Trading Psychology: Understanding Successful Trader Mentality – Behind The Trades | Ep. #20

[smart_track_player url=”https://media.warriortrading.com/2017/03/BehindTheTradesEp1_Final_audio.mp3″ download=”false” ]

Transcribed Audio from Behind The Trades

Hey everyone. All right, so we’re going to do a special episode here. This is a new segment called Behind the Trades. Today we’re going to talk about, basically a recap of some of the best and worst trades of the week. I’m going to go over my stats for the week. And also talk about finding A quality setups and one of the things that I struggled with this week, which is going to be the topic of this episode, is maintaining emotional composure during choppy trading markets. That’s really what we saw for a lot of this week. That’s the agenda for today. At the very end we’re going to have a segment called Ask the Warrior. So you can ask me questions, so make sure you get your questions ready and I’ll get those answered for you, all right?

Small Account Trading Stats Review

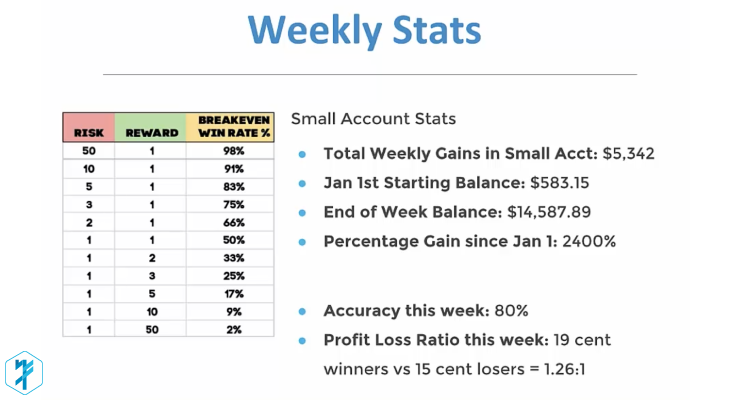

We’ll start by looking at the weekly stats, the big picture. And this is specifically for my small account. Now, I finished the week with $5,342 in trading profits, which means my ending balance is $14,587. Now, I started with $583 on January 1st, which means I’m up over 2,400% in the last, this is day 18 of the small account challenge. Today I’m up $2,249, which makes it my best day of the year.

Through the last five days this week, my accuracy has been 80%. My profit-loss ratio has been 1.26:1, so 19 cent average winners versus 15 cent average losers, which is not bad. Obviously, I made a couple goals at the beginning of this year. One was to increase my accuracy above 68%, to try to get closer to 70-75%. This week I’m doing that. My second goal was to try to increase my profit-loss ratio to 1.5:1, ideally getting closer to 2:1. I wasn’t able to make much headway on that this week.

I think one of the reasons is that, a few of the trades, the couple of losses that I took, and I only took about 16 or maybe 17 trades this week in the small account, and I had three losers. Those losers were losses of 26 cents, 7 cents, and there was another one, I can’t remember what the loss was, might’ve been 15 cents. Generally speaking, the losses weren’t that big, but I had one that was on the bigger side, 26 cents, and that of course draws down my whole ratio. That’s the result.

But remember that this profit-loss ratio guide here, if you trade at 1:1, you only need to be right 50% of the time. For those of you watching on Facebook Live, I’ll show you. You only need to be right 50% of the time when you trade with this 1:1 ratio. If you trade with a 2:1 ratio, right down here, you only have to be right 33% of the time to break even. I was trading sort of in between these two, 1.26:1, which means my accuracy breakeven point was probably around 46% or something like that. So the fact that I was trading with 80% accuracy is why I was able to make $5,342 this week.

Now, the exciting thing is that this week I broke through the $12,500 threshold. That’s the line in the sand that I really wanted to break this week because that meant I’m halfway to $25,000. I was basically there yesterday, I started this morning with $12,338, and then I made 2,250. So I’m right under $15,000, which means I’m about $10,000 away from 25,000.

