Reviewing 3-Years Worth of March Profits & Losses (P&L) as a Trader

Hey all, John L10 here!

Now that March is over with now, that closes up Q1 of 2017.

I can imagine that there are many different types of people who might read this article. Some of you are just learning the basics of trading, while others might be just break-even after several months of real money.

Some of you might have already realized huge losses, while some continue to reap consistent profits day after day. Wherever you are, understand that I can probably relate! It can take some serious time and commitment, day after day, coming to the market, to put all the things that you have learned into practice and come out with actual gains.

It should be known that it wasn’t very long ago that I too, was a struggling trader. This is not going to be an article where I talk about my entire journey, but I want to start the story right around when I made the decision to leave my career and commit to trading.

By this time, I had already made well over six figures within three months, riding the wave of cannabis legalization by capitalizing on what was at the time, just a dozen or so penny stock companies.

I was getting used to making gains hand over fist, like a hot shot, with not a lot of work. During this time even a dummy could make money, it wasn’t skill, just good timing. Although I learned the hard way about charts, technical analysis and fundamental analysis, to a degree, I didn’t really understand how day traders actually trade for a living, and I didn’t really understand the tools they used either.

I will talk more about that at a later date, but for now, I want to focus on the fact that I did decide to leave a very comfortable career for a life of a trader without any real education. I said to myself, “I can figure this out”.

Well, let’s see how long it actually took me to figure trading out by measuring my performance of only March 2015, March 2016 and March 2017. Please note that all numbers are considered gross, meaning, before commissions and expenses for the exception of March 2015, which is net. For a trader, when you get to the point of three or four figure days consistently, the cost for those trades is typically nominal.

March of 2015

Paying Trader Dues and Learning The Hard Way

I had to actually re-create these records from by broker because the day-to-day stats are so bad, I never wanted to look at them again, but here they are. $243.43 for the month, and $11.57 on average per day. I bet that bottle collectors who roam the streets of New York make more than that.

During this period of 2015 I was evaluating a lot of different styles of trading. I checked out several trading education services looking for the holy grail, and I didn’t really have any style or strategy. I was shooting at whatever. The most I did know is, I didn’t want to lose a lot of money, so at the very least I did keep losses small. I really could not afford a big draw-down. I had to figure it out.

Now, with that said, 2015 wasn’t a dud all together. Although March of 2015 is quite embarrassing, I did start to figure trading out, both through learning the hard way and discovering Ross’s service at Warrior Trading, I managed to finish 2015 with $42,000.

That was good enough to prove that with enough time in the market, trading could potentially become a very lucrative profession. 2015 was a big turning point in my trading career, and I will never forget all the trials and tribulations of it.

I hope to talk more in depth about this soon, because even though I did have a large account, I needed to pay the bills. I took a remote job where I could work from home during this period at a drastically reduced salary, in order to reduce my stress while I attempted to become consistently profitable month-to-month.

March of 2016

Grinding out Consistent Small Profits

BOOM! That’s the thundering sound of transporting in time to March of 2016. By this year, I was confident enough to toss my remote job away because it wasn’t worth the time anymore. Since we’re skipping so far ahead, this was around the time I also started up a business to eventually provide extra income. I knew that this too, would take significant time if it was going to work, but like trading, the rewards were too compelling to ignore.

For the purpose of this example above, I excluded a $5,045 dollar options trade I made GWPH on 3/14/16, because it was out of the scope of what I do, and does not reflect something that you can repeatedly pull off. I got lucky on a one-time event and that’s all it was. So with that number excluded, it leaves me with $5,474.49 for the month or an average of $260.69 per day. Not bad really, that’s like $60,000 a year.

Although I did make more than that! (Hint: I made $160k). Going back to the screen shot above, you can see, no 4-figure days, no big winners, but good risk management. Not a lot of losing days, I was just grinding it out, day after day. All of this trading was taken place in the first couple hours of the market open. Compare this with March of 2015 and it starts looking a lot more professional.

March of 2017

Making Consistently Big Profits While Eating Grey Poupon

Oh hey, welcome to 2017, the current year this post was written. So far the first quarter of the year is quite good. I’m up about $115,000 with just capital gains, and a lot more if we start to include other business income. I have stressed in my other posts how important other business income can be!

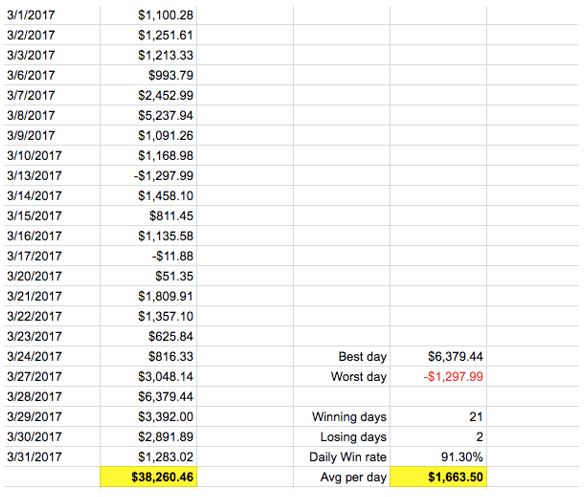

Let’s take a look below at my trading days during the month. One thing to take note here, a lot of 4 figure days. If you have seen my prior two posts I have included my P&L for both January and February of 2017. At this point in my trading career, these gains are common now. I don’t expect them, but they just kind of happen. I think that’s a good thing as I am not pushing or stressing myself out if it doesn’t happen. Traders need to think big picture.

Allow me to explain what I mean by big picture:

There were two days in March where I had an $11 loss and a $51 winner. They were depressing days, because let’s face it – trading is one of the only professions out there that you can come to work and actually lose money. Consider though, in the grand scheme of the month, did it really matter? Traders need to minimize their losses and drawdowns. Small red days are actually gifts from the market.

I will happily take a small red day now and say thank you to the market (I will say much worse things if the market gives me a big red day though). With that said, I am a lot better at “battling back” from being red on a trade, there have been dozens of days where I came out of a $1000+ hole to being positive. Previously, I would just close the day red, but if you can keep a loss small enough and find another good trading opportunity, there is a chance for redemption for skilled traders who can temper their emotions.

Final Thoughts

So that wraps up the review of my P&L for March 2015, 2016 and 2017, I hope people reading this find it insightful. The overall take away from this article is that trading will require a lot of personal sacrifice. In my case, I took the long road and skipped a lot of required education that I probably should have learned right away.

I literally paid my dues through time and losses. Luckily, it does not have to be that hard. Many people will pay their dues and still fail, because they run out of funds or time. I want to stress that, no trading education is going to make you an instant overnight success, but it’s important to at least get educated.

The quicker you can get from knowing nothing to knowing as much as you can, before you even place a single trade, is extremely valuable. There is a saying in trading that you are actually just a perpetual student of the markets. Always adapting, learning and growing.

With that said, currently I am auditing the live trading courses which is being taught by Ross at 4pm ET every Monday-Thursday on WarriorTrading.com. All courses will be recorded so if you miss the live class, you can watch them on your own time. If you are there, feel free to say hello!

Anyway, see you in chat!