-

Value For Investors

-

Value For Day Traders

-

Customer Service

-

Commissions & Fees

-

Platforms & Tools

Summary

ChoiceTrade is an online broker that specializes in active self-directed trading, including day and swing trading. The main downside to this broker is they only offer equities, options and mutual fund trading. Cryptocurrency and Futures are not offered at ChoiceTrade.

Pros

- Responsive customer service

- Non-US accounts are available

- Good business history

- $0 commissions on some trades

- Multiple software platforms

- Several day-trading tools

- Auto-staging service

Cons

- Unnecessary fees in several situations

- Multiple asset classes are missing

- PDT rule in full force and effect

- No retirement accounts

- Software fees can be pricey

- OTC stocks have steep fees

Brief Overview

ChoiceTrade has been delivering brokerage services with advanced technical tools since 2000. Despite more than two decades in business, it has zero disclosures on its BrokerCheck profile.

Should this be your next broker? Let’s find out.

Services Offered

ChoiceTrade specializes in active self-directed trading, including day and swing trading. The brokerage house provides access to these asset classes:

- Equities, including both penny and over-the-counter stocks

- Closed-end and exchange-traded funds

- Options, including cash settled products

Unfortunately, ChoiceTrade does not offer trading in other investment vehicles, such as cryptocurrencies or futures contracts.

During my testing of ChoiceTrade’s online application, I was able to open individual, joint, custodial, and business accounts.

ChoiceTrade does not currently offer Individual Retirement Accounts. The brokerage firm does have an IRA option on its online application. Maybe the current policy will change in the future.

ChoiceTrade is an American broker, but it does nevertheless open accounts for non-US citizens. They do have some more hurdles to clear, though. For example, they must fill out Form W-8BEN.

Leverage and Shorting

ChoiceTrade maintains a 50% initial margin requirement for most long stocks and ETFs. Maintenance decreases to 30%.

For short positions, the initial figure is the greater of 50% or $5. Maintenance is somewhere between 35% and 100%. ChoiceTrade does not permit the shorting of securities that are priced below $2.50.

These house numbers can change based on current volatility of a security.

New issues have 100% maintenance requirements during the first 30 days of trading.

ChoiceTrade requires a $100 minimum cash balance to trade over-the-counter and Bulletin Board securities.

Day Trading

ChoiceTrade requires at least $25,000 in account equity to day trade. It does not provide 4x day-trading leverage with or without this amount.

Despite these rather disappointing policies, ChoiceTrade does offer some good day-trading tools in several software platforms. Examples include:

- Full-screen charts with tick-by-tick price action

- Level 2 data

- Real-time news and alerts

- Time & sales data

- Short locating

- Direct-access routing

Trading Platforms

ChoiceTrade offers three platforms, each with a mobile app cousin.

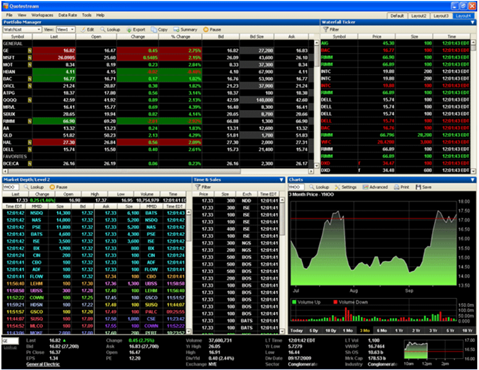

QuoteStream

The first (and cheapest) program ChoiceTrade clients can use is QuoteStream. During my testing of the software platform, I found it less user-friendly than other programs. Nevertheless, it does have some good features. Highlights include:

- Full-screen charts. A left-hand column makes adding upper and lower indicators a breeze. Graph styles include line, OHLC, mountain, candlestick, and a few others. Drawing tools are also available.

- Waterfall ticker. This widget will stream time & sales information for an entire portfolio. Data can be filtered by trade size, buy-side trades, and more.

- Stock screener. A very thorough equity screener is integrated. The tool can scan using lots of criteria. Examples include average volume, market cap, and income growth rate.

- Research tools. Companies and markets can be analyzed on the QuoteStream platform. Relevant pieces of information include earnings estimates, upcoming IPOs, interest rates, market movers, and much more.