Remember also that I said I want to be at $25,000 in total equity by March 1st, but I was hoping I might be able to get there by President’s Day weekend, which is a long weekend. I’d really like to be able to celebrate the long weekend knowing that I hit that goal. That means I have three weeks to make $10,500. Okay, so I need to average about $3,500 a week. Based on my gains this week of $5,342, I should be able to do that. Hopefully I will be able to do that, and I’ll be able to enjoy President’s Day weekend. But, you know, if things slow down then I’ll just have to go with the flow, and that’s part of the deal with trading.

Normal Account Overview

That’s the big picture, broad brush strokes of my small account. Now, during the week I was also trading in my regular size account, and in my regular account I trade a slightly different strategy where I can be a little bit more aggressive. I’m not as worried about losses, I’m not trying to have really, really high consistency, I’m more looking for home run trades. And in that account I made about $11,000.

As a result, I am now up on the month $39,112, making this the best month, better than any month I had in 2016, which is really exciting. So that’s a great way to start the year. January, great month, and we’ve still got two days left. I’m hoping, I think $40,000 will be achievable as long as I have some good trades Monday and Tuesday. 45,000, might be? 50,000, you never know. I mean, maybe if we get a really good setup, I’ll be able to do that.

Now, that type of gain probably wouldn’t be in my small account, it would mostly be in my bigger account. In my bigger account I’ve been taking 10,000 shares on most of these trades. When I get a nice 30-40 cent move, it’s $3-4,000. Yesterday I made 6,000 in my big account. It’s just 10,000 shares, 60 cent move, there’s six grand. Obviously I’m not trading that aggressively in my small account. The reason is because, if I take 10,000 shares and, let’s just run through the scenarios.

Why You Can’t Take Huge Positions In A Small Account

Number one, what if I lose my internet connection and I’m offline and the stock drops 50 cents? I’m going to lose $5,000 and I’m going to lose 40% of my account. I can’t afford that. Number two, what if I get into the trade and I don’t lose internet connection, but it just drops really hard, I have trouble selling. Maybe my platform goes down, there’s a connectivity issue. There’s just so many scenarios where something bad could happen. I cannot empower any single trade to potentially ruin this challenge. That’s why I have to be a little bit more conservative on my share size.

As a result, even though I took some of the same trades, I wasn’t taking as much size in short trader, I was being more conservative, and so my gains are a little bit smaller this week compared to my big account. But I’m at a point today where I’ve got $83,000 in buying power. I could take 10,000 shares, but I want to make sure I take my time and don’t get too carried away. I don’t want to get myself into a situation where, like I said, I give back a lot of profit too soon.

Best and Worst Trades of the Week

Now let’s talk about the best and worst trades of the week, now that we’ve talked about the broad brush strokes. My best trade of the week was FFHL yesterday. And in this trade I made in my small account, $1,900. And you can see here my entry, well, we’re watching this pre-market for a gap and go trade. I was watching it long over the pre-market high of 3.59. The market opens and it pops up just a little bit and I got in at 3.70. Unfortunately, I only filled 70 shares. I wanted 2,500. My 70 shares, we squeezed up to 4.60 and then we pulled back, and I added 4,000 shares at 4.60 and sold them at $5. In that squeeze right there, four times four, $1,600. Then we pulled back off of five and I added for a second break of $5, giving me another $200-300 profit.

The sad thing is that this could’ve been a $5-6,000 winner in my big account, if only I had been able to get my full order filled. But this is sort of the luck of the draw where, sometimes, you get yourself setup and it just doesn’t, for whatever reason your order doesn’t fill and you got to sit on the sidelines. But, even still, I made $1,900 on that gap and go trade. Two trades, 4,000 shares each. First entry was 3.70, 70 shares. And then I added 2,500 at 4.60, right around 4.60. And then we got to push up to five, pull back, and I added right here, you can see on this one minute break. I added on here on the one minute pullback in anticipation that we would break over $5.

And when I got in here, I got in low enough that when we broke over five, I was able to sell for profit, but we very quickly rolled over and it ended up being a false break, which was disappointing. But nonetheless, being quick, punching the hotkeys, I was able to get in, get out, and book a couple hundred dollars on that one.

