Updated: January 9, 2025. Written by Ross Cameron

As an active trader, I get stuck in circuit breaker halts multiple times each week while I’m day trading. But being in a trading halt isn’t necessarily a bad thing! If you bought a stock and it gets halted going up, that means it’s moving quickly. However, if you’ve never been in a trading halt before, they can be a little bit scary.

This article got a lot of visitors in 2021 when GameStop was halting every few minutes. Many traders didn’t understand what was happening. They blamed their brokers, they blamed the big hedge funds, they blamed Citadel, but the fact is, circuit breaker halts, or volatility trading halts were implemented by FINRA and the SEC following the stock market crash of 1987. They’ve been around for a long time.

Video Lesson on Circuit Breaker Trading Halts

What is a Trading Halt?

There are several different times of trading halts that we’ll discuss in this article. The most common is a circuit breaker halt or a volatility trading pause.

Code: LUDP – Volatility Trading Pause

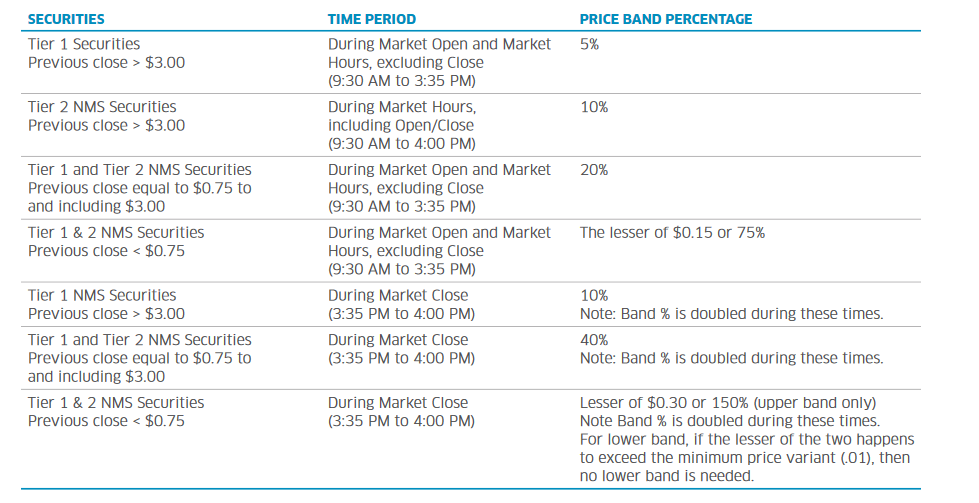

A circuit breaker halt, or a volatility pause, occurs when the exchange freezes trading in a security because the price exceeds the acceptable volatility bands. Any stock in the market can be halted. The volatility bands that trigger a circuit breaker trading halt are established based on the prior day’s closing price of a security, as you can see in Figure 1.

Tier 1 security includes all securities listed in the S&P 500, the Russell 1000, and select ETF’s.

Tier 2 securities are all other securities not including warrants.

Volatility Thresholds

- All Tier 2 stocks that closed the previous day over $3.00 a share will have trading halt thresholds at 10%.

- All Tier 2 stocks that closed the previous day between 75 cents and $3.00 will have trading halt thresholds at 20%.

- All Tier 2 stocks that closed the previous day below 75 cents will have trading halt thresholds at the lessor of 15 cents or 75%.

- NOTE: The volatility bands are doubled to accommodate increased volatility near the closing bell between 3:35pm-4pm.

This DOES NOT mean a stock that goes up 100% will halt a minimum of 5 times. In fact, a stock can go up several hundred percent without having trading halted even once. So this begs the question, “How are trading halts calculated?”

The History of Circuit Breaker Trading Halts

Some of you may skip right past this part, but for a stock market junkie like myself, I do find the history fascinating. It was October 19, 1987. Today, we know it as Black Monday. The stock market dropped an astonishing 22.6% in 1 day. This created a panic as traders and investors rushed to exit positions. The crash sent shockwaves through the financial markets.