QuoteStream is customizable. Multiple layouts and workspaces can be created. The interface isn’t overly attractive, though.

A mobile app functions on both tablets and phones (on both Android and Apple devices). Many of the same resources are on the mobile platform, including watchlists and analyst recommendations.

Direct Pro

Direct Pro is simply DAS Trader Pro branded for ChoiceTrade customers. The software does have some advanced features that day traders will like. These include:

- Hot keys

- Level 2 data

- Direct access to specific market venues

- Multi-monitor capability

- Integrated option spreads (with direct-access routing)

- Short locating widget

A chart on Direct Pro can be separated into its own window and expanded full screen. There are about 40 integrated technical studies and multiple graph styles.

One feature I really like about Direct Pro is the trading window. It includes both an order form and Level 2 quotes. It’s easy to see what bids and asks are coming in for an entered ticker symbol. Prices are color coded.

Trade types include limit, market, stop, and trailing stop. I counted almost 20 routing options.

The Direct Pro mobile app also uses color-coded Level 2 data. The platform manages to pack a lot of the same features into a small interface. Charts, option chains, and even a short locate tool make appearances.

ChoiceTrade Elite

The final platform is ChoiceTrade Elite. This one is built by iVest Plus, Inc. The software is more user-friendly than the other two but doesn’t quite deliver the same level of trading. For example, the platform doesn’t have direct-access routing or Level 2 quotes.

ChoiceTrade Elite does have some good charting tools, though. During my investigation, I found roughly 40 technical studies. There are 4 graph styles. Comparisons are another highlight.

ChoiceTrade Elite has an order ticket with a discrete sell short button, an important benefit for day traders. There are several order types, including on-the-open and on-the-close. Trailing orders can be submitted in either dollar or percent terms.

The ChoiceTrade Elite mobile app is essentially a clone of its computer cousin. This means that a charting window has buy and sell buttons. Multiple watchlists can be created, and these sync with the PC platform. Just tap on an entry to quickly pull up an asset’s profile.

Pricing Schedule

Although ChoiceTrade’s software is pretty good, its software fees aren’t.

- QuoteStream: $14.95 per month ($24.95 for a Pro version)

- Direct Pro: $135 per month

- ChoiceTrade Elite: $29.95 per month

Both ChoiceTrade Elite and Direct Pro have a 14-day free trial. ChoiceTrade Elite‘s monthly fee can be waived with a $30,000 account balance.

In return for these rather steep platform fees, you’ll get $0 commissions on stock and ETF trades. There is some fine print to this policy, however:

- Share price must be above $1

- Security must trade on the NYSE, Nasdaq, or AMEX

- Account balance must be at least $100

- Over-the-counter trades are $12 each

- Trades executed during extended hours carry a 0.5¢ surcharge per share

- Another surcharge of 0.7¢ per share above 10,000 shares

Option trades have no base charge. ChoiceTrade does charge a per-contract fee of 40¢ and an exercise/assignment fee of $5.

ChoiceTrade has a $100 deposit requirement for a cash account. This increases to $2,000 for a margin account.

Customer Service

ChoiceTrade has customer service reps on the phone Monday through Friday from 9 am until 5 pm. It has a service e-mail address and a contact form on its website. There is no chat widget, though.

During a test call, I was able to talk to a human rep in less than 2 minutes. This is a lightning fast response time during the Covid-19 epidemic.

Comparison

ChoiceTrade is one of the few brokerage firms today to allow foreign citizens to open accounts. Obviously, it would be a good choice for non-Americans.

But there’s no way around the PDT rule at ChoiceTrade. TradeZero, by comparison, does offer accounts without the $25,000 requirement.

Not all brokerage firms offer multiple platforms to choose from. TD Ameritrade, for example, has just one. But it’s free.

TradeStation has an elementary browser platform that is also free (and very easy to use). Despite its simplicity, it does have direct-access routing and a discrete sell short button.

ChoiceTrade hasn’t yet jumped on the cryptocurrency bandwagon. tastyworks, by comparison, does now offer crypto trading.

Bottom Line

ChoiceTrade has very good resources for the short-term trading of stocks, options, and ETFs. But its steep software fees and lack of IRAs mean it may not be the right broker for everyone.