Now, this is probably going to be a trend. Hopefully not, but my best trade and my worst trade of the week were both on the same stock. My worst trade of the week here, also on FFHL. This was a $300 loss for me. I got in here, I wrote a five minute pullback, this is actually a one minute pullback here. I got in at $4, right at this one minute candle here. You can see we got this move up, a little pullback, I got in here thinking the break over $4 would bring us back towards 4.50, maybe even back towards high of day. You can see here, getting in for the first candle, make a new high right there. And then it just rejected and dropped down very quickly. On that one I lost a full 15 cents with 2,000 shares, but I had reduced my share size to only 2,000 because I knew I was getting in a place that was a little higher risk.

The big issue with this setup to me is that we were traced more than 50% of the move. The open price was 3.70 and we pulled all the way back to 3.70. We pulled all the way back to that level. To me, I should’ve been a little, well I was pretty cautious because I took only 2,000 shares instead of 4,000, but I think I could’ve been maybe mindful enough that I could’ve just passed on the trade completely because of the fact we had retraced too much.

Even though we were consolidating above the nine moving average, which is good, I think it had pulled back a little bit too much. And I knew that it wouldn’t be back on the high day scanners until we got back up above 5.20, which was high of day. So to get in at $4, knowing we’re not going to hit high day scanners until we hit 5.20 … You need to have a lot of people that are watching the stock. Most people will see these stocks because they’re hitting scanners, and we know it’s not going to hit the scanner until it’s back at the high. I think on this one, I maybe should’ve just passed on that trade.

Dealing With False Breakouts

It’s been hard this week, we’ve seen a lot of rejections at half dollars and whole dollars where the stock breaks over this level like this, and then when it comes back down below it, the people who bought for the breakout like myself end up stopping out, number one. Number two, anyone who wants to short goes and takes the short position and then it drops back down.

You sort of have these two groups of sellers who’re both piling on these stocks right around whole dollars. My feeling on that, I know this has probably been a fun week for short sellers because we’ve had such strong rejections at these levels. At the same time, they’ll say, “Well these stocks are up for no good reason, so I’m gonna short them.” Fair enough. Most of these stocks did have news, FFHL had news, but maybe it’s irrationally strong. So, okay, they want to short the highs and ride the move back down, that’s fine. But you know what creates parabolic movers, the ones that go up 100, 200, 300%?

Parabolic Mover Anatomy

What creates that are two things. One, the stock starts squeezing up on some type of catalyst, whether it’s a technical breakout or a fundamental breakout. It pulls back and short sellers short that first pullback. Long bias traders, like myself, see the pull back as an opportunity to buy, so we buy the first candles to make a new high. And then as we squeeze through the high of day, I often add. At the same time, when we make new highs, anyone who shorted early needs to cover their position. Now you have two groups of buyers buying these breaks, short sellers covering, buying to cover, and long bias traders buying to ride the momentum. So if you didn’t have people shorting early, you wouldn’t get these parabolic moves.

Those parabolic moves are the result of early shorts having to cover, plus long bias traders wanting to get in to ride the momentum. It’s those two groups that create these movers. The market really trades on this collective trading mentality, where if you’ve got 20,000 traders who all think this is a good opportunity for a long bias, a long position, they have a long bias on it. Well, they’re going to buy it, the stock’s going to go up.

And then again, you say, “Well, half of them have a short bias and wanna short the tops.” But eventually, when you have a stock that’s really, really strong, with a really good catalyst, those short sellers are gonna end up getting squeezed. That’s the type of thing that we saw on DRYS when it went from $4 to 120. People were saying, “It’s irrationally strong.” And it was. I’m not going to deny that it wasn’t. But the chart in that case just continued to run. If you’re shorting it, you’ve got to know when to throw in the towel. And whenever you throw in the towel, you’re a buyer and you’re buying to cover. That just adds more and more buying, and that’s when you create that imbalance between buyers and sellers.