Stock market crashes are always fueled by the emotions of fear and greed. This becomes a vicious cycle where the more people sell, the more others begin selling themselves. It only stops once the weakest hands have capitulated and a few brave souls begin to come in an press in the midst of panic.

Following the crash, financial regulators met to discuss mechanisms that could be implemented to protect confidence in the market, protect valuations, and protect individual investors.

Today, our circuit breaker halt rules and halt thresholds are evolved to meet the needs of today’s volatile markets. However, as you’ll learn in this article, there is still room for improvement. The mechanisms designed to protect investors and restore confidence in the markets at times seem to do the opposite.

How are Trading Halt Volatility Bands Calculated?

Every stock has halt bands, volatility bands, or volatility thresholds. These terms are synonyms. In Figure 2 you can see the blue dotted line that shows an upper band and a lower band. These represent the volatility bands. As long as the stock stays within the bands, it will not get halted. So if a stock moves up 500%, but it never does it so quickly that it breaks the top of the volatility band, it will not halt.

Figure 2

Figure 2

Volatility bands are calculated by the average price of the stock over the last 5 minutes, and the update the band prices every 30 seconds. They do not update in real-time with every second that passes. The halt bands remain the same for approximately 30 seconds before updating based on the new average price of the last 5 minutes. So a more accurate depiction of the volatility bands would look more like Figure 3.

Limit Up Limit Down Trading Halt

The Limit Up Limit Down price will appear on the Level 2 of software used by professional day traders as you can see in Figure 4 and Figure 5. The LULD price appears in Red on the Level 2 window. Retail brokers like Robinhood or ThinkorSwim do not show the LULD prices. This price is an actual limit. The stock cannot trade above or below the Limit Up Limit Down level. If the stock remains fixed at the LUDL level for more than 15 seconds, the stock will be halted on a circuit breaker, or a volatility trading pause, for a minimum of 5 minutes.

How Does A Stock Get Trading Halted?

In order for a stock to get halted up, buyers must keep the bid at the upper volatility band for 15 seconds. In order for a stock to get halted down, sellers must keep the ask at the lower volatility band for 15 seconds. Sometimes we will see the stock appear that it is about to get halted then suddenly reverse directions. I call this a “False Halt”. This happens when enough buyers/sellers

How Long is a Trading Halt?

Volatility trading halts last for a minimum of 5 minutes. A circuit breaker halt can last longer if there is a large imbalance of unmatched orders. This imbalance is caused by traders who placed orders just before the halt, or during the halt. Let’s say for example a stock halts up and you want to sell. You might put out several orders to sell while the stock is getting halted. But there may be other traders who want to buy, they put out orders to buy during the halt.

While the stock is halted, no order will get filled. However, a resumption price is based on where the higher buyers and the lowest sellers meet. Often when a stock halts up it opens substantially higher. Sometimes 10% or more.

If the order remain unbalanced at 5 minutes, the stock will remain halted for another 5 minute interval. At 10 minutes from when the stock was halted, if the orders are balanced, the stock will resume trading at the new price (higher or lower). If the orders are still not balanced, another 5 minute interval will pass. For this reason, halt times are typically 5 minutes, 10 minutes, 15 minutes, 20 minutes, 25 minutes, 30 minutes, etc. Occasionally stocks will resume at unusual times, but never at an unusual time of less for halts that are less than 10 minutes.

Trading halts due to other codes discussed below including T1 or T12, can last for hours or even days.

The Flaw with Trading Halt Levels on Penny Stocks

In Figure 4 and Figure 5 you’ll see two stocks that are nearly the same price at 1.42 and 1.44. Yet, the trading halt levels are substantially cheaper. The halt band prices are in red in the row that says “LULD”.

On the stock up 143%, the halt levels are 15 cents apart. This is because as per Figure 1, the stock closed the previous day below 75 cents, and is thus halting every 15 cents.

On the stock down 32%, the halt levels are 20%. That’s because the stock opened between 75 cents and 3.00 a share.

Thus, we have two stocks trading at the same price but with substantially different volatility bands.

- Figure 4

- Figure 5

Example:

A stock closed the previous day at 74 cents. It is a Tier 2 security and will halt the lesser of the two: 15 cents or 75% in less than 5 minutes.

