit your options.

So, if you don’t want to be scammed, checkout the following resource on how to choose a stock broker.

Selecting the right broker should also include making sure they have a solid platform that will meet your needs as an investor. This should largely be dependent on your frequency of trades, investment strategy and preferences.

The best platform should have a web browser, mobile app and desktop platform.

See our round up of the best online stock trading brokers.

With your new trading account, you are ready to start investing in stocks.

Final Thoughts

There you have it. The ultimate guide on how to invest in stocks.

Once you have everything as described above, all you need is to utilize the available tools, develop trade strategies, implement them, research, stay up to date with market news and manage your emotions.