Now, the tricky thing is we don’t know when a stock is going to squeeze from, let’s say $1.80 to 3.80 and then pull back, and when it’s going to go to 4.80, 5.80, 6.80, 7.80, 8.80. That’s the challenge with trading in general, whether you’re long-biased or short-biased. You never know how far these stocks are going to go. As a long bias trader, if I get into a stock for a whole dollar break and it gives me a hard rejection like we saw in FFHL here, or we saw here as well, I stop out. When I stop out, I’m a seller. And that, of course, helps anyone that’s shorting because you’ve got an imbalance between buyers and sellers. But, on the flip side, when these stocks start to squeeze up first candle to make a new high, buyers come back in, and anyone who’s short needs to cover.

I hate to get into the whole thing of shorts versus longs and the bashing that some people do. You guys know that I never do that. I don’t criticize someone who has a different point of view on a trade than me. But, at the same time, it’s important to be mindful that we’re all trading these same stocks, and these stocks, whether they’re going up or going down, are impacted by collective trading mentality. It’s not really that there’s a right or wrong. A stock can be irrationally strong or irrationally weak and we have to trade the chart. A little bit of a tangent there off of the best and worst trades of the week.

Trading Psychology

Now, one of the the things that I struggled with this week, and this is going to be the topic of the day, one of my struggles was employing mindfulness. This week was tricky because we didn’t have a lot of good follow through. When we have a slow week, you can do one of two things, you can take one of two paths. The first path is that you feel frustrated that you’re not hitting your daily goal, and out of frustration you decide to fight the market. You trade every day until four p.m., maybe you even start trading after hours. You start to feel fatigue, you feel frustrated, and you’re more apt to make mistakes.

That’s a path that I’ve taken on many days. Days where I lost $200 in the first hour and I spent the next four or five hours trying to make back that 200. Instead of just throwing in the towel and saying, “Today’s not a great day,” I kept trying to fight it out. It took me a long time to realize that that was not a good path for me to go down on a day-to-day basis, because we’re all going to have days where the market’s not on our side.

This whole week for me has been, it really wasn’t very good until Thursday and Friday. Thursday and Friday were the best days of the week, and those two days made up I’d say like 85% of my profits from the entire week. Monday, Tuesday, and Wednesday, let’s see, Monday I made 319, Tuesday I made 800, and Wednesday I made 468. Then Thursday I made 1,900, and today I’m up 2,200. You can see that, when I’m connecting, I’m connecting, and when I’m not it’s just kind of like grinding, it’s just treading water. Not to say that 400 or $500 isn’t good, but it’s not quite what I wanted to be achieving.

Being Mindful Of Market Conditions

Here’s the deal, on Monday, Tuesday, and Wednesday, I needed to take the second path, which was really to have the presence of mind to realize that the market is slow today and to simply wait for better opportunities. And on those three days, better opportunities didn’t come. My best opportunities were in the first 30 minutes, first 45 minutes, and by the end of the first hour, by 10:30 Eastern? It was done, there was nothing really else to trade. Yes, I could’ve tried to stick it out, I could’ve tried to pull up an ETF that has a lot of volatility and a big ATR, try to trade gold or try to just trade SPY options or something like that, but that’s going down that path of frustration, fatigue, where you’re more apt to make mistakes and you’re much more likely to give back profits.

I’m going to give you a real life example of this. This week I had to run an errand during the snowstorm. We had a snowstorm here in New England, it was Tuesday night and Wednesday. This errand involved driving what would typically only be about an hour. It ended up being more than two hours because instead of being able to drive at regular highway speeds, I could only drive 30-40 miles an hour most of the way. And this is the same highway that I usually drive on, and that I can usually drive 65-70 on, right? But the difference was that Tuesday was not the right type of day to drive 70 miles an hour in the snow. Let’s go ahead and get, this is video of me driving on Tuesday, and that was the highway. I’m driving in the middle of the road because, basically, that’s the best place to be. There’s the E-ZPass or something sign, but I’m driving 40 miles an hour. Even that, at times, felt too fast.

I could have chosen to beat myself up and say, “I’m supposed to make this drive in one hour. Every single time I take this drive it takes an hour, this is unacceptable that it’s taking longer than an hour. This should be a one hour long drive.” And I could get flustered and I could get frustrated. But, you know what? Some days are like this. We all want to get there and achieve our daily goal, our $500 a day. It’s just like trading, we’ve got $500 a day, but not every single day is the right type of day where that’s going to happen. So you can do one of two things, path one is, in the case of driving, you slow down. You drive 30 miles an hour. And then the second path is that you try to go 60, and you end up being one of those guys that’s off on the side of the road. Same with trading. You either trade smart, you minimize your risk, or you push it, you get frustrated, and you end up having a max loss, a completely unnecessary loss.

Even as I say all of this, it took me a really long time to develop a sense of mindfulness. To get to the point where I could walk away down a couple hundred dollars and not feel like I was … Just not feel really frustrated and disappointed with myself. At that point, when I would have those days, it almost felt like I had tunnel vision. Like I would become another person, I would just be so focused, completely hyper-focused on, “I can’t close down even a dollar, I need to close the day green.” But the end of the day, it actually doesn’t matter. Today and yesterday are two days that, in these last two days I’ve made, let’s see, I’m up a combined almost $4,000 today plus $7,000 yesterday in my two accounts, $11,000 in two days. These more than make up for the fact that Monday, Tuesday, and Wednesday were slow. But it took me a long time to realize that.

So what changed? Well, I realized that I needed to practice mindfulness. I needed to be mindful of my emotional state and to start to become aware of my emotional responses that I would have, and how those could trigger this kind of downward spiral of anger, frustration, irritation, et cetera, et cetera. So how do I do it? Well, this is what I did, after every single trade I would take, I would write down my emotional state. How do I feel? I just took a trade. Do I feel happy? Do I feel angry? Do I feel frustrated? Do I feel like I want to throw my computer out the window? And to really give an honest answer. If the answer is anything that is likely to be on the extremes of emotion, which is like really, really happy, because that can be just as bad because you can get overconfident, or really, really frustrated, then I’m going to say, “You know what? It’s time to throw in the towel.” And just get out, leave the office.

It took, like I said, a long time to get to that point, but the best thing you can do is start writing down your emotional state after every single trade, just as a log. You’ll start to realize that there are certain things that are triggers for you. One of my triggers is when I have my daily goal, I’m up $4-500, and then I go red. When I go from up $500 to being down even $30, it’s infuriating. It makes me so frustrated, irrationally so. I feel so annoyed because it’s like I had it. It’s like you had the fish on the line and then it’s gone. You let it go. And you feel stupid for having that happen, you know it’s your own fault, you had the day and now it’s gone. So I realized that’s one of my triggers. One of my rules during the time when I was really struggling with maintaining my composure was that, if I was up 500, which was my daily goal at the time, and I went down into the red, I was done trading.

I’m now at a point where I can usually trade when I have gone from green to red. I wouldn’t go from my new daily goal of 1,000. If I went from that to being red, I would also throw in towel, because that’s a bad day. Obviously something went wrong that I lost 1,000 or $1,200 on a trade. That’s one of the things that I think can really help to help you improve your sense of awareness. Something that you also need to be mindful of is, what’s going on with the overall market? Are we having a day where everyone is trading this one stock or these two stocks? Because this week lots of traders were all over GLBS. I’ll show you here, GLBS at the very beginning of the week. Monday, Tuesday, Wednesday, just so choppy. But so many people were trading it on Monday because it looked like it was maybe going to go parabolic. Unfortunately that drew all of that collective mentality, all of that collective energy on to this kind of junky stock. Lots of traders were focused on GLBS.

On Tuesday, I can’t remember what we had. Tuesday we had only one trade, there was like nothing on Tuesday, I traded BGI. Wednesday we had Oryx and CDTI, but CDTI ended up being very sloppy, just totally crushed right out of the gates. This is the sort of market that we were in at the beginning of the week and I said, “Look, guys, I wanna trade just as much as you do. I wanna have some good gains and have some big winners, but I can’t afford to make mistakes in my small account. I need to trade smart, and right now that might mean sitting on my hands, holding my hands.” Literally holding my hands and saying, “No, don’t take any more trades. Just sit, wait, be patient. There will be opportunities that come around. And maybe you’ve gotta wait till tomorrow.”