A stock closed the previous day at 76 cents. It is a Tier 2 security and will halt if it goes up or down 20% in less than 5 minutes.

Market Wide Circuit Breaker Trading Halts

There have been a few times the circuit breaker halts have been tested by market volatility on a msasive scale. On August 24th 2015, Black Monday Round 2, there were over 1200 circuit breaker halts when the market opened. It was the most extreme amount of volatility across the entire market I’d ever seen as a trader. The market tanked over 1,000 points causing circuit breakers on the way down, then it experienced such a massive bounce off the lows it caused additional circuit breakers coming back up! The purpose of these circuit breakers and 5min volatility pauses were to prevent a full market crash. While the market still dropped 1,000 points it could have been much worse. – CNN Money

During the Covid Lockdown in 2020 it happened again. The market dropped 30% in a matter of days, and during this time we experienced massive volatility across all sectors and in almost all stocks. Circuit Breaker Halts paused trading, gave investors a moment to compose themselves, and more importantly, stopped the algorithmic trading computers from executing sell orders. False crashes can be caused by computer programs entering into a vicious sell cycle where they set each other off. These halt bands stop the spiraling before it gets worse.

So while halts do disrupt trading in some areas, at a whole, they protect the market and they protect investors.

Other Stock Market Halt Types

Code: T1

News Pending: The company has requested trading in the stock be halted while they release material news. This can be good or bad. When the stock reopens, the market will react to the news. Sometimes stocks that are moving quickly on rumors will get halted while the company comes out and responds to the rumor. That’s why holding stocks that are moving on rumors can expose you to halt risk.

Code: H10

SEC has suspended trading in this stock (common among penny stocks and companies suspected of stock promotion or fraud)

This is a 5min halt to pause trading for stocks priced above $3 and that move more than 10% in a 5min period.

Stocks under $3.00 have different circuit breaker rules, and S&P 500 stocks and Indices also have different rules.

When a stock is halted, you cannot trade it, you have to wait.

Code: T12

The Exchange has halted the security pending the company providing more information to the exchange. When a stock makes a sudden move of 100% or more with no news, the stock is at risk for the exchange halting trading and requesting more information from the company. While the stock is halted, traders cannot buy or sell. They are stuck. When stocks resume from T12 halts, they can resume at a fration of the price they halted at, especially if the company confirms that there is no news to account for the move.

Halt Code T1: News Pending

Holding a stock that is Halted Pending News can be a little scary. It means that the company is choosing to release material news in the middle of the trading day, instead of after hours.

In my years or trading I’ve found the most common reason a stock will be halted mid-day Pending News is because the stock was making a huge move on rumors.

Maybe rumors of bankruptcy is driving the stock down, or rumors of a buyout is driving the stock up.

In either case, the company feels they must respond to the rumors. If they deny the rumor, the stock will often quickly reverse directions.

As a day trader you have to understand that stocks spiking on rumors or for no apparent reason are always at risk of getting halted pending news. It shouldn’t be a surprise if and when it happens.

Halt Code H10: Trading Suspended

This one is bad. If a stock is halted by the SEC it’s typically because it’s a penny stock, OTC stock, and it’s being used by criminals to front load or manipulate the price of the stock.

These stocks can be halted for days or weeks, and often resume trading at a fraction of the price before the halt. Sometimes they drop as much as 80%. This is a good reason to use extreme caution when you’re trading penny stocks.

Halt Code T12: Additional Information Requested Code

This is typically another bad halt which usually happens when a stock has run up a lot but there is no reason backing the run.

This usually happens on pump and dumps or huge short squeezes and in most cases when this halt is lifted the stock will come plummeting down because there is nothing to support this drastic move.

How to Find Halt Status

The Nasdaq has a Current Trading Halts page that updates in real-time when a stock is halted and provides the code associated with the halt. At Warrior Trading, we also offer a scanner that provides traders with real-time halt alerts and audio notifications. The reason it’s important to know about halts is because when they are due to volatility, it’s very likely when the stock resumes trading we will see continued volatility. This can be an opportunity for taking a trade.