-

Value For Investors

-

Value For Active Traders

-

Commission & Fees

-

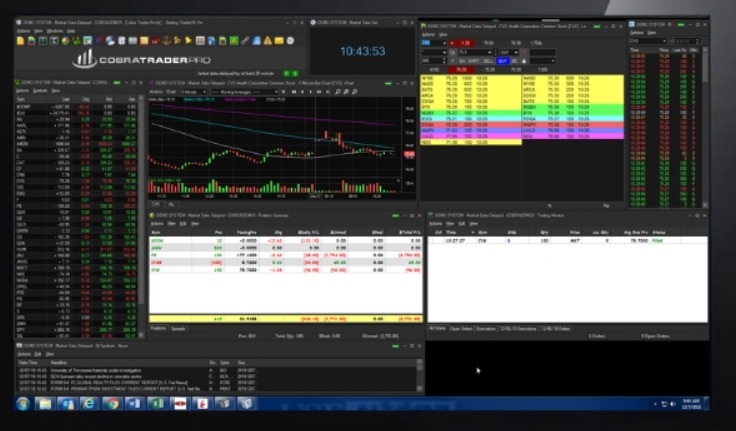

Platform & Tools

-

Customer Service

-

Order Execution

-

Options Trading

Summary

Cobra trading is a sophisticated direct access broker designed to fit the needs of institutional and retail traders. Note that futures trading with cobra is only available via venom. Overall Cobra is a quality broker for traders.

Pros

- Multiple trading tools available

- Excellent margin rates

- Discounts for active traders

- Penny and OTC stocks

- Maker-taker fees

- Several customer service channels

- Direct market access

Cons

- No foreign stocks

- Not a $0 commission broker

- Large deposits required to open an account

- Many tradable instruments aren’t available

- No mobile app

- Steep software fees

If your current broker only offers you one trading platform, it may be time to shop around. If it doesn’t provide any rebates for adding or removing liquidity, you may want to consider Cobra Trading. Cobra Trading offers these services…and more.

Brief Overview

Founded in 2003 in Plano, Texas, Cobra Trading has been fine-tuning its brokerage services for nearly 20 years. Nevertheless, it does remain a rather small firm. On its YouTube channel, it has just one video and 46 subscribers. Despite its small size, it does have some strong points.

Services Offered

Cobra provides a range of account types, including:

- Taxable individual and joint accounts

- Non-taxable IRAs

- Business accounts

- Trust accounts

- Margin accounts

In these accounts, Cobra offers trading in stocks, options, and ETFs. Stocks include penny and OTC securities. Futures and forex can be traded in a separate account with Cobra’s affiliate Venom.

For order submission, Cobra Trading has no less than 4 desktop platforms. And Venom has its own suite of trading tools.

Cobra Trading does require a $25,000 deposit to open an account. Then the broker-dealer requires $10,000 to keep the account going. And these numbers are for non-day-trading accounts.

Day Trading

Accounts that will be day trading must deposit an initial $30,000. Accounts opened by foreign persons must deposit at least $50,000. The maintenance requirement in either case is $25,000. This policy of course results from the regulators’ PDT guidelines.

In exchange for the high balance requirements, Cobra offers day traders the following services:

- Professional-level charting on several desktop platforms

- Online short locating

- Level II quotes

- Direct-access routing with maker-taker fees

Cobra also offers extended-hours trading, just in case you can’t place that really important trade during the day’s session. The broker’s morning session starts at 6:00 am, New York time. And the late-night period ends at 8:00 pm.

Leverage and Shorting

Cobra Trading generally follows FINRA’s day-trading guidelines. This means PDT accounts have 4:1 leverage as intraday buying power. Overnight leverage is cut in half. Cash accounts get the same numbers, although they’re limited to three day trades in a rolling 5-business-day period. Some stocks and funds may have higher maintenance requirements, and thus lower leverage.

Using Wedbush Securities as its clearing firm, Cobra Trading is able to locate hard-to-borrow stocks for shorting purposes. Stocks can be located directly on Cobra’s platforms. The broker has access to multiple locate sources. Locating services may incur fees, which vary by stock.

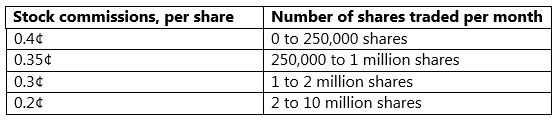

Commission Schedule

Commissions for stock and option trades are priced on a tiered schedule.

Here they are:

Accounts that trade more than 10 million equity shares per month can get even lower commissions.

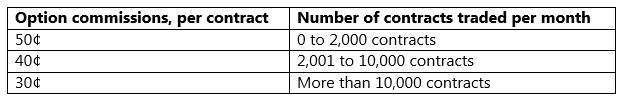

For options, it looks like this:

Cobra Trading charges a very low 5.25% on margin debits up to $1 million. Above that level, lower rates can be negotiated.

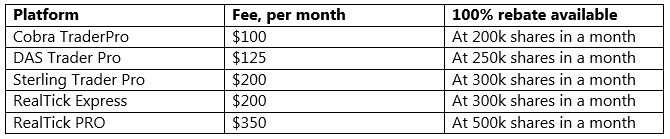

And you will need to pay software fees to gain access to the platforms the broker offers. Here are the numbers:

Options trading on Sterling adds an extra $30 per month.