I think also comes back to embracing the concept that trading is a marathon. This is a career that you could be doing for the rest of your life. You don’t want to do something that in day could jeopardize your entire account, right? And I’ve had bad days, but you don’t want to have a day that you could potentially blow up your account and it puts you completely out of the game. You have to trade smart, this is a marathon. Every single day that you get a little bit of profit is a small step forward. A day where you lose a little bit of money, when you look back on it a month later you’re like, “That’s no big deal. Why was I getting all beaten out of shape about that? It was not an issue, I shouldn’t have gotten myself so frustrated.”

And again, I say all of this having been at the point where I would get really, really angry. Where I would just feel, almost completely furious. Mostly with myself for feeling like I couldn’t identify the right setup, or that I would do something so stupid as to get in this trade that high, et cetera, et cetera. When you have those emotional responses you just have to be aware of them and realize that those are not going to help you be a better trader. When you feel that way, you got to just step back a little bit.

Now, let’s have a Ask the Warrior session here where you guys can ask me questions that you’ve had over the week, that you’ve been thinking about. I’ll make sure we answer these as best as I can. I’d love to hear how your week went, if there’s anything that you struggled with, or your best and worst trades, etc. Let’s see. Michael, right, I know, that’s the thing. I had a great week, 14,000, 15,000, whatever it is. I’m up to 14,000 in the short trader account, but even today, my last trade was a loser. I lost on GLBS 26 cents with 1,000 shares, down $265. I think that it’s almost good for me to end the day on a loser because it keeps me humble, it keeps me from getting overconfident, and then I come in the next day just reset. So I really don’t mind ending on small loss because it does soften that sense of confidence that you can get from having a big green day. I think it’s actually a good thing.

My biggest daily gain this year is, let’s see, $9563 in my speed trader account. On that day I had a $12,000 winner on DFFN and I had a loser on, I can’t remember what it was. Let’s see, let me scroll back. Oh, COOL, yeah, I lost $1,400 on COOL.

Best Practices For Dealing With Your Emotions

Let’s see. Daniel, the best way to deal with the trader emotions? Well, for me, a couple things that have helped. When I used to get into the habit of making rules and then breaking the rules, I created a punishment of running a mile for every rule that I broke. Once I realized that I would sometimes choose to run a mile so I could have ability to break a rule, I said, “New rule is that you run five miles, regardless of whether you break one rule or you break 10.” After my last five mile run in the rain, I said, “That’s it. I really am not gonna break rules any more.” That’s what it took. Having rules and then having the discipline to enforce them, that really helped there.

It may be unconventional, but for me it worked. I figured I’d either be, at the end of this all, I’d either be in great shape and broke or I wouldn’t be running any more and I’d be making money. Fortunately, my physical fitness has kind of stabilized at just so-so, which is good. Let’s see. I haven’t read that book, Trading in the Zone, but I did read a book. I think Mike might have read that one. I did read Trade Mindfully by Gary Dayton, and I recommend that to a lot of our students because it’s a good book on mindfulness, which again is one of those things that I wouldn’t have expected I would need to think about or care about being a trader, but the emotions of fear and greed and being happy and upset all are a very big part of the experience of a trader.

Let’s see. The max share size on my small account, biggest shares actually were today. 6,000 shares of ESES, which is a $1.60 stock. Even though it was pretty big share size, it was a cheap stock so I didn’t feel like I had a lot of money in that trade. In total I had only $10,000 in that trade. The risk there wasn’t too bad, but I’ve been keeping share size moderate and 6,000 was the highest. 4,000 and 2,000 has been standard.

Let’s see. Yeah, so, this is one of these things where hitting the first trade out of the gates, hitting that gap and go gives you that quick win as soon as the market opens, and then there’s that tendency if you didn’t fully capitalize on it to go in for the second and third trades, and then if those stocks don’t end up being strong you end up giving back profit, which is something that can be really frustrating. Fortunately today I was able to do fairly well on the gappers that I was trading, but even MYOS, I only made 1,000 bucks in my small account on this one. Despite the fact that it moved pretty nicely from 3.40 up to, what was it, 4.07. I couldn’t take enough size because I was restricted on margin. I’ve got that margin restriction and that made it so I couldn’t take a big size.

Let’s see. Any other questions? MYOS? This was on our scan for former runners and the pattern really was about the daily chart as it was starting to curl up here. Lincoln, yeah, when you sell on the bid, that is essentially like placing a market order because that’s the market price. Selling on the bid is like a market order. The only difference is that by having a limit, if your limit is, let’s say the bid is $3, your limit’s 2.95, you won’t get anything lower than 2.95 when you sell, whereas a market order you could get filled 2.70 or 2.50 if it drops fast enough. That’s the danger.

And Mitch, yeah, what I’ve been trying to do on all of my trades is 20 cent max loss. And on most trades, 10 cent max loss, but like on GLBS today I lost 26 cents. I was only trying to risk 16, but it dropped quickly and so that’s what it was. It’s disappointing because I don’t think that trade really had the potential to give me a $500 winner unless it had moved 50 cents, and I’m not sure that that would have happened. A little disappointed on that one, but overall, I think I did the best I could to minimize the loss. And I’m glad that I traded with small size so that if I did lose, the loss wouldn’t be too bad.

Jose, becoming faster with hotkeys. Hotkeys are definitely a big part of my trading, and a big part of almost any active trader’s strategy. One of the things that you could do to practice and that I’ve done is sit on my computer at night, unplug the computer or take out the battery, and just practice those hotkeys. Just start typing, just start punching the keys, testing it out, and seeing whether or not you’re getting faster at it. You could also go, for our students that are in the course, we have you guys take a typing test because I like to know how fast you can type. If you can improve your typing skills, you could start taking some typing tests. You could do that maybe just once a night. Do 30 minutes of studying, one of those typings tests, to try to get you faster with your keys. That would help you also.

And MYOS, on the one hand I think that it looks good for a move back up towards $7 based on its chart. On the other hand, it’s still up at a real premium versus where it was at before this spike. It was at $1.24, so we’re still up like 300%. So I wouldn’t want to hold the stock up that much in case they do something like a secondary offering or, I don’t know. I wouldn’t want to hold it overnight so I’m not, but I’ll keep it on watch for day trades in case something else opens up. And yeah, the label maker. I absolutely label my hotkeys. I labeled them on the computer that I used to trade with over here, and now on this one I’ve just memorized where they are so I didn’t need to write them a second time. Yeah, I definitely recommend using the label maker, it’ll help you.

Daily profit target is $500. 500 a day is the minimum goal. That’ll get me to $100,000 in the small account by the end of the year. But, obviously, I aim for 1,000. And if I can do $1,000 a day, that will get me to the goal that much faster and make this year that much better. At the same time, I just have to go with the market. I think last year I averaged like $970 a day. We’ll see. I’ll do the best I can, but if we have slow days then, you know. I just got to play it smart. Kelly, 250 trading days in the year.

My daily gain and my daily loss targets are the same? Yeah, right now my max loss also about 500. I probably wouldn’t trade if I was down more than $500, so that would still be my max loss. And Tucker, your question about staying and winning trades longer, you’re getting out too early. This is something that I used to struggle with as well, and that’s why I started selling half of my position and then adjusting my stop to breakeven. So when I was up 20 cents I sell half instead of the whole thing, then I hold the rest as long as I can. Sometimes that means I sell another 1/4 when I’m up a bit more, or another 1/8 or whatever it might be. That has helped me increase my average winners. Although, at the same time, it’s increased my commissions. The big picture is that commissions, if you trade with a larger size are not a big factor. It’s just part of the deal and you’ve gotta do what’s right for the wins and getting those big trades.

Lori, that’ll be back next week. And Diana, no, the hotkey software is built into your trading platform. Like SureTrader, SpeedTrader it’s built-in, same with Lightspeed, same with Interactive Brokers, same with Ameritrade. Tips to improve the entries? The biggest tip I would have would be to focus on the five minute chart. When you’re trading on the five minute chart, your entry should be down to the penny. For instance on, let’s see, what was a good one? We had ETRM the other day do a nice clean five minute pullback, so let’s go back to that one. Yeah, I think it was here. So ETRM for instance. This was on the 25th and the proper entry was at 7.39, to the penny. This was the proper entry. The first candle to make a new high was as we broke 7.39, so 7.39, 7.40 was the proper entry at 1:35 in the afternoon on the 25th. This actually wasn’t the spot I was looking at, but it works just as well. It’s a good five minute pattern.

If you have your entry and you have it dialed in to the penny, all you have to do is make sure that you’re pressing your order soon enough that you’re able to get filled at that spot. Darren, let me look at your question, let’s see, Jim. Okay, when you hit the hotkey nothing happens. One of the things you’ve gotta make sure you’re doing is that you’re in the Level 2 window when you’re pressing those hotkeys. You actually have to have your mouse, well the mouse doesn’t have to stay in that window, but you’ve got to click that window. Usually you’ll have like a red box around it to show you that that window is highlighted. That’s how you know that the hotkeys will work, otherwise, some of the hotkeys that your computer just generally has like the music, making the music go up and down, they’re audio, those will work regardless of what window is highlighted. But hotkeys only work when you’re in the trading platform and when you’ve got that window highlighted, so just double check that and make sure that that’s not what’s going on there.

Sometimes Level 2 gets screwed up and I have this really on pretty much all of my platforms where sometimes you’ll just see an order that just gets stuck. Where you’ll get across Level 2. Instead of being 3.05 by 3.10, it shows 3.10 by 3.05. It’s showing the bid higher than the ask. If you tried to place your order, that bid gets ignored, I don’t know why those get stuck there sometimes. On ETRM, for example, how would I ensure that I got the right entry price? If I wanted to get in at 3.39, and I knew that was the price I wanted to enter, now I would start watching the Level 2. And if I started to see a lot of buyers coming in at 3.37, 3.38, I might just press my order in anticipation of the break. Alternatively, I might wait until we break 39 and get in at 40. I’m comfortable using a five cent offset where I would get filled as high as 7.44, but I wouldn’t want to be filled higher than five cents above the trigger. Within five cents above the trigger, above or below, is usually okay with me.

And Don, yeah, you can trade more than one stock at a time in the simulator, and of course with real money too. Although, for me, I don’t trade more than one stock at a time almost ever. I really focus on one trade at a time because that’s one way for me to mitigate risk. If you’re trading three stocks, you can’t give your full focus to each of those three. So inevitably one takes the back burner, and that’s okay if you’re swing trading or if you’re holding longer term positions. But when you’re day trading, that can be a little tricky because you really want to focus on each of them pretty equally.

Yeah, my hotkeys for sure are compatible with SpeedTrader and SureTrader, because they’re both the DAS Trader platform. And Mitch, no, I don’t trade pre-market and I don’t think I plan to unless we see some real shift in the way these stocks trade, where they only move pre-market, but I haven’t seen any indication that that would happen, so I’m gonna focus on waiting until the bell rings for my trades. MYOS was on a former runner scanner and it was on our watch list from yesterday because yesterday it was gapping up, so we just kept it on watch today.

Sizing Up

Well, at what point does share size risk increase the risk that you won’t get filled, Joseph? That’s a good question, and that depend on a couple of factors. Depends on the amount of volume in the stock you’re trading, and it depends on the price, it depends on the float, so based on those things, some stocks you can buy 30,000 shares no problem and other stocks it can be hard to even buy 5,000 shares.

For most of the stocks that we’re trading on a day-to-day basis, buying 10,000 shares or buying 20,000 shares is not usually an issue, and I know that because I’ve traded those sizes on a fairly regular basis. I don’t usually go as high as 20,000, but on the days that I have I didn’t have an issue. But I think 30,000 would be pushing it, 40,000 would be harder, and 50,000, it just depends. Stocks like PULM today had a lot of volume, so that would have been one that you could’ve taken 50,000 shares of, but you wouldn’t have been able to do that with MYOS or ESES. I mean, you could have, but you wouldn’t have gotten good fills is the problem.

All right guys, so I will leave it at that for today. If you guys do have other questions, you can of course email me, [email protected], or I will see you guys first thing on Monday morning. I hope you guys all have a great weekend and I will see you on Monday. All right, thanks guys.