If you need market data, there will be a charge for that, too. A basic package that includes Level II data costs $25 per month for non-professionals. Pros have to pay $79 per month. Other data packages are available at additional cost. For example, pink sheet Level II data costs $20 per month.

Broker-assisted trades at Cobra carry no surcharges, which is a great deal. On the flip side, ACAT outgoing transfers are a steep $95, and IRAs carry a $35 annual fee. There’s also a quarterly inactivity fee of $15.

Customer Support

During our research on Cobra Trading, we were impressed with the level of customer service we found. It’s possible to contact the broker by phone during the week. Hours of operation are 6:00 am, EST, through 8:00 pm.

There is a really convenient chat feature, found in the lower-right corner of the website.

Software

Now we come to the heart of the matter: actual trading.

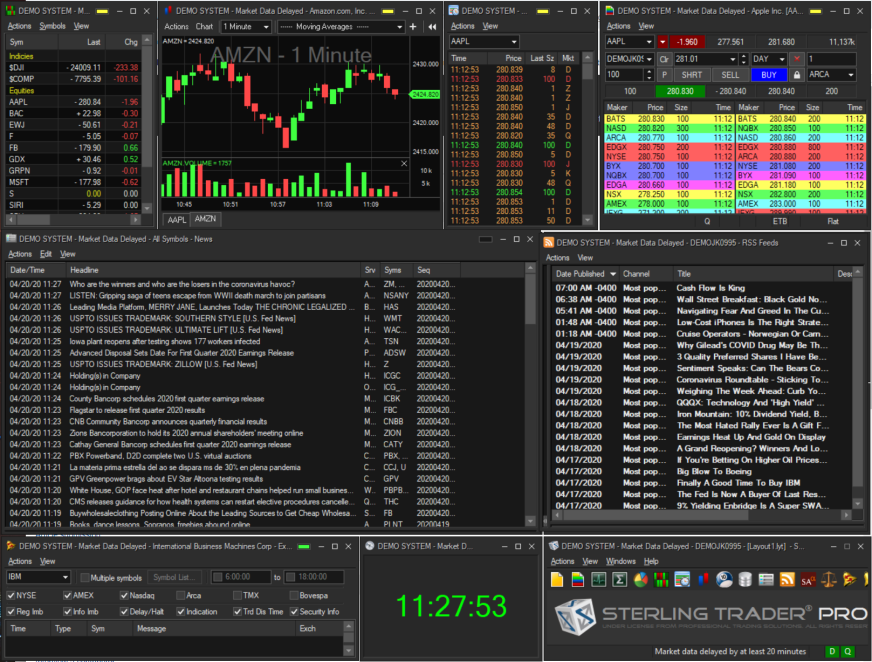

Sterling Trader Pro

This robust piece of desktop software offers equity and options trading with some really nice features. These include:

- Advanced charting tools

- Multiple order types

- Greek values for option contracts

- Watchlists

- Basket trading

- Level II quotes with integrated trading ticket

The software’s charting program delivers a good experience with a full-screen mode and nearly 80 technical indicators. Even better, we were able to follow the price action of several assets simultaneously. We did this by adding multiple charting windows with tabs at the bottom of the screen.

One final note about Sterling: the platform’s menu is located (strangely) at the bottom of the screen. It’s in the lower-right corner. On the plus side, it does contain a lot of helpful icons that will generate all sorts of widgets. These range from RSS feeds to alerts and many more.

DAS Trader Pro

Moving on to DAS, we get a higher monthly fee but also sub-millisecond executions. This is possible because DAS servers are located at both the NYSE and the Nasdaq. Highlights on the trading platform include:

- Charting with right-click trading

- An order ticket with integrated Level II data

- Direct-access routing

- Stock screener (although there’s only a small number of search variables)

Option traders get access to chains of calls and puts. There are also chains for option spreads. To find the widget for derivatives, just click on Quotes in the top menu. One unique feature DAS offers is the ability to route option orders to specific market makers.

Cobra TraderPro

The cheapest option at Cobra Trading is the company’s namesake platform. Despite the budget price, it does offer some features that day and swing traders will need. The software is actually based on the Sterling platform. So if you’ve used Sterling before, the learning curve will be very quick here. Highlights worth mentioning include:

- A discrete stock locating window

- Hotkeys

- Level II window with order ticket

- Customizable alerts

- Watchlists

The one caveat with Cobra TraderPro is that the firm restricts its use to individual non-professionals. So if you’re a hedge fund or other professional trader, you’ll have to pick another platform, such as RealTick.

RealTick Pro and Express

Cobra Trading offers RealTick platforms, in Pro and Express formats. The former is the higher-end software with all available tools. These include:

- Alerts

- Hotkeys

- Alarms

- Time & sales window

- Ability to display several Level II windows at one time

One of the great features of the Pro platform is the sheer plethora of order types. We counted almost 40 of them.

The Express edition limits the number of Level II windows to four. But it still has many features day traders need, including charting and hotkeys.

Bottom Line

Cobra Trading delivers a lot of great desktop trading platforms for day and swing traders. But they come with hefty fees, and several investment vehicles are missing. Frequent traders who don’t qualify for software fee rebates may be hit with a hefty commission